If the push to turn Canada into an energy superpower is a tricky jigsaw puzzle, the country’s largest petroleum producer and largest pipeline operator just put some key pieces on the board.

On Friday morning, energy infrastructure giant Enbridge outlined plans to expand its Mainline network by up to 400,000 barrels per day before the end of the decade through two different phases — and has upsized its proposed second capacity increase.

The same day, Canadian Natural Resources, which pumped out a record 1.6 million barrels of oil equivalent (boe) per day during the third quarter, held its investor day and detailed future growth potential of 745,000 boe a day.

To be clear, the company didn’t give the green light to such aggressive increases, but it highlights the opportunities for industry to significantly ramp up volumes in the coming years, depending on government carbon and economic policies, sufficient egress and future commodity prices.

“I’d say this is a bit of a tone change, in that they’re outlining a much more organic growth-led future,” Mark Oberstoetter, head of North American upstream research at energy consultancy Wood Mackenzie, said Friday.

While the province’s plan to increase oil output to eight million barrels per day by 2035 seems hugely ambitious — total crude production hit 4.2 million bpd in September — stronger growth is a possibility if more projects and pipeline capacity are sanctioned in the coming years.

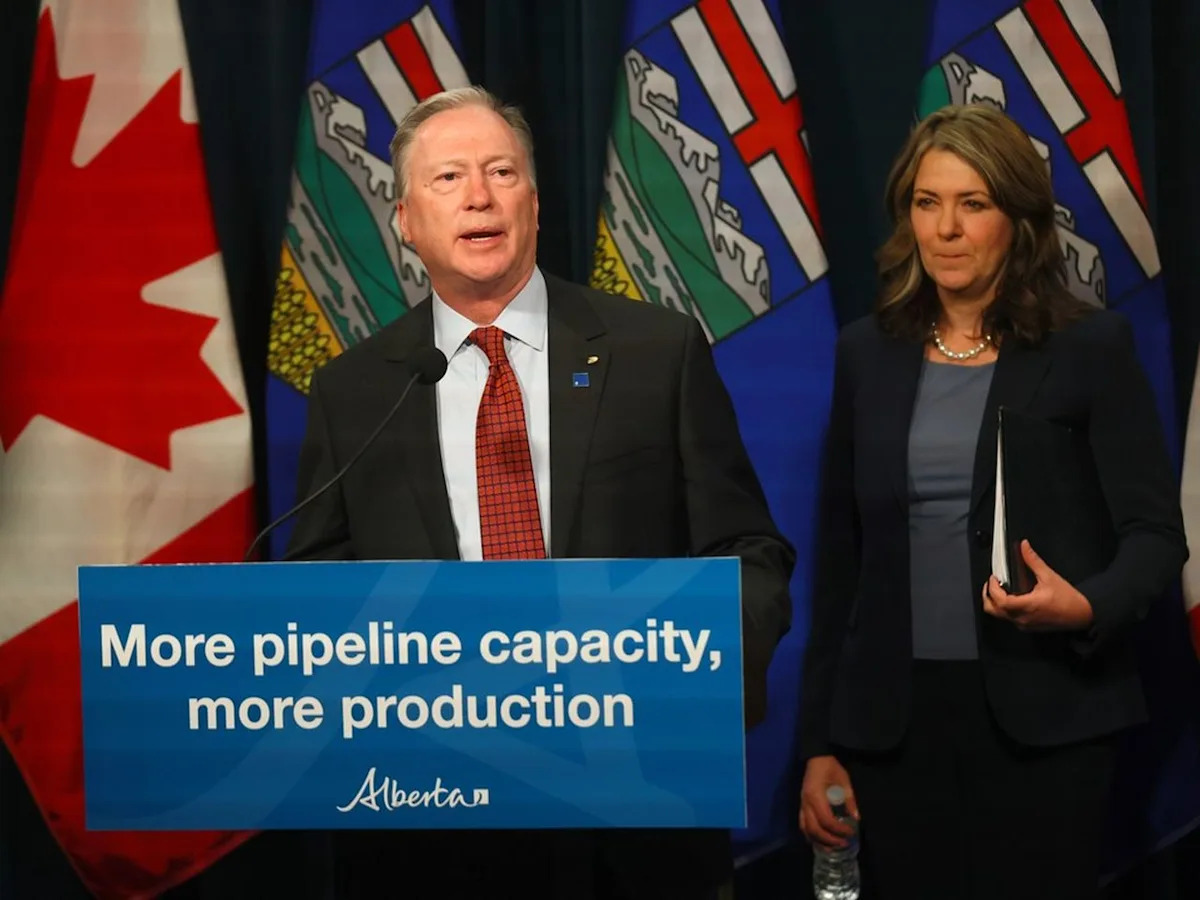

“There has been a sea change in the conversation about oil and gas development,” Premier Danielle Smith said Friday. “I want Alberta to have a greater share of that growing market.”

Calgary-based Enbridge is advancing plans to optimize the capacity of its 13,800-kilometre Mainline pipeline network, which moved an average of 3.1 million barrels per day during the July-to-September period.

Enbridge Inc. oil storage tanks are seen in Hardisty, Alberta, Canada in 2020.

In March, the company discussed a $1.5-billion expansion plan for its Mainline — to increase existing capacity by 150,000 bpd by 2027 — and potentially adopt a second phase that would add a similar amount.

On Friday, Enbridge said the first phase will remain the same size and pointed out negotiations with customers are in the final stages. It anticipates making an announcement this quarter on sanctioning the project, and bringing it into service in 2027.

However, a second expansion phase to optimize the system — in combination with the Dakota Access Pipeline, which runs from North Dakota to Illinois, and is partly owned by Enbridge — would add 250,000 bpd of capacity by 2028 for producers in Western Canada.

An announcement for an open season to determine shipper interest in the second phase is planned for early next year, CEO Greg Ebel said on an analyst call.

“Relative to potential greenfield projects that would require significant energy policy change, these brownfield opportunities offer the quickest and most cost-effective way of adding close to 500,000 barrels a day of capacity to satisfy the near-term production increases forecasted out of the basin,” he said.

Producers in Western Canada have faced pipeline bottlenecks over the past 15 years, which sometimes caused the price differential between benchmark U.S. crude and Western Canadian Select (WCS) heavy oil to widen sharply.

The expansion of the Trans Mountain pipeline to the West Coast, completed last year, has provided sufficient capacity and lowered the discount on Canadian oil.

Kilometre Zero of the Trans Mountain pipeline system at Edmonton Terminal located in Sherwood Park.

Yet, as output rises, analysts say the transportation system could be running full again later this decade, without expansions or a new pipeline.

Trans Mountain Corp. is also examining its own optimization plans to add capacity.

In Alberta, the Smith government wants to see a new greenfield pipeline built to the B.C. coast — capable of transporting one million barrels per day of oil — included on the federal government’s major projects list.

Colin Gruending, Enbridge’s president of liquids pipelines, cited third-party estimates of 500,000 to 600,000 bpd of supply growth coming from the Western Canadian Sedimentary Basin by the end of the decade.

“I don’t know that it’s an acceleration here, per se. I think it’s been ‘game on’ here for a while,” Gruending said on the third-quarter earnings call.

The company is also looking at additional expansions on the Mainline in the future, “because there is a scenario here where Canada and the U.S. do a bigger trade deal and energy is part of it, and the imperative may accelerate,” he added.

Wood Mackenzie expects oilsands production in Canada to grow by about 100,000 bpd annually in the next two years, and reach about 3.5 million bpd in 2027. The optimization plans for the Mainline and Trans Mountain would provide “a few more years of breathing room” for increased supplies, noted Oberstoetter.

Meanwhile, Canadian Natural Resources, which boosted its average production during the third quarter by 19 per cent from a year earlier, touted its ability to grow organically in the coming years — both over the short and long term — at its investor day meeting on Friday.

For 2026, the Calgary-based company expects production to average about 1.62 million boe per day, up about three per cent, or 50,000 from this year, but it has the opportunity for more growth in the years ahead.

Company president Scott Stauth said the company has the potential to increase its conventional production by 295,000 boe per day, boost thermal oilsands output by 210,000 bpd, and ramp up oilsands mining and upgrading by 240,000 bpd.

Canadian Natural Resources president Scott Stauth during the company’s annual general meeting at the Telus Convention Centre in May.

Other oilsands operators are also expanding output.

Suncor Energy produced a record 870,000 barrels of oil per day during the third quarter, up 41,000 barrels from the same time last year, while Cenovus Energy achieved record production, up eight per cent from a year earlier, to average 833,000 boe a day.

Oberstoetter said growth ambitions will vary by company and be affected by oil prices, market demand and egress, but the tone toward increasing output is shifting.

“It does show the sentiment in Canada is much more positive, that the midstream, upstream and the governments are all trying to paint a vision of potential growth,” he said.

Chris Varcoe is a Calgary Herald columnist.