The board of Korea Electric Power Industrial Development Co., Ltd (KRX:130660) has announced that it will pay a dividend on the 15th of April, with investors receiving ₩367.00 per share. The dividend yield is 3.2% based on this payment, which is a little bit low compared to the other companies in the industry.

Estimates Indicate Korea Electric Power Industrial Development’s Could Struggle to Maintain Dividend Payments In The Future

If it is predictable over a long period, even low dividend yields can be attractive. Before making this announcement, Korea Electric Power Industrial Development’s dividend was higher than its profits, but the free cash flows quite comfortably covered it. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

Looking forward, EPS could fall by 7.9% if the company can’t turn things around from the last few years. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 129%, which could put the dividend under pressure if earnings don’t start to improve.

KOSE:A130660 Historic Dividend November 9th 2025

KOSE:A130660 Historic Dividend November 9th 2025

View our latest analysis for Korea Electric Power Industrial Development

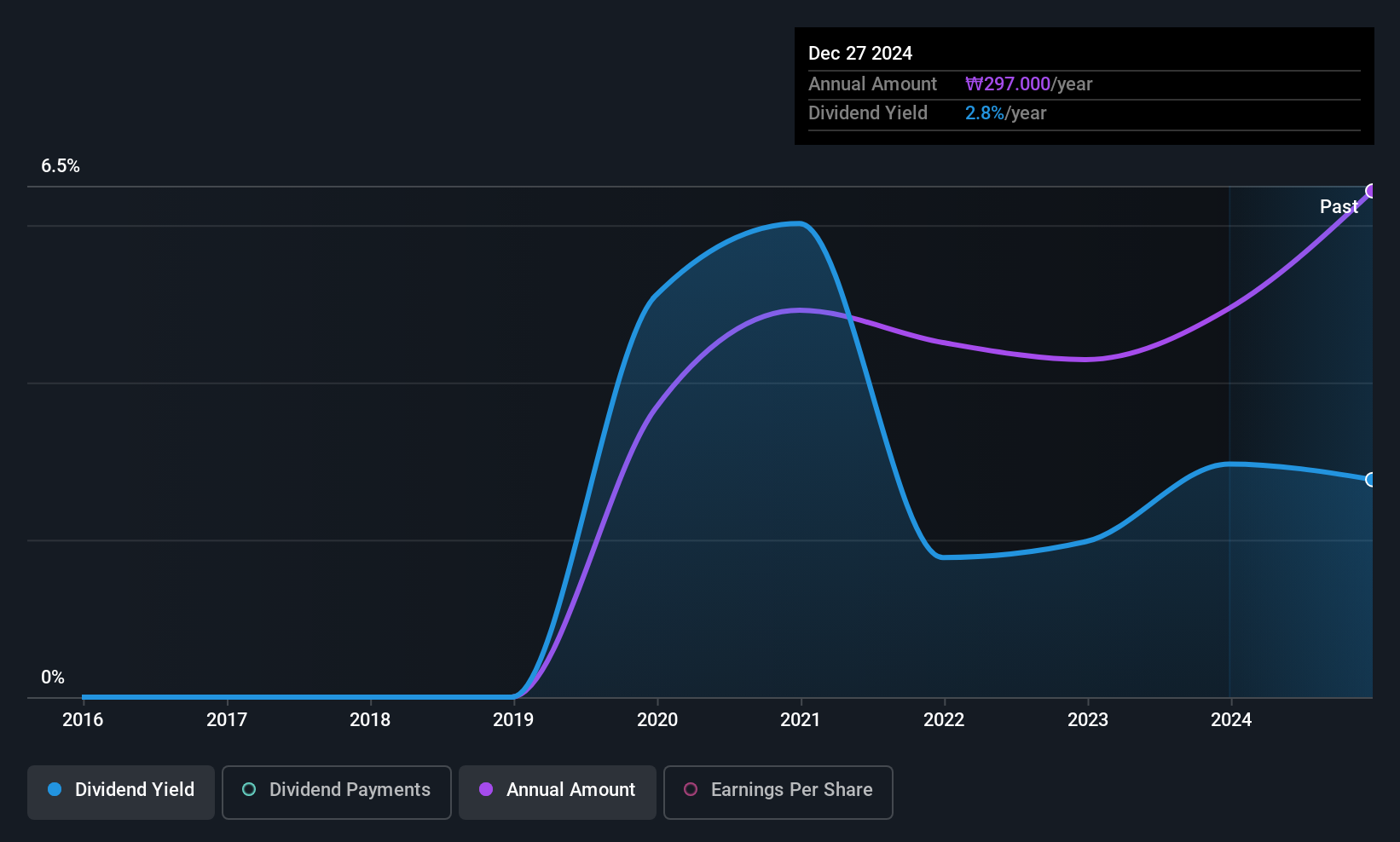

Korea Electric Power Industrial Development Doesn’t Have A Long Payment History

Korea Electric Power Industrial Development’s dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. The annual payment during the last 6 years was ₩169.00 in 2019, and the most recent fiscal year payment was ₩367.00. This works out to be a compound annual growth rate (CAGR) of approximately 14% a year over that time. We’re not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth May Be Hard To Come By

Some investors will be chomping at the bit to buy some of the company’s stock based on its dividend history. However, things aren’t all that rosy. In the last five years, Korea Electric Power Industrial Development’s earnings per share has shrunk at approximately 7.9% per annum. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

The Dividend Could Prove To Be Unreliable

Overall, it’s nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don’t think Korea Electric Power Industrial Development is a great stock to add to your portfolio if income is your focus.

It’s important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we’ve identified 2 warning signs for Korea Electric Power Industrial Development that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Discover if Korea Electric Power Industrial Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.