Q2 Holdings (QTWO) made headlines after boosting its revenue guidance for 2025 and unveiling a new $150 million share repurchase plan. Investors are paying close attention, as these moves highlight stronger profitability and ongoing growth.

See our latest analysis for Q2 Holdings.

Following the upbeat earnings, higher full-year guidance, and the new buyback program, Q2 Holdings’ share price jumped 16.6% over the past week. While 2025 has been challenging and the stock is still down nearly 28% year-to-date, this week’s momentum signals renewed optimism around profitability and growth, even as longer-term total shareholder returns remain mixed.

If this kind of momentum has you rethinking your portfolio, now is a smart time to see what’s happening with other fast-growing companies backed by strong insider conviction—discover fast growing stocks with high insider ownership

With shares still trading nearly 17% below analysts’ price targets and profitability sharply improving, the big question is whether Q2 Holdings is truly undervalued or if the market has already factored in these growth prospects.

Most Popular Narrative: 28.6% Undervalued

Compared to Q2 Holdings’ recent closing price of $71.99, the most widely followed narrative assigns a significantly higher fair value, indicating that shares are priced below what analysts expect based on fundamental drivers and long-term trends.

The increasing focus by financial institutions on digital transformation, evidenced by strong engagement and expanded investments in mission-critical digital banking, fraud prevention, and AI solutions, is likely to drive robust subscription revenue growth and improve retention for Q2 over the longer term. Heightened demand for integrated, omni-channel, and mobile-first banking experiences is accelerating adoption of Q2’s unified platform across both new and existing customers. This is expanding the addressable market and supporting higher average revenue per user (ARPU) as well as overall revenue growth.

Curious what kind of future growth rates and margin improvements have tipped the scales in this valuation? There is a bold catalyst at play, hinting at a digital transformation arc and ambitious profit trajectory that might shake up Q2 Holdings’ fundamentals. See why analysts are betting on numbers well above the status quo—the drivers are more surprising than you think.

Result: Fair Value of $100.86 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, continued consolidation among key banking clients and heightened competition from specialized vendors could put pressure on Q2 Holdings’ growth expectations moving forward.

Find out about the key risks to this Q2 Holdings narrative.

Another View: What Do Market Ratios Say?

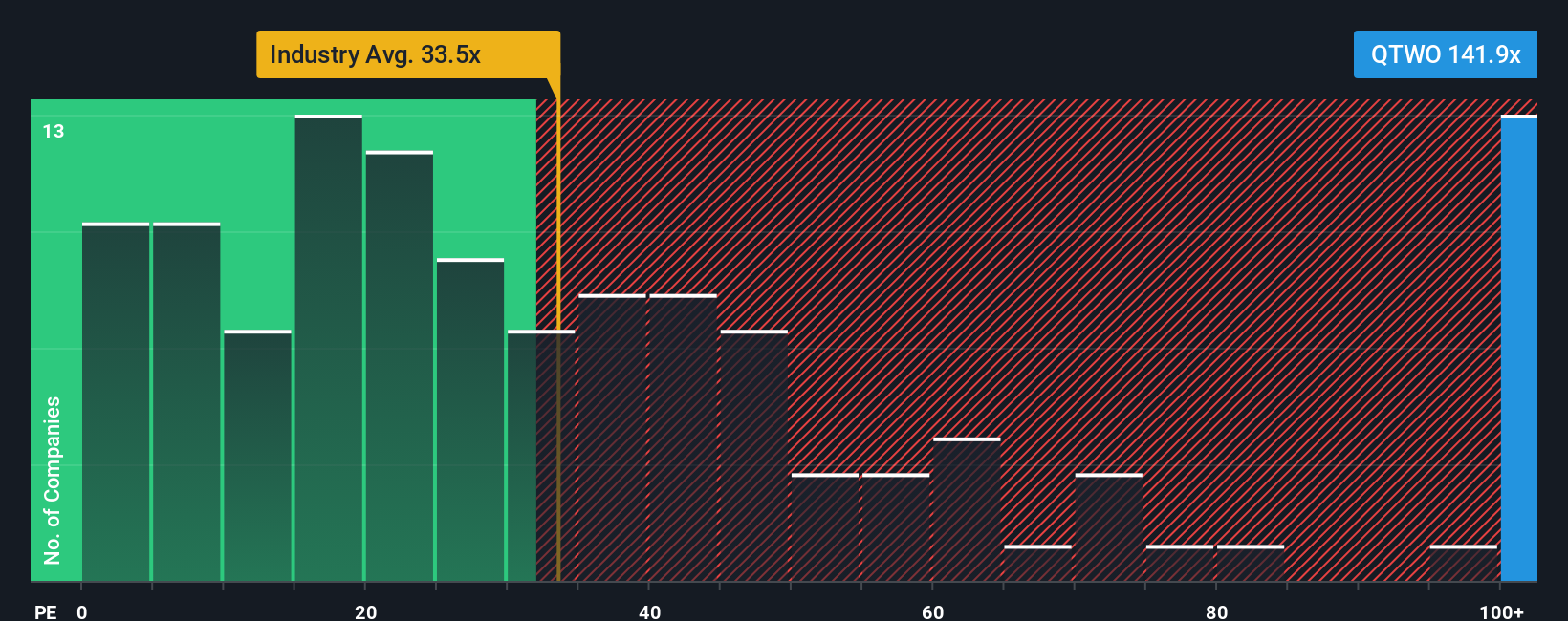

While the consensus narrative points to undervaluation based on future earnings growth, taking a closer look at Q2 Holdings’ price-to-earnings ratio tells a different story. The company trades at 141.9x earnings, which is much higher than the US Software industry average of 33.5x, its peer group at 27.9x, and above the fair ratio of 58.8x. This significant gap suggests that, despite strong growth, investors may be taking on more valuation risk than they realize. The question is whether the market will eventually catch up, or if expectations are running ahead of reality.

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:QTWO PE Ratio as at Nov 2025 Build Your Own Q2 Holdings Narrative

NYSE:QTWO PE Ratio as at Nov 2025 Build Your Own Q2 Holdings Narrative

If you’re not convinced by these narratives or want to dig deeper on your own, you can uncover your take on the numbers in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Q2 Holdings.

Looking for More Smart Investment Ideas?

Don’t stop at just one opportunity. Make sure you’re uncovering stocks with unique upside by using Simply Wall Street’s screens tailored to your goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com