Published on

November 12, 2025

A definitive shift is reshaping global travel. The planet’s premier destinations are implementing massive financial barriers. This is a quiet revolution in pricing. Four critical nations now impose sophisticated levies that will fundamentally redefine your travel budget in 2026. Thailand, Japan, Italy and the Netherlands are leading this charge. They wield compulsory Tourist Taxes to manage climate strain and overtourism. You must now view these charges as essential costs of international access.

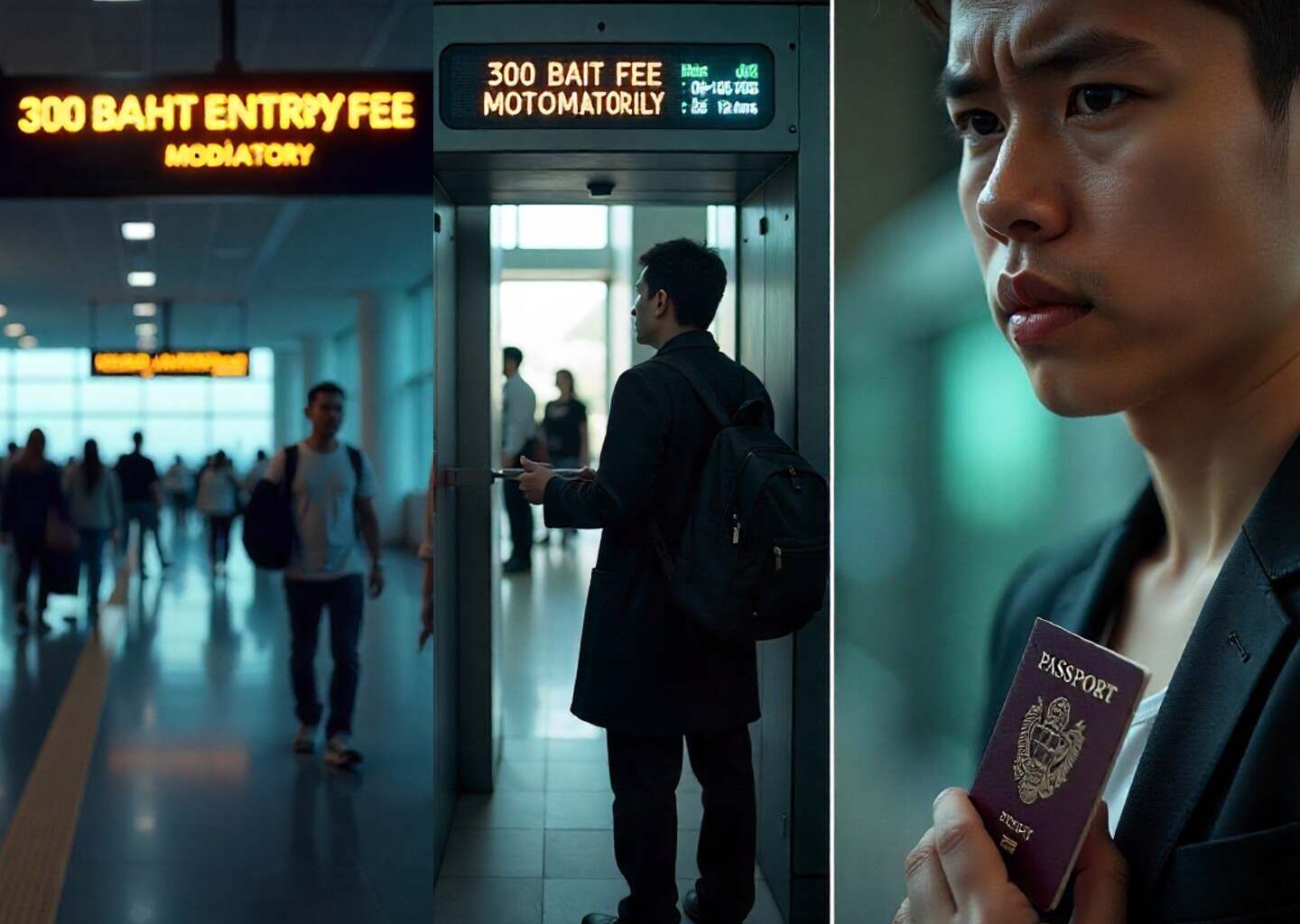

This is no longer about small hotel fees. Japan is enacting a luxury tax regime so aggressive it sends accommodation charges soaring by up to ten times for high-end travellers. The Netherlands has mandated a drastic, across-the-board VAT hike, dramatically increasing the cost of every overnight stay. Italy is fine-tuning its dynamic Access Contribution to charge day-trippers visiting Venice. Meanwhile, Thailand’s 300-Baht entry fee is set to become an operational reality after years of technical delays. These new Tourist Taxes compel visitors to fund local infrastructure and environmental resilience. They shift the financial burden directly onto the consumer. Prepare your finances now. The cost of seeing the world has just gone up dramatically.

Thailand’s Great Delay Ends: The 300-Baht Fee Becomes Reality

Thailand has long debated a compulsory entry fee for tourists. That debate is now settled. The fee is mandatory. It is simply a matter of implementation date. Government officials confirmed in mid-2025 that the new tax is unlikely to be implemented before 2026. This marks the end of a multi-year delay.

The proposed charge is 300 Baht (about £7.70 or $9 USD) for air arrivals. Land and sea arrivals face a smaller 150-Baht fee. The government has already approved these rates. This is not merely a tax increase. It is a mandatory entry levy, a financial toll just to step onto Thai soil.

Why the introduction of this new Tourist Tax? The reasons are clear. The funds collected serve a critical dual purpose. Firstly, the revenue is earmarked for infrastructure improvements and tourism development across Thailand. Secondly, a portion is explicitly dedicated to providing mandatory travel insurance coverage for foreign visitors. This covers injury or death during their stay. The policy shifts the financial burden of tourist safety incidents away from the state budget.

The delay has been purely technical. The primary obstacle remains the struggle to integrate the fee into airline ticketing systems. These systems currently cannot distinguish accurately between Thai citizens and foreign nationals. This technological hurdle is the only thing offering a temporary reprieve for travellers. Once resolved, the Tourist Taxes will begin defining the cost of holidays to Thailand. Experts warn travellers to be flexible with their Tourist Taxes budgets. The implementation, though postponed, is inevitable.

Japan’s Luxury Squeeze: Kyoto’s 10,000 Yen Shockwave

Japan is confronting overtourism head-on. Kyoto, its cultural capital, is leading the charge. The city confirmed the implementation of Japan’s highest hotel tax ever. This dramatic increase takes effect in March 2026.

Kyoto’s new tax is severely tiered. It punishes luxury stays. The new rates are astronomical compared to the current charges. For stays costing ¥100,000 or more per night, the tax leaps to a staggering ¥10,000. This is equivalent to approximately $68 USD or £56.50 per person, per night.

Consider the impact. A couple staying for one week in an ultra-luxury hotel faces an accommodation tax bill of ¥140,000. That is over $900 or £790 in tax alone. This high-end levy represents a tenfold increase from the previous maximum.

Even budget travellers will feel the pinch. Rates start at ¥200 per night for budget accommodations. The city officials are unapologetic. They say tourists must bear the cost of countermeasures against overtourism. Revenue from these Tourist Taxes funds critical infrastructure improvements. This includes new express bus services and multilingual information systems.

The new tax applies to all stays starting on or after March 1, 2026. This applies regardless of when the booking was made. Travellers with existing reservations must pay the new, higher rates. This massive adjustment confirms Japan’s commitment to managing visitor numbers through fiscal policy.

Venice’s Access War: Italy Takes Control of the Day-Tripper

Italy is utilizing a highly targeted, logistical form of taxation. Venice, famous for its canals and its crowded squares, has officially set the application dates for its Access Contribution for the year 2026. This is specifically a day-tripper fee.

The charge applies to anyone entering the Ancient City of Venice on designated high-traffic days. The goal is simple: logistics control and demand management. The fee employs a dynamic pricing structure. It actively penalises procrastination.

The fee is €5.00 daily if you pay by the fourth last day before your scheduled visit. However, if you wait to pay after that deadline, the fee doubles instantly to €10.00 daily. This is a tool of behavioural engineering, not just revenue generation. It forces travellers to commit early.

Crucially, travellers staying overnight in Venice are exempt from this charge. This is because they already pay the separate city lodging tax through their hotel. Exemptions also apply to minors under 14 and residents of the Veneto region. The minor islands of the lagoon—like Murano and Burano—are also officially excluded from the 2026 fee area.

The Venice Access Contribution represents a growing global trend. Governments use fees to manage physical access to sensitive, high-density areas. Italy’s decision sets a precedent for dynamic Tourist Taxes based on when you book, not just what you book.

The Silent Burden: Why the Netherlands Will Become Dramatically Pricier

The Netherlands is introducing perhaps the most sweeping and financially punishing tax change of the four. This move is not a small levy. It is a massive hike to the Value Added Tax (VAT) rate on accommodation.

The VAT rate for short-stay overnight accommodations will increase from 9% to 21%. This new 21% VAT rate is scheduled to take effect on 1 January 2026. This immense increase applies across the board. It affects hotels, holiday homes, bed and breakfasts, guesthouses and accommodations rented through online platforms.

This is a quiet, yet devastating, price increase. It will drastically affect overall holiday costs. Tourists will see their nightly rate jump by 12 percentage points. This increase is already scheduled. Furthermore, this 21% VAT rate applies even to advance payments and bookings made before 1 January 2026, as long as the stay itself occurs in 2026.

Amsterdam already has one of Europe’s highest local tourist taxes. The city levies a 12.5% tax on hotel and rental costs. Adding the new 21% VAT creates a staggering combined fiscal burden. This move by the Netherlands government signals a clear intent: to dramatically increase tax revenues from the tourism sector. This general tax increase acts as a powerful, non-negotiable Tourist Taxes hike.

The New Regulatory Blueprint: Climate and Compliance

The 2026 fiscal changes are not isolated events. They reflect a fundamental global policy shift. Governments are now legally and fiscally linking tourism revenue to solutions for environmental and demographic strain.

Take the example of Greece. It established a Climate Resilience Fee. This fee replaced the old stayover tax. The Greek government explicitly linked this fee to the National Climate Law. The revenue extracted is legally required to fund national climate adaptation programs and infrastructure resilience.

This tax is complex. It involves highly differentiated seasonal rates. It is tiered based on accommodation category. For instance, high-season rates for 5-star hotels are €10.00 per night. However, luxury furnished short-term rentals face an even higher rate of €15.00 per night. This aggressive, tiered structure targets high-growth sectors.

Barcelona, Spain, provides another example of fiscal layering. The city implemented a dual tax structure. It combines a regional tax with a municipal surcharge. The city increased its municipal surcharge to €4.00 per night, effective in October 2024. This resulted in total daily taxes reaching €7.50 for luxury hotels. The revenue from this surcharge goes entirely to the Barcelona City Council. This money funds local projects like the Barcelona Schools Climate Plan. This structure proves the political durability of environmentally-mandated Tourist Taxes.

Across the globe, the collection methods are also evolving. Mexico’s state of Quintana Roo mandates VisiTAX. This is a fixed $10–$11 USD fee for all international visitors. It must be paid digitally before departure. The system generates a QR code linked to the traveller’s passport. This centralized digital model minimizes leakage and maximizes government control. Bali, Indonesia, uses a similar digital levy (IDR 150,000) for culture and environment protection. Travellers are strongly encouraged to pay online before arrival.

Preparing for the 2026 Price Shock: A Final Warning

The operational landscape for travel companies has become immensely complex. Compliance systems must now handle layered taxes (Barcelona), seasonal variances (Greece) and dynamic pricing (Italy). Failure to integrate these new Tourist Taxes correctly means financial and legal risk.

For the ordinary traveller, preparation is mandatory. You can no longer rely on simple nightly rates. You must account for additional costs due to Thailand’s entry fee , Japan’s exorbitant luxury fees, Italy’s access charge and the Netherlands’ dramatic VAT hike.

This global acceleration of fiscal tourism regulation represents a permanent, structural change. Tourism is now officially deemed a direct funding source for adaptation and infrastructure globally. Expect these new, higher Tourist Taxes to continue defining international travel costs well beyond 2026.