Listen and subscribe to Decoding Retirement on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

Many people say they want to phase in and out of work and retirement. On paper, it sounds possible.

And in reality, it is, according to Jillian Johnsrud, author of “Retire Often.”

In a recent episode of the Decoding Retirement podcast, Johnsrud discussed the growing debate about hustle culture sparked by tech titans Jeff Bezos and Eric Schmidt. They’ve argued that true growth requires total commitment and that “balance” can be a euphemism for mediocrity.

According to Johnsrud, there’s value in going all in on your career. “But I think of it like sprinting,” she said. “Sprinting is great, but you can’t sprint forever. You sprint, then you walk. It’s like interval training.”

Johnsrud said workers need seasons of intensity and seasons of rest.

“Employers today often burn through our human capital in three to five years and replace workers when they’re burned out,” she said. “If they’re not invested in our long-term well-being, then we have to be. Sprint when you need to — but also rest.”

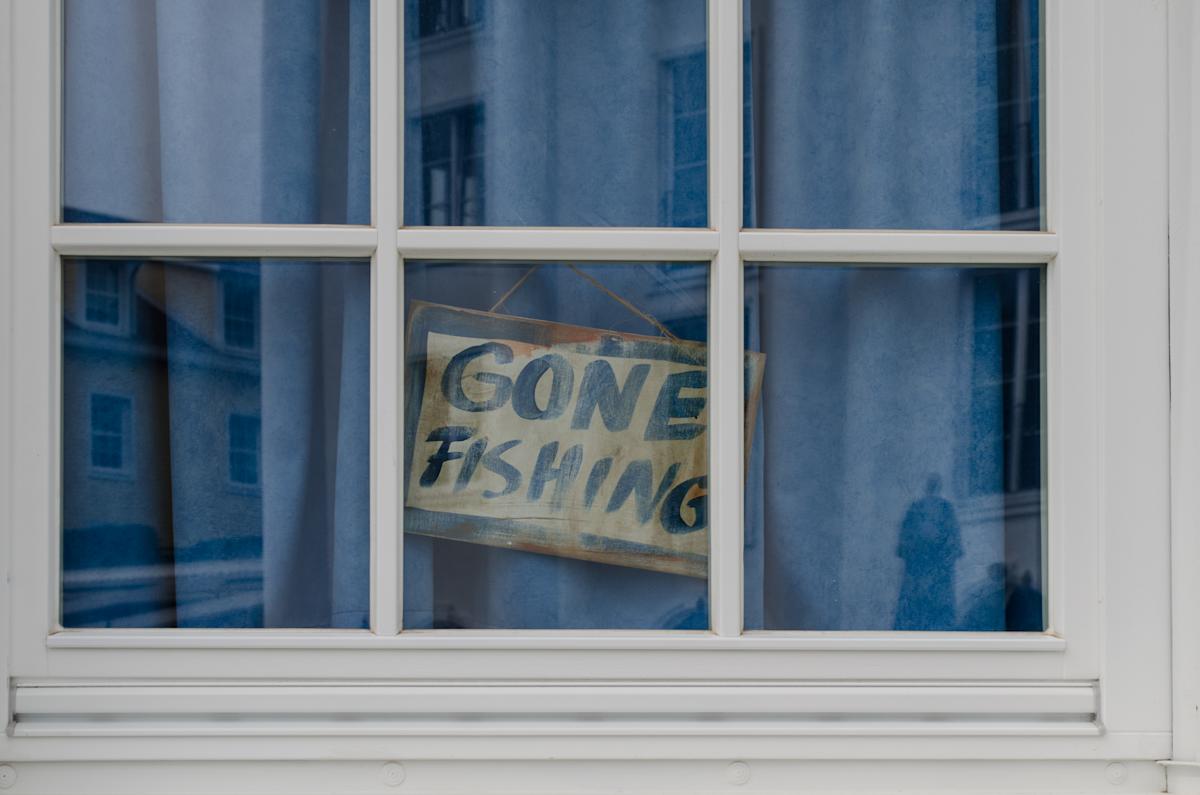

For Johnsrud, that rest is what she calls a “mini retirement.”

She explained that a mini retirement doesn’t mean sitting on the couch for a month. Instead, she recommended planning three to five activities a day that “give you more energy than they take,” such as going for walks, doing yoga, and having lunches with friends.

To be sure, taking time off for a mini retirement might seem financially impossible, especially for younger workers. But Johnsrud said there’s a smart way to do it without putting your finances at risk.

“Start small,” she said. “I define a mini retirement as a month or more off from your nine-to-five to focus on something meaningful. Negotiate a month off between jobs. Taking even one every decade — in your 20s, 30s, and 40s — can reset motivation and build perspective.”

Read more: Find the 10 best high-yield savings accounts

So what are the financial nuts and bolts of taking a mini retirement?

“For your first mini retirement, cash savings work fine,” Johnsrud said. “Later, you can use investments, real estate, or freelance income. For example, one friend wants to move to Europe and is freelancing now to secure a visa and income there. Once people experience a mini retirement, they often restructure finances to make it a regular part of life.”