Marathon Petroleum (MPC) just posted third quarter earnings showing net income and earnings per share more than doubling from last year, even though revenue stayed largely unchanged. That kind of profit jump gets investors’ attention.

See our latest analysis for Marathon Petroleum.

Marathon Petroleum’s shares have been on a tear lately, riding a wave of strong quarterly results along with the announcement of new buybacks and leadership changes. With a 1-year total shareholder return of nearly 30% and a price return of over 41% year-to-date, momentum is clearly building for investors who favor consistent performance in addition to those headline-making profit numbers.

If the surge in buybacks and executive moves has you looking for more opportunities, broaden your search and uncover fast growing stocks with high insider ownership.

But with all this positive momentum, is the recent rally leaving shares undervalued at these levels? Or has the market already priced in Marathon Petroleum’s next stage of growth and profitability?

Most Popular Narrative: Fairly Valued

With Marathon Petroleum’s most popular narrative placing fair value at $197.50, just under the last close of $199.98, the market appears to be pricing in the latest expectations. Investors are facing a scenario where consensus and traded price are nearly aligned, raising the stakes for what could move the stock next.

Disciplined capital allocation through continued share buybacks, increasing MPLX distributions, and maintenance of an investment-grade balance sheet are set to drive higher earnings per share and sustained shareholder returns. This aligns with positive long-term company trends.

The secret sauce behind this fair value? Bold profit margin expansion and aggressive share count reduction expectations. Curious which of these numbers dominates the narrative math? Only the full narrative reveals the forecast fueling Wall Street’s consensus.

Result: Fair Value of $197.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, if environmental policies tighten or demand for refined products drops faster than expected, this fair value case could unravel quickly.

Find out about the key risks to this Marathon Petroleum narrative.

Another View: Our DCF Model Points Higher

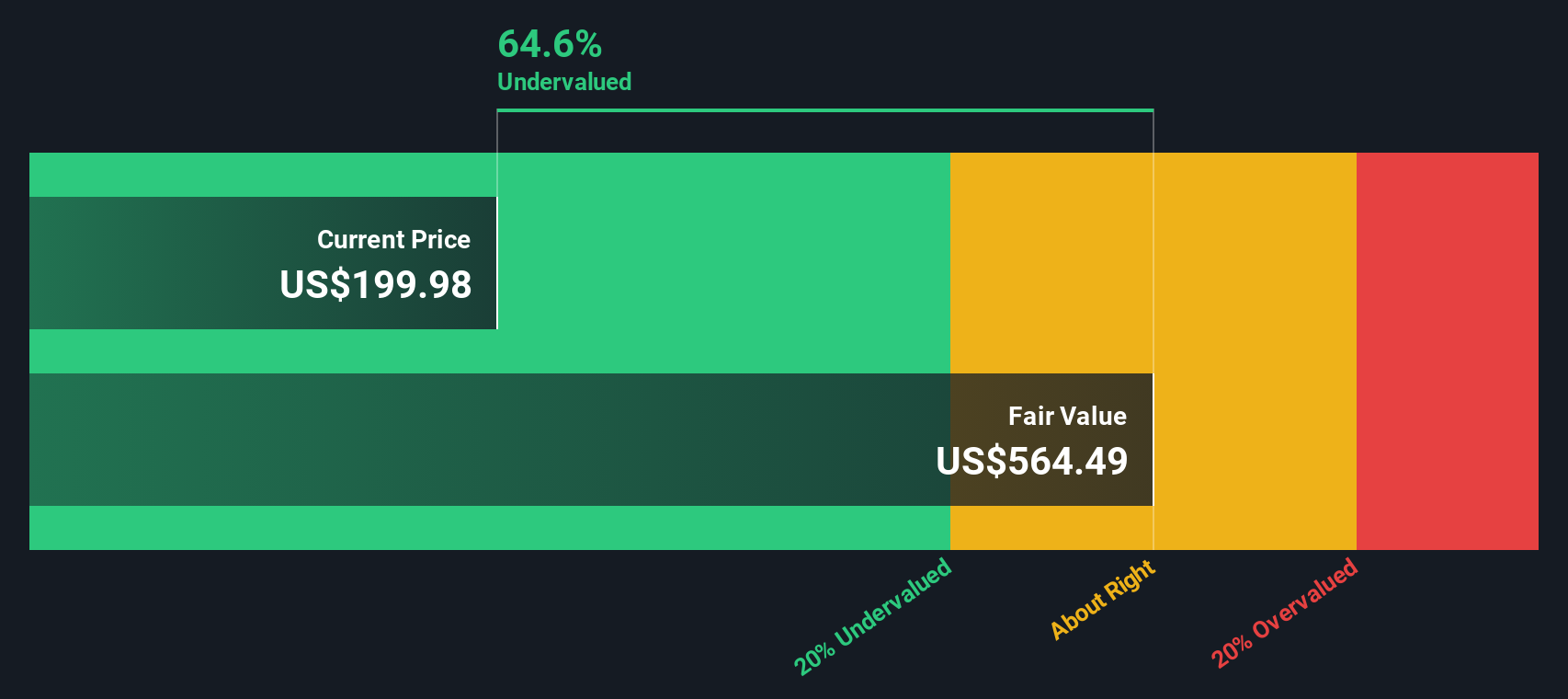

Looking at the SWS DCF model, Marathon Petroleum’s current share price of $199.98 is trading far below its estimated fair value of $564.49. From this perspective, the market appears to be overlooking a significant upside opportunity if future cash flows materialize as forecasted. Could this DCF valuation be too optimistic, or is the fair value consensus simply playing it safe?

Look into how the SWS DCF model arrives at its fair value.

MPC Discounted Cash Flow as at Nov 2025

MPC Discounted Cash Flow as at Nov 2025

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Marathon Petroleum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Marathon Petroleum Narrative

If you have a different angle, or want to dive deeper into the numbers on your own terms, you’re just minutes away from building it yourself. Do it your way.

A great starting point for your Marathon Petroleum research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your portfolio to a single opportunity when so many promising stocks are waiting to be uncovered. The best investors cast a wider net, so make your next move count with these handpicked ideas:

Catch income opportunities and see how you can add stability with these 16 dividend stocks with yields > 3% offering yields above 3% in today’s market. Power up your returns by jumping into these 25 AI penny stocks, where innovative companies are transforming entire industries with artificial intelligence breakthroughs. Capitalize on the next wave of tech by tapping into these 26 quantum computing stocks, leading advancements in quantum computing solutions and reshaping tomorrow’s landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com