Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

BlackSky Technology Investment Narrative Recap

To be a shareholder in BlackSky Technology, you likely need to believe in the company’s ability to convert its Gen-3 constellation investments and expanding international defense customer base into more predictable, recurring revenues. The new US$30 million multi-year contract helps address concerns around customer commitment and ramps up visibility for revenue growth, but the company’s growing net losses and cash burn remain a key risk in the short term, progress on margin improvement will be critical going forward.

The just-announced international defense contract is especially relevant for understanding near-term catalysts, as it converts an early-stage opportunity into a secured multi-year revenue stream. This may help lessen some revenue volatility and show early traction for Gen-3 services, supporting BlackSky’s focus on international expansion, although ongoing net losses and the need for additional capital still weigh on the business story.

However, investors should be alert to the risk that, despite headline contract wins, many customer agreements are still early access or trial-based, meaning …

Read the full narrative on BlackSky Technology (it’s free!)

BlackSky Technology’s narrative projects $230.4 million revenue and $16.4 million earnings by 2028. This requires 30.1% yearly revenue growth and a $102.5 million increase in earnings from -$86.1 million today.

Uncover how BlackSky Technology’s forecasts yield a $27.29 fair value, a 107% upside to its current price.

Exploring Other Perspectives BKSY Community Fair Values as at Nov 2025

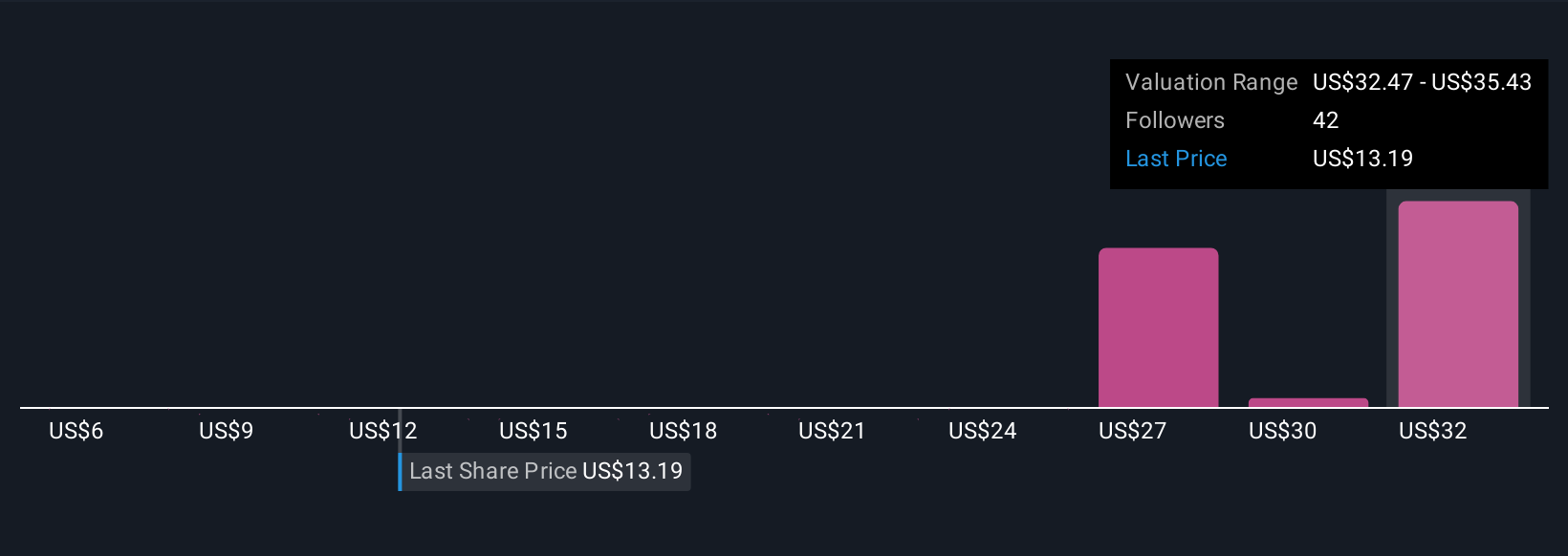

BKSY Community Fair Values as at Nov 2025

Simply Wall St Community users have published nine fair value estimates for BlackSky Technology ranging from US$5.84 to over US$35.42 per share. With expectations for accelerated Gen-3 service adoption as a recurring revenue catalyst, you may want to compare alternative views in light of these varied community opinions.

Explore 9 other fair value estimates on BlackSky Technology – why the stock might be worth less than half the current price!

Build Your Own BlackSky Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Curious About Other Options?

Early movers are already taking notice. See the stocks they’re targeting before they’ve flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if BlackSky Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com