American Water Works Company has requested regulatory approval to increase customer water and wastewater rates. The company aims to fund $1.2 billion in capital investments through 2027. The plan is designed to upgrade infrastructure and enhance service reliability.

See our latest analysis for American Water Works Company.

American Water Works Company’s share price has pulled back in the last month, but overall, momentum remains steady with a 6.3% year-to-date increase and a modest 0.5% total shareholder return over the past year. The recent announcement about new rate adjustments and infrastructure investments has kept investors’ attention on the utility’s growth and reliability. At the same time, near-term price swings reflect shifting outlooks on future returns and regulatory outcomes.

If you’re interested in finding other companies with clear growth signals and strong insider backing, now’s a great moment to discover fast growing stocks with high insider ownership

With steady growth but a recent pullback, does American Water Works now trade at an appealing discount for long-term investors, or has the market already priced in future growth and improvements from these planned investments?

Most Popular Narrative: 8.5% Undervalued

The most popular narrative places American Water Works Company’s fair value at $143.78, notably above the last close of $131.62. This sets up expectations for potential upside as analysts consider both industry trends and the company’s growth blueprint.

Persistent population growth and urbanization across key U.S. states are fueling organic customer additions (for example, a 2% customer growth target and multiple acquisitions adding approximately 87,000 connections). This underpins long-term revenue growth as American Water expands its service footprint and taps into rising water demand.

What is the secret behind this bullish fair value? The narrative is betting on robust customer growth, ambitious acquisition plans, and a future profit profile that rivals industry leaders. Want to see the bold financial projections and market-shifting assumptions that analysts believe will drive the stock higher? Dive into the full story to discover the remarkable numbers fueling this valuation.

Result: Fair Value of $143.78 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent cost inflation and regulatory hurdles in key states could still threaten margin growth and limit American Water Works Company’s long-term upside.

Find out about the key risks to this American Water Works Company narrative.

Another View: The Market’s Multiple Tells a Different Story

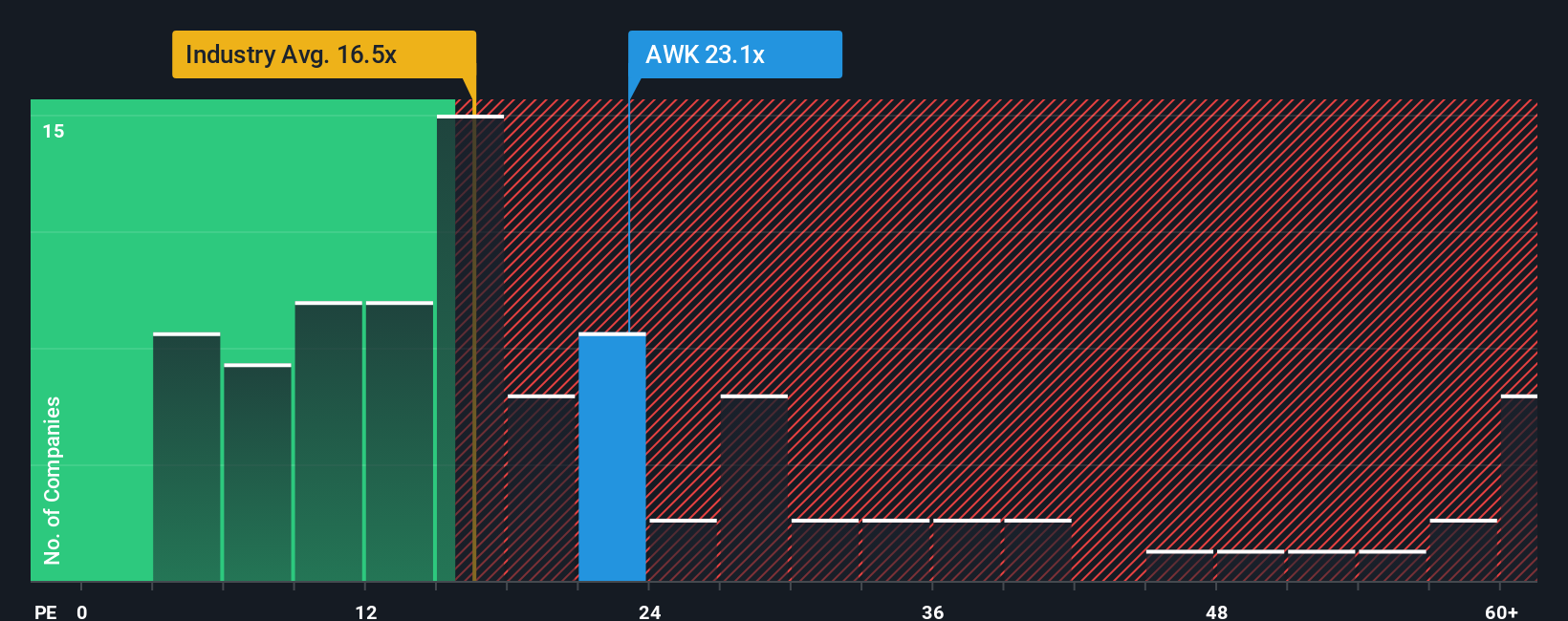

While some believe American Water Works Company has upside based on long-term growth, its current price-to-earnings ratio of 23.1x stands notably above the peer average of 18.7x, the global industry average of 16.6x, and even the fair ratio of 21.9x our analysis suggests. This premium raises important questions about future return potential versus valuation risk. Are expectations already built in, or is the market still missing something?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:AWK PE Ratio as at Nov 2025 Build Your Own American Water Works Company Narrative

NYSE:AWK PE Ratio as at Nov 2025 Build Your Own American Water Works Company Narrative

If you see things differently or prefer to dig into the numbers yourself, crafting your own unique narrative for American Water Works Company is quick and straightforward. Do it your way Do it your way.

A great starting point for your American Water Works Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Seize your chance to spot hidden winners before the crowd. The Simply Wall St Screener highlights bold investment opportunities you truly don’t want to overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com