Press Release

LONDON — November 17, 2025 — ETFGI, a leading independent research and consultancy firm known for its expertise in subscription research, consulting services, events, and ETF TV on global ETF trends, announced today that assets in the European ETF industry reached a record US$3.11 trillion at the end of October. During the month, European ETFs gathered net inflows of US$42.30 billion, bringing year-to-date inflows to US$333.22 billion, according to ETFGI’s October 2025 European ETFs and ETPs industry landscape insights report, part of its annual subscription research service. (All figures in USD unless otherwise noted.)

Record Assets: European ETF industry assets reached $3.11 trillion at the end of October, surpassing the previous record of $3.01 trillion in September 2025.

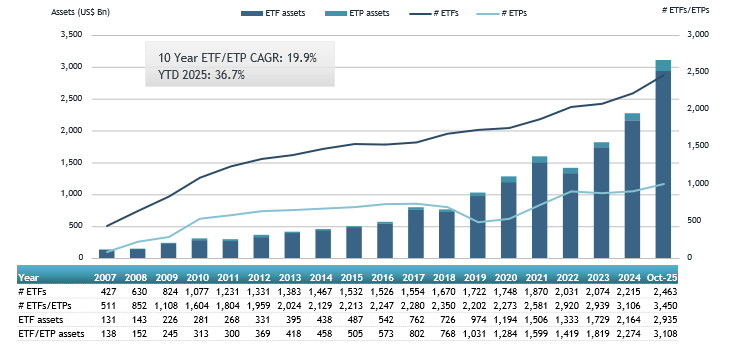

Strong Growth: Assets have grown 36.7% year-to-date, rising from $2.27 trillion at the end of 2024.

October Flows: Net inflows of $42.30 billion in October 2025.

Historic YTD Inflows: Year-to-date net inflows of $333.22 billion, the highest on record, ahead of $207.79 billion in 2024 and $165.83 billion in 2021.

Consistency: This marks the 37th consecutive month of net inflows.

The S&P 500 rose 2.34% in October, bringing its year-to-date gain to 17.52%. Developed markets excluding the U.S. advanced 1.69% in October and are up 29.83% so far in 2025, with Korea (+18.88%) and Luxembourg (+6.71%) leading the monthly gains. Emerging markets climbed 1.71% during October and have gained 24.50% year-to-date, driven by strong performances in Taiwan (+8.60%) and Hungary (+8.41%), according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Growth in assets in the European ETFs industry as of the end of October

The ETFs industry in Europe had 3,450 products, with 14,472 listings, assets of $3.11 Tn, from 132 providers listed on 30 exchanges in 25 countries at the end of October.

iShares is the largest ETF provider in Europe with US$1.26 trillion in assets, representing a 40.6% market share. Amundi ETF ranks second with US$382.36 billion (12.3%), followed by DWS Xtrackers at US$326.18 billion (10.5%). Together, the top three providers—out of 132—account for 63.4% of European ETF assets, while the remaining 129 providers each hold less than 8% market share.

In October, European ETFs attracted net inflows of $42.30 billion. Equity ETFs led with $25.66 billion, bringing year-to-date net inflows to $221.98 billion—well above the $144.69 billion recorded at this point in 2024. Fixed income ETFs added $15.92 billion in October, pushing YTD net inflows to $64.43 billion, compared to $54.52 billion last year. Commodities ETFs saw net outflows of $5.24 billion during the month, though YTD net inflows remain positive at $10.57 billion, a sharp improvement from $4.51 billion in net outflows in 2024. Active ETFs attracted $5.06 billion in October, bringing YTD net inflows to $32.09 billion—more than double the $13.24 billion reported at this time last year.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $21.03 Bn in October. Amundi EUR Corporate Bond 1-5Y ESG UCITS ETF Acc (EBBB FP) gathered $5.04 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets October 2025: Europe

Name

Ticker

Assets

($ Mn)

Oct-25

NNA

($ Mn)

YTD-25

NNA

($ Mn)

Oct-25

Amundi EUR Corporate Bond 1-5Y ESG UCITS ETF Acc

EBBB FP

6,587.02

5,641.51

5,043.05

iShares MSCI USA ESG Enhanced UCITS ETF

EEDS LN

26,390.96

3,704.99

1,730.74

iShares Core S&P 500 UCITS ETF

CSSPX SW

138,828.94

8,617.98

1,280.04

Invesco US Treasury 7-10 Year UCITS ETF

TREX LN

2,531.03

1,212.23

1,244.83

Vanguard FTSE All-World UCITS ETF

VWRD LN

50,717.82

10,200.50

1,119.91

iShares Core MSCI World UCITS ETF

IWDA LN

126,767.64

11,570.58

1,089.42

iShares MSCI USA ESG Screened UCITS ETF

SASU LN

17,767.78

5,441.53

1,021.60

UBS Core S&P 500 UCITS ETF

UBU9 GY

2,949.00

1,457.87

845.80

Amundi Core S&P 500 Swap UCITS ETF USD Dist

LSPU LN

27,440.98

3,727.84

729.70

iShares € High Yield Corp Bond UCITS ETF

IHYG LN

9,517.51

638.55

718.64

Xtrackers MSCI Japan UCITS ETF

XMJP GY

5,158.91

1,291.72

718.38

PIMCO US Dollar Short Maturity ETF

MINT LN

3,454.11

1,371.16

707.12

UBS Core MSCI World UCITS ETF

UBU7 GY

7,265.60

4,176.16

693.11

Amundi Smart Overnight Return UCITS ETF Acc

CSH2 FP

7,248.63

2,693.16

657.36

HSBC Global Government Bond UCITS ETF

HGVU LN

8,505.56

1,105.91

600.03

Xtrackers MSCI World Swap UCITS ETF

XMWO GY

10,609.33

1,392.45

596.15

VanEck Vectors Gold Miners UCITS ETF (GDX)

GDX LN

3,181.97

642.77

574.90

Invesco UK Gilt 15+ Year UCITS ETF

GT15 LN

562.46

556.20

554.84

UBS Solactive China Technology UCITS ETF

CQQQ SW

778.17

726.89

553.79

Schroder Global Equity Active UCITS ETF

SAEG LN

592.24

581.85

551.76

The top 10 ETPs by net new assets collectively gathered $1.83 Bn during October. CoinShares FTX Physical Staked Solana (SLNC GY) gathered $456.96 Mn, the largest individual net inflow.

Top 10 ETPs by net new assets October 2025: Europe

Name

Ticker

Assets

($ Mn)

Oct-25

NNA

($ Mn)

YTD-25

NNA

($ Mn)

Oct-25

CoinShares FTX Physical Staked Solana

SLNC GY

965.56

648.00

456.96

CoinShares Physical Staked Toncoin

CTON SW

339.00

339.00

339.00

AMUNDI PHYSICAL GOLD ETC (C) – Acc

GOLD FP

10,491.26

1,691.73

313.33

iShares Bitcoin ETP

IB1T GY

702.15

657.57

143.47

WisdomTree Industrial Metals

AIGI LN

613.18

78.93

125.42

WisdomTree Physical Stellar Lumens

XLMW SW

93.99

99.67

99.67

21Shares Solana Staking ETP

ASOL SW

1,388.34

306.50

95.12

WisdomTree Physical Platinum

PHPT LN

610.51

(289.38)

93.77

WisdomTree Physical Bitcoin

BTCW SW

1,454.34

273.93

83.40

WisdomTree WTI Crude Oil

CRUD LN

596.33

73.65

77.98

Investors have tended to invest in Equity ETFs during October.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

Register now to attend our 7th Annual ETFGI Global ETFs Insights Summit – Canada on December 9 in Toronto at Borden Ladner Gervais LLP (BLG)’s office!

The day will begin with an opening bell-ringing ceremony with the TMX Group to celebrate 35 years of ETFs in Canada, followed by a full-day of panel discussions featuring industry leaders.

The summit is designed as an educational event to foster deep, insightful discussions on the use, due diligence and selection and best trading practices for ETFs by financial advisors and institutional investors in Canada. Explore how regulatory changes are impacting product development including share classes, Active ETFs, Alternative ETFs, Crypto, digital assets and tokenisation and market structure.

SPEAKERS INCLUDE:

Greg Benhaim, Executive Vice President of Product and Head of Trading, 3iQ Corp

Jean-René Carle-Mossdorf, Head of ETF Product Development, Desjardins

Raymond Chan, SVP, Investment Management Division, Ontario Securities Commission

Deborah Fuhr, Managing Partner, Founder, ETFGI

Valerie Grimba, Director, Head of Global ETF Strategy, RBC Capital Markets

Andrea Hallett, Vice President, Portfolio Manager, Mackenzie Investments

Marchello Holditch, Head of Multi-Asset Solutions, BMO Global Asset Management

Stephen Hoffman, Managing Director, Exchange Traded Funds, RBC Global Asset Management

Pei-Ching Huang, Senior Legal Counsel, Investment Management Division, Ontario Securities Commission

Ronald C. Landry, Vice President, Head of Segment Solutions and Canadian ETF Services, CIBC Mellon

Graham MacKenzie, Managing Director, Exchange Traded Products, TMX Group

Breiffni McCormack, Managing Director, Client Solutions, RBC Investor Services

Stephen Paglia, Vice President, Investment Management, Ontario Securities Commission

Lindsay Patrick, Chief Strategy & Innovation Officer, RBC Capital Markets

Grace Pereira, Partner, Borden Ladner Gervais LLP

Jeffrey Sardinha, Senior Vice President – Head of ETF Solutions – Americas, State Street

Raline Sexton, Director Digital Asset Business Strategy, MarketVector Indexes

Whitney Wakeling, Partner, Investment Management, Borden Ladner Gervais LLP

Hail Yang, Director, iShares Strategy, BlackRock Canada

Mary Jane Young, Managing Director, Head of CA ETF Trading, TD Securities

SESSIONS INCLUDE:

Bell Ringing Ceremony with TMX Group

Trends in the ETFs Industry – ETFGI Research

CSA ETF Consultation Update

Update on the Canadian ETF Market Landscape

How Regulations are Impacting ETFs and Investors

How Investors are Using ETFs

Fireside Chat – Managing Career Transitions – In Partnership with Women in ETFs

Evolving Life Cycle of ETFs

The Rise of Alternative Strategies in the ETF Wrapper

The Future of the Asset Management and ETFs industry

Don’t miss this opportunity to explore key trends and network with industry leaders driving the future of ETFs. Register now to join us!

📅Event Date: Tuesday, December 9th

⏰Time: Full day event

📍Location: Borden Ladner Gervais’s office in Toronto

🆓Free Registration: For CFA members, buy-side institutional investors, and financial advisors.

![]() CPD Credits: Earn educational credits

CPD Credits: Earn educational credits

📋View the agenda, speakers, and topics from last year’s successful annual ETFGI Global ETFs Insights Summit – Canada – https://rb.gy/rremx7

Register your interest in attending our 2026 ETFGI Global ETFs Insights Summits:

ETFGI (www.ETFGI.com) is a leading independent research and consulting firm which has for over 13 years provided subscription research services providing monthly reports covering trends in the global ETFs ecosystem. Stay ahead of the curve with ETFGI’s trusted, data-driven insights into the global ETF ecosystem — from active and smart beta strategies to crypto, ESG, and institutional usage.” Contact us if you are interested in subscribing to any of our annual research services. Our reports cover the Global ETFs industry which had 15,125 products, with 29,677 listings, assets of $18.81 trillion, from 915 providers on 81 exchanges in 63 countries at the end of September 2025.

ETF TV (www.ETFtv.net) is an on-demand program that highlights newly launched exchange-traded funds, products, and notes, while exploring the most pressing topics shaping the ETF landscape. Each episode brings together leading voices from across the industry—including issuers, investors, benchmark providers, and traders—to discuss the trends and developments influencing the use and management of exchange-traded products.

Every show features insightful interviews with key market participants, offering expert perspectives on the issues that matter most to the ETF community. ETF TV also offers the opportunity to create sponsored episodes, allowing partners to collaborate with us in producing custom content tailored to their brand and messaging.

Contact us if you are interested in sponsoring or speaking at any of our upcoming events, subscribing to our annual research services or sponsoring an episode of ETF TV or have any questions, please contact us deborah.fuhr@etfgi.com and margareta.hricova@etfgi.com.

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr Twitter | LinkedIn

ETFGI Twitter | LinkedIn | Website

ETFs Network LinkedIn

ETF TV Twitter | LinkedIn | Website

Women in ETFs, Board member and founder

Women in ETFs Twitter | LinkedIn | Website

Disclaimer:

This press release is published by, and remains the copyright of, ETFGI LLP (“ETFGI”) or its licensors. The information and data in this press release is for information purposes only. ETFGI makes no warranties or representations regarding the accuracy or completeness of the information contained on this press release.

ETFGI does not offer investment advice or make recommendations regarding investments and nothing in the press release shall be deemed to constitute financial or investment advice in any way and shall not constitute a regulated activity for the purposes of the Financial Services and Markets Act 2000. Further, nothing in this press release shall constitute or be deemed to constitute an invitation or inducement to any person to engage in investment activity. Should you undertake any such activity based on information contained in this press release, you do so entirely at your own risk and ETFGI shall have no liability whatsoever for any loss, damage, costs or expenses incurred or suffered by you as a result.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Our registered office is at 130 Jermyn Street, 2nd Floor, St James’s, London, SW1Y 4UR.