From being plundered by the Nazis to becoming the world’s third-largest holder of gold reserves, Italy’s journey with gold has been fraught with blood and tears. Despite a debt-to-GDP ratio of 137%, the country has refrained from touching this wealth.

Italy’s sovereign assets have often been the focal point of market crises in recent years. However, with the country’s central bank holding vast gold reserves that have reached record highs alongside rising gold prices, Italy is now reaping an ‘unexpected windfall.’

Italy’s gold reserves stem from its steadfast commitment to asset preservation—having rebuilt its reserves plundered by the Nazis in the 1940s, the country has consistently resisted calls to ‘sell gold’ despite multiple crises and surging national debt over the decades.

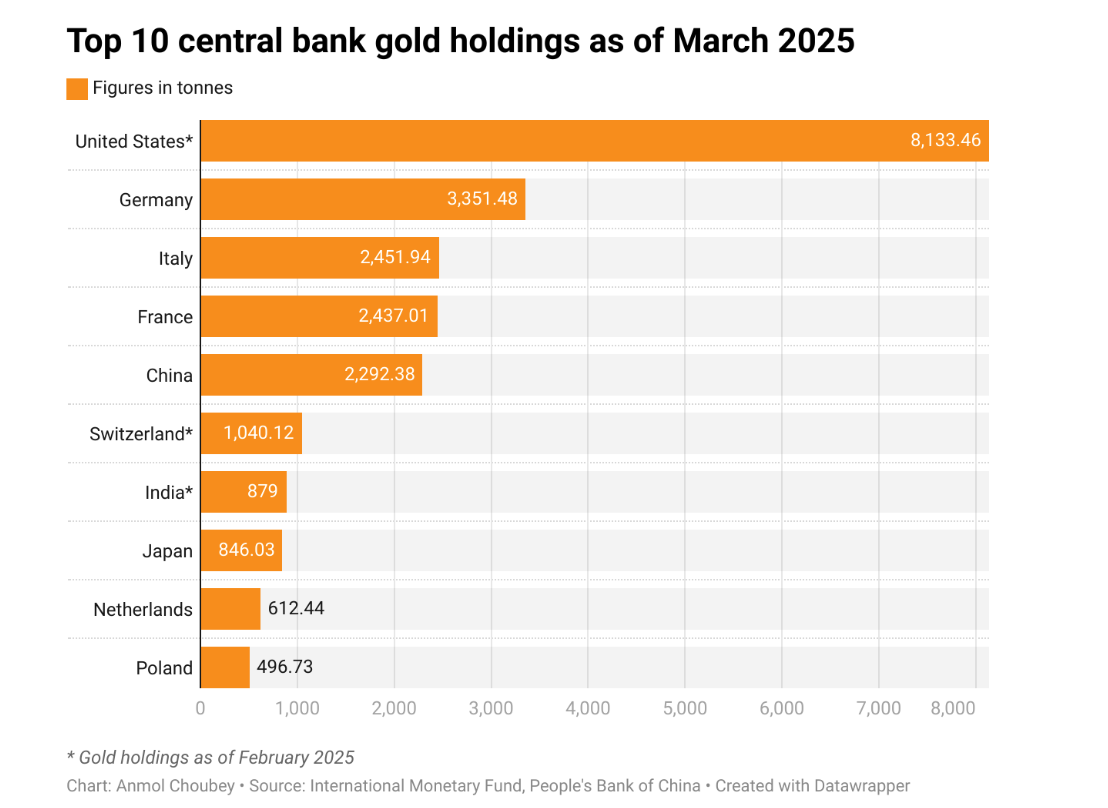

According to Reuters calculations, the Bank of Italy currently holds the world’s third-largest national gold reserve, trailing only the United States and Germany. Its 2,452 tons of gold, valued at current prices, amount to approximately USD 300 billion, roughly equivalent to 13% of Italy’s projected national output in 2024.

According to Reuters calculations, the Bank of Italy currently holds the world’s third-largest national gold reserve, trailing only the United States and Germany. Its 2,452 tons of gold, valued at current prices, amount to approximately USD 300 billion, roughly equivalent to 13% of Italy’s projected national output in 2024.

Top ten central banks with the largest gold holdings as of February 2025Wartime experiences shape peacetime policies

Top ten central banks with the largest gold holdings as of February 2025Wartime experiences shape peacetime policies

Italy’s ‘affinity’ for gold dates back thousands of years: the Etruscans mastered gold bead fusion techniques even before the Roman era. During Julius Caesar’s reign, the aureus became the monetary cornerstone of the Roman Empire; centuries later, the influence of the Florentine fiorino in medieval Europe rivaled that of the modern-day US dollar.

The formation of Italy’s modern gold policy is closely tied to its wartime experiences: under the assistance of the Fascist regime, Nazi forces plundered 120 tons of Italy’s gold reserves. By the end of World War II, Italy’s gold reserves had dwindled to approximately 20 tons.

During the post-war ‘economic miracle,’ Italy emerged as an export-oriented economy, with a significant increase in foreign exchange inflows (especially US dollars). According to the Bank of Italy’s official website, part of this foreign exchange was converted into gold.

By 1960, Italy’s gold holdings had climbed to 1,400 tons, including three-quarters of the ‘plundered gold’ recovered in 1958.

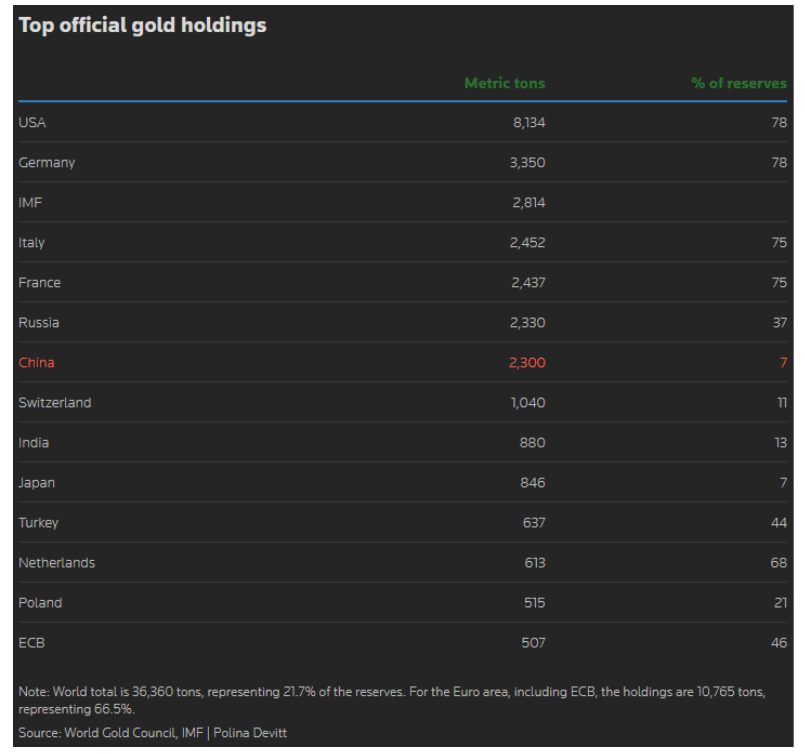

Gold holdings of major central banksAs precious as ‘family silverware’

Gold holdings of major central banksAs precious as ‘family silverware’

The oil crisis of the 1970s triggered a broader range of global uncertainties, which for Italy meant social unrest and frequent government changes—factors considered risks by investors.

‘Extreme monetary instability prompted Western central banks to purchase gold because it represents the ultimate symbol of financial stability,’ Stefano Caselli, Dean of SDA Bocconi School of Management, told Reuters.

To fill the budget gap left by capital flight, in 1976, the Italian government pledged 41,300 gold bars from its gold reserves as collateral for a $2 billion loan application to the German central bank.

But unlike the UK or Spain, Italy has consistently refused to sell its gold, even during the 2008 debt crisis, maintaining its full reserves.

‘Gold is like family silverware, like a grandfather’s cherished watch, the last resort in times of crisis—any crisis that weakens international confidence in Italy can be supported by it,’ wrote Salvatore Rossi, former deputy governor of the Bank of Italy, in his 2018 book Oro (Gold).

Choices of a New Era

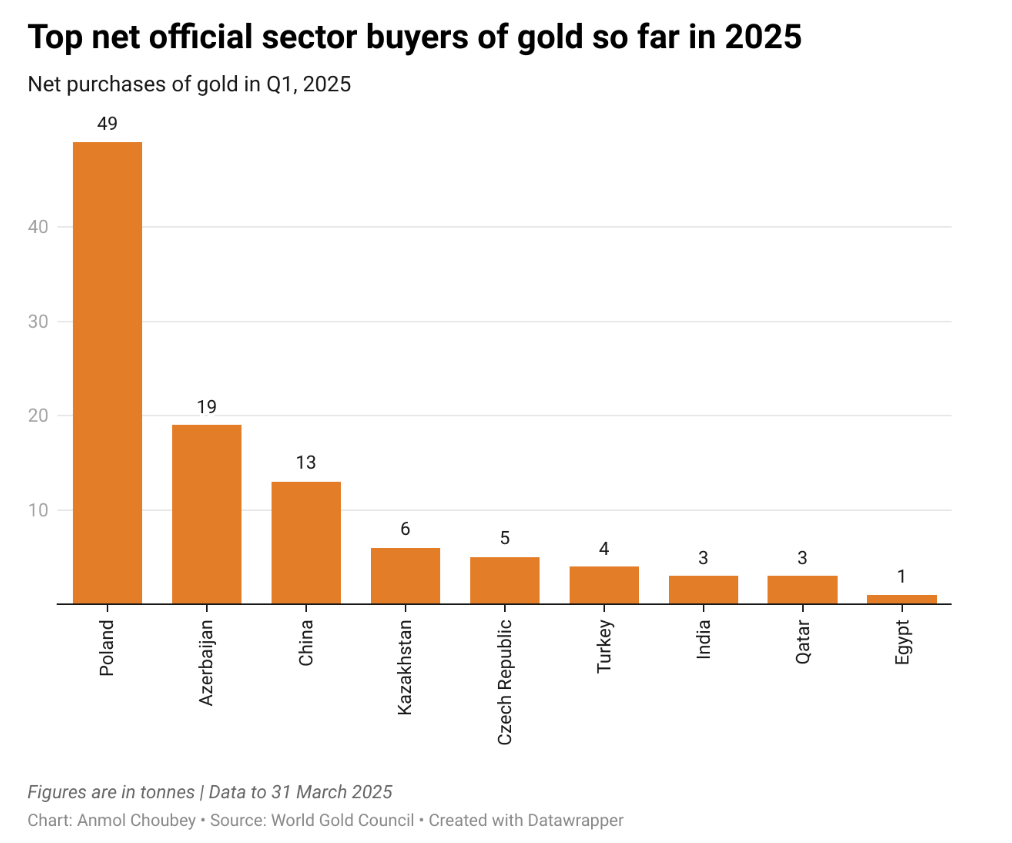

Today, many Western countries still regard gold as the “ultimate safeguard.” Amid the reshaping of the global order, central banks around the world have once again embarked on a trend of increasing their gold reserves.

“The historic decision made by the Bank of Italy back then now appears remarkably forward-looking,” Caselli said. “Because we are once again returning to a similar situation.”

Net buyers of gold in the first quarter of 2025

Net buyers of gold in the first quarter of 2025

Currently, the vault of the Bank of Italy holds approximately 871,713 gold coins, with a total weight of about 4.1 tons. This vault is nicknamed the “sacristy,” named after the room in churches where sacred objects are stored.

According to data from the World Gold Council, as of the end of last year, gold accounted for nearly 75% of Italy’s official reserves, significantly higher than the Eurozone average of 66.5%.

Among this, approximately 1,100 tons of gold are stored in the underground vault of the Bank of Italy’s headquarters (located at Palazzo Koch), just a short distance from the Roman Colosseum; a similar amount is stored in the United States, with smaller quantities held in the United Kingdom and Switzerland.

Moreover, Italy remains one of the world’s top exporters of gold jewelry, with production concentrated in Alessandria, Arezzo, and Vicenza. Luxury brands such as Bulgari, Buccellati, and Damiani enjoy global renown.

Gold: “The Hottest Asset”

Italy’s national debt has now exceeded €3 trillion (approximately $3.49 trillion), and the debt-to-GDP ratio is projected to reach 137.4% next year. Calls to “sell gold to reduce national debt” have repeatedly emerged but have not yet been approved.

“Even if half of its gold reserves were sold, it would not resolve Italy’s debt problems,” said Giacomo Chiorino, Head of Market Analysis at Banca Patrimoni Sella & C.

Some argue that selling gold bars could unlock funds for improving public services and benefiting the population, rather than leaving the gold idle in vaults.

Nevertheless, the Bank of Italy has no intention of selling its gold. The bank did not comment on the gold policy mentioned in this article.

“As the global order is being reshaped, market valuations reach unprecedented levels, and digital assets such as stablecoins and cryptocurrencies emerge, central banks hold the hottest asset—gold,” said Caselli of Bocconi University. “Their decision not to sell is the right one.”