사진 확대

사진 확대 The Federal Reserve System (Fed) is widely expected to freeze its key interest rate at the Federal Open Market Committee (FOMC) in December. The cut was expected in December following two consecutive interest rate cuts in September and October this year, but inflation concerns from tariffs have intensified and the announcement of employment indicators to support the cut has been delayed in the aftermath of the federal government shutdown.

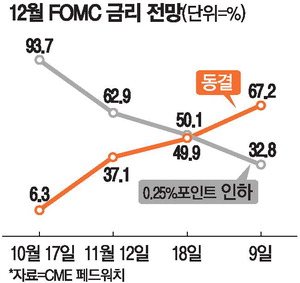

According to the Chicago Mercantile Exchange (CME) FedWatch on the 19th (local time), the probability of a 0.25 percentage point rate cut in the FOMC in December dropped to 32.8%. On the other hand, the outlook for freezing interest rates soared to 67.2%. A month ago, the possibility of a rate cut exceeded 90%, and a week ago, there were many prospects for a cut to 65-35, but the atmosphere has changed 180 degrees. As the Fed previously cut interest rates in September and October, the benchmark interest rate is currently 3.75% to 4%.

In the October FOMC minutes released on the same day, opposition or prudence prevailed a little more than in favor of additional interest rate cuts. According to the minutes of the meeting, “Many participants said it is appropriate to keep interest rates at the current level until the end of the year,” adding, “Most participants saw that there is a possibility of further cuts in the future, but that may not necessarily be December.” From a dovish standpoint, the minutes said, “Some participants evaluated that it is appropriate to cut further in December if the economy meets expectations in the future.” They say it is necessary to stop cutting interest rates and check economic conditions and data. However, it is unclear whether it will lead to an actual interest rate freeze, as other than 12 regional Federal Reserve Bank governors who have the right to vote also spoke.

The lack of data to confirm the deterioration of employment, which was based on the Fed’s two consecutive rate cuts in September and October, also makes it difficult to cut further. The release of the October employment report, which had been delayed due to the aftermath of the federal government shutdown, was eventually canceled. The Bureau of Labor Statistics (BLS) has decided to announce it on the 16th of next month after integrating it with the employment report in November this year. It is after FOMC in December. Earlier, Fed Chairman Jerome Powell drew the line at a FOMC press conference in October that the additional rate cut in December was “not a fact of the fixed term.”

“The November data will only be released after the Fed meeting, which will reduce the likelihood of a rate cut given the divided FOMC,” said Leah Traub, manager of Lord’s Abbit and Company.

Due to the Fed’s division, the FOMC in December is expected to produce an all-time no vote. Christopher Waller, Michelle Borman, and Stephen Myron, who have advocated further rate cuts, are certain to vote for the cut. On the other hand, Kansas City Fed President Jeffrey Schmitt, who was the only one to support the rate freeze during the FOMC in October, Boston Fed President Susan Collins and St. Louis Fed President Alto Mussalem have indicated their opposition to further rate cuts. Two people each voted against the rate decision in September and October, the first time in 32 years. Bloomberg said it would be the first time since 1988 if three were against it.

Meanwhile, President Donald Trump again targeted Powell at the U.S.-Saudi Arabia investment event and pressured him to cut interest rates. President Trump said of Powell that he was “seriously incompetent” and that he “would like to blow it up right away.” Powell’s term is until May next year. At the same time, he joked to Treasury Secretary Scott Bessant, saying, “The only thing Scott can’t do is the Fed,” adding, “If you don’t get him to cut it quickly, I’ll fire you, too.” President Trump said that Commerce Secretary Howard Rutnick, a close aide of both, was active in dismissing Powell, but Bessant begged him to “let it go for three more months.”

[New York correspondent Lim Sung Hyun]