FLEX LNG (NYSE:FLNG) caught investors’ eyes this week after the company issued earnings guidance for 2025, released its third quarter results, declared a dividend, and announced plans for a follow-on equity offering. These moves provide investors with fresh insight into the company’s outlook and capital plans.

See our latest analysis for FLEX LNG.

With a string of headline-making updates, including earnings guidance for next year, a fresh dividend, and plans for a follow-on offering, FLEX LNG has kept the spotlight firmly on itself. That attention has translated to strong momentum: the stock’s share price has climbed 10.8% year-to-date, while its total shareholder return over the past 12 months stands at 15%. This reaffirms both short-term optimism and the company’s long-term growth story.

If FLEX LNG’s recent moves have you thinking bigger, it could be the perfect time to discover fast growing stocks with high insider ownership

With the stock riding such strong momentum and management signaling confidence through guidance and dividends, investors face a classic dilemma: is FLEX LNG currently undervalued, or is the market already pricing in the company’s future growth?

Most Popular Narrative: 6.2% Overvalued

With FLEX LNG most recently closing at $26.90, just above the consensus narrative fair value of $25.33, analysts suggest investors might be paying a premium for the stock. The market appears cautiously optimistic, but the numbers behind the narrative may hold surprises for those digging deeper.

The company’s multi-year contract backlog (56 years minimum, up to 85 years with options) and long-term charters secure steady revenue and earnings despite short-term market softness. This positions FLEX LNG to benefit as global LNG trade volumes are projected to rise due to new export capacity coming online, particularly from the US, Qatar, and Africa. This expansion could boost future cash flow visibility and net margin stability.

Want to know why the market is pricing FLEX LNG above its consensus fair value? The narrative hinges on relentless contract coverage and the potential for a margin leap, plus one bold future earnings projection hidden inside. Unpack the real driver behind today’s lofty share price and learn which number could change everything in the next earnings cycle.

Result: Fair Value of $25.33 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, if vessel supply surges or LNG demand weakens in key markets, FLEX LNG’s charter rates and margins could come under pressure, shifting the narrative unexpectedly.

Find out about the key risks to this FLEX LNG narrative.

Another View: The SWS DCF Model Paints a Different Picture

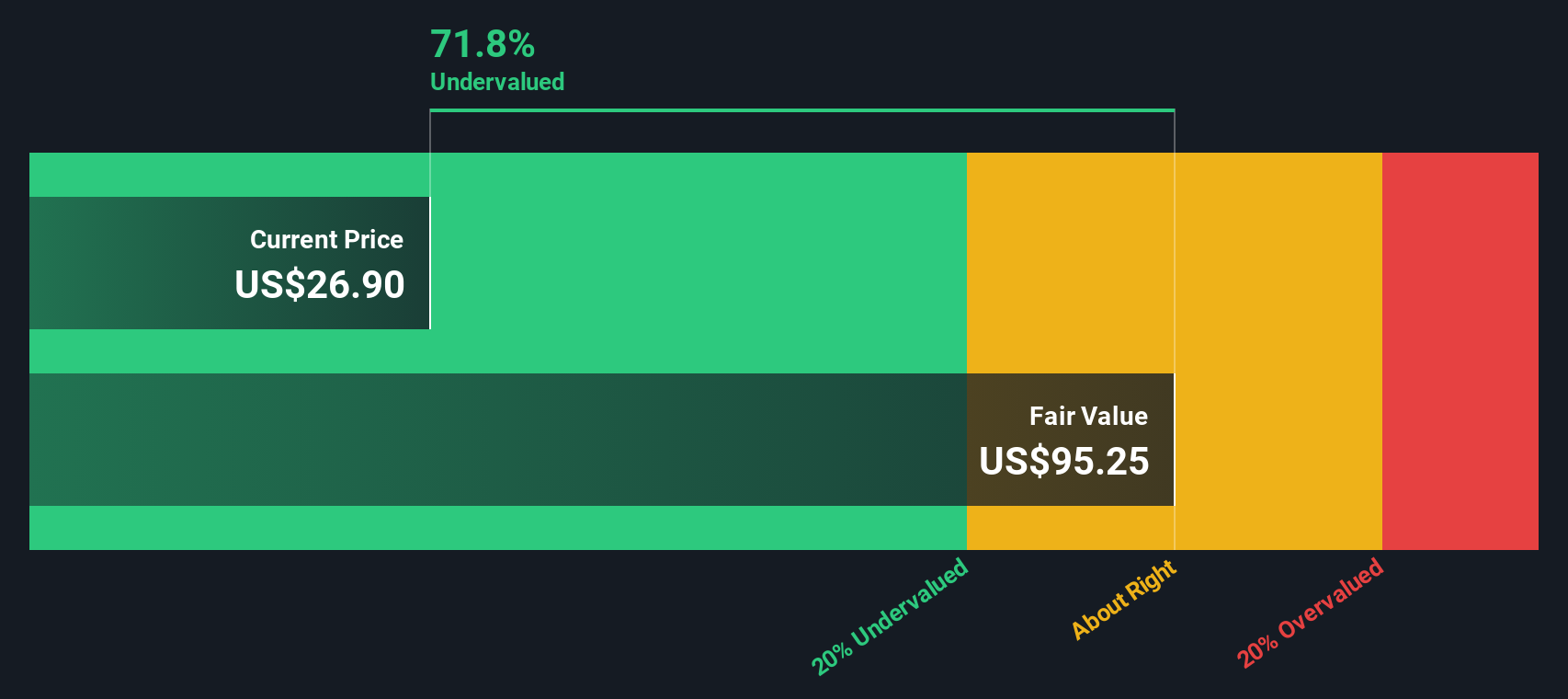

While analysts currently see FLEX LNG as slightly overvalued based on consensus expectations, our discounted cash flow (DCF) model offers a very different perspective. According to the SWS DCF model, FLEX LNG could be deeply undervalued, trading well below its intrinsic value estimate. Could the market be overlooking something fundamental in its current pricing?

Look into how the SWS DCF model arrives at its fair value.

FLNG Discounted Cash Flow as at Nov 2025

FLNG Discounted Cash Flow as at Nov 2025

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FLEX LNG for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own FLEX LNG Narrative

If this view does not fit with your perspective or if you prefer a hands-on approach, you can quickly assemble your own FLEX LNG story in just a few minutes. Do it your way

A great starting point for your FLEX LNG research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your portfolio and stay ahead by scanning the opportunities that others might overlook. Not all stocks are created equal, so make sure you are capturing the edge that counts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com