Seven mayors will receive billions in funding to invest in their local areas.

The chancellor said she would be “putting money and power back in local and regional leaders”.

She said she is devolving £13bn of flexible funding for seven mayors to invest in skills, business support and infrastructure

She also said she will be extending business rates retention pilots in west of England, Liverpool city region and Cornwall until 2029.

Athena Stavrou26 November 2025 12:53

The Independent’s political correspondent Caitlin Doherty reports:

Rachel Reeves has blamed Brexit and the pandemic for the OBR’s downgrading of the productivity numbers, rather than Labour policy.

She said that the watchdog “are clear that this is not about the last fourteen months.We all know it is about the previous fourteen years – the legacy of Brexit and the pandemic, and the damaging decisions of the party opposite”.

Ms Reeves has also said that because of her Budget “borrowing will fall as a share of GDP in every year of this forecast” and the amount of headroom against the Government’s targets will double to £21.7 billion.

Joe Middleton26 November 2025 12:52

The Independent’s Whitehall Editor Kate Devlin reports:

The chancellor has said that from April 2027 she will reform our ISA system.

The allowance will be kept at £20,000, but £8,000 of it will be designated exclusively for investment, not cash.However, following criticism, over 65s will be able to keep the full cash allowance.

Joe Middleton26 November 2025 12:50

The Independent’s political correspondent Caitlin Doherty reports:

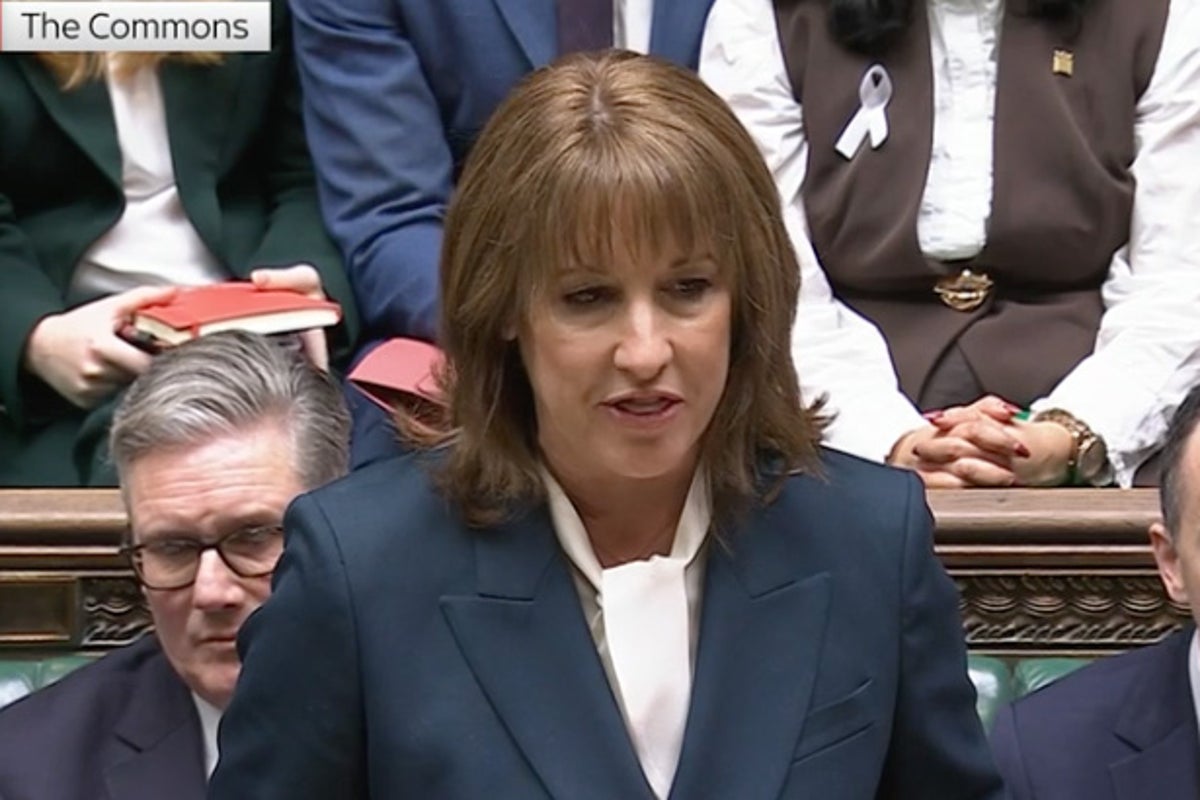

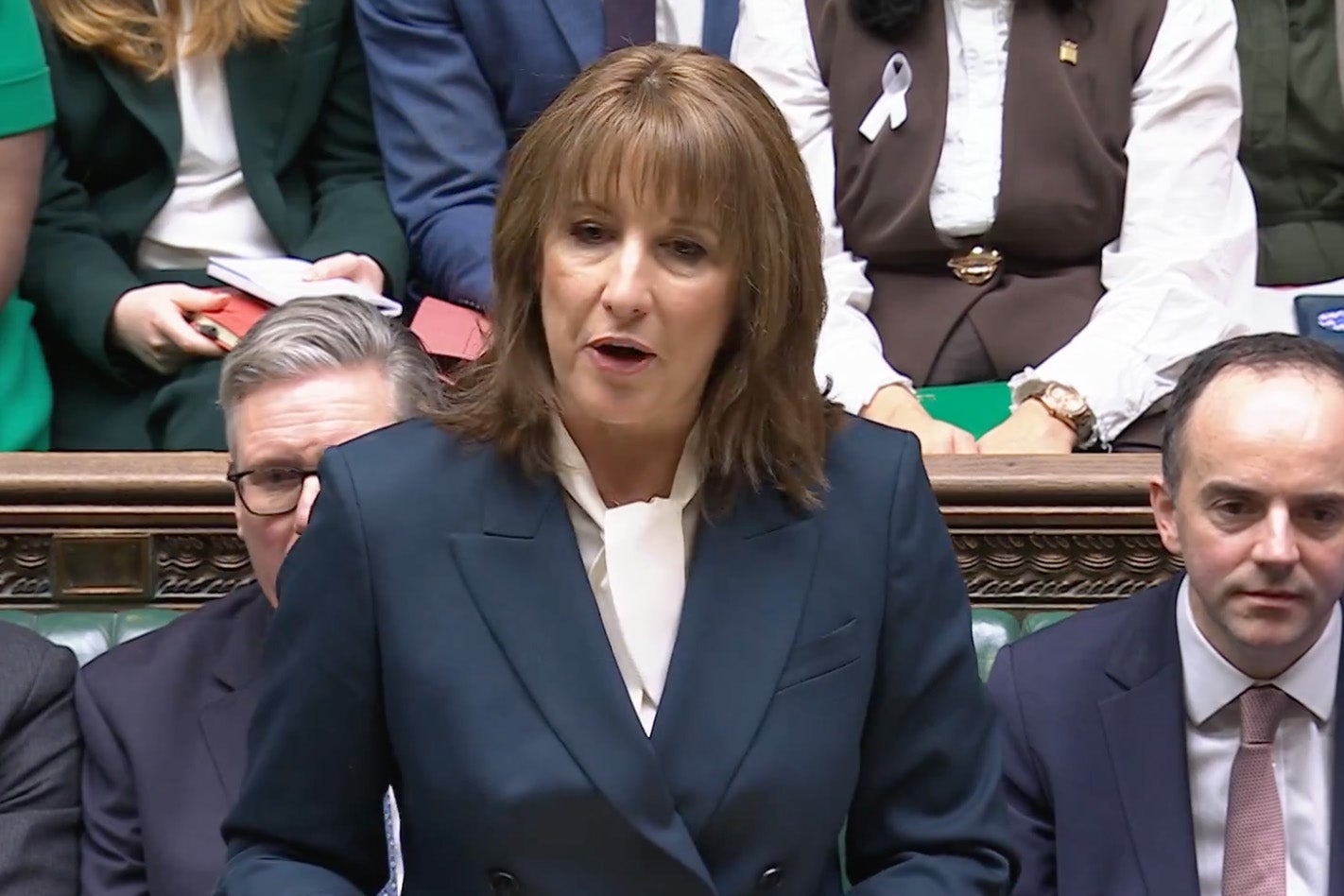

Rachel Reeves was forced to address the OBR leak as she began her speech with condemnation of the watchdog for the leaked document, as she was met with noise on both sides of the Commons.

Budget day is often one of the louder days in the House, as government MPs look to back their chancellor, while the opposition try to match their noise.

Deputy speaker Nusrat Ghani on more than one occasion has had to interrupt the chancellor to call for calm on the green benches.

(House of Commons/UK Parliament)

Alex Ross26 November 2025 12:47

Rachel Reeves is championing her achievement of “beating” economic forecasts.

She called such predictions a “Tory legacy”. This

was met by loud jeers, prompting the speaker to intervene and say it was “hard to hear” the chancellor.

The OBR’s leaked forecast predicted GDP will grow by 1.5 per cent – 0.3 percentage points slower than projected in March.

(Parliament TV)

Athena Stavrou26 November 2025 12:45

At the start of her Budget statement – much of which has now been leaked online – Rachel Reeves hit out at the OBR, which was responsible for the mistake.

The chancellor criticised what she said was a “serious error” as she emphasised that it had nothing to do with her and her department.

The unprecedented pre-Budget publication of the OBR’s document was “deeply disappointing and a serious error on their part,” she said.

Her comment came just minutes after the Deputy Speaker of the House of Commons Nusrat Ghani also hit out at the leak, telling MPs that she “expected better”.

Kate Devlin26 November 2025 12:41

Rachel Reeves has stood to unveil her Budget statement in the Commons.

As she stepped up to the despatch box, she was met with cheers and jeers.

She began with saying the unprecedented pre-Budget publication of the Office for Budget Responsibility’s document was “deeply disappointing and a serious error on their part”.

(Sky news)

Athena Stavrou26 November 2025 12:37

The OBR has highlighted that spending will increase by billions each year hitting £11bn in 2030 in extra spending by Rachel Reeves which is primarily puts down to her U-turns on welfare.

It states: “Against this backdrop, Budget policies increase spending in every year and by £11 billion in 2029-30, primarily to pay for the summer reversals to welfare cuts and lift the two-child limit in universal credit.

It also notes: “The Budget also raises taxes by amounts rising to £26 billion in 2029-30, through freezing personal tax thresholds and a host of smaller measures, and brings the tax take to an all-time high of 38 per cent of GDP in 2030-31.

“The net impact of Budget spending and tax policies increases borrowing by £5 billion on average over the next three years but then reduces it by £13 billion on average in the following two.”

David Maddox, political editor26 November 2025 12:35

The chancellor is about to stand at the despatch box to deliver her highly-anticipated Budget.

The statement comes after the OBR accidentally published it’s forecast ahead of the the statement.

Before she stood, the speaker made a statement condemning extensive briefings to the media on the Budget before it was announced in the Commons.

She reminded the government that announcements should be made in the chamber before they are given to the media.

She said: “Like many, I expected better.”

(BBC)

Athena Stavrou26 November 2025 12:35

The Independent’s business editor Karl Matchett reports:

As the Budget announcement prepares to start (but after that early, now-apologised-for leak), investors haven’t impacted the stock market too unduly – the FTSE 100 is down just a tiny 0.04 per cent for the day.

It is a small decline across the last couple of hours given there was a rise in earlier trading, but it’s far from a damaging or dramatic concern at this stage.

Currency markets and the bond yields are where the primary action will come, with stock market changes a knock-on from those and from which companies or industries will be most impacted as a result of changes – both positively and negatively, of course.

(PA Archive)

Athena Stavrou26 November 2025 12:31