A recent state visit by President Alar Karis to Kazakhstan has led to hopes transit of that country’s grain exports, via Estonia’s Muuga port, will continue to grow.

Kazakhstan, the largest of the Central Asian Republics, is reportedly preparing to increase grain and oilseed exports via the Baltic Sea, with a particular focus on Estonia.

Estonia’s own more modest grain output also continues to be exported via Muuga, even after the poor weather seen in summer 2025.

“Aktuaalne kaamera” reported the hopeful sign of a large vessel being loaded with 75,000 tonnes of Estonian wheat. The last time a vessel of this size last visited the terminal was over a decade ago, and though this ship will be exporting fodder-grade wheat to Spain, the hope is it is heralding more growth to come.

“We are confident that, with support from the Estonian government, this project is entirely realistic. Most important is that this backing continues. Muuga Grain Terminal is fully ready to receive large volumes and will start work immediately once the logistics are in place,” said Jan Lipinski, board member of the terminal.

Muuga Grain Terminal (MGT), with its iconic grain elevator, is in any case far from full capacity when it comes to Estonia’s own wheat output. MGT’s export capability is 2.5 million tonnes per year, more than Estonia alone can grow, but this year it will ship out only a maximum of 300,000 tonnes.

The iconic grain terminal in Muuga, just east of Tallinn. Source: ERR

The iconic grain terminal in Muuga, just east of Tallinn. Source: ERR

The freighter in port when “Aktuaalne kaamera” visited, the Trans Africa, a Maltese-flagged ship, accounts for around a quarter of this total alone.

“This is Estonian grain, bought from Estonian farmers by Baltic Agro, and it’s heading to Spain. Assembling grain for such large ships is not always a goal in itself — it must make financial sense; this time, things simply aligned that way,” Timo Sildvee, head of grain trading at Baltic Agro, said.

This is despite a poor harvest this year, mainly due to weather conditions. Another hampering factor is soaring input costs.

Alo Vahtmäe, CEO of Pae Farmer, noted that the market price of grain has also gone back 10 years. “In 2015 and 2016, the grain price was actually the same — but comparing inputs then and inputs now, well the gap is huge,” he noted.

The Trans Africa bunkered at Muuga. Source: ERR

The Trans Africa bunkered at Muuga. Source: ERR

Despite everything, the company is satisfied with this year’s yield, he said, partly thanks to soil conditions mitigating the heavy rainfall seen in summer. “Our soils are prone to drought, with a lot of limestone. Limestone has a property: When water arrives, it drains out easily, doesn’t stay on the surface, and doesn’t ruin the crop.”

Sildvee added that pre-season, there had been options out there to lock in higher fixed prices, but global production has been high and so prices have fallen. “And today, the reason we can sell to Spain is that for them, our grain is affordable. They prefer feed wheat from our region, over maize of other origins,” he said.

During his state visit to Kazakhstan last week, President Alar Karis and President Kassym-Jomart Tokayev discussed boosting economic, educational, security, and cultural relations. Estonia sees Kazakhstan as a strategic partner for connecting the EU with Kazakhstan and the wider Central Asian region, and joint memoranda on education, digital cooperation, and taxation were signed, focusing on regional trade, logistics, and technology.

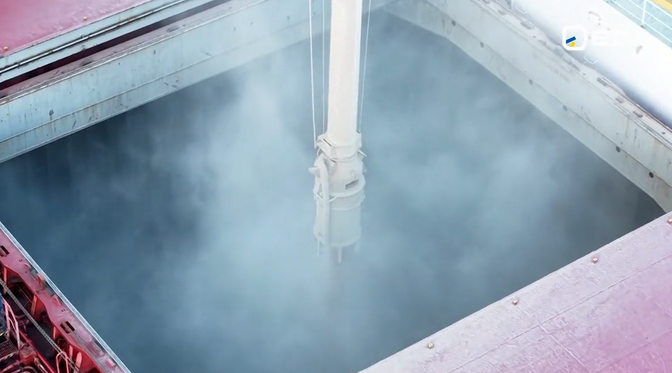

Grain being loaded into the vessel. Source: ERR

Grain being loaded into the vessel. Source: ERR

Russia’s invasion of Ukraine severely disrupted global grain markets, since both countries are major players on the world market with vast grain resources, the bulk of which are exported from Black Sea ports. The disruption and uncertainty brought by the war and the end of a temporary initiative to allow safe passage across the Black Sea caused price spikes and threatened countries in Africa and elsewhere who are dependent on exports from both Russia and Ukraine.

Being small in size and mostly forested, Estonia’s grain output is much more modest at a little over a million tonnes in a year (compared with hundreds of millions for Russia). Muuga, just east of Tallinn, could also be used as a transit port for grain grown elsewhere.

—