See our latest analysis for Circle Internet Group.

Circle Internet Group’s recent 7-day share price return of 4.2% shows a bit of momentum after a challenging month, as the 30-day share price return remains steeply negative at -49%. While short-term sentiment has shifted positively, the longer-term trend reflects a reset in expectations, with the stock still well below its highs.

If this turnaround caught your attention, now is a good time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares still trading at a sharp discount to analyst targets but following significant volatility, the key question for investors is whether Circle Internet Group is undervalued at current levels or if the market is already factoring in its future growth potential.

Most Popular Narrative: 40.5% Undervalued

Circle Internet Group’s last close at $72.64 remains far below the most popular narrative’s fair value estimate. This suggests there is a gap between the current market price and fair value perspectives.

What Visa did for plastic cards, Circle and Tether are doing for digital dollars, and the addressable market is global. Growth Catalysts: GENIUS Act Passed (July 2025). The U.S. House passed the GENIUS Act, providing the first federal regulation for stablecoins. Circle now has regulatory clarity and a license to operate across the United States. This provides a first-mover advantage over competitors like Tether, which remains offshore and unregulated.

Ever wonder what bold assumptions could place Circle’s value so far ahead of today’s price? The narrative highlights a formula based on rapid expansion, global adoption, and a transformative regulatory shift. The fair value in this analysis leans on aggressive forecasts that most investors may not have seen. Don’t miss the next move hiding beneath the headline numbers.

Result: Fair Value of $122.1 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, falling interest rates or regulatory shifts could quickly undermine Circle’s yield-driven model. This could challenge even the most optimistic growth narratives.

Find out about the key risks to this Circle Internet Group narrative.

Another View: Multiples Raise Caution

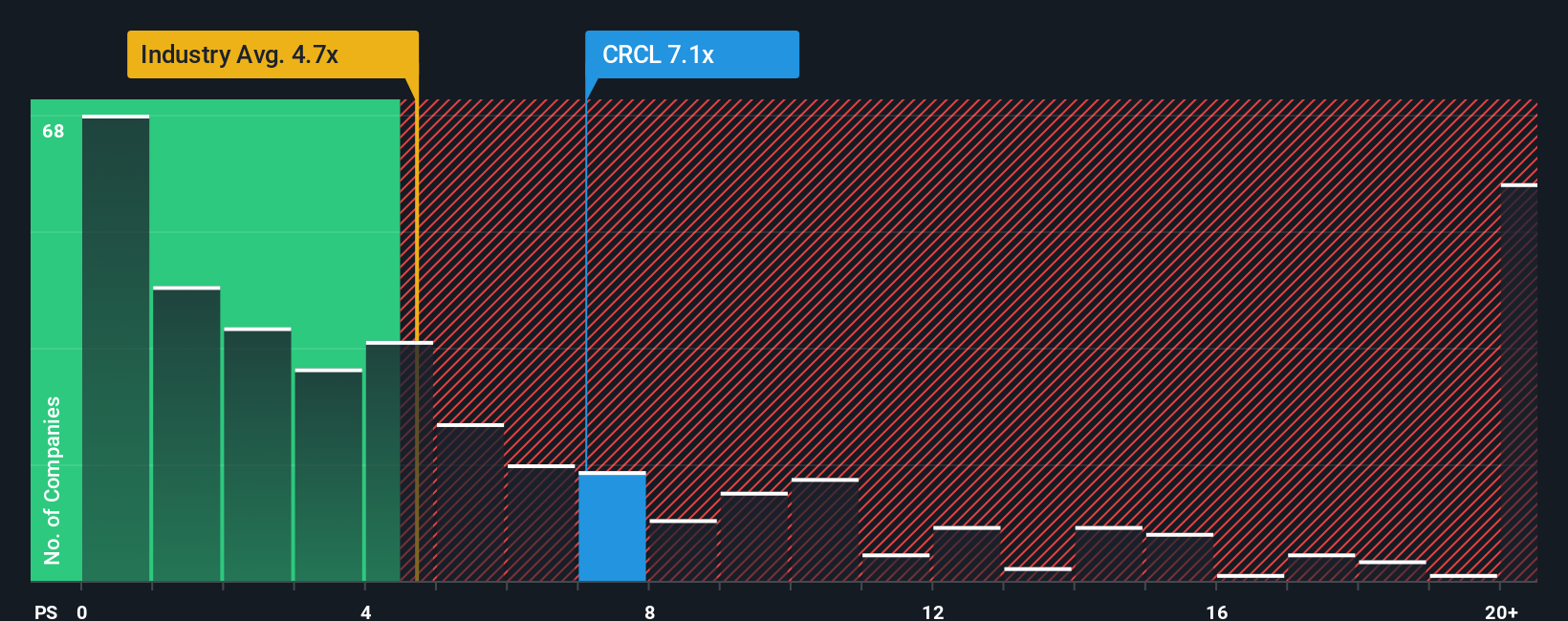

When looking at Circle Internet Group’s price-to-sales ratio, which currently sits at 7.1x, the story gets more complicated. That is higher than both the US Software industry average of 4.7x and the fair ratio of 7x. It is also less attractive than peers at 8.4x. This suggests investors are already pricing in aggressive growth, and any misstep could be punished quickly. Is there enough upside to justify these expectations?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:CRCL PS Ratio as at Nov 2025 Build Your Own Circle Internet Group Narrative

NYSE:CRCL PS Ratio as at Nov 2025 Build Your Own Circle Internet Group Narrative

If you see the numbers differently, or you prefer digging into the data on your own terms, shaping your own view can take just a few minutes. Do it your way

A great starting point for your Circle Internet Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunities pass you by. Supercharge your portfolio by tapping into new themes and high-potential stocks with the Simply Wall Street Screener. Here are three powerful ways to get started:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com