Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Xcel Energy Investment Narrative Recap

To be optimistic about Xcel Energy, an investor needs to believe in the company’s ability to successfully execute large capital investments in regulated clean energy infrastructure, supported by steady regulatory outcomes and customer demand growth. The recent Colorado rate case filing ties directly into this, as its outcome could influence the company’s near-term revenue trajectory, but until the commission’s decision in late 2026, it does not appear to materially alter the biggest immediate catalyst (rate approval) or the main risk (financing and regulatory setbacks) facing the business.

Relating closely to the Colorado filing, Xcel’s recent announcement on new power generation projects in Texas and New Mexico highlights its ongoing infrastructure buildout in response to demand growth. These measures reinforce the significance of regulatory approvals and timely execution as central to the company’s investment narrative and future earnings potential.

In sharp contrast, one risk investors should keep top of mind is the potential for regulatory delays or disapprovals in key jurisdictions…

Read the full narrative on Xcel Energy (it’s free!)

Xcel Energy’s narrative projects $17.4 billion in revenue and $2.9 billion in earnings by 2028. This requires 7.6% yearly revenue growth and an $0.8 billion increase in earnings from the current $2.1 billion.

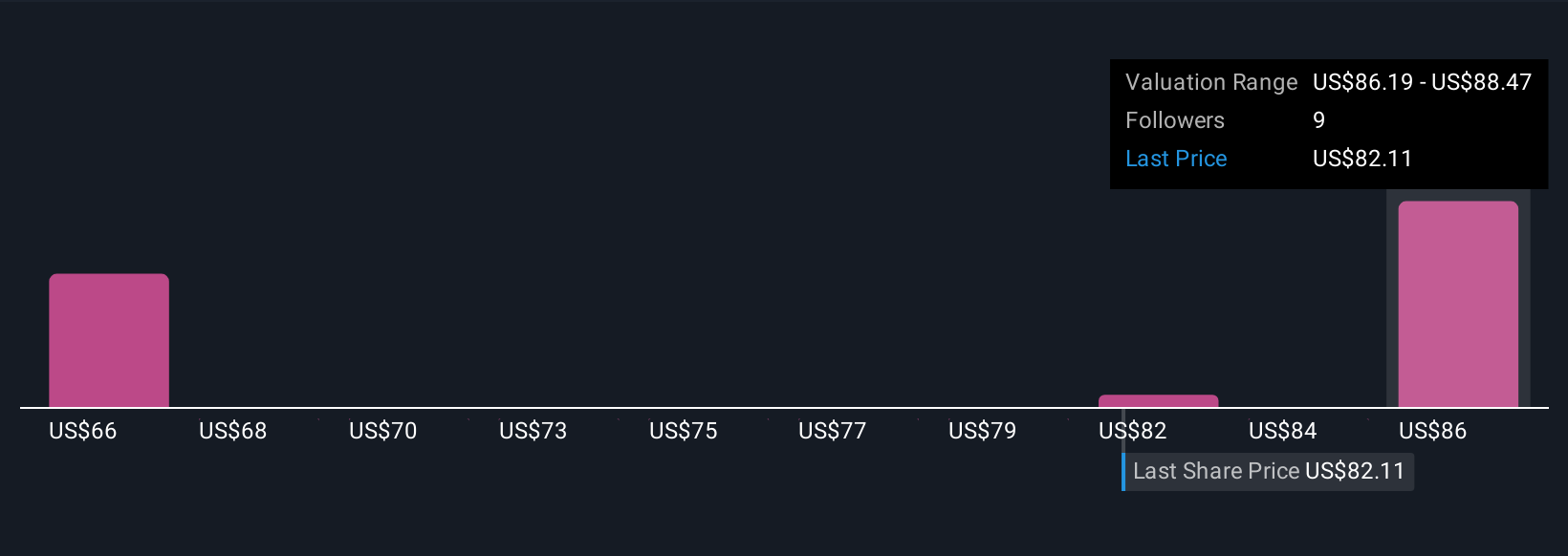

Uncover how Xcel Energy’s forecasts yield a $88.47 fair value, a 8% upside to its current price.

Exploring Other Perspectives XEL Community Fair Values as at Nov 2025

XEL Community Fair Values as at Nov 2025

Simply Wall St Community members estimate Xcel’s fair value between US$65.71 and US$88.47 across 3 separate views. With regulatory outcomes now front and center, see how others weigh the company’s growth versus its risks.

Explore 3 other fair value estimates on Xcel Energy – why the stock might be worth 20% less than the current price!

Build Your Own Xcel Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

No Opportunity In Xcel Energy?

The market won’t wait. These fast-moving stocks are hot now. Grab the list before they run:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com