Europe Comic Book Market Size

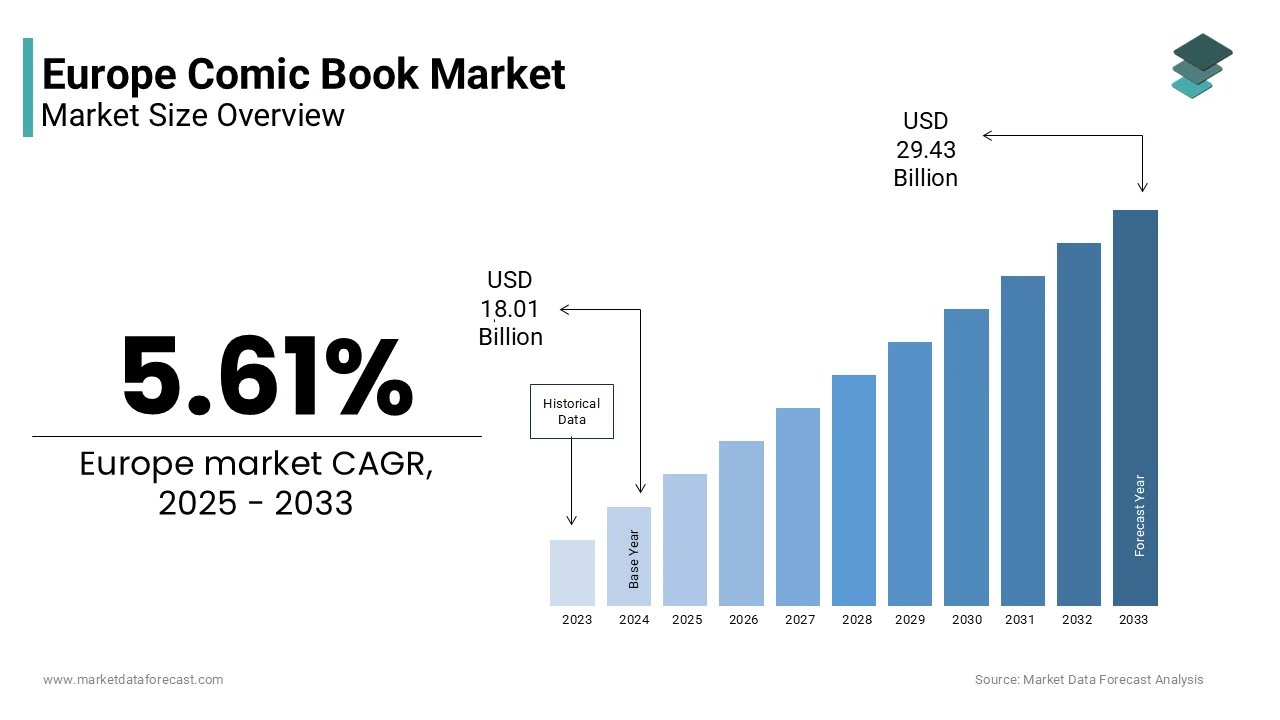

The Europe comic book market size was valued at USD 18.01 billion in 2024 and is projected to reach USD 29.43 billion by 2033 from USD 19.02 billion in 2025, growing at a CAGR of 5.61%.

Comic book is a sequential art narrative in printed and digital formats across European countries with distinct regional traditions such as Franco-Belgian bande dessinée, Italian fumetti and British graphic storytelling. Unlike the North American superhero-dominated model, Europe exhibits a pluralistic ecosystem wherein adult-oriented graphic novels, historical narratives and socially conscious themes hold significant cultural weight. For instance, Europe hosts a large number of active independent comic publishers with France remaining the continent’s strongest comic market. According to sources, almost half of the French population reads at least one comic annually, which is demonstrating deep-rooted cultural integration. In Belgium, comic consumption remains part of national identity with Brussels featuring around 50 official comic-themed murals across the city. Germany sees consistent engagement through major festivals like the Erlangen International Comic Salon, which draws tens of thousands of visitors biennially. Italy maintains a robust legacy through publishers like Sergio Bonelli Editore, whose Tex Willer series has surpassed three hundred million copies sold since 1948. These socio-cultural indicators indicate the market’s embeddedness in Europe’s literary and visual heritage beyond mere commercial metrics.

MARKET DRIVERS Resurgence of Graphic Novels in Educational and Literary Spheres

Graphic novels have witnessed a paradigm shift from juvenile entertainment to respected literary and pedagogical instruments across Europe, which is fuelling demand within the comic book segment and is one of the key factors propelling the European comic book market. In France, graphic novels remain one of the strongest-performing segments within the national book market with titles like Persepolis and Blue Is the Warmest Color routinely featured in school curricula. According to the UK’s National Literacy Trust, around 2 in 5 young people read comics or graphic novels at least once a month in 2024, which is indicating their growing role in supporting independent reading. This institutional endorsement has driven publishers to invest in original educational and autobiographical graphic narratives targeting adolescents and adults. Germany’s Federal Agency for Civic Education actively commissions comicbased historical accounts with substantial annual distributions of The Search, which is a Holocaust education graphic novel, to schools nationwide. In Spain, the Ministry of Education included graphic novels in its 2022 national reading promotion plan, which is contributing to increased school library acquisitions of such formats in subsequent years. Such integration into formal and informal learning ecosystems has elevated the perceived legitimacy of comics, thereby sustaining consistent consumer demand across age groups and reinforcing the medium’s cultural relevance beyond entertainment.

Expanding Digital Access and Subscription Platforms

Digital transformation has significantly broadened access to European comic content through mobile reading applications and subscription-based services, thereby stimulating market reach and consumption frequency, which is further driving the European comic book market. Platforms like Izneo, which specializes in European comics remain key digital distributors across the region. Belgiumbased publisher Dupuis noted that digital sales accounted for 38% of its total revenue in 2023, which is an up from 22% in 2020 as per its financial disclosures, which is reflecting accelerated consumer adoption. In Scandinavia, Storytel added a dedicated comics vertical in 2022 and by 2024 had expanded its European comic catalog to over twelve thousand titles, which is attracting more than 800,000 subscribers as stated in its Nordic market update. The convenience of ondemand access, multilingual support and integrated reading analytics has particularly appealed to urban millennials and Gen Z consumers. Furthermore, the European Union’s Digital Europe Programme allocated 18 million euros in 2023 to support digitization of cultural content including heritage comics, which is enabling publishers to legally monetize backlist titles. This infrastructure investment combined with evolving reader preferences has transformed digital access from a niche channel into a primary growth vector for the European comic book market.

MARKET RESTRAINTS Persistent Challenges in Cross-Border Linguistic Fragmentation

Europe’s linguistic diversity, while culturally enriching, poses a formidable barrier to scalable distribution and marketing of comic books across national borders, which is a key restraint to the European comic book market. With over twenty-three official languages and distinct reading traditions, local language editions are essential yet commercially inefficient for all but the largest titles. According to the European Commission, comic publications in the European Union face limited multilingual circulation, restricting continental reach. Frenchlanguage comics dominate the internal market yet often struggle in translation with publishers in major markets such as Germany and Italy indicating that only a small share of acquired FrancoBelgian titles achieve profitability in their territories. The cost of translation, adaptation and cultural localization further disincentivizes smaller publishers from pursuing international editions. For instance, industry benchmarks in Spain indicate that professional translation and lettering for a standard onehundredpage graphic novel can require several thousand euros in production expenditure. This economic reality restricts crossnational audience building and fragments promotional efforts, resulting in duplicated investments and underutilized creative content. Consequently, the market remains largely nationalized with limited economies of scale, thereby constraining overall sectoral growth despite high domestic engagement levels.

Rising Production Costs and Paper Supply Volatility

The growing pressure from escalating production expenses, particularly in printing and raw material procurement due to energy inflation and supply chain instability, which is further hindering the European comic book market. According to Eurostat, producer prices for paper and paperboard in the European Union have risen significantly since 2021, which is intensifying cost pressures for printreliant publishers. Italian publishers reported that average printing costs per comic volume have increased notably over the past several years. This surge disproportionately affects independent and smallscale creators who lack bulk purchasing power and vertical integration. Furthermore, as per the European Environment Agency, stricter regulations on forestsourced paper have reduced the availability of affordable certified stock in 2024, which is prompting publishers to seek alternatives that often compromise print quality or increase lead times. Belgian publishers have also indicated that delays in paper procurement have extended production cycles compared to prepandemic norms. These compounding pressures have forced publishers to either absorb losses, raise cover prices, or reduce print runs with each choice threatening accessibility and market diversity. As a result, the physical comic segment faces structural headwinds that challenge its historical dominance in the European landscape.

MARKET OPPORTUNITIES Growing Institutional and Municipal Support for Sequential Art

Public investment in comics as a cultural asset presents a significant growth vector for the European market through grants, festivals and archival initiatives, which is a significant opportunity for the European market. In France, the Centre National de la Bande Dessinée et de l’Image provides substantial annual funding to support creation, distribution and international promotion of graphic narratives. Similarly, the Flemish Government in Belgium has increased its cultural funding in recent years, dedicating specific resources to digital preservation and emerging author residencies. Italy’s Ministry of Culture launched the “Fumetto Futuro” initiative in 2023, which is providing 200,000 euros in non-repayable grants to debut graphic novelists with thirty-seven projects funded in the first cycle as per ministry records. These programs not only sustain artistic innovation but also enhance the sector’s economic viability by de-risking creative entrepreneurship. Additionally, cities like Angoulême and Lucca host internationally recognized comic festivals drawing over 200,000 attendees annually, thereby generating tourism revenue and global visibility. Such institutional anchoring transforms comics from a commercial product into a protected cultural expression, which is ensuring long-term market stability and creative renewal across Europe.

Expansion of Transmedia Storytelling and IP Licensing

European comics are increasingly serving as foundational intellectual property for cross-platform adaptations, which is amplifying their commercial lifespan and audience reach and is a potential opportunity for this regional market. The success of The Little Vampire, which is a German comic series adapted into multiple animated films and streaming content, has contributed to significant ancillary revenue for its rights holders. According to Glénat, a French publisher, a meaningful share of its topselling titles are either under option for animation or have active licensing deals with European production houses. As per the European Audiovisual Observatory, growing volumes of EUfunded coproductions drawing on comic source material in recent years, which is indicating policylevel encouragement. Moreover, collaborations with gaming studios demonstrate innovative IP extension. These transmedia strategies not only monetize narrative universes beyond print but also attract younger audiences through familiar digital touchpoints. As streaming platforms like Canal+ and Sky invest in locally rooted but globally exportable content, European comics offer a rich repository of prevalidated stories with builtin fan bases, thereby opening sustainable revenue channels beyond traditional publishing models.

MARKET CHALLENGES Intensifying Competition from Global Streaming and Gaming Content

The European comic book market contends with formidable diversion of leisure time and discretionary spending toward on-demand video entertainment and interactive gaming. Europeans are spending increasing amounts of time on digital entertainment platforms with overall screenbased media consumption continuing to rise across the region. Concurrently, more than half of Europeans aged sixteen to 34 engage with video games on a weekly basis, which is reflecting a steady expansion of interactive entertainment. This behavioural shift particularly impacts younger demographics who historically formed the core comic readership. For instance, a comparatively small share of adolescents read printed comics monthly in Germany, while a significantly larger proportion engage with narrativedriven video games that incorporate comicinspired aesthetics. The immersive and socially connected nature of digital entertainment offers immediate gratification and community interaction that static sequential art struggles to replicate. Publishers attempting to counter this through motion comics or augmented reality features face high development costs without guaranteed returns. Consequently, the comic book medium risks marginalization as a niche cultural artifact unless it can strategically integrate with or differentiate itself from dominant digital storytelling ecosystems.

Generational Transition and Declining Print Literacy

A structural demographic shift combined with evolving reading habits threatens the continuity of comic readership in Europe, which is further challenging the growth of the European comic book market. According to the data from the Organisation for Economic Co-operation and Development, reading proficiency among fifteenyearolds in European countries declined by an average of 13.7 points between 2018 and 2022 with France, Germany and Italy recording the steepest drops. A growing majority of schoolchildren now access narratives primarily through screens rather than printed pages and this trend undermines the tactile and visual rhythm inherent to traditional comic consumption, which relies on pageturning pacing and physical layout. Moreover, the aging core readership in key markets like France creates a succession gap. Independent bookstores, which historically curated and promoted bande dessinée, report declining engagement among undertwentyfiveyearold customers in the post2020 period. Without targeted interventions in early literacy and print engagement, the cultural transmission of comics as a shared generational experience weakens. This erosion of foundational reading practices poses an existential challenge to the longterm viability of the printbased European comic ecosystem despite its current cultural prestige.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

5.61%

Segments Covered

By Type, Genre, Format, and Region

Various Analyses Covered

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic

Market Leaders Profiled

Marvel Entertainment (Disney), DC Comics (Warner Bros. Discovery), Image Comics, IDW Publishing, Dark Horse Comics (Embracer Group), Shogakukan, Hakusensha, Shueisha, TOKYOPOP, and Panini S.p.A.

SEGMENTAL ANALYSIS By Type Insights

The print segment remains the dominant format in the European comic book market by holding the largest share of this regional market in 2024. The dominance of the print segment in the European market is attributed to the deeply ingrained cultural habits particularly in France Belgium and Italy where physical albums are viewed as collectible art objects rather than disposable media. In France, printed comics remain the dominant format within the national comic market, which is reflecting strong consumer preference for highquality paper bindings and curated bookstore experiences. Similarly, Italian publisher Sergio Bonelli Editore continues to derive the vast majority of its revenue from print editions, which is indicating loyalty to physical formats among its core readership. The tactile nature of European albums, which often feature hardcovers, large page counts and premium inking and this supports their status as gift items and library staples. Book festivals such as Lucca Comics and Angoulême consistently say that most visitor purchases are physical copies. Additionally, independent comic shops across Germany, Spain and the Netherlands emphasize curated print selections as a key differentiator from digital saturation, which is further anchoring demand. These cultural, economic and aesthetic factors collectively sustain print as the backbone of the European comic ecosystem despite digital advances.

The digital segment is anticipated to grow at a promising CAGR of 14.3% over the forecast period in the European market owing to the increased smartphone penetration and mobile optimized reading interfaces that cater to younger demographics who prioritize convenience over collectibility. In Sweden and the Netherlands, digital consumption among younger comic readers continues to rise with surveys indicating that a growing share of readers under thirty now access content primarily through digital subscriptions. Publishers are also driving this shift by investing in exclusive digitalfirst series such as Dupuis’s “Digital Originals” line, which has reported strong yearonyear growth in downloads. The European Union’s Creative Europe programme further catalyzed growth by funding multiple digital comic startups in 2023 through its cultural support mechanisms. Moreover, the rise of multilingual digital libraries like Europe Comics has enabled simultaneous releases across several languages, eliminating traditional translation delays and broadening panEuropean reach. These structural and policylevel enablers combined with evolving reader behaviors position digital as the most dynamic growth vector in the European comic landscape.

By Genre Insights

The manga segment commanded for 35.5% of the European comic book market share in 2024. The growth of the manga segment is majorly driven by sustained demand among adolescents and young adults particularly in France Germany and Italy where Japanese graphic storytelling has permeated mainstream youth culture. In France, manga represents roughly half of all comic volumes sold according to industry analyses with titles like Demon Slayer and My Hero Academia consistently ranking among national bestsellers. Germany’s Institut für Demoskopie Allensbach reported in 2024 that 56% of Germans aged 15 to 24 had read at least one manga title in the past year, which is reflecting deep market penetration. Italian publisher Panini Comics disclosed that its manga division grew revenues by 28% year on year in 2023, which is driven by localized editions with highquality paper and righttoleft formatting that respect original aesthetics. School manga clubs, university anime societies and social media fandoms further amplify organic discovery with platforms like TikTok generating substantial mangarelated engagement across Europe. This synergy of authentic localization, peerdriven engagement and crosscultural resonance solidifies manga’s leadership in the European genre landscape.

The non-fiction segment is estimated to grow at a CAGR of 13.5% over the forecast period in this regional market. The rising demand for accessible yet rigorous narrative journalism, historical testimony and civic education through visual storytelling are propelling the growth of the non-fiction segment in the European market. In Belgium, the graphic memoir, The Return detailing a refugee’s journey achieved strong multilanguage sales across Europe in 2023. Public institutions are key enablers with France’s Ministry of Education purchasing large quantities of nonfiction comics for civic education programs in 2024 as stated in its procurement bulletin. Similarly, Germany’s Federal Agency for Civic Education distributed thousands of climatefocused graphic narratives to schools and libraries in 2023, as per its annual report. The success of titles like Threads from the Refugee Crisis, which won the European Press Prize for Visual Journalism in 2023, has elevated the genre’s credibility among educators and policymakers. Additionally, crowdfunding platforms like Ulule reported significant yearonyear growth in successful nonfiction comic campaigns in Europe during 2023, which is indicating strong grassroots support. These converging forces of institutional backing, journalistic innovation and public interest position nonfiction as the most rapidly evolving comic genre in Europe.

REGIONAL ANALYSIS France Market Analysis

France dominated the comic book market in Europe in 2024 by holding 40.8% of the European market share. The dominance of France in the European is attributed to the unique cultural framework treats bande dessinée as the “ninth art” a status enshrined in public policy and educational curricula. Annual per capita comic consumption in France remains among the highest in Europe, which is reflecting strong national engagement with the medium. Major publishers like Dupuis, Glénat and Dargaud maintain robust backlist sales with classic series such as Asterix surpassing 380 million copies sold globally. The Angoulême International Comics Festival draws over two hundred thousand visitors each January, functioning as both cultural showcase and industry marketplace. Government support remains pivotal with the National Center for Comics providing substantial funding in 2023 to independent creators and international promotion. Additionally, France’s dense network of specialized comic bookstores ensures high visibility and editorial curation. This ecosystem of institutional recognition, commercial scale and public engagement cements France’s centrality to the European comic landscape.

Italy Market Analysis

Italy captured the second leading share of the European comic book market in 2024. The growth of Italy in the European market is driven by the loyal readership around serialized adventure sagas with publisher Sergio Bonelli Editore reaching a large and enduring fan base through titles like Tex Willer and Dylan Dog. The company reported distributing over 11 million physical copies in 2023, maintaining a weekly release rhythm that has endured since the 1940s as per its annual production report. Italian comics benefit from deep integration into family reading traditions with widespread household comic ownership reported in national readership surveys. The Lucca Comics and Games festival attracted hundreds of thousands of attendees in 2023, which is making it one of Europe’s largest pop culture events. Moreover, Italian publishers have successfully modernized classic series through digital reprints and transmedia extensions such as the Dylan Dog Netflix adaptation slated for 2026. This blend of intergenerational continuity and strategic innovation ensures Italy’s sustained prominence in the European comic hierarchy.

Germany Market Analysis

Germany is predicted to account for a considerable share of the European comic book market over the forecast period. While historically slower to embrace comics as serious literature Germany has undergone a significant cultural shift with graphic novels now routinely featured in literary awards and mainstream media. Sales of nonsuperhero graphic narratives continued to grow in 2023 with publishers like Carlsen Verlag reporting that a substantial share of their comic revenue now comes from European and Japanese titles rather than American imports. Public libraries have played a crucial role with the German Library Association noting rising comic acquisitions between 2020 and 2023 to meet patron demand. Educational adoption is also increasing with the Kultusministerkonferenz including graphic narratives in reading literacy initiatives across sixteen federal states as per its 2024 education guidelines. Additionally, Germany’s strong manga market and is driven by localized translations and fan conventions like Connichi, which drew large crowds in 2023. These institutional and demographic shifts reflect Germany’s evolving but robust comic culture.

Spain Market Analysis

Spain is estimated to witness a healthy CAGR in the European comic book market during the forecast period. Spain is experiencing a creative renaissance driven by a new generation of auteurs blending social critique with innovative visual language. Sales of Spanishauthored graphic novels continued to grow in 2023 with publishers like Astiberri and Norma Editorial leading the surge. Public support has been instrumental with the Ministry of Culture providing significant grant funding to comic creators in 2023 through its “Narrative Arts” program as stated in official budget disclosures. Barcelona’s Comic Barcelona festival drew large crowds in 2023, highlighting strong urban engagement, while school reading programs increasingly incorporate titles like The Photographer for historical education. Digital platforms also contribute with Spanishlanguage editions on Izneo reporting notable yearonyear growth in unique readers in 2023 according to platform analytics. This convergence of state backing, artistic innovation and educational integration positions Spain as a dynamic and expanding node in the European comic network.

United Kingdom Market Analysis

The United Kingdom is expected to exhibit a notable CAGR in the European comic book market during the forecast period. While historically dominated by American superhero imports, the UK market is diversifying through independent publishers and homegrown talent. Sales of Britishauthored graphic novels continued to grow in 2023 with publishers like SelfMadeHero and Jonathan Cape reporting strong revenues in their annual business summaries. The British Library’s “Comics Unmasked” initiative continues to elevate the medium’s academic status with substantial visitor engagement recorded in its graphic narrative exhibitions. Educational adoption is accelerating, supported by findings from the National Literacy Trust showing that around two in five young people in the UK read comics or graphic novels at least once a month. Additionally, UKbased digital platforms like Panel Syndicate pioneered paywhatyouwant models that have influenced European distribution strategies. Though smaller than continental markets, the UK’s strength lies in its creative output, global editorial influence and growing institutional recognition of comics as legitimate literature.

COMPETITIVE LANDSCAPE KEY MARKET PLAYERS

Some of the notable key players in the Europe comic book market are

Marvel Entertainment, LLC (The Walt Disney Company) DC Comics (Warner Bros. Discovery, Inc.) Image Comics, Inc. Idea and Design Works LLC (IDW Publishing) Dark Horse Comics LLC (Embracer Group) Shogakukan Co., Ltd. Hakusensha Co., Ltd. Shueisha Inc. TOKYOPOP Panini S.p.A. TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Europe comic book market deploy several core strategies to sustain competitiveness and drive growth. They prioritize digital transformation by expanding e book and app based distribution through platforms such as Izneo. Publishers actively invest in transmedia development licensing characters for animation gaming and streaming to amplify brand visibility. Strategic international co productions enable cross border content sharing and cost efficiency. Talent incubation through grants residencies and digital contests ensures a pipeline of innovative creators. Additionally they strengthen institutional ties by collaborating with ministries of culture libraries and educational bodies to embed comics in curricula and public programming. These approaches collectively reinforce market resilience and cultural relevance.

COMPETITION OVERVIEW

Competition in the Europe comic book market is characterized by a blend of legacy publishers and agile independents vying for cultural influence and consumer attention. Unlike markets driven purely by sales volume European rivalry emphasizes artistic distinction narrative authenticity and national identity. Major houses such as Glénat Dupuis and Sergio Bonelli Editore leverage decades of brand equity while newer entrants like Astiberri and SelfMadeHero disrupt with socially conscious and experimental content. The contest extends beyond print into digital curation transmedia rights and educational partnerships. Although price competition exists it is secondary to editorial quality festival presence and public funding access. With low barriers to digital publishing yet high costs for physical distribution the landscape rewards both institutional scale and creative agility. This dynamic fosters a vibrant yet fragmented ecosystem where cultural capital often outweighs commercial metrics in determining market leadership.

TOP PLAYERS IN THE MARKET Glénat Editions is a leading French publisher renowned for its diverse portfolio spanning bande dessinée graphic novels and manga. The company plays a pivotal role in shaping European comic culture by championing both legacy series and emerging auteurs. In recent years Glénat has reinforced its position through strategic digital partnerships notably expanding its catalog on Izneo and launching exclusive webcomic series tailored for younger audiences. It has also intensified international co productions with Italian and Spanish studios to develop transmedia properties. These initiatives demonstrate Glénat’s commitment to innovation while preserving the artistic integrity of European sequential art on the global stage. Sergio Bonelli Editore stands as Italy’s most influential comic publisher with a legacy built on iconic weekly series such as Tex Willer and Dylan Dog. The company contributes significantly to global graphic storytelling by exporting its distinctive narrative style and character archetypes beyond Europe. Recently Bonelli has strengthened its market presence through digitization of its vast archive multilingual ebook releases and licensing deals with streaming platforms for animated adaptations. Its collaboration with European gaming studios to create interactive experiences based on its IPs further underscores its proactive evolution in a converging media landscape. Dupuis a cornerstone of the Franco Belgian comic tradition is celebrated for launching legendary series including The Smurfs and Gaston. The publisher maintains global relevance by curating high quality graphic novels that appeal to adult readers and literary critics alike. In recent years Dupuis has amplified its reach through the “Digital Originals” initiative fostering new talent via online serialization. It also participates in EU funded cultural programs to promote European comics internationally and has enhanced its direct to consumer platform with personalized subscription models. These actions affirm Dupuis’s dual mission of heritage preservation and market adaptation. MARKET SEGMENTATION

This research report on the Europe comic book market has been segmented and sub-segmented based on categories.

By Type

By Genre

Science-Fiction Manga Superhero Non-fiction Others

By Format

Hard Copy E-Book Audiobooks

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe