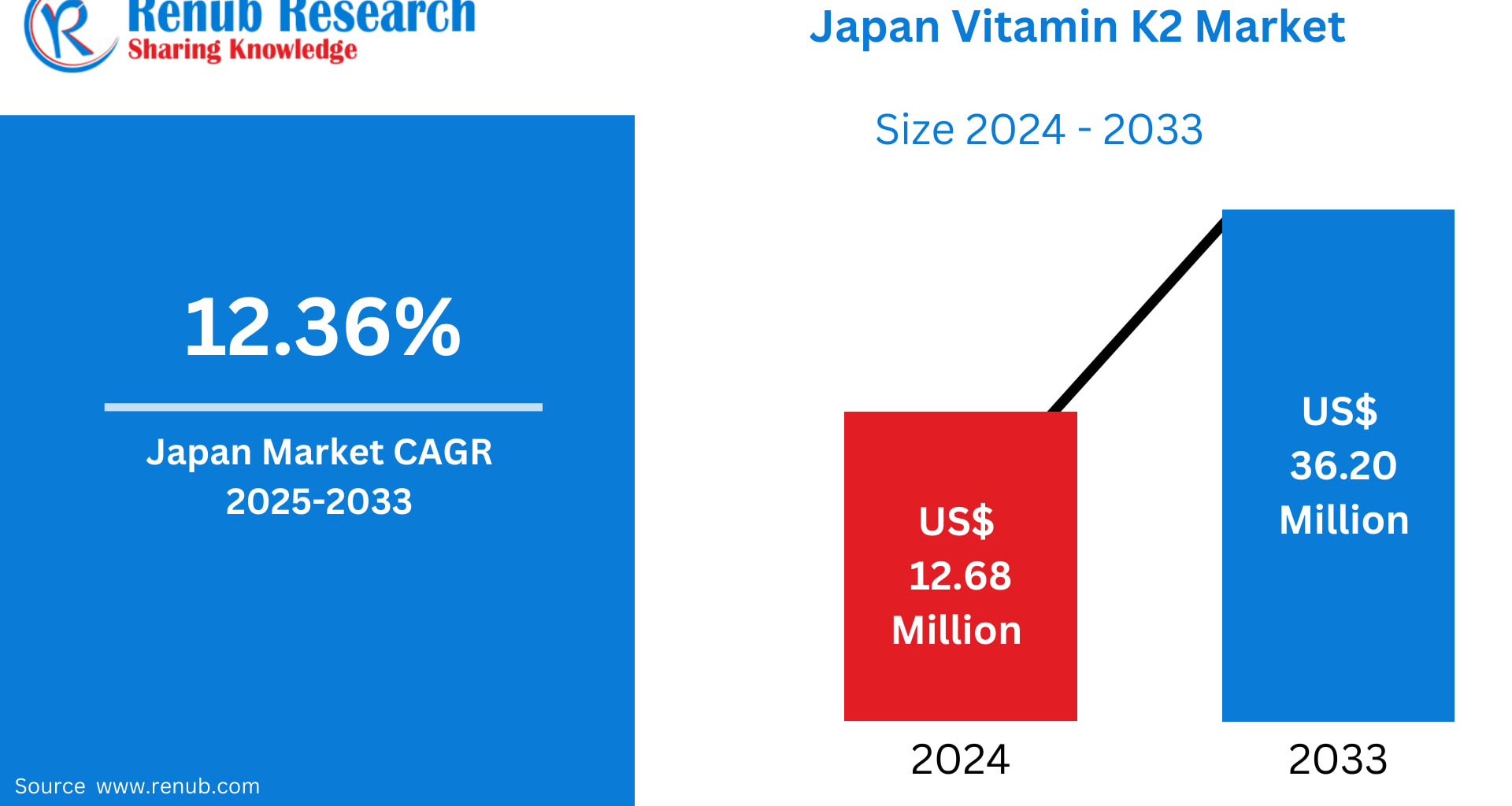

The Japanese Market for Vitamin K2 is on a strong upward trajectory, driven by a powerful combination of demographic pressures, rising health awareness, and the country’s thriving functional foods culture. According to Renub Research, the market is projected to grow significantly—from US$ 12.68 million in 2024 to US$ 36.20 million by 2033, registering a robust CAGR of 12.36% between 2025 and 2033. This impressive expansion is rooted in Japan’s unique health challenges and consumer preferences: an aging society, an increasing need for bone and cardiovascular health solutions, and a cultural affinity for natural and fermented ingredients.

As Japanese consumers place greater importance on preventive wellness, Vitamin K2—especially forms like MK-4 and MK-7—has emerged as a critical nutrient. With applications spanning health supplements, functional foods, pharmaceuticals, and fortified everyday products, the market is poised for a decade of high growth and continuous innovation.

Japan Vitamin K2 Market Outlook

Vitamin K2 is a fat-soluble vitamin essential for regulating calcium in the body, preventing arterial calcification, and strengthening bones. In Japan, both MK-4 and MK-7 are widely researched and recognized for their efficacy. The nutrient plays a critical role in activating proteins responsible for bone mineralization and cardiovascular health—two areas of growing concern in a country where nearly 30% of the population is above 65 years of age.

Japan’s deep-rooted familiarity with fermented foods, especially natto, has long positioned Vitamin K2 as a naturally occurring part of local diets. However, as modern lifestyles shift and natural consumption declines, consumers are increasingly turning to supplements and fortified foods to maintain adequate levels.

The stiff rise in osteoporosis cases, age-associated vascular disorders, and lifestyle-related chronic diseases underscores the nationwide need for nutrients that support healthy aging. With both government and private-sector initiatives promoting holistic health, Vitamin K2 has secured a significant place in Japan’s nutraceutical and medical landscape.

Growth Drivers for the Japan Vitamin K2 Market

1. Rising Awareness of Cardiovascular and Bone Health

Japan’s aging society presents an urgent demand for nutrients capable of maintaining bone density and preventing cardiovascular complications. Vitamin K2’s proven role in calcium metabolism—ensuring calcium binds to bones rather than arteries—makes it a top choice for preventing osteoporosis and arterial calcification.

Growing consumer awareness, intensified by healthcare professional recommendations and public health campaigns, has fueled widespread adoption. A notable example is the September 2023 initiative by Fujitsu Limited and iSurgery Co., Ltd., which launched a “bone health promotion project” in partnership with Jikei University School of Medicine. Running through March 2025, the project explores chest radiographs as a tool for bone assessment—a first in Japan’s corporate health programs. Such efforts boost consumer understanding of bone health markers and encourage proactive supplementation, including Vitamin K2 intake.

2. Expansion of Functional Foods and Nutraceuticals

Japan is a global pioneer in functional foods, with long-standing traditions such as FOSHU (Foods for Specified Health Uses). The integration of Vitamin K2 into beverages, dairy products, yogurts, nutrition bars, infant formulas, and fortified staples aligns perfectly with the nation’s preventive healthcare trend.

Convenience, taste, and multifunctional benefits drive consumers toward nutraceuticals enriched with Vitamin K2. Japanese companies are responding with innovative delivery forms like powders, soft gels, fortified dairy drink shots, and kombucha blends.

A key milestone occurred in December 2022, when J-Oil Mills secured trademarks for Menatto (MK-7) in major markets including Japan, the U.S., Europe, and Australia. This trademarking supports global expansion and strengthens Japan’s position in the premium Vitamin K2 production ecosystem.

3. Growing Use of Natural and Fermented Ingredients

Japanese consumers prefer clean-label, naturally sourced ingredients, aligning with national dietary habits founded on fermented foods. This preference strongly favors Vitamin K2 derived from natural fermentation—especially natto-derived MK-7.

Widespread skepticism around synthetic additives gives natural Vitamin K2 a competitive edge. This cultural alignment has accelerated market penetration in functional foods, herbal supplements, and holistic lifestyle products.

A landmark collaboration in August 2024 between Kirin Holdings Co. and Takanofoods Co., a leading natto manufacturer, further validates this trend. Their joint efforts aim to bring fermented, natto-based Vitamin K2 products to eastern Japan, expanding consumer options and strengthening regional supply chains.

Market Challenges

1. High Production Costs of Natural Vitamin K2

Producing Vitamin K2 from natural fermentation—especially MK-7—requires advanced extraction technologies, controlled fermentation environments, and rigorous purification. These factors raise manufacturing costs, which are ultimately passed on to consumers. As a result, premium supplements and fortified foods remain less accessible to price-sensitive demographics.

Manufacturers face the challenge of balancing cost efficiency with product quality and maintaining competitive pricing in a marketplace heavily driven by trust and authenticity.

2. Limited Consumer Awareness Outside Urban Centers

While regions like Tokyo, Osaka, and Kyoto exhibit strong familiarity with nutraceuticals, rural populations remain less informed about Vitamin K2’s benefits. Limited exposure to modern functional foods, fewer marketing campaigns, and lower availability in local retail stores hinder adoption.

Broadening regional awareness will require targeted campaigns, partnerships with local pharmacies, and improved retail penetration. Without these efforts, Vitamin K2 demand may remain heavily urban-centric, slowing nationwide growth.

Japan Vitamin MK-4/K2 Market Breakdown

Japan Vitamin MK2 Market

Vitamin MK2 plays a critical role in clinical settings for treating bone-related disorders, particularly osteoporosis—a major health concern among Japan’s elderly. Hospitals and doctors increasingly prescribe MK2 supplements, ensuring stable demand from the pharmaceutical channel.

Japan Vitamin K2 Powder & Crystalline Market

Powder and crystalline forms are highly sought after for their superior stability, extended shelf life, and compatibility with diverse formulations. As the nutraceutical industry expands, demand from functional food companies and supplement manufacturers continues to rise.

Japan Natural Vitamin K2 Market

Natto-derived Vitamin K2 remains highly trusted due to its cultural roots and perceived purity. Natural Vitamin K2 is preferred by Japan’s health-conscious segments, particularly those following traditional diets and clean-label wellness trends.

Japan Vitamin K2 Health Supplements Market

Vitamin K2 supplements—including tablets, capsules, and soft gels—are increasingly popular. Their convenience and clear positioning for bone and cardiovascular health attract both elderly consumers and younger adults focused on longevity and preventive health.

Japan Offline Vitamin K2 Market

Despite rising e-commerce adoption, offline channels—pharmacies, supermarkets, and specialty health stores—dominate Vitamin K2 sales in Japan. Shoppers value expert feedback, trusted brands, and the reassurance of physical inspection before purchase.

Regional Analysis

Kansai Vitamin K2 Market

Home to Osaka and Kyoto, the Kansai region is a booming hub for Vitamin K2 due to its significant aging population, robust healthcare framework, and vibrant food culture. Its concentration of supplement manufacturers strengthens domestic production and innovation.

Tokyo Vitamin K2 Market

Tokyo leads the national market, fueled by highly health-conscious consumers, a fast-paced urban lifestyle, and strong retail and diagnostic networks. Tokyo often serves as the launchpad for new nutraceutical innovations, including premium K2-infused products.

Saitama Vitamin K2 Market

Saitama benefits from proximity to Tokyo, growing suburbanization, rising disposable income, and expanding retail networks. Increasing awareness of preventive health among middle-class families is pushing Vitamin K2 product uptake higher.

Market Segmentations

By Product

MK-7

MK-4

By Dosage Form

Powder & Crystalline

Capsules & Tablets

Oils & Liquid

By Source

Natural

Synthetic

By Application

Health Supplements

Functional Foods & Beverages

By Distribution Channel

Offline

Online

Top 10 States

Tokyo

Kansai

Aichi

Kanagawa

Saitama

Hyogo

Chiba

Hokkaido

Fukuoka

Shizuoka

Key Companies Covered (with 5 Viewpoints Each)

NOW Foods

Life Extension

Nestlé

Bronson

NatureWise

Solaray

Natural Factors

Source Naturals

(Each includes Overview, Key Person, Recent Developments, SWOT Analysis, and Revenue Analysis.)

Final Thoughts

Japan’s Vitamin K2 market is entering a transformative decade, propelled by demographic realities, innovative functional food development, and the country’s deep cultural connection with fermented foods. As consumers shift toward preventive healthcare and natural wellness solutions, Vitamin K2 stands out as one of the most important nutrients shaping Japan’s longevity landscape.

With strong market fundamentals, ongoing scientific research, and expanding product portfolios, Japan is poised to remain one of Asia’s most influential Vitamin K2 markets through 2033. The rising convergence of medical research, functional nutrition, and natural ingredient demand ensures that Vitamin K2 will remain a central component of the country’s health and wellness evolution.