Market Overview

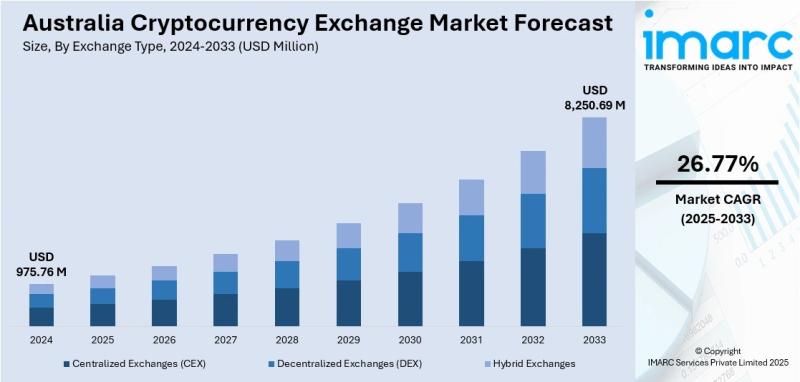

The Australia cryptocurrency exchange market reached a value of USD 975.76 Million in 2024 and is projected to expand to USD 8,250.69 Million by 2033. Spanning a forecast period from 2025 to 2033, the market growth is marked by a compound annual growth rate of 26.77%. This growth is driven by adoption of automated trading tools like OKX’s bots and increased institutional investing with platforms such as Kraken.

For comprehensive details, visit the Australia Cryptocurrency Exchange Market

https://www.imarcgroup.com/australia-cryptocurrency-exchange-market

How AI is Reshaping the Future of Australia Cryptocurrency Exchange Market:

• AI-powered automated trading bots like OKX’s Spot Grid Bot and DCA Martingale Bot have doubled Australian trading volumes by enabling 24/7 trading and risk management.

• AI-driven analytics enhance institutional investment platforms, exemplified by Kraken’s crypto derivatives product that offers sophisticated risk management for wholesale clients.

• Enhanced AI algorithms improve fraud detection and cybersecurity measures, critical in protecting digital asset exchanges from evolving cyber threats.

• AI assists in user experience personalization and beginner-focused tools development, contributing to rising retail participation in crypto trading.

• Australian fintech ecosystem integration with AI technologies accelerates processing speed and transaction transparency in digital asset exchanges.

• AI-powered market sentiment analysis and prediction tools support traders in managing volatility and speculative risks more effectively.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-cryptocurrency-exchange-market/requestsample

Australia Cryptocurrency Exchange Market Growth Factors

The Australian cryptocurrency exchange market is driven by the rising popularity of cryptocurrency within Australia. Cryptocurrency becomes more mainstream to which more Australians are using cryptocurrencies as investments and in payment transactions. Retailers demand Bitcoin, Ethereum and other cryptocurrencies now, and businesses explore an option to offer crypto payments for flexibility and lower transaction costs. The development, including integration with local mobile banking applications, of blockchain-based remittances, cross-border payments and other use cases has democratized access to digital assets, creating demand for local, trusted, safe and regulations-compliant exchanges.

Australia has an existing blockchain ecosystem that supports the use and expansion of cryptocurrency services, with many blockchain companies, digital payments companies and API-based finance companies forming the supporting infrastructure to add cryptocurrency trading into the broader financial ecosystem. Fintech companies partner with crypto exchanges to strengthen trading infrastructure, to speed up transactions, and to speed up the user experience. Blockchain solutions help financial institutions make operations more efficient. These solutions also improve transparency. Venture capital investment into the crypto economy is also driving rapid development in Australia.

Regulatory clarity in Australia has improved recently, with measures for thorough cryptocurrency taxation regulations, exchange licensing, anti-money laundering, (AML) efforts and consumer protection contributing to more efficient market participation. Regulatory bodies such as the Australian Securities and Investments Commission (ASIC) and Australian Transaction Reports and Analysis Centre (AUSTRAC) are regulating and enforcing crypto activities, with a view to weeding out sca mmers and building confidence through the establishment of clear, secure and scalable environments to ease individual and institutional investor activity.

Australia Cryptocurrency Exchange Market Segmentation

Exchange Type Insights:

• Centralized Exchanges (CEX)

• Decentralized Exchanges (DEX)

• Hybrid Exchanges

Cryptocurrency Type Insights:

• Bitcoin (BTC)

• Ethereum (ETH)

• Stablecoins

• Altcoins

• Meme Coins and Emerging Tokens

User Type Insights:

• Retail Traders

• Institutional Investors

• High-Frequency Traders

Revenue Model Insights:

• Transaction Fees

• Subscription-Based Models

• Listing Fees

• Staking and Yield Farming Services

Trading Services Insights:

• Spot Trading

• Futures and Derivatives Trading

• Margin Trading

• Peer-to-Peer (P2P) Trading

Regional Insights:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Key Players

• OKX Australia

• Kraken

• Swyftx

• Easy Crypto

• WhiteBIT

Recent Development & News

• May 2025: Swyftx acquired Easy Crypto, New Zealand’s largest crypto exchange, expanding its footprint in the ANZ region with 1.1 million sign-ups, accelerating growth into new products and markets while boosting competition and innovation.

• March 2025: WhiteBIT, Europe’s largest crypto exchange by traffic, launched in Australia and registered with AUSTRAC, enhancing secure transaction capabilities and introducing new trading tools to meet growing local demand.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

https://www.imarcgroup.com/request?type=report&id=36213&flag=F

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.