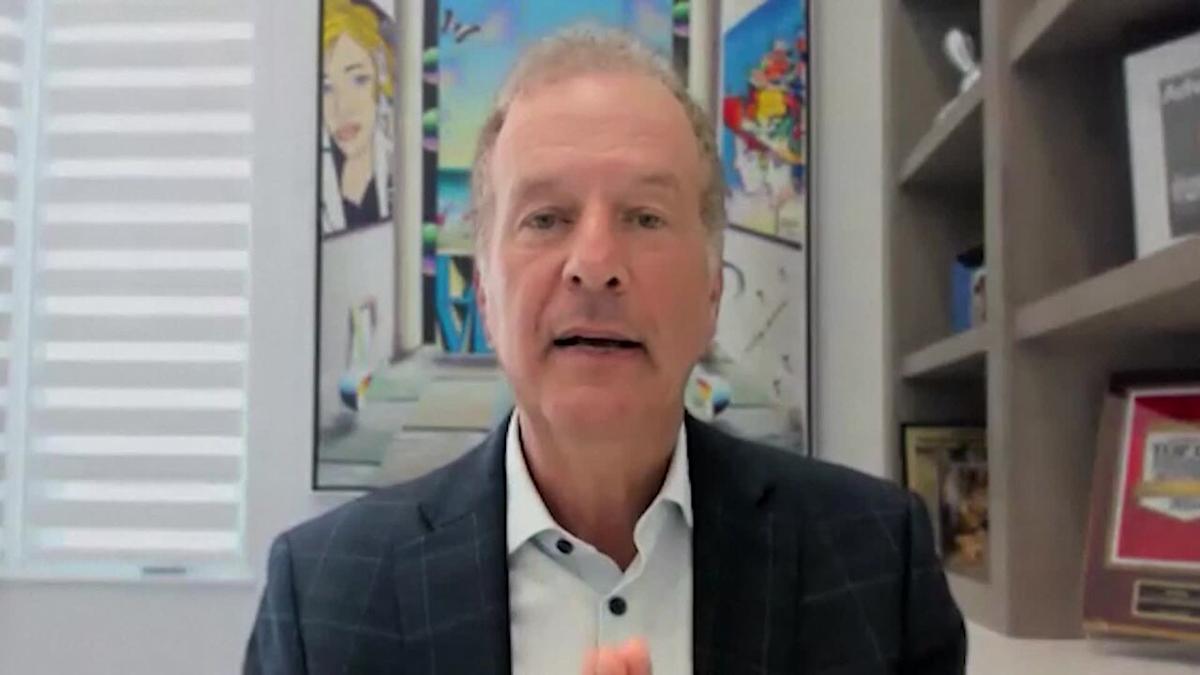

STORY: Wall Street’s main indexes closed slightly higher on Friday, with the Dow and S&P 500 each rising roughly two-tenths of a percent and the Nasdaq adding three-tenths of a percent.Investors digested a slew of economic data this week, including Friday’s Personal Consumption Expenditures Price Index from September, the release of which was delayed due to the government shutdown. The report put the annual inflation rate at 2.8%, still above the Federal Reserve’s 2% target.While traders are betting the central bank will cut rates at its policy meeting next week, several Fed governors may dissent due to concerns about persistent inflation.But Eric Diton, president and managing director of The Wealth Alliance, points to other data that he believes should lead the Fed to lower rates.”The Leading Economic Index versus the Coincident, that’s the future versus now, it’s a ratio that some people look at, is actually one of the weakest we have seen, going back to the ’80s – talking about three other times that we’ve seen a weak number. So that means we’re strong today, not strong looking forward. And that can be pre-recessionary. So if I were on the Fed and you were asking me what I would do, I would probably cut rates this month as just a preventative measure.”Stocks on the move Friday included Warner Bros Discovery, which climbed more than 6% after Netflix agreed to buy its TV, film studios, and streaming division for $72 billion, ending a weeks-long bidding war.Netflix shares closed nearly 3% lower, while shares of Paramount Skydance, one of the other bidders for Warner Bros, tumbled almost 10%.And shares of Ulta Beauty surged more than 12.5% after the beauty retailer raised its annual sales and profit forecasts.