Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

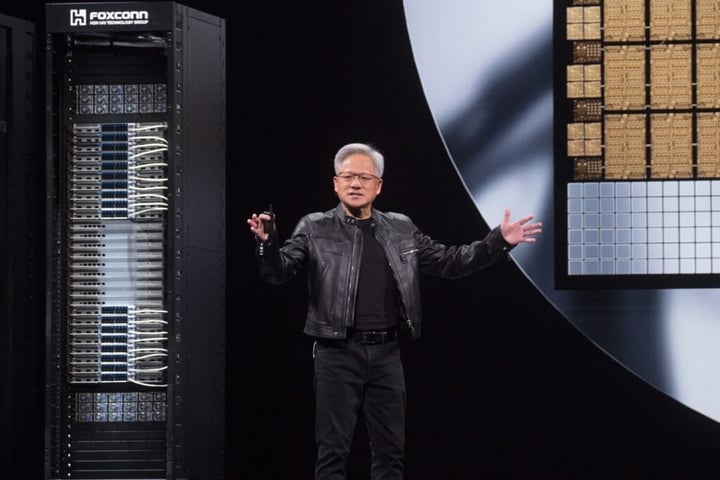

NVIDIA Corp. (NASDAQ:NVDA) CEO Jensen Huang appeared Wednesday on “The Joe Rogan Experience” podcast and delivered a strong validation of the nuclear sector.

Can Huang’s powerful support of the industry help to reverse the brutal November stock slide experienced by small nuclear reactor (SMR) developers like NuScale Power Corp. (NYSE:SMR), Nano Nuclear Energy, Inc. (NASDAQ:NNE) and Oklo, Inc. (NYSE:OKLO).

Don’t Miss: If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

Nvidia’s Huang, kingmaker of the AI boom, addressed the industry’s ultimate bottleneck: energy.

When discussing the immense and rapidly growing power demands of AI data centers, which he referred to as “gigawatt factories,” Huang noted that these concentrated power needs cannot be easily integrated into the existing public grid without risking instability.

His solution was definitive: Dedicated or off-grid power generators (such as SMRs) are necessary for the continued growth of AI.

Huang said he expects to see “a whole bunch of small nuclear reactors” in the hundreds of megawatts range powering data centers within six to seven years.

Nuclear stocks faced a steep correction in November rooted in fundamental skepticism—namely, how SMR firms, which currently lack significant revenue, will finance and execute massively expensive, multi-year projects.

See Also: Missed Nvidia and Tesla? RAD Intel Could Be the Next AI Powerhouse — Invest Now at Just $0.85 a Share

Huang’s quote directly attacks that skepticism by confirming demand for SMRs is not just abstract, but a strategic necessity for the AI revolution.

Validation of Demand: Linking SMRs directly to the exponential growth of AI shifts the focus from the companies’ high risk to the extraordinary market opportunity they serve.

Setting the Clock: Huang’s “six to seven years” timeline provides investors with a clear, credible horizon from a technology leader, encouraging patient capital to return after short-term traders abandoned the sector in November.

Huang has given the nuclear sector the ultimate tailwind. The AI revolution needs SMRs.

This fundamental truth provides a powerful support and positions companies like NuScale, Nano Nuclear and Oklo to overcome their November woes if they can deliver on the promise of the AI energy future.