The disparity between oil and gas operators, utilities, and the state government towards Cook Inlet natural gas volumes leaves residents of Southcentral Alaska caught between the expiring gas contracts and the higher costs of imported liquefied natural gas (LNG). Current prices for Cook Inlet gas hover around $8 per thousand cubic feet (Mcf), according to data from the November 2024 Wood MacKenzie analysis, providing a stable and relatively affordable source for heating and electricity. However, with Railbelt utility gas contracts expiring and utilities diversifying towards renewables, importing LNG could push prices to $12-$14 per Mcf, an increase that would burden households with higher bills.

Alaska vs. The Lower 48: Residential Gas Prices

The distinction between Henry Hub (the U.S. benchmark wholesale price at about $5.07/Mcf) and Cook Inlet prices highlights Alaska’s isolation from the Lower 48 pipeline network. Henry Hub drives commodity costs nationwide but Alaska’s local market keeps residential rates lower at $15.38/Mcf in September 2025, per EIA data. This contrasts with the U.S. average of $24.56/Mcf. Electric power prices, which utilities pass on for gas-fired generation, mirror wholesale trends more closely; in the Lower 48, they’re often near Henry Hub levels, while Alaska’s could rise with imports, straining the customers.

Compared to other states, Alaska ranks fifth lowest in residential gas prices, behind New Mexico ($5.73), Utah ($12.09), Idaho ($12.49), and Montana ($14.33). Texas stands at $33.22 and New York at $26.67— illustrating how southern states face higher markups from distribution and demand.

The LNG Project as Path to Relief

The proposed Alaska Gasline and LNG project provides a path to relief but is still years away. Phase 1, an 800-mile pipeline from the North Slope, is projected to deliver gas at $11.62/Mcf by 2031, competitive with imports at $10.59-$14.24, while the full project drops to $2.31/Mcf, potentially yielding billions in savings.

The majority of the value in the Gasline will come from exporting LNG where a fraction of the total volume has been allocated for instate use. The Trump and Dunleavy administrations have secured various letters of intent and agreements from the governments of Japan, Taiwan, Thailand, and others totaling half of the projects expected gas volume.

Director of Division of Oil and Gas Speaks on the Cook Inlet Resource Management

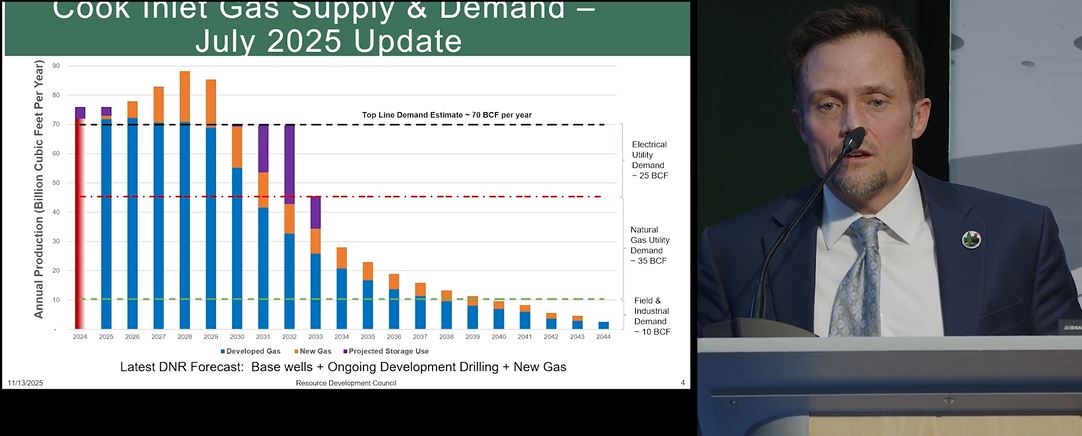

At the 2025 Resource Development Council Conference, Derek Nottingham, Director of the Division of Oil and Gas, shared a volume forecast of Cook Inlet as recent as July 2025.

Nottingham was enthusiastic when describing how operators in the Cook Inlet are optimizing drilling programs and bringing forward new gas wells in fields where they know there are good gas targets, like the Beluga River field.

“We know there are big, undeveloped gas resources in the Cook Inlet,” Nottingham stated, “this represents the current view of what we have right now which is new gas being brought online in the Kitchen Lights Unit (KLU). Excess gas now has the potential to be stored for the future to curb annual decline and have gas available for use.”

When discussing the demand gap, Nottingham made a point to illustrate that if a renewable project could reduce the electric demand by 10% every other year, roughly equal to 2.5-3BCF per year, it only reduces the electrical demand 25BCF in the next decade.

The main chart still reflects the outcome of the 2022 and 2023 studies where there is no drilling assumed in the Cook Inlet beyond 2030. A stark contrast, made evident by the fact that the operators have more than fulfilled the gap in supply with new wells planned to be drilled in the coming years. This should provide confidence to the utilities to come back to the table and secure new gas contracts to mitigate the risk of higher gas import costs.

“We are going to depend on natural gas in the Cook Inlet for a long time. We absolutely have to find new sources of that,” said Nottingham.

To date, neither Enstar nor the Railbelt electric utility co-ops have signed connection agreements with 8 Star LLC or AGDC for gas offtake from the proposed gas pipeline. This leaves Southcentral dependent on the Cook Inlet operators to continue innovating and bring new volumes to market as a firm alternative to importing LNG.

Related