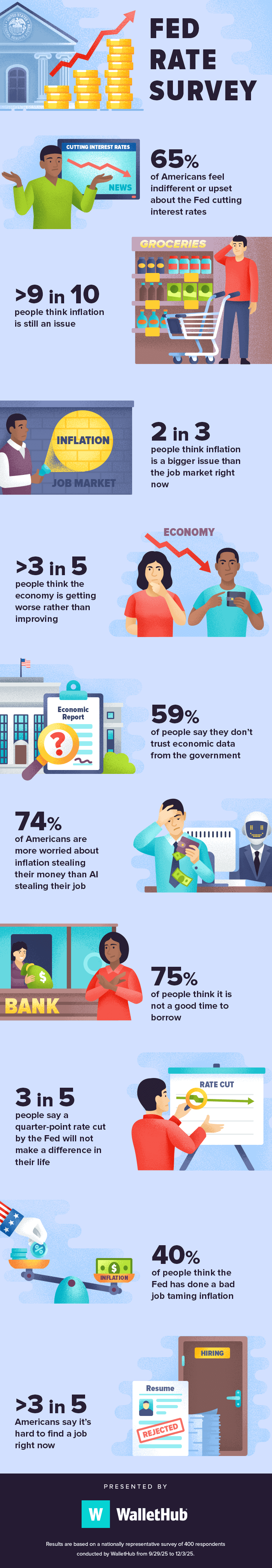

MIAMI—With markets pricing in an 87% chance that the Federal Reserve will cut its benchmark rate by 25 basis points Wednesday, a new WalletHub survey finds that most Americans are far from enthusiastic about the prospect, reflecting deep-seated anxiety over inflation and growing distrust of official economic data.

According to the WalletHub Fed Rate Survey, 65% of Americans say they feel indifferent or upset about a rate cut, while more than 90% believe inflation remains a serious problem. Nearly two-thirds say inflation now outweighs job-market concerns, and more than three in five believe the economy is deteriorating rather than improving. Trust in government economic data is also low, with 59% saying they do not believe official numbers.

Despite the negative mood, WalletHub estimates a rate cut would deliver meaningful savings across consumer credit. Credit-card holders would save about $1.93 billion in interest over the next year, while mortgage rates have already fallen an estimated 11 basis points, equal to $10,080 in savings over the life of a 30-year loan. Auto-loan borrowers could see the average APR on a 48-month new-car loan drop by about 18 basis points in coming months.

WalletHub Editor John Kiernan said the disconnect between potential savings and public sentiment reflects inflation fatigue.

“Lower interest rates should be cause for celebration among consumers, considering that even a quarter-point cut translates to billions in annual savings. But people are far from pumped,” Kiernan said. He added that 74% of Americans are more worried about inflation eroding their money than about artificial intelligence threatening their jobs, underscoring how price pressures continue to dominate household economic concerns.

Section: Standard

Word Count: 368

Copyright Holder: CUToday.info

Copyright Year: 2025

Is Based On:

URL: https://www.cutoday.info/Fresh-Today/Rate-Cut-Likely-Confidence-Not-New-Survey-Finds-Americans-Wary-Of-Economy-And-Data