As European markets navigate mixed returns and inflationary pressures, investors are increasingly on the lookout for opportunities that lie beyond the major indices. Penny stocks, a term often associated with speculative investments, continue to hold potential when backed by robust financial health and sound fundamentals. In this context, we explore three European penny stocks that present promising prospects for growth and stability amidst current economic conditions.

Top 10 Penny Stocks In Europe

Click here to see the full list of 279 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orthex Oyj is a houseware company that designs, produces, markets, and sells household products in the Nordics, Europe, and internationally with a market cap of €84.18 million.

Operations: The company’s revenue is primarily generated from its Housewares & Accessories segment, amounting to €88.79 million.

Market Cap: €84.18M

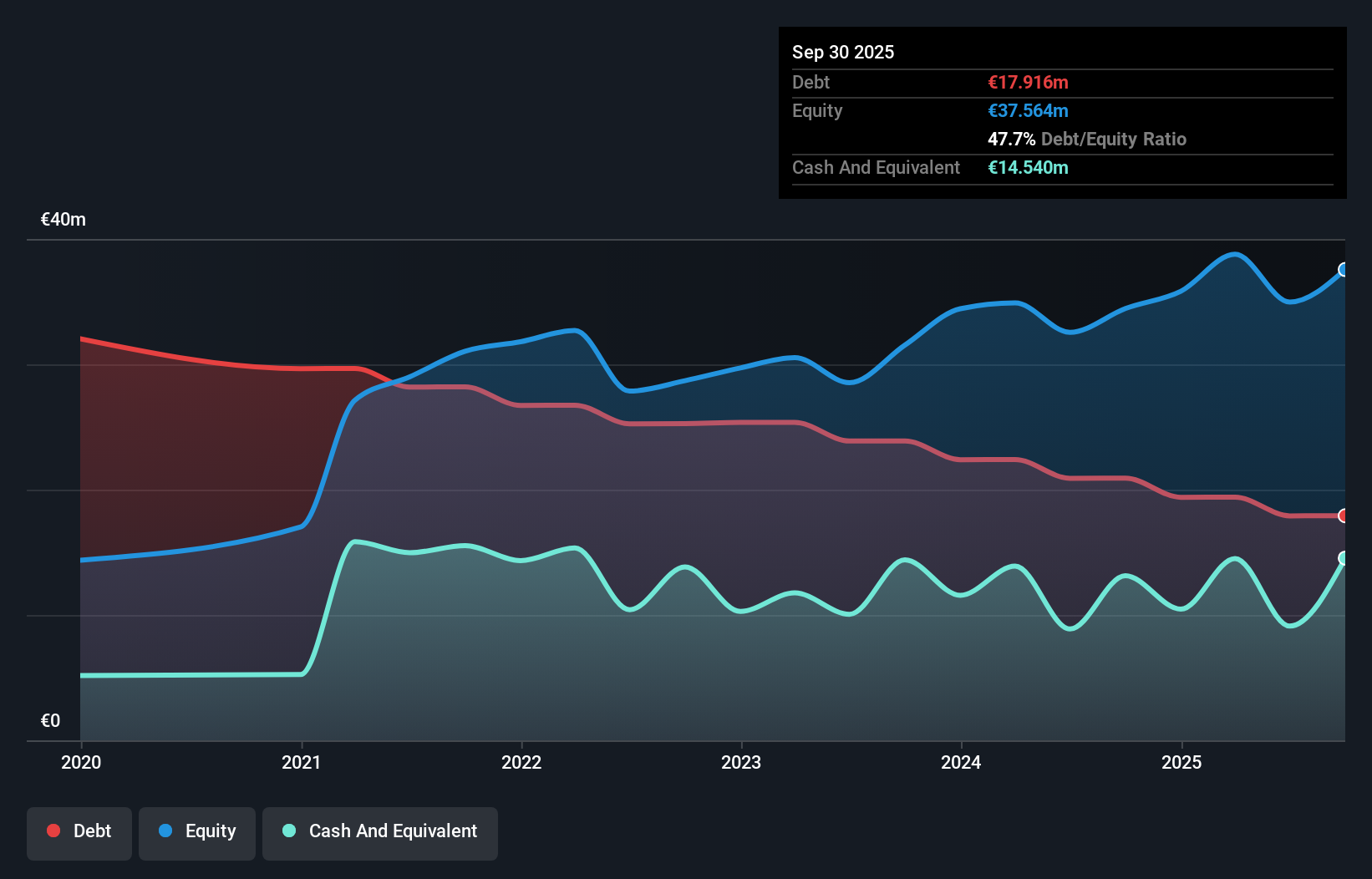

Orthex Oyj, with a market cap of €84.18 million, demonstrates stability in the penny stock landscape through its robust financials and strategic management. The company has maintained high-quality earnings with a modest growth in net income for the third quarter of 2025 at €2.43 million, compared to €1.8 million last year. Its debt is well-managed, covered by operating cash flow at 68.2%, and its short-term assets surpass both short- and long-term liabilities significantly. Despite low return on equity at 17.1%, Orthex trades below estimated fair value, offering potential value relative to peers in the industry.

HLSE:ORTHEX Debt to Equity History and Analysis as at Dec 2025

HLSE:ORTHEX Debt to Equity History and Analysis as at Dec 2025

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Scana ASA is a company that offers technology and services to the offshore and energy sectors across various regions including Norway, other parts of Europe, the United States, Asia, and Africa, with a market capitalization of NOK673.43 million.

Operations: The company’s revenue is primarily derived from the Offshore Segment, contributing NOK1.12 billion, and Energy, which accounts for NOK520.2 million.

Market Cap: NOK673.43M

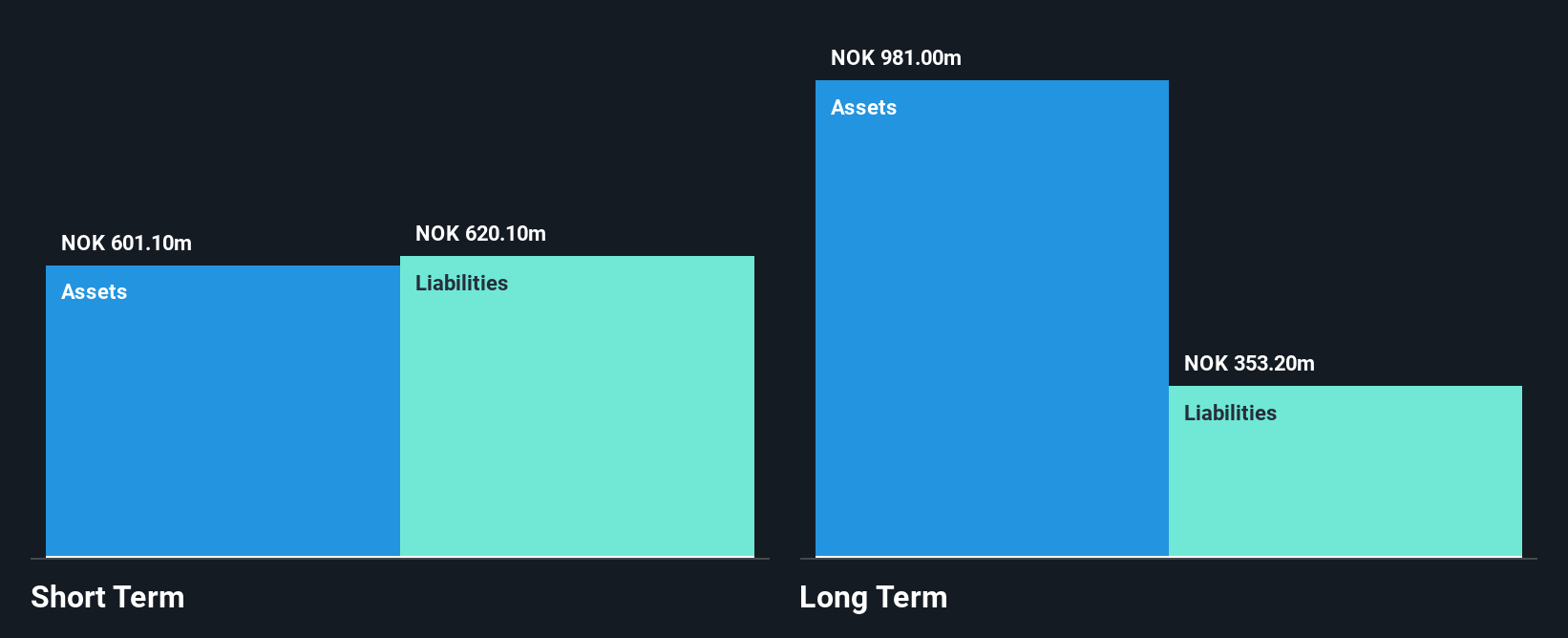

Scana ASA, with a market cap of NOK673.43 million, operates in the offshore and energy sectors but faces challenges as it remains unprofitable with rising losses over five years. Recent earnings showed a net loss of NOK0.8 million for Q3 2025, down from a profit last year. Despite this, Scana’s valuation appears attractive as it trades significantly below estimated fair value and has not diluted shareholders recently. The company maintains a satisfactory net debt to equity ratio of 23.3% and holds sufficient cash runway for over three years due to positive free cash flow growth, although short-term liabilities slightly exceed assets.

OB:SCANA Financial Position Analysis as at Dec 2025

OB:SCANA Financial Position Analysis as at Dec 2025

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: IPOPEMA Securities S.A. operates in Poland, offering brokerage, company analysis, and investment banking services, with a market cap of PLN98.79 million.

Operations: IPOPEMA Securities S.A. does not report specific revenue segments.

Market Cap: PLN98.79M

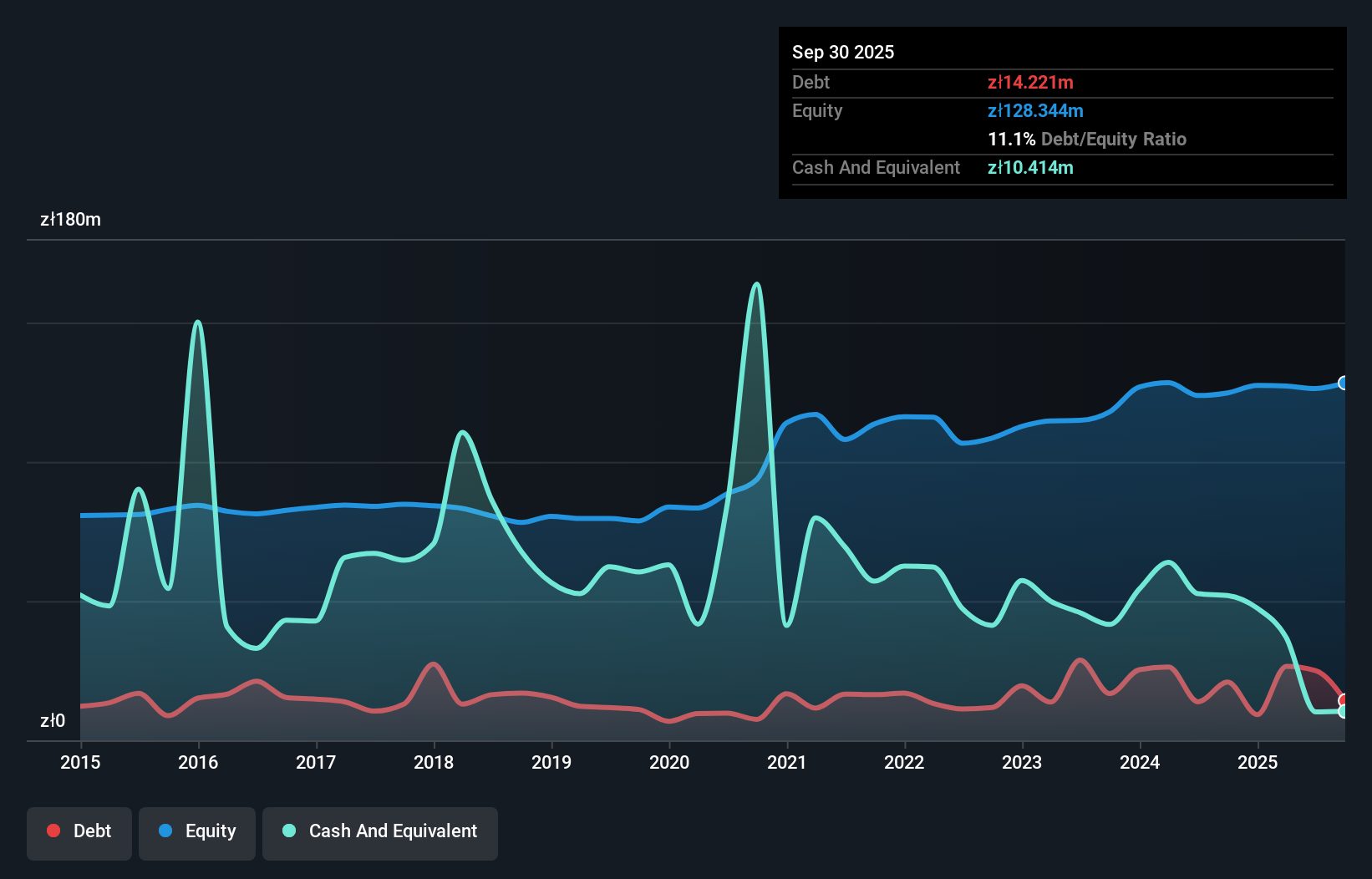

IPOPEMA Securities S.A., with a market cap of PLN98.79 million, shows mixed performance indicators. The company’s net debt to equity ratio is satisfactory at 3%, and short-term assets exceed both short and long-term liabilities, highlighting strong liquidity management. Earnings for the third quarter improved year-over-year with net income rising to PLN1.91 million from PLN0.938 million, though profit margins have declined from last year’s figures. Despite negative earnings growth over five years, IPOPEMA’s price-to-earnings ratio of 10.7x suggests it may be undervalued compared to the Polish market average of 11.9x, offering potential value for investors mindful of its unstable dividend history and large one-off items affecting financial results.

WSE:IPE Debt to Equity History and Analysis as at Dec 2025Summing It All Up

WSE:IPE Debt to Equity History and Analysis as at Dec 2025Summing It All Up

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com