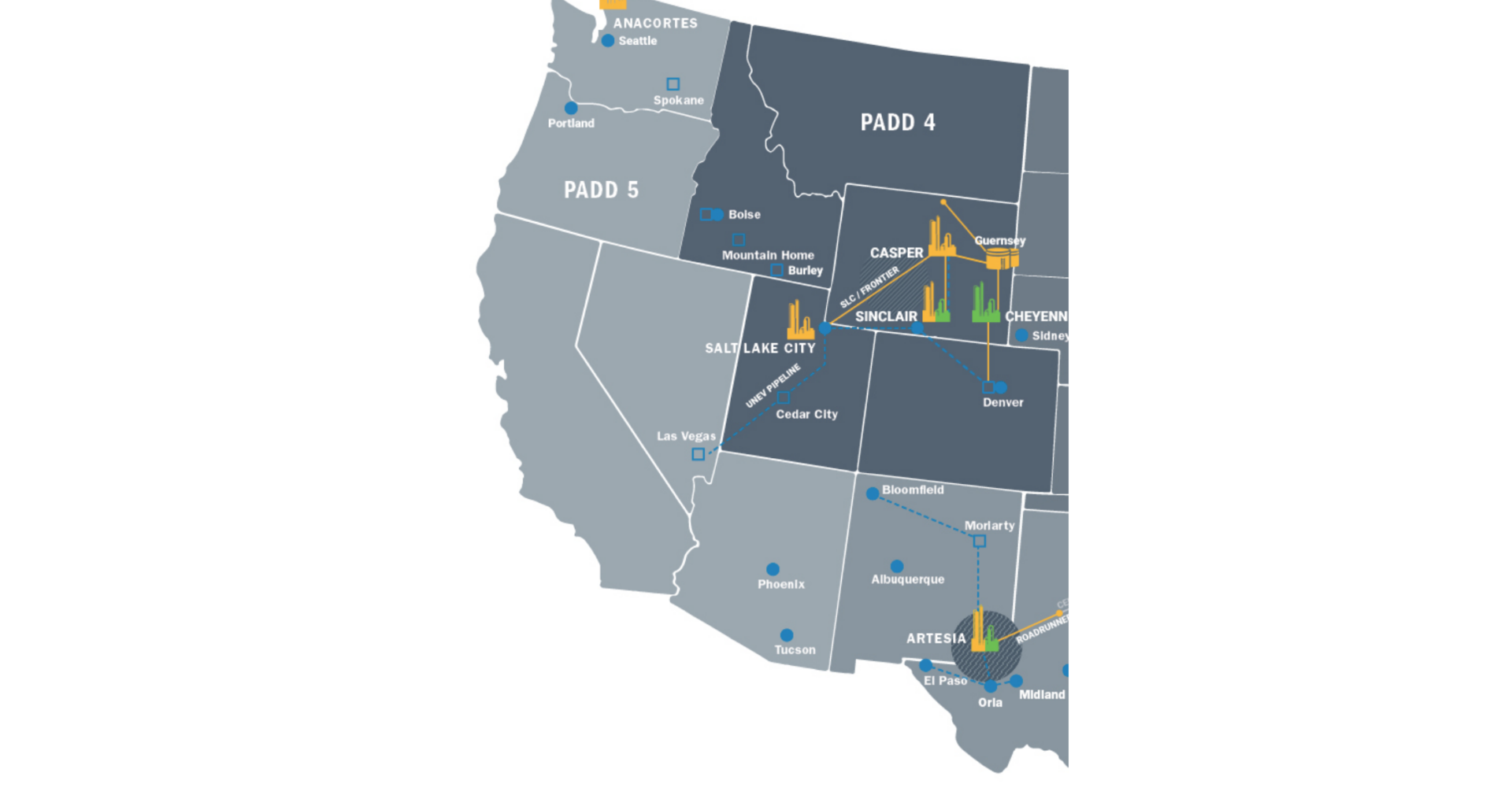

The three projects are competing to fill an expected supply shortfall in the West. California is steadily losing refining capacity as companies like PSX close refineries, curtailing volumes of gasoline, diesel and jet fuel that can be piped inland. At the same time, demand is increasing in Sun Belt states like Arizona and Nevada from economic growth and an influx of new residents.

If constructed, the Sinclair project will likely stimulate new demand for crude oil from the Denver-Julesburg, Uinta, Green River and Powder River basins, providing a broad-based lift to oil and gas operations in the Rockies. As competition heats up to move products west, DINO aims to capitalize on its existing pipeline infrastructure to meet the regional supply and demand imbalance.

Supply and Demand

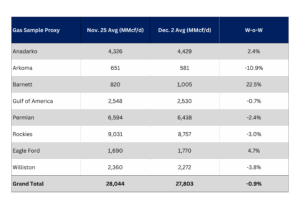

The US natural gas pipeline sample, a proxy for change in oil production, decreased 0.9% W-o-W across all liquids-focused basins.

The Barnett sample in North Texas increased 22.5%, the Anadarko rose 2.4% and the Eagle Ford sample gained 4.7% W-o-W. These increases coincided with decreases in the other basins. The most notable decreases occurred from the Arkoma by 10.9%, Permian by 2.4%, Rockies by 3.0% and Williston by 3.8%. The Rockies and the Gulf of America have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

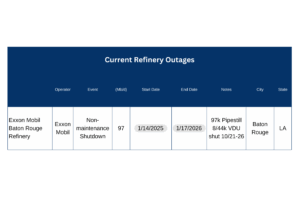

As of Dec. 8, there is no refining capacity offline for planned maintenance, as refinery outages reach a low. In January, a non-maintenance shutdown of 97 Mb/d is expected for half a week at ExxonMobil’s Baton Rouge refinery.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 23 vessels loaded for the week ending Dec. 6, coming down from a multi-month high the previous week.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Gray Oak Pipeline, LLC: Certain available capacity discounts were increased.

Magellan Pipeline Company, L.P.: The tariffs were revised to add a new product and to update the product grade document to be consistent with ONEOK’s product grade documents.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/