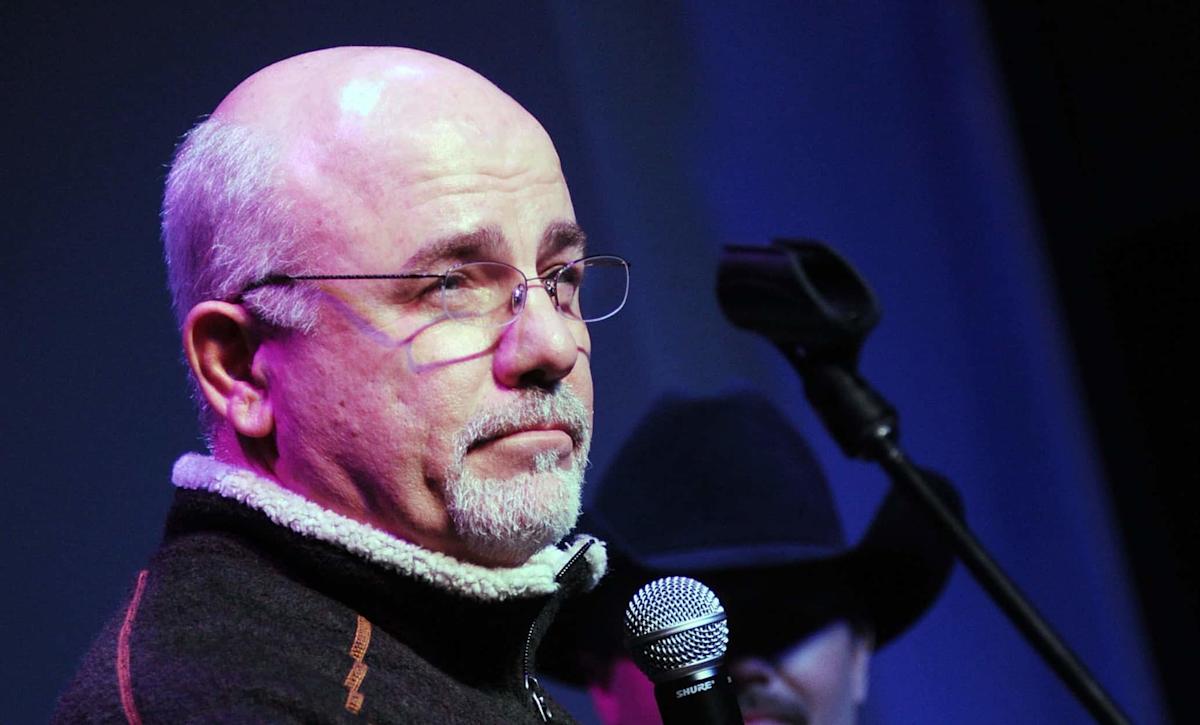

Rick Diamond/Getty Images)

Financial advice radio program host Dave Ramsey usually gets callers with specific questions on their personal situations. However, among general topics, one that has come up is the different mindset that separates the rich from the poor.

Ramsey noted that the major question that a rich person asks when posed with a proposition is: “How much?” Conversely, Ramsey says that a poor person will ask: “How much down payment?”

The implication is that rich people don’t spend beyond their means, while poor people habitually overspend themselves into debt scenarios. They purchase based on whether or not they can afford the down payment, without consideration about how high interest rates, sudden emergencies, a loss of employment or a pay cut can impact the ability to maintain payments, not to mention the higher total net cost when the interest is added on.

The average American carries $104K in debt across mortgages, credit cards, auto loans and student loans.

Credit card balances surpassed $1 trillion in Q4 2023. 35% of Americans have maxed out their cards.

85% of those with maxed out cards cite inflation and higher prices as the primary driver.

If you’re thinking about retiring or know someone who is, there are three quick questions causing many Americans to realize they can retire earlier than expected. take 5 minutes to learn more here

Getty Image

According to Debt.com, 1 in 3 Americans have maxed out their credit cards.

According to Business Insider, the average American is $104,215 in debt, inclusive of mortgage, credit cards, auto loans, and student loans. The yoke of debt around American taxpayers’ necks grows continually larger; the national debt is presently increasing by $1 trillion every fiscal quarter.

There is absolutely no question that the debt and credit business is huge. Visa Inc. (NYSE: V) stock, at the time of this writing, is currently 4 points shy of its 52-week high of $296.34, and Barclays has just announced its 12-month target for Visa is $347.00. Rival MasterCard (MYSE: MA) is trading at $506 and has an analyst consensus 12-month target price of $544.36.

Credit card balances exceeded the $1 trillion milestone in Q4 2023. A Debt.com report cited the following statistics among American respondents:

45% have had to use credit cards to pay for staples, due to inflation-fueled higher prices.

9% have had a financial emergency requiring use of a credit card.

35% have maxed out their credit cards.

85% of those with maxed out credit cards blamed inflation and higher prices as the overwhelming factor in prompting card use.

22% were carrying credit card debt between $10,000 and $20,000.

5% were carrying credit card debt in excess of $30,000.