Key insights on the natural gas market provided by NGI’s price and data analysts

Expand

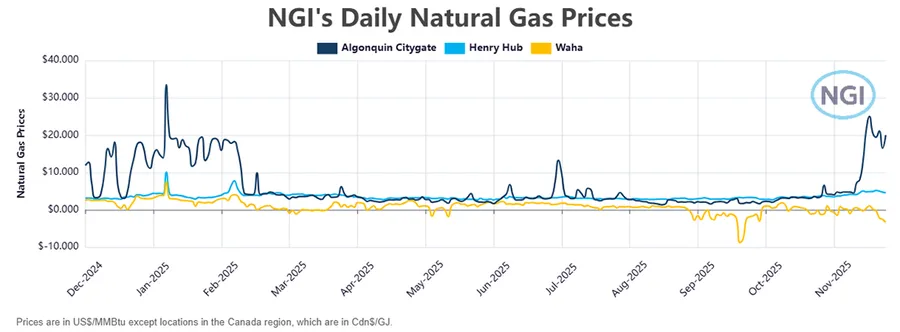

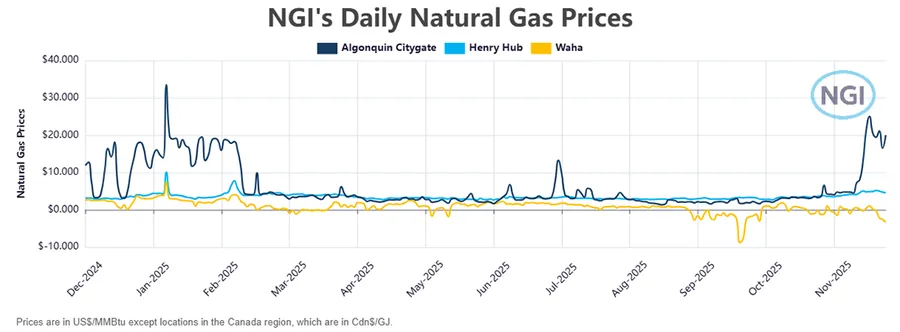

Most of the Lower 48 is seeing natural gas spot prices above $4.00/MMBtu and Northeast prices are upward of $20.00, so why are Permian Basin prices back in the negatives? Waha traded as low as negative $4.100 on Wednesday and averaged negative $3.350 after plummeting 76.0 cents day/day, according to NGI daily data. For comparison, NGI’s National Avg. was $4.970 after gaining 32.0 cents on the day.Notably, the bleeding in Permian cash is occurring during one of the coldest stretches of weather the gas market has seen since February. Lower 48 demand was seen at around 115 Bcf/d on Thursday, up more than 5 Bcf/d from Wednesday and in line with the previous week’s average, according to Wood Mackenzie.But a key pipeline traversing the Permian is limiting the amount of gas that can move downstream to demand centers. A force majeure on El Paso Natural Gas Pipeline Co. LLC’s Line 1103 is restricting westbound flows through the Lordsburg corridor in New Mexico. Wood Mackenzie noted that the event, in place since Dec. 6, originally caused an impact of up to 380,000 MMBtu/d. However, on Thursday, El Paso announced an additional tightening at Lordsburg that reduced net available capacity to 419,639 MMBtu/d from 450,997 MMBtu/d. This essentially increases the potential westbound impact to nearly 453,000 MMBtu/d based on the last 30-day maximum schedule capacity.“This marks the first meaningful step-down in capacity since the force majeure began,” said Wood Mackenzie’s Jade Monjaraz, natural gas analyst. She noted that another reported 50,000 MMBtu/d reduction at the Wilclat point remains in place as well, but that flows there remain unconstrained because of low utilization.The gas flow restrictions come as continued cold weather is in store for much of the country in the coming days. NatGasWeather said stronger demand is expected through the weekend as a frosty weather system sweeps deep into northern Texas and portions of the South.