Businesses have overcome fear of falling economy, but concerned over stagnant investment

Highlights:

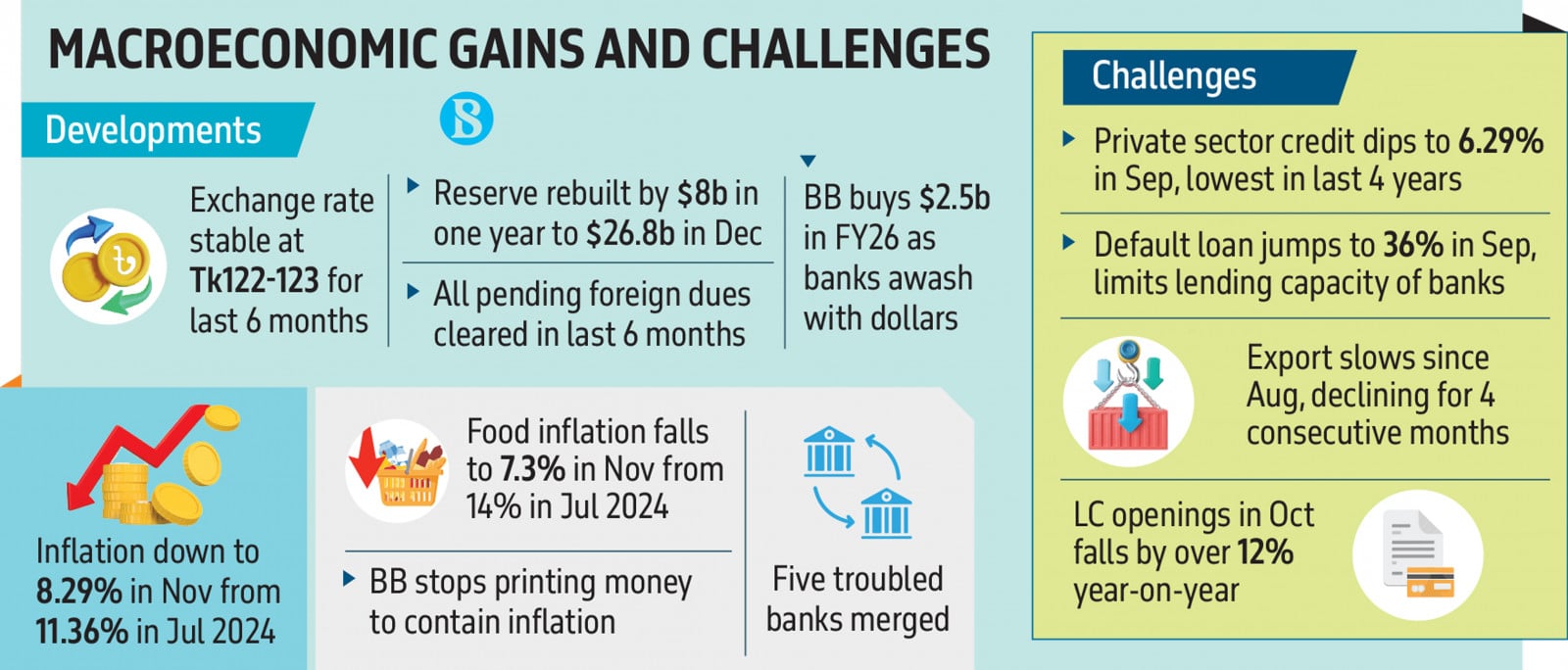

Bangladesh avoided Sri Lanka-style economic collapse after regime change

Forex reserves rose from $18.8B to $26.8B in 2025

Taka stabilized at Tk122–123; inflation fell to single digits

Banking reforms improved deposits but credit growth remains weak

Export earnings declined four months consecutively; global demand slows

Loan rescheduling package aids businesses, but investment remains subdued.

Just before the regime change in August 2024, Bangladesh faced an acute fear of economic collapse.

Foreign exchange reserves were draining rapidly, external dues were piling up, and inflation surged as the Bangladesh Bank injected at least Tk10,000 crore a week to keep several cash-strapped banks afloat. Businesses were absorbing heavy exchange losses amid extreme dollar volatility, further eroding confidence.

Following the political transition, however, the central bank’s macroeconomic reset helped stabilise key indicators and dispel fears of a Sri Lanka-style crisis. Dollar shortages eased, inflation cooled, and investor sentiment improved both domestically and internationally.

Infograph: TBS

“>

Infograph: TBS

Foreign exchange reserves rebounded strongly after the interim government cleared external arrears. The Bangladesh Bank added $8 billion to reserves within a year, raising the total from $18.8 billion in December 2024 to $26.8 billion as of 4 December 2025, enough to cover more than four months of imports.

A more flexible exchange rate regime, coupled with aggressive policy rate hikes, restored discipline to the currency market. The taka has held steady at Tk122–123 per dollar for six consecutive months. The central bank also stopped money printing and moved swiftly to merge and restructure troubled banks, calming depositors and bringing back liquidity. Deposits increased noticeably after governance reforms at problematic banks.

Many large conglomerates have struggled to service debts since the regime change due to exchange losses and political disruptions.

These measures helped inflation fall from a 12-year high of 11.36% in July 2024 to single digits for the past six months. Food inflation, once at 14%, dropped to 7.36% in November. Although still above the Bangladesh Bank’s FY26 target of 6.5%, the government’s Bangladesh State of the Economy 2025 attributes the improvement to monetary tightening, supply-side interventions, stable global commodity prices, and a steady exchange rate.

Challenges remain

Despite improved dollar availability and monetary stability, investment remains subdued as businesses delay expansion ahead of the February national election. The Planning Commission’s Economic Update and Outlook (October 2025) notes that tight monetary policy, while successful in curbing inflation, is also suppressing credit growth.

Private-sector credit growth fell to a four-year low of 6.29% in September. Years of banking sector mismanagement and capital flight under the previous regime have left lenders with limited capacity to support new investment. Non-performing loans hit 36% of total outstanding loans in September, further restricting credit supply. According to Bangladesh Bank data, total NPLs surged to a historic Tk6.44 lakh crore. Just a year earlier, defaults stood at Tk2.84 lakh crore.

A senior official at the Bangladesh Economic Zones Authority (Beza) said investors are watching a series of post-regime-change policy shifts on tax, VAT, advance income tax, and profit repatriation, typical in a transition period

“As a country, we have overcome the fear of a Sri Lanka-like collapse,” said Asif Ibrahim, vice-chairman of Newage Group. “But low investment is now the biggest concern, with direct implications for employment.”

He said his company, a major garment exporter, has postponed expansion plans despite the improved availability of dollars. “Businesses are waiting for political clarity,” he said, adding that potential declines in export orders, tariff risks, and global uncertainties are also weighing on confidence.

Bangladesh’s export earnings have now fallen for four consecutive months—the longest slide since the Covid-19 pandemic. Exporters cite lower US demand amid Trump-era tariffs, intensifying competition from China and India in the EU market, and buyer anxiety over Bangladesh’s political climate.

Export data from the Export Promotion Bureau shows November shipments fell 5.54% year-on-year to $3.89 billion.

The Asian Development Bank, in its Asian Development Outlook: December 2025, downgraded Bangladesh’s FY26 GDP growth forecast to 5%, citing weakening global demand, supply-chain stresses, and declining orders in key sectors.

Import demand is also slowing sharply. LC openings dropped more than 12% year-on-year in October, reflecting weak investment appetite. The Bangladesh Bank has had to purchase over $2.5 billion in FY26 to prevent the taka from appreciating as banks sit on excess dollars.

A senior official at the Bangladesh Economic Zones Authority (Beza) said investors are watching a series of post-regime-change policy shifts on tax, VAT, advance income tax, and profit repatriation, typical in a transition period. “Investors want to see whether these changes hold after the election,” the official said.

He noted that Bangladesh remains an attractive investment destination, especially as Trump-era tariffs raise operating costs in India and China. “Many Chinese investors, especially in garments, are eager to shift operations here but they will not commit before political stability returns,” he said.

Special rescheduling package

Many large conglomerates have struggled to service debts since the regime change due to exchange losses and political disruptions. To prevent widespread distress, the Bangladesh Bank introduced a long-term loan rescheduling package allowing businesses to reschedule loans for up to 10 years with a 2% down payment.

Since May, the central bank has received 1,200 applications from borrowers with loans exceeding Tk50 crore. A senior private bank manager said cash flow at many large business groups has deteriorated sharply, pushing them to lean on rescheduling schemes rather than consider new investment.