Europe Automotive Lubricants Market Size

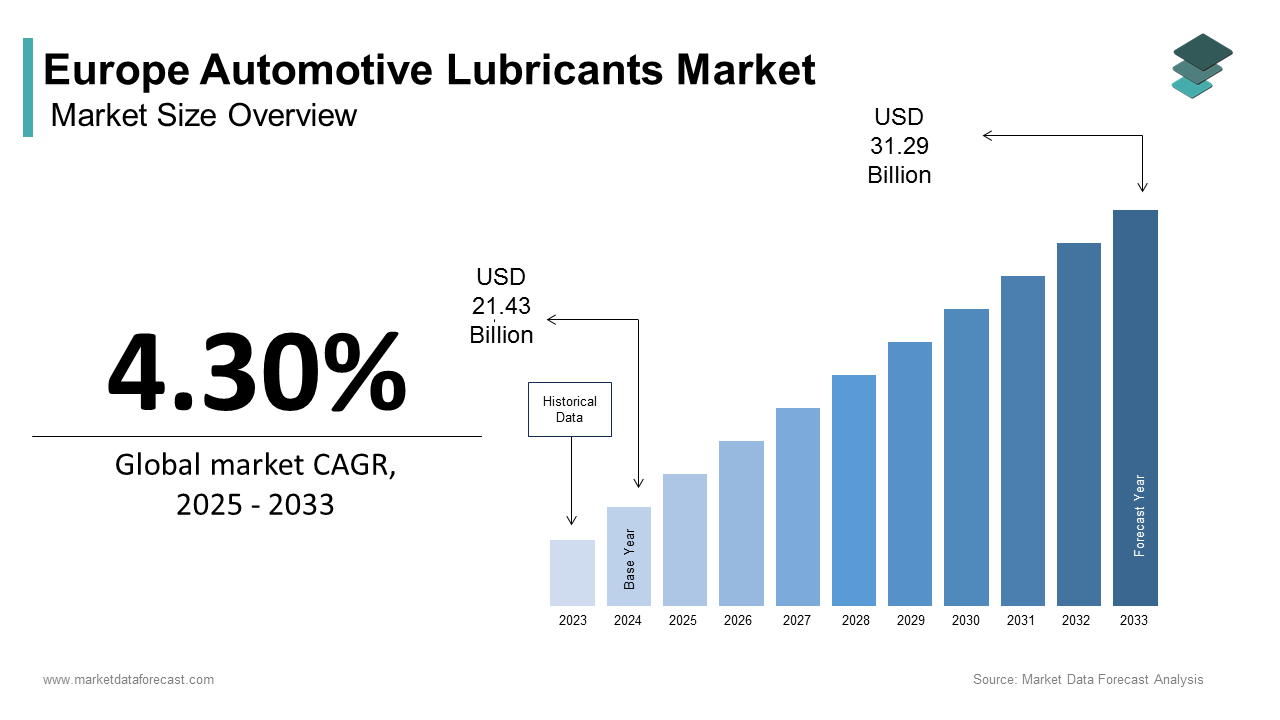

The Europe automotive lubricants market size was calculated to be USD 21.43 billion in 2024 and is anticipated to be worth USD 31.29 billion by 2033, growing from USD 22.35 billion in 2025 at a CAGR of 4.30% during the forecast period.

Automotive lubricants are fluids engineered to reduce friction, enhance engine efficiency, and prolong vehicle component life across passenger cars, commercial vehicles, and off-road machinery. According to sources, the overall number of motor vehicles in the European Union has been steadily increasing, confirming a consistent demand for maintenance-related consumables such as lubricants. Despite a gradual decline in internal combustion engine vehicle sales, Europe still accounts for a substantial legacy fleet that continues to require regular servicing. As per the data from the European Automobile Manufacturers Association, the average age of light-duty vehicles in major EU markets like Germany, France, and Italy is over a decade old, indicating a sustained need for aftermarket maintenance and related products like lubricants. Simultaneously, evolving regulatory frameworks such as the European Green Deal are reshaping product formulation standards, pushing manufacturers toward lower viscosity and environmentally compatible solutions. The transition toward electrification remains uneven across member states, with southern and eastern European countries exhibiting slower adoption rates, thereby preserving internal combustion engine dominance in those regions. These structural dynamics, combined with seasonal driving patterns and stringent OEM specifications, define the nuanced operational landscape of the Europe automotive lubricants market.

MARKET DRIVERS Increasing Vehicle Parc and Aging Fleet Drive Lubricant Demand

The region’s expansive and maturing vehicle population remains a pivotal accelerator of the Europe automotive lubricants market. Older vehicles typically undergo more frequent oil changes and require higher viscosity lubricants due to increased engine wear and tolerances. This demographic reality translates into consistent demand for conventional and semi-synthetic oils, particularly in the independent aftermarket segment. These vehicles often do not meet the latest emission or efficiency standards and thus depend heavily on periodic fluid maintenance to remain operational. The persistence of such legacy vehicles, especially in rural and economically transitional regions, ensures a baseline consumption of engine oils, gear lubricants, and transmission fluids that cannot be immediately displaced by electric mobility trends. Besides, extended service intervals recommended by modern OEMs do not apply universally to aging engines, which often follow time-based rather than mileage-based oil change schedules, which further amplifies volume requirements across the region.

Stringent Environmental Regulations Accelerate High-Performance Lubricant Adoption

Environmental mandates originating from the European Commission have profoundly influenced lubricant formulation and specification across the automotive sector to ultimately fuel the expansion of the Europe automotive lubricants market. The implementation of Euro 6d emission standards and the upcoming Euro 7 framework compel vehicle manufacturers to optimize engine efficiency and reduce particulate outputs, which in turn necessitates advanced lubricants with lower sulfated ash, phosphorus, and sulfur content. Furthermore, the EU’s Ecolabel certification program encourages the development of biodegradable and less toxic formulations, which has prompted major lubricant suppliers to reformulate products using high-quality Group III and Group IV base stocks. This regulatory shift not only raises technical barriers to entry but also increases per-unit value, as premium synthetic lubricants become standard for compliance. Countries have integrated lubricant sustainability criteria into public fleet procurement policies as per national transport ministries, which further accelerates market transformation. Consequently, the demand for tailored high-performance lubricants aligned with emissions control technology represents a structural and irreversible driver for product innovation and value growth in the European market.

MARKET RESTRAINTS Electrification of Transport Diminishes Long-Term Lubricant Consumption Potential

The accelerating adoption of battery electric vehicles across the region poses a challenge to the automotive lubricants market. This shift is fundamentally altering vehicle fluid requirements. Battery electric cars utilize no engine oil and require minimal transmission lubrication, typically only for a single-speed gearbox, resulting in less fluid consumption over the vehicle’s lifetime compared to internal combustion engine counterparts, according to the International Energy Agency. Countries such as Norway, Sweden, and Germany lead this transition, with notable electric vehicle penetration in several quarters. The overall volume trend for traditional automotive lubricants is expected to decline consistently, notwithstanding the ongoing demand within the commercial vehicle and heavy-duty sectors. This transition pressures lubricant manufacturers to diversify into electric vehicle-specific fluids such as thermal management dielectric coolants and e-axle lubricants, which currently represent a marginal fraction of total sales and face lower replacement frequency. The pace of this disruption varies regionally, but the underlying trend signals a profound recalibration of market fundamentals across Europe.

Volatility in Base Oil Supply and Raw Material Costs Constricts Profitability

Persistent pressure from fluctuating costs and the constrained availability of high-quality base oils has been a major impediment to the Europe automotive lubricants market. These oils form the foundational component of finished lubricants. Group II and Group III base stocks, essential for producing fuel-efficient, low-viscosity oils, are primarily derived from crude oil refining or gas-to-liquid processes whose supply chains remain vulnerable to geopolitical instability and energy policy shifts. Fluctuations in the price of crude oil have led to increased costs for base oils, which consequently affect the profit margins of product formulators. New environmental regulations on imported goods are adding compliance costs for base oils sourced from regions outside of Europe with differing carbon rules. These regulations are making sourcing options for European blenders more restricted. A lack of sufficient domestic refining capacity exacerbates these supply challenges, as Europe relies significantly on importing a specific category of base oils from other continents. Supply chain disruptions such as those caused by the Red Sea shipping crisis further strained logistics and inflated freight expenses. These combined pressures compel lubricant manufacturers to either absorb costs or pass them to consumers in a highly competitive market where price sensitivity remains elevated, especially in the independent aftermarket. Consequently, formulation flexibility is reduced, and innovation cycles are delayed as companies prioritize cost containment over product differentiation.

MARKET OPPORTUNITIES Growing Demand for EV-Specific Fluids Opens New Product Frontiers

The rise of electric mobility is causing demand for specialized lubricants and thermal fluids that cater to the unique operational requirements of battery electric powertrains, and thereby provides new opportunities for the growth of the Europe automotive lubricants market. Unlike conventional vehicles, electric cars require dielectric transmission fluids that provide both lubrication and electrical insulation for components such as e-axles and power electronics. The adoption of dedicated e-fluid formulations is an emerging trend in the electric vehicle industry, driven by the need for enhanced thermal management and optimal electrical properties to support the increasing performance and efficiency of new EV models. This emerging segment is projected to grow, driven by increasing vehicle complexity and performance expectations. Companies have already introduced e-fluid product lines validated by European OEMs, demonstrating commercial viability. Furthermore, the need for battery thermal management fluids that operate safely in direct contact with high-voltage cells is creating additional opportunities for chemically stable and non-flammable formulations. Countries with aggressive electrification targets like France and the Netherlands are accelerating R&D partnerships between lubricant producers and automotive suppliers to co-develop next-generation fluids. This shift not only diversifies revenue streams for lubricant manufacturers but also aligns their portfolios with Europe’s decarbonization agenda, thereby transforming a potential threat into a strategic growth vector.

Circular Economy Initiatives Promote Re-refined Lubricant Adoption

The region’s strong policy commitment to circular economy principles is creating fresh prospects for the expansion of the Europe automotive lubricants market. This provides a fertile environment for the adoption of re-refined base oils in automotive lubricants. Currently, re-refined base oils can achieve performance parity with virgin Group I and Group II oils as verified by independent testing conducted by the German Federal Environment Agency. Used oil collection demonstrates consistent performance across the European Union. Collection levels in some member countries are particularly high. Major lubricant producers are incorporating used feedstocks into their supply chains, with used oil being processed into high-quality base stocks. Consumer awareness is also rising, as sustainability labels increasingly influence purchasing decisions in both consumer and fleet segments. The economic case is further strengthened by lower carbon intensity. Re-refined base oils generate less CO2 equivalent emissions compared to virgin alternatives. As regulatory pressure mounts and collection systems mature, the re-refined lubricant segment is positioned to capture meaningful market share, particularly in commercial vehicle and industrial applications where performance standards are stringent yet cost sensitivity remains high.

MARKET CHALLENGES OEM Specification Proliferation Complicates Product Development and Inventory Management

An ever-expanding and fragmented landscape of original equipment manufacturer specifications, which complicates formulation standardization and supply chain efficiency. This challenges the growth of the Europe automotive lubricants market. Each major automaker, including Volkswagen, BMW, Mercedes-Benz, and Renault, maintains proprietary oil standards that dictate precise performance parameters for viscosity, thermal stability, and additive compatibility, often requiring unique approvals for warranty compliance. The number of distinct original equipment manufacturer oil specifications has grown to reflect the evolution of engine technology. This proliferation forces lubricant blenders to maintain extensive product portfolios and invest heavily in certification testing. Smaller formulators and independent brands struggle to keep pace, leading to market consolidation and reduced competition in the premium segment. Furthermore, the lack of harmonization across specifications impedes pan-European product rollouts, necessitating country- or brand-specific SKUs that inflate logistics costs and inventory complexity. Dealership service networks often mandate exact specification adherence, limiting cross-compatibility even among vehicles with similar engine architectures. This environment elevates barriers to entry, restricts innovation agility, and increases time to market for new formulations, thereby constraining the ability of suppliers to respond dynamically to shifting OEM and regulatory demands.

Aftermarket Fragmentation and Channel Disintermediation Erode Brand Control

Extreme fragmentation, with thousands of service providers, importers, and private label brands competing across diverse distribution channels, also impedes the expansion of the Europe automotive lubricants market. In the European automotive independent aftermarket, the majority of vehicle servicing and lubricant sales occur through workshops not affiliated with original equipment manufacturers. This dynamic weakens manufacturer influence over product placement and application accuracy, particularly in southern and eastern Europe, where regulatory enforcement of OEM standards is inconsistent. Simultaneously, the rise of digital marketplaces and direct-to-consumer platforms has accelerated channel disintermediation, enabling low-cost private label and uncertified products to gain traction among price-sensitive consumers. The absence of universal labeling standards allows ambiguous marketing claims to mislead buyers into selecting inappropriate products that may compromise engine performance or void warranties. Major manufacturers counter this by investing in digital verification tools and workshop accreditation programs, yet coverage remains incomplete. This structural fragmentation not only suppresses pricing power but also heightens reputational risk, as substandard products bearing superficial resemblance to established brands circulate widely, undermining trust in the lubricant category as a whole.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

4.30%

Segments Covered

By BaseOill, Application, Vehicle Type, and Region

Various Analyses Covered

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic

Market Leaders Profiled

Shell, BP, TotalEnergies, ExxonMobil, Chevron, FUCHS, Castrol, ENI, Petronas, Valvoline, Liqui Moly, Motul, Repsol, Q8 Oils, Wolf Oil Corporation

SEGMENTAL ANALYSIS By Base Oil Insights

The mineral oil lubricants segment dominated the Europe automotive lubricants market and accounted for a 46.2% share in 2024. The dominance of the mineral oil lubricants segment is primarily driven by the extensive legacy vehicle parc across Southern and Eastern Europe, where cost sensitivity and service infrastructure limitations favor conventional lubricants. In countries, a portion of vehicles on the road exceed ten years of age,e making mineral oils the default choice for routine maintenance due to their affordability and widespread availability. Furthermore, the relatively lower performance thresholds of older engine architectures do not necessitate advanced syntheticformulationso, ns reducing the urgency for upgrades. Even in Western Europe, mineral oils retain relevance in light commercial and agricultural applications where operational conditions are less demandin,g and service intervals are shorter. This entrenched ecosys, em supported by established supply chains and distribution networks,rks ensures mineral oil lubricants remain the volume leader despite regulatory and technological headwinds favoring newer chemistries.

The bio-based lubricants segment is anticipated to witness the fastest CAGR of 9.3% between 2025 and 2033. The rapid expansion of the bio-based lubricants segment is fuelled by the EU’s binding sustainability mandates under the Green Deal and Circular Economy Action Plan, which incentivize renewable content in industrial fluids. Advanced ester-based bio lubricants derived from rapeseed, sunflower,r and used cooking oil now meet stringent OEM performance benchmarks for oxidation stability and viscosity index. Moreover, the European standard EN 16807, which defines criteria for biodegradability and low aquatic toxicity, has enabled clearer market differentiation and consumer trust. Production capacity is scaling rapidly with Neste and Biesterfeld Specialty Chemicals commissioning dedicatebio-lubricantnt blending facilities in the Netherlands and Germany. Hence, the segment benefits from strong policy tailwinds, premium pricing,g and alignment with corporate net zero commitments, ts making it the highest growth vector in the base oil landscape.

By Application Insights

The engine oil segment led the Europe automotive lubricants market and captured a share of 62.1% share in 2024. The supremacy of the engine oil segment is credited to the universal requirement of internal combustion engines for regular oil replacement as a non-discretionary maintenance activity across all vehicle types. Furthermore, engine oils are subject to the most stringentOEM-specificationsi,ons including ACEA and manufacturer-specific approvals, which drive formulation complexity and value per liter. The proliferation of turbocharged direct injection engines has increased thermal stress on lubricants, necessitating higher-quality additives and more frequent changes in performance-oriented models. This combination of volume necessity, technical rigor, and regulatory oversight solidifies engine oil as the central pillar of the European lubricants value chain.

The transmission fluids segment is likely to experience the fastest CAGR of 7.8% over the forecast period, owing to the rising complexity of drivetrain architectures, including dual clutch transmissions, automated manuals, and hybrid-specific e-transmissions, which demand specialized fluids with precise frictional and thermal properties. Additionally, the integration of electric motors in hybrid powertrains has introduced new fluid challenges such as electrical insulation compatibility and copper corrosion inhibition, leading OEMs to mandate proprietary e transmission fluids. The growing average vehicle age also contributes,,s as aging automatic transmissions experience increased wear and fluid degradation, prompting more frequent servicing in the independent aftermarket. Unlike engine oils, which face long term obsolescence from electrification, transmission fluids retain relevance even in mild hybrids and plug-in hybrids, which still utilize mechanical gearsets. This dual relevance across both legacy and transitional powertrains positions transmission fluids as the highest growth application category in the evolving European automotive landscape.

By Vehicle Type Insights

The passenger cars segment held the leading share of 58.3% of the Europe automotive lubricants market in 2024. The leading position of the passenger cars segment is attributed to the sheer scale of the passenger vehicle parc,c which exceeded millions of units across the EU and EFTA countries in 2024. Annual servicing requirements across this vast base generate consistent demand for engine oil,l LS transmission fluids, and greases, particularly in mature markets like Germany, Italy, and France. The high density of franchised and independent workshops ensures regular fluid change cycles even for older models. Moreover, passenger cars represent the primary focus of OEM lubricant specifications. Even as new electric vehicle sales rise, the dominance of internal combustion engine passenger cars in the existing fleet ensures sustained lubricant consumption through the next decade. This combination of volume density, service infrastructure, and technical standardization cements passenger cars as the core demand engine of the European lubricants market.

The light commercial vehicles segment is on the rise and is expected to be the fastest growing segment in the market by witnessing a CAGR of 6.5% between 2025 and 2033 due to the explosive growth ofe-commercee and last-mile delivery networks, which have intensified urban logistics activity across European metropolitan areas. Registrations of new light commercial vehicles across the European Union have shown a notable increase in sales volume. Certain national markets in Europe have experienced significant growth in the number of newly registered light commercial vehicles. Light commercial vehicles generally accumulate higher annual mileage compared to typical private passenger cars. Due to extensive use, these commercial vehicles require more frequent maintenance, including regular fluid changes. The transition of the light commercial vehicle sector to full electrification is proceeding at a slower pace due to various operational and economic challenges. Battery electric variants currently represent a smaller portion of the overall new light commercial vehicle market. Most continue to rely on diesel engines, which demand robust lubricants with high soot handling and oxidation resistance capabilities. Fleet operators also prioritize total cost of ownership, leading to increased adoption of extended drain synthetic oils that reduce downtime. This operational intensity,ity combined with delayed electrification, ensures light commercial vehicles will drive disproportionate lubricant volume growth in the coming years.

REGIONAL ANALYSIS Germany Automotive Lubricants Market Analysis

Germany was the top performer in the Europe automotive lubricants market by holding a 18.5% share in 2024. The demand for automotive lubricants in Germany is driven by its dense vehicle parc of millions of units, a high concentration of premium OEMs, and a mature aftermarket ecosystem. A portion of vehicles on German roads is over ten years old, ensuring steady demand for maintenance fluids. The presence of Volkswagen,n BMW, and Mercedes-Benz not only drives stringent OEM specification development but also anchors a network of thousands of authorized workshops that enforce approved lubricant usage. Germany’s robust industrial base further supports light and heavy commercial vehicle operations, which collectively contribute a portion of national lubricant consumption. Environmental regulations are equally influential,l with the country enforcing some of the strictest low SAPS requirements in Europe, pe accelerating synthetic adoption. Despite a rising electric vehicle share, the sheer scale of the internal combustion engine fleet ensures Germany remains the undisputed volume leader in the European lubricants landscape.

France Automotive Lubricants Market Analysis

France followed closely in the Europe automotive lubricants market by accounting for a 13.2% share in 2024. It maintains a large total number of registered vehicles, though the overall fleet composition is gradually shifting as diesel passenger cars, which once comprised a majority of new purchases, are being steadily phased out in favor of alternative fuel sources. Diesel engines require higher quality lubricants with greater soot dispersancy and thermal stability,ity sustaining demand for mid-grade and synthetic formulations. France’s diverse geography continues to support a significant light commercial vehicle sector essential for logistics, a market that experienced a robust increase in new registrations throughout 2023. Public policy plays a dual role: the government’s ban on internal combustion engine sales by 2035 pressures long term outlook, yet its circular economy laws promote re refined oil use. This combination of fleet composition,n regulatory nuance, and service density solidifies France’s pivotal role in the European market.

Italy Automotive Lubricants Market Analysis

Italy grew steadily in the Europe automotive lubricants market due to an exceptionally aged vehicle fleet. This aging profile drives frequent oil changes and preference for cost-effective mineral and semi-synthetic products, particularly in southern regions where economic constraints limit discretionary spending. Italy also maintains a dense network of independent repair garages, which account for a notable share of service interventions, further amplifying aftermarket fluid demand. Urban congestion in cities like Rome and Milan increases engine idling time, which accelerates oil degradation and shortens drain intervals. New car electrification might be proceeding slowly, but the substantial legacy fleet maintains a reliable volume. Additionally, Italy’s strong motorcycle culture with millions of units registered sustains niche demand for specialized two-stroke and four-stroke oils, reinforcing its position as a key volume market.

United Kingdom Automotive Lubricants Market Analysis

The United Kingdom is another key country in the Europe automotive lubricants market. Despite exiting the European Union, the UK maintains alignment with many EU automotive standards while developing its own sustainability framework under the Net Zero Strategy. The country’s vehicle parc of millions of units includes a high proportion of premium brands whose service networks enforce strict lubricant specifications, driving synthetic adoption. Urban driving conditions in Greater London and Birmingham are characterized by frequent stop-start cycles, which increase engine stress and oil consumption rates. Additionally, the government’s 2030 ban on new petrol and diesel car sales has accelerated hybrid adoption, which still requires transmission and e-axle fluids, ensuring transitional demand. This blend of regulatory foresight, fleet modernization, and commercial logistics activity secures the UK’s strategic position in the regional market.

Spain Automotive Lubricants Market Analysis

Spain is predicted to grow in the Europe automotive lubricants market from202t, owing to rapid growth in light commercial vehicle registrations, which surged, driven by expansion in tourism, construction, and last-mile delivery services. Unlike northern European peers, Spain has a lower electric vehicle penetration, with battery electric models accounting for only a portion of new sales, preserving internal combustion engine dominance. The country also hosts several major lubricant blending facilities serving both domestic and North African markets, leveraging its geographic position. Combined with rising fleet utilization and delayed electrification, Spain’s lubricant market exhibits both volume scale and growth resilience within the European context.

COMPETITION OVERVIEW

Competition in the Europe automotive lubricants market is characterized by a blend of global integrated oil companies, regional specialty formulators, and private label suppliers. The market features intense rivalry driven by rapid technological change, stringent environmental regulations, and evolving vehicle architectures. Leading players differentiate through OEM approvals, advanced additive chemistry, and sustainability credentials rather than price alone. The independent aftermarket remains fragmented, with thousands of workshops influencing purchasing decisions based on performance, reliability, and technical support. Simultaneously, OEM channels enforce strict fluid specifications, creating high barriers for new entrants. Digitalization of service networks and growing demand for electric vehicle-specific fluids are reshaping competitive dynamics. Companies must balance legacy internal combustion engine support with innovation in e-mobility applications. This duality requires significant R and D investment, agile supply chains, and strong regulatory foresight. As a result, the competitive landscape rewards technical excellence, strategic partnerships, and environmental compliance while marginalizing undifferentiated generic offerings across the European region.

KEY MARKET PLAYERS

A few major players of the Europe automotive lubricants market include

Shell BP TotalEnergies ExxonMobil Chevron FUCHS Castrol ENI Petronas Valvoline Liqui Moly Motul Repsol Q8 Oils Wolf Oil Corporation Top Strategies Used by the Key Market Participants

Key players in the Europe automotive lubricants market prioritize product differentiation through advanced formulation aligned with evolving OEM specifications and emission regulations. They invest heavily in research and development to create synthetic and bio-based lubricants that support fuel efficiency and reduceenvironmental impact. Strategic collaborations with vehicle manufacturers enable co-engineered fluid solutions for both internal combustion and electric powertrains. Companies are also expanding digital service platforms to enhance technical support and product authenticity verification for workshops. Additionally, sustainability-driven initiatives, including re-refining programs and circular economy partnerships,arebeing redeployeddd to meet EU regulatory expectations and consumer demand for greener products. These integrated strategies strengthen competitive positioning while addressing the dual challenges of electrification and environmental compliance across the European landscape.

Leading Players in the Europe Automotive Lubricants Market Shell is a globally influential participant in the automotive lubricants sector with extensive operations across Europe. The company leverages its strong research and development capabilities to formulate advanced synthetic and low viscosity lubricants that meet stringent European OEM specifications. Shell has recently intensified its sustainability initiatives by expanding its portfolio of re-refined and bio-based lubricants in alignment with the EU Circular Economy Action Plan. It also deepened technical collaborations with major European automakers to co-develop electric vehicle-specific fluids, including dielectric transmission oils. These efforts reinforce Shell’s commitment to innovation and environmental stewardship while ensuring relevance across evolving powertrain technologies throughout the European market. TotalEnergies maintains a prominent position in the European automotive lubricants landscape through its high-performance product lines and integrated downstream strategy. The company actively supplies lubricants to both original equipment manufacturers and the independent aftermarket across multiple European countries. In recent developments, TotalEnergies accelerated its transition toward sustainable solutions by launching a new generation of low SAPS and fully synthetic lubricants compatible with Euro 7 emission standards. It also enhanced its digital service platform for workshops to improve product traceability and technical support. These actions strengthen its value proposition and customer engagement across diverse automotive segments in Europe. FUCHS Petrolub stands out as a leading specialty lubricant developer with deep roots in the European automotive industry. The company supplies tailored formulations to premium German and Italian vehicle manufacturers and maintains a robust independent aftermarket presence. FUCHS has recently expanded its e-mobility portfolio by introducing a range of electric axle and battery thermal management fluids validated by European OEMs. It also commissioned a new R and D center in Mannheim, Germany, focused exclusively on future mobility lubricants, including those for hybrid and fuel cell vehicles. These strategic investments underscore FUCHS’s agility in adapting to technological shifts while reinforcing its engineering-driven reputation in the region. MARKET SEGMENTATION

This research report on the Europe automotive lubricants market has been segmented and sub-segmented based on base oil, application, vehicle type, and region.

By Base Oil

Mineral Oil Lubricants Synthetic Lubricants Semi-Synthetic Lubricants Bio-Based Lubricants

By Application

Engine Oil Gear and Brake Oil Transmissions Fluids Greases Others

By Vehicle Type

Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Motorbikes

By Region

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe