Core Scientific Inc.’s stocks have been trading up by 7.6 percent following positive sentiment and market interest.

Blockfusion aims for the sky, planning to go public via a union with Blue Acquisition Corp. Their goal? Amp up their data center might, with a clean energy twist fueling the charge.

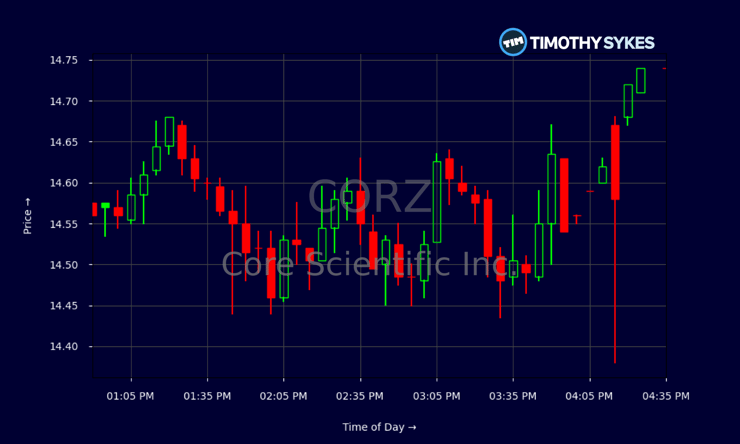

Live Update At 17:04:05 EST: On Thursday, December 18, 2025 Core Scientific Inc. stock [NASDAQ: CORZ] is trending up by 7.6%! Discover the key drivers behind this movement as well as our expert analysis in the detailed breakdown below.

Earnings Report Breakdown

When it comes to the unpredictable world of penny stock trading, traders must remain vigilant and adaptable. As millionaire penny stock trader and teacher Tim Sykes says, “Embrace the journey, the ups and downs; each mistake is a lesson to improve your strategy.” This mindset is crucial for traders who want to succeed in this volatile market. Recognizing that losses are part of the process can help traders refine their techniques and emerge stronger and more resilient. Trading in penny stocks is not just about the financial gains but also about the skills and insights gained along the way.

Core Scientific, the leading torchbearer in data and crypto solutions, recently unveiled a fascinating earnings report. The numbers are a mixed bag of highs and lows, with specific metrics catching our attention.

The company’s last revealed revenue stands at $510.67M, though it’s been witnessing a dip of 25.89% over the last three years. Despite challenges, their comprehensive EBIT margin of 106.8% reflects impressive operational discipline. However, the pretax profit margin remains in negative territory at -189.4%, highlighting underlying financial quandaries. The overall sentiment around financial health is one of cautious optimism.

Their balance sheet reflects muted strength, with a current ratio of 1.6 suggesting that liabilities are well covered by assets. The quick ratio stands at 0.7, raising concerns about immediate liquidity. With an interest coverage of 218.7, Core Scientific could comfortably pay its debt interest.

In the cost terrain, general and administrative expenses make up a hefty portion, totaling $69.35M. Their net income is currently facing the music at a daunting -$146.66M. Their shares stand firm at around 310.06M in count, revealing an EPS (earnings per share) slump of -0.46. Amid these revealing figures, the shine of their gross profit remains dim at $3.9M.

Market Ripples from Recent Developments

Japan’s regulatory stance is strategic. The financial watchdog’s decision to require cryptocurrency companies to reserve assets serves as a protective measure and an inevitable operational challenge. With investors’ safety prioritized, Core Scientific must navigate this evolving landscape carefully. Their position is both intriguing and precarious in a volatile industry where government involvement can significantly alter market dynamics.

Blockfusion, on another hand, piques investor curiosity. Their go-public scheme via Blue Acquisition Corp has the right flavor for impressive growth, spotlighting data centers and green energy. Though not directly linked to Core Scientific, this movement might shake up the broader market sentiments and shape investor perceptions, indirectly affecting affiliated entities like Core Scientific.

More Breaking News

The Road Ahead

Navigating this unpredictable journey, Core Scientific finds itself at a critical crossroads. The regulatory landscape offers both hurdles and protective cushions, hinting at potential challenges and opportunities. Traders, understandably, are on the lookout for strategic moves and further announcements that could sway market orientations.

The layers unraveled from these recent analyses reveal more than just numbers. They expose stories of growth ambitions, regulatory wrangles, and capital dilemmas. The intricacies of data shaping cryptocurrencies, the looming challenges in maintaining financial alacrity, and pivotal navigation through this ever-twisting maze present a rich landscape for analysis and intrigue. As millionaire penny stock trader and teacher Tim Sykes, says, “There is always another play around the corner; don’t chase just because you feel FOMO.” This mindset could be invaluable for traders navigating the volatile currents of cryptocurrency markets.

As the cryptocurrency odyssey unfolds, Core Scientific remains a focal point of intrigue for traders and analysts, offering a fascinating financial puzzle and compelling narrative to follow into the future.

This is stock news, not investment advice. Timothy Sykes News delivers real-time stock market news focused on key catalysts driving short-term price movements. Our content is tailored for active traders and investors seeking to capitalize on rapid price fluctuations, particularly in volatile sectors like penny stocks. Readers come to us for detailed coverage on earnings reports, mergers, FDA approvals, new contracts, and unusual trading volumes that can trigger significant short-term price action. Some users utilize our news to explain sudden stock movements, while others rely on it for diligent research into potential investment opportunities.

Dive deeper into the world of trading with Timothy Sykes, renowned for his expertise in penny stocks. Explore his top picks and discover the strategies that have propelled him to success with these articles:

Once you’ve got some stocks on watch, elevate your trading game with StocksToTrade the ultimate platform for traders. With specialized tools for swing and day trading, StocksToTrade will guide you through the market’s twists and turns.

Dig into StocksToTrade’s watchlists here: