West African crude oil exports reversed a negative multiyear trend this year. In its latest weekly report, shipbroker Banchero Costa said that “after a modest upturn in 2024, when global crude oil loadings increased by +0.8% y-o-y, trade started very slowly in 1H 2025 but seriously picked up pace in recent months. In Jan-Nov 2025, global crude oil loadings increased by +1.9% y-o-y to 2,038.6 mln tonnes, excluding all cabotage trade, according to vessels tracking data from LSEG. Exports from the Arabian Gulf were up by +2.0% y-o-y to 810.5 mln t in Jan-Nov 2025 and accounted for 39.8% of global seaborne crude trade. Exports from Russian ports (including oil of Kazakh origin) increased by +1.0% y-o-y to 212.9 mln t in JanNov 2025, or 10.4% of global trade. From South America, exports surged by +11.1% y-o-y to 202.0 mln t. From the USA, exports went down by -8.3% y-o-y at 167.1 mln tonnes in Jan-Nov 2025. From West Africa, exports increased by +3.3% y-o-y to 161.2 mln t. From ASEAN exports dropped by -12.6% y-o-y to 97.6 mln t in Jan-Nov 2025 (this inevitably includes transshipped Iranian & Russian cargoes)”.

Source: Banchero Costa

According to the shipbroker, “in terms of demand, the top seaborne importer of crude oil in Jan-Nov 2025 was Mainland China, accounting for 22.8% of global trade. Discharges in China declined by -1.4% y-o-y to 457.9 mln t in Jan-Nov 2025, from 464.6 mln t in Jan-Nov 2024. Imports into the EU27 declined by -2.8% y-o-y to 422.5 mln t, accounting for 21.0% of global trade. To ASEAN, imports increased by +6.5% y-o-y to 258.6 mln t. To India, they went up +2.8% y-o-y. To South Korea, imports declined by -1.0% y-o-y to 126.6 mln t. Imports into the USA declined -9.5% y-o-y to 112.4 mln t in Jan-Nov 2025. To Japan, imports increased by +0.5% y-o-y to 101.0 mln t”.

Banchero Costa said that “West Africa as a region is now the fifth largest exporter of crude oil in the world, after the Arabian Gulf, Russia, South America, and the United States. It accounted for 7.9% of global crude oil exports in 2024. Total crude oil loadings from West Africa in the 12 months of 2024 declined by -1.3% y-o-y to 171.3 million tonnes, according to revised vessels tracking data from LSEG. The trend had been negative for many years. However, this year has been surprisingly positive, with exports from W. Africa increasing by +3.3% y-o-y in Jan-Nov 2025 to 161.2 mln t, from 156.1 mln t in Jan-Nov 2024. This has been the highest since the 184.1 mln t in Jan-Nov 2020. In terms of individual countries, the biggest exporters in the region are Nigeria and Angola. Nigeria exported 62.1 mln t in JanNov 2025, up +7.6% y-o-y. Angola exported 46.3 mln t in Jan-Nov 2025, down -10.6% y-o-y. Other major crude oil exporters in the region are Congo-Brazzaville with 11.7 mln t in Jan-Nov 2025 (+10.3% y-o-y), Gabon 10.2 mln t (- 5.1% y-o-y), Cameroon with 8.2 mln t (-11.6% y-o-y), Ghana 7.3 mln t (+15.3% y-o-y), Senegal 4.9 mln t (+138.0% y-o-y), Cote D’Ivoire 4.3 mln t (+58.8% y-o-y), Benin 3.3 mln t (+295% y-o-y), Equatorial Guinea 2.2 mln t (-28.3% y-o-y)”.

Source: Banchero Costa

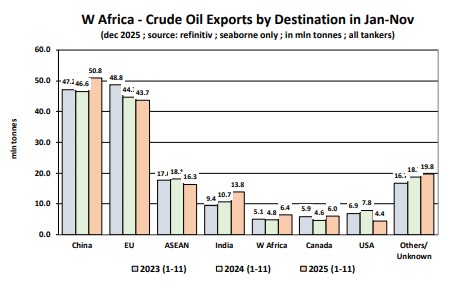

“The majority (53% in Jan-Nov 2025) of West African crude oil exports are loaded on VLCCs, with 45% on Suezmaxes and 2% on Aframaxes. Trade patterns for West African crude oil exports tend to be quite long haul, with the majority of volumes going to Asia. The number one destination is now Mainland China, accounting for 31.5% of volumes shipped from West Africa in Jan-Nov 2025. Exports from West Africa to China increased by +9.2% y-o-y in Jan-Nov 2025 to 50.8 mln tonnes, just shy of the 51.1 mln t of Jan-Nov 2020. The second major destination is the EU, which accounted for 27.1% of W African exports in Jan-Nov 2025. Shipments from West Africa to the EU declined by -2.4% y-o-y in JanNov 2025 to 43.7 mln t. Another 10.1% of shipments in 2025 were sent to the ASEAN region, 8.6% to India, 2.7% to the USA”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide