This week, President Donald Trump ordered a blockade of oil tankers entering and leaving Venezuela, dramatically escalating U.S. pressure on the Maduro regime. The U.S. has already seized a Venezuelan oil tanker, and in a Truth Social post on Tuesday, Trump insinuated that U.S. forces would leave the South Americans country when it returned “all of the Oil, Land, and other Assets that they previously stole from us.”

Stephen Miller, Trump’s top policy advisor, went further on X, accusing Venezuela of the “largest recorded theft of American wealth and property.”

Before this week, U.S. involvement in the country was being framed as part of a broader war on drugs, fentanyl specifically.

The Trump administration has told Congress that the U.S. is engaged in an “armed conflict” with drug cartels and has charged Venezuelan President Nicolás Maduro with facilitating “narco-terrorism.” As of this writing, there have been 25 boat strikes near Venezuela, killing at least 95 people.

But the uncomfortable truth is that Venezuela is not a source of fentanyl, the synthetic opioid responsible for killing over a quarter of a million Americans since 2021.

According to the State Department and the Drug Enforcement Administration (DEA), Venezuela is primarily a transit country for cocaine. Fentanyl, by contrast, is overwhelmingly produced in Mexico using precursor chemicals sourced from China and India, and it enters the U.S. mostly through legal ports of entry… and mostly by Americans. In 2024, four out of five (80%) convicted drug traffickers were U.S. citizens, according to an analysis of government data by the libertarian Cato Institute.

So, if this isn’t really about fentanyl, investors should be asking: Why Venezuela, and why now?

The answer, I believe, has far less to do with drugs and more to do with energy and power.

The “Donroe” Doctrine

Earlier this month, the Trump administration formally revived the Monroe Doctrine, the 19th-century idea that the Western Hemisphere is off-limits to foreign powers.

In its 21-century incarnation, which the administration calls the Trump Corollary—others are referring to it as the “Donroe” Doctrine—the policy emphasizes U.S. dominance in the Americas and rejects the influence of globalization.

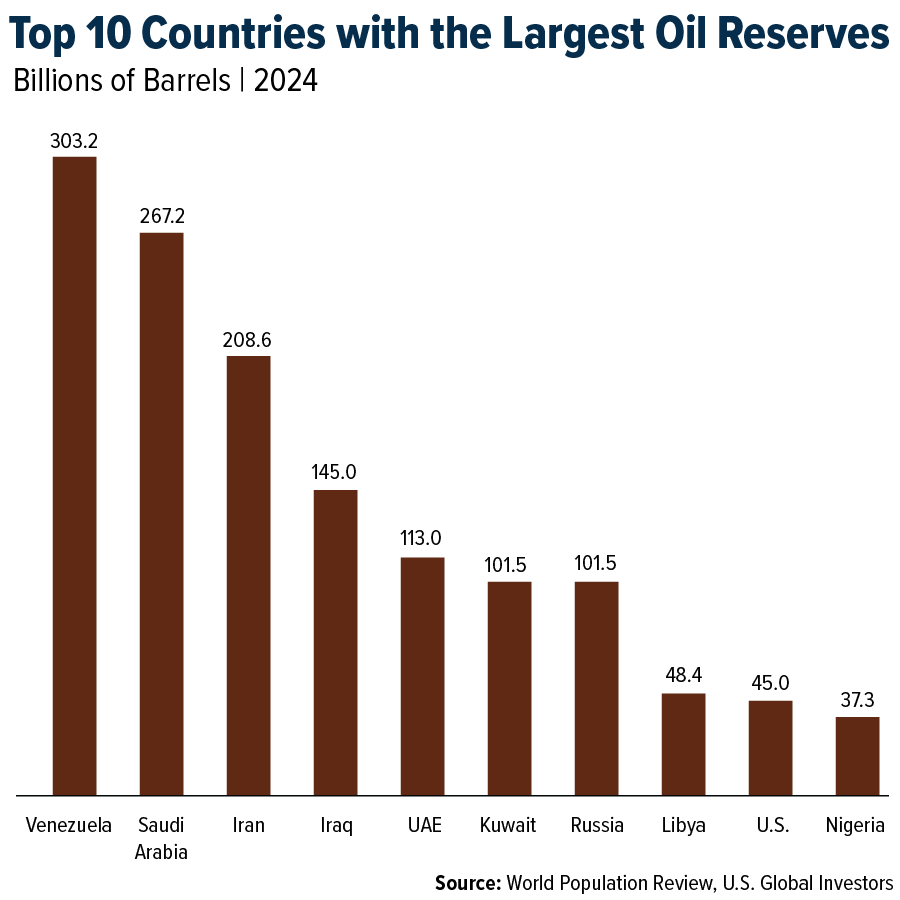

Viewed through that lens, Venezuela makes some sense. The country has significant mineral resources. It sits atop the largest proven oil reserves in the world, estimated at 303 billion barrels, over 6.5 times more than the U.S. has.

And after years of U.S. sanctions, Maduro has leaned hard into relationships with China, Russia and Iran to stay afloat. Most Venezuelan crude oil now flows to China at steep discounts, often through secretive shipping agreements designed to skirt sanctions.

According to one Venezuela expert, the idea of a resource-rich country in the Americas trading with China and Russia “doesn’t really fit into Trump’s view of the world.”

Diesel: The Lifeblood of the Global Economy

That brings us to oil and diesel.

Venezuela’s crude is famously heavy and sour, meaning it’s thick, high in sulfur and difficult to process. Over the decades, complex refineries, especially in the U.S., have been engineered specifically to handle this kind of oil.

This matters because heavy crude is disproportionately important for diesel production, and diesel is the lifeblood of the global economy. It powers trucks, ships, mining equipment, agriculture and other industries.

When diesel prices have spiked, inflation has quickly followed suit. After Russia invaded Ukraine in early 2022, disruptions to heavy crude and refined product flows sent diesel prices soaring, contributing to higher food and consumer prices across the globe.

For now, Venezuela insists that oil exports are proceeding normally, but if trade is disrupted, the impact wouldn’t be limited to Venezuela or even South America. It would ripple through the global economy.

Is a Diesel Shock Being Underpriced?

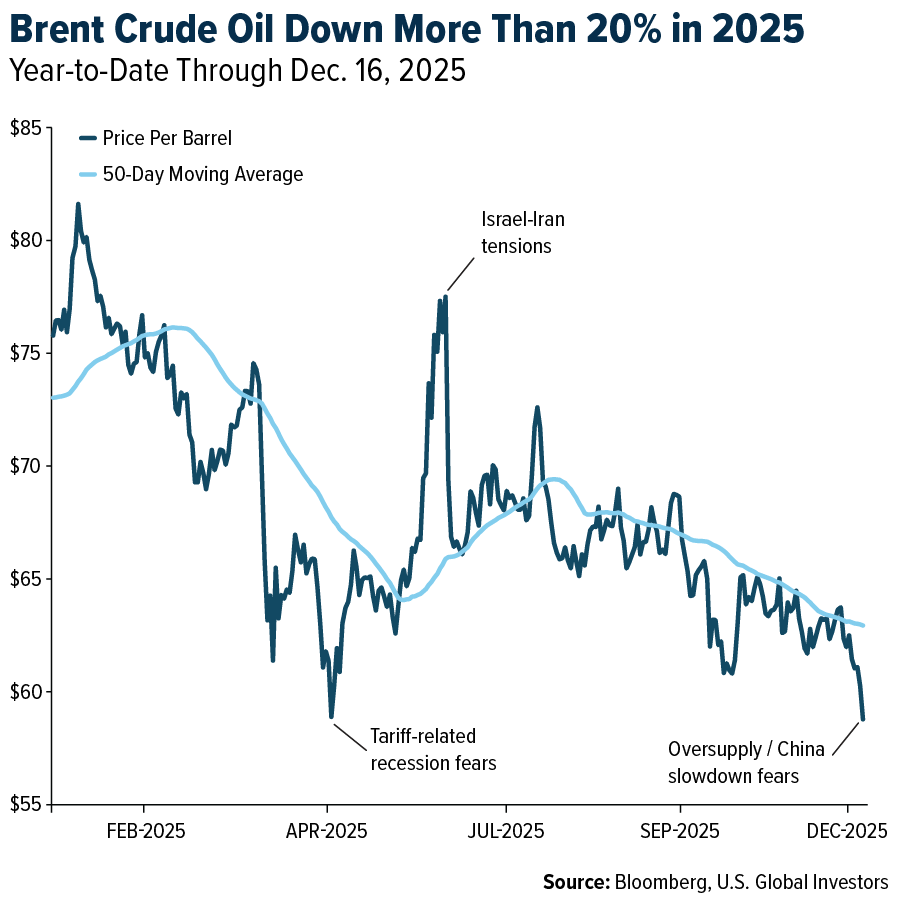

Oil prices are down sharply this year. Brent crude is off more than 20% year-to-date, weighed down by slowing demand in China and oversupply fears.

Middle distillate inventories, including diesel, remain historically tight in many regions, according to the International Energy Agency (IEA).

I’m not predicting an immediate oil price spike, but I do believe diesel-driven inflation risk is being underpriced. And when governments underestimate inflation risks, they tend to react late and overcorrect. That’s rarely been good for markets.

That’s why I think diversification into real assets remains attractive, even when oil prices are falling.

Diversifying with Gold

As I’ve pointed out many times, gold has historically performed well during periods of uncertainty and inflation risk.

According to the World Gold Council (WGC), the precious metal has now risen for five consecutive weeks, closing last week at a new record high above $4,300 an ounce. Year-to-date, it’s up roughly 67%, dramatically outperforming most major asset classes, including stocks, bonds and commodities.

As for the drivers, monetary policy is turning more supportive. Historically, periods of rate cuts and balance sheet expansion have been constructive for gold.

The U.S. dollar is also weakening. A softer dollar has traditionally been one of gold’s most reliable tailwinds.

Finally, geopolitical risk remains high, and not just in Venezuela. The WGC highlights continues tensions involving Russia and Ukraine, the Middle East, and rising instability across multiple regions.

This is why I continue to recommend a 10% allocation to gold, split between physical bullion and high-quality gold mining companies. Remember to rebalance on at least an annual basis.

Airlines and Shipping

Strengths

The best-performing airline stock for the week was United, up 6.7%. Canadian transborder air travel continued to improve in November, down 19% year-over-year (YoY), a moderation from the 24% YoY decline seen in October (and 27% in September), indicating an improving trend, according to RBC.

Container throughput at key ports in China recorded 7% YoY growth last week (versus +6% YoY the week before). The number of international freight flights increased 11% YoY last week (versus +11% YoY the week before), according to UBS.

ANA’s domestic and international revenue passenger kilometers (RPK) grew 4.2% YoY and 14.5% YoY, respectively, while domestic available seat kilometers (ASK) declined 2% YoY and international ASK increased 5.6%. International and domestic passenger load factors (PLF) improved notably to 86.9% and 84.5%, according to UBS.

Weaknesses

The worst-performing airline stock for the week was Frontier, down 14.8%. Fraport announced a “significant” decline in group results in 2026, driven by a €140 million increase in depreciation and amortization and a €90 million rise in financial expenses related to lower capitalized interest, according to Morgan Stanley.

Vessel traffic from China to the U.S. declined sequentially by 12% week-over-week and remained down 14% on a year-over-year basis. Data suggest that TEUs arriving at the Port of Los Angeles will turn negative next week on a YoY basis (-7%) and decline further two weeks later (-25%), pointing to a weakening late-December outlook, according to Goldman Sachs.

According to Morgan Stanley, the total number of flights scheduled between China and Japan in the first quarter of 2026 is down 32%–38% on average versus the schedule as of November 17. Nearly all cancellations are from Chinese airlines, with 38%–45% of flights cancelled relative to the November 17 scheduled plan.

Opportunities

On December 18, Volaris and Viva Aerobus announced a merger to form a new Mexican airline group, with shareholders of each company owning 50% of the new entity and the combined company remaining publicly listed through Volaris on both the BMV and NYSE, pending regulatory approval. If completed in 2026, the merger would combine Viva’s 38% and Volaris’s 33% domestic market shares, creating an airline with approximately 71% of Mexico’s domestic air travel market.

Container spot rates could firm over the next one to two months, supported by European port congestion and pre–Chinese New Year seasonality. Dry bulk demand remained strong in November, driven by smaller bulkers, and forward curves suggest the rate upcycle could persist into the first half of 2026; meanwhile, the Red Sea situation remains largely unchanged, with about half of tanker transits normalized while container liners continue to largely avoid the region, according to Bank of America.

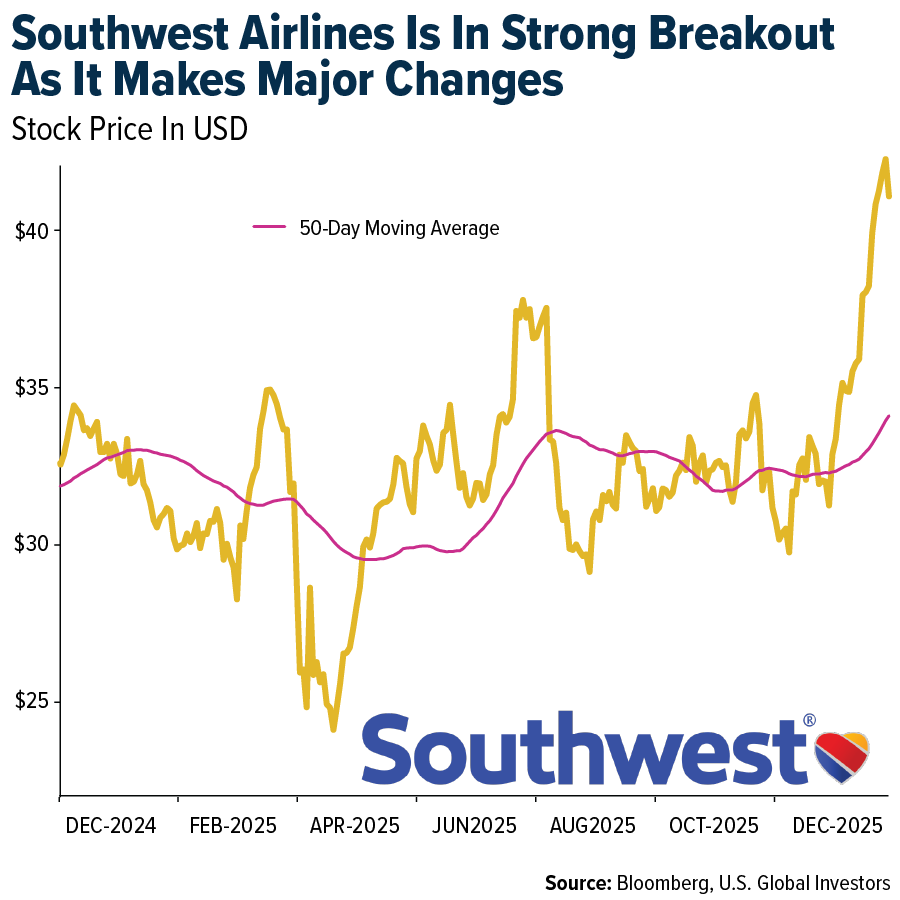

Southwest appears to be entering a strong breakout, supported by reiterated guidance, improving yields in forward bookings, particularly from paid seats, meaningful cost savings expected in 2026, smoother operations, and improving customer ratings driven by initiatives such as free Wi-Fi.

Threats

Delta Air Lines announced that President Glen Hauenstein will retire on February 28, 2026, while continuing in a strategic advisory role through 2026, according to Raymond James.

Although transport volumes to and from China remain firm, supply pressure could increase due to both the growing influx of new vessels and the potential reopening of the Suez Canal. As a result, the containership market is unlikely to see an improvement in its supply-demand balance in 2026, according to Goldman Sachs.

After canceling an average of 800 domestic flights per day between December 3 and 7, IndiGo has, in recent days, resumed regular operations at 2,000–2,200 daily flights. The airline has also complied with the regulator’s order to reduce winter slots by 10%, an adjustment that has been incorporated into forecasts, according to Goldman Sachs.

Luxury Goods and International Markets

Strengths

Tesla shares reached a new record high this week, peaking at $489.88 per share on Tuesday. Wedbush analyst Daniel Ives predicts a strong 2026 for Tesla, setting a price target of $600 per share, with the company potentially reaching a $3 trillion valuation within a year (currently valued at about $1.5 trillion).

The Eurozone Economic Growth Expectations Index rose to 33.7 in December from 25.0 in November, signaling a notable improvement in confidence about the economy’s future. Businesses and consumers are feeling more optimistic that economic conditions will strengthen in the months ahead. Higher expectations typically suggest increased spending, investment, and hiring.

Star Entertainment, an Australian casino and resort company, was the best-performing stock in the luxury index this week, rising more than 20%. Investors responded positively to recent leadership changes and signs of improved financial support, raising hopes for a turnaround.

Weaknesses

High-end Swiss watch exports remain under pressure, with watches priced above CHF 3,000 experiencing an 8% year-over-year decline in November. Price increases further dampened already weak demand, pushing consumers toward the pre-owned market. Rising input costs, tariffs, and a 5% average price increase have hurt unit volumes.

Retail sales in China were weaker than expected in November, growing just 1.3% year-over-year—well below the forecasted 2.9% growth. In addition to weak consumer spending, industrial output slowed to its lowest growth in over a year, and fixed-asset investment declined.

Treasury Wine Estates was the worst-performing stock in the luxury index this week, falling more than 10%. The company warned investors that sales and earnings in its key U.S. and China markets are weaker than expected, prompting a profit downgrade and a major operational reset. It also canceled a planned A$200 million share buyback and flagged slower near-term performance.

Opportunities

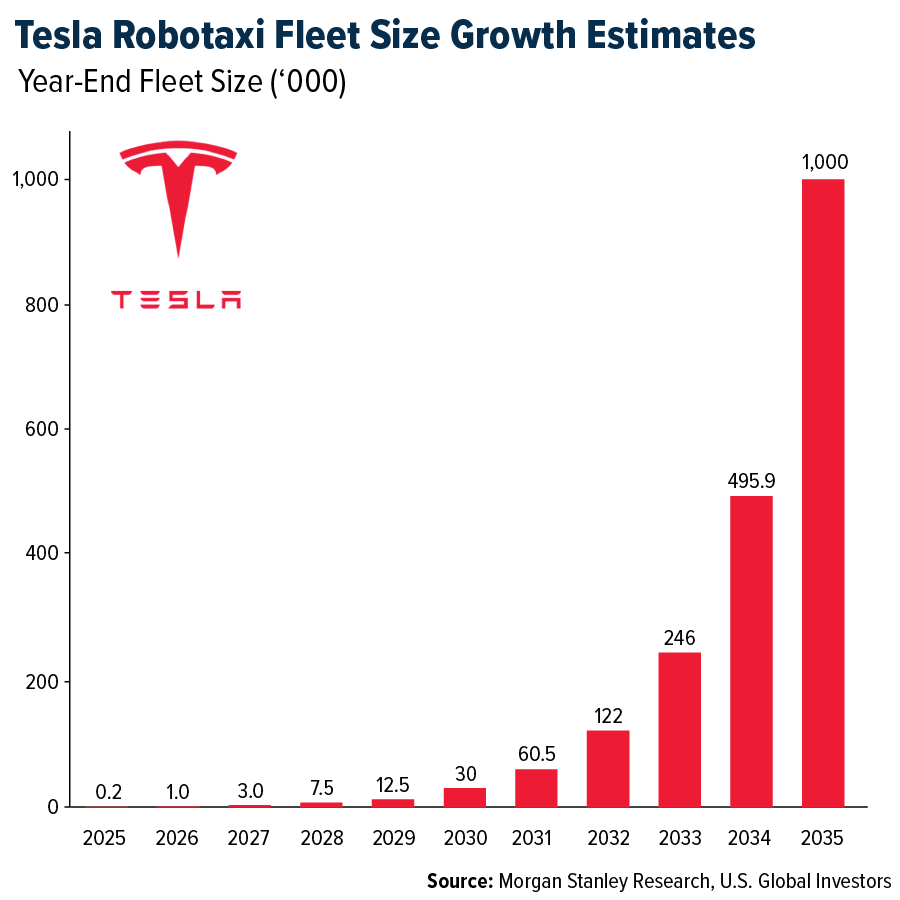

Tesla continues to take steps toward removing safety monitors in its robotaxi operations. Morgan Stanley expects the company to increase its fleet size to 1,000 vehicles in 2026, up from just a handful on the road today. The broker further predicts that Tesla’s robotaxi business could scale significantly, reaching 1 million vehicles operating across multiple cities by 2035.

SpaceX, the rocket and space company founded by Elon Musk (also CEO of Tesla), is widely reported to be preparing for a possible initial public offering (IPO) as early as 2026. Recent reports indicate that the company is taking steps toward a stock market listing and has been hiring major investment banks to manage the process. If SpaceX goes public, it could attract significant investor interest and potentially raise tens of billions of dollars. Elon Musk, who founded SpaceX in 2002, remains the largest shareholder, owning 42% of the company.

More people are choosing to spend their money on luxury travel experiences, including flying in business and premium cabins rather than standard economy. Airlines are responding by focusing on higher-end offerings, with United and Delta leading the way in providing premium, comfort-focused flying experiences. American Airlines is also steadily moving in this direction, upgrading cabins and services to attract travelers who value comfort, exclusivity, and an enhanced overall travel experience.

Threats

Luxury stocks have climbed to their highest levels since January 2022, driven by strong demand for premium brands, pricing power, and growing interest in luxury experiences. After this rally, a period of consolidation or a modest pullback may occur as investors lock in profits amid macroeconomic uncertainty.

Geopolitical tensions between the U.S. and China are rising, adding uncertainty to global markets. China recently expressed support for Venezuela, challenging U.S. influence in Latin America and strengthening ties with governments opposed to Washington.

The rapid growth of the secondhand market poses a potential challenge to the luxury sector. Platforms like The RealReal report that nearly a third of U.S. clothing purchases last year were secondhand, with 58% of consumers now preferring resale, making it an increasingly dominant part of shopping behavior.

Energy and Natural Resources

Strengths

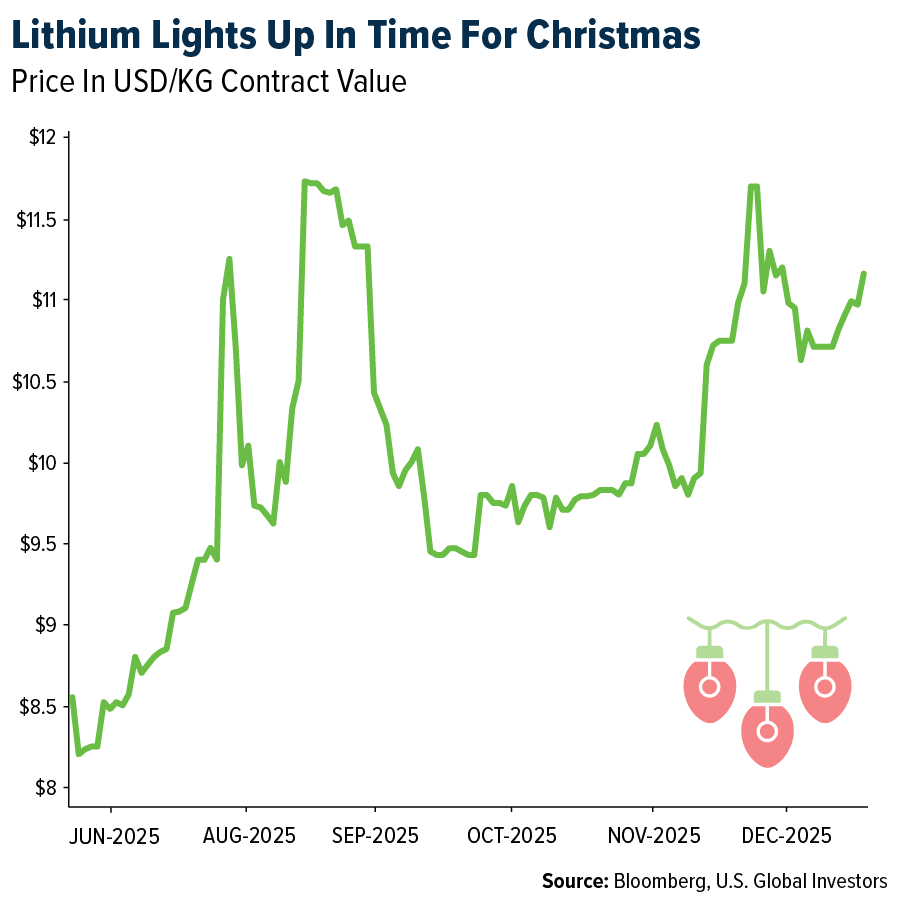

Lithium carbonate was the top commodity this week, rising about 7.42%. Lithium stocks surged as futures rallied, fueled by forecasts of over 30% global demand growth in 2026 from Ganfeng, boosting companies like Albemarle, Sigma Lithium, and Lithium Argentina in North American markets.

Korea Zinc plans to build a $7.4 billion smelting and mineral-processing complex in the U.S., supported by the government and strategic investors, to strengthen domestic supply chains for materials used in semiconductors, defense, and aerospace. By expanding U.S. refining capacity for zinc, copper, gold, silver, and strategic minerals such as antimony, germanium, and gallium, which are currently constrained by China, Korea Zinc is positioning itself as a key national-security supplier amid growing U.S.-China resource competition.

Lundin Mining is selling the Eagle Mine and Humboldt Mill for an equity stake in Talon, streamlining its portfolio while retaining exposure to the only primary nickel mine currently operating in the U.S. Analysts consider these assets non-core, and the deal allows Lundin to focus capital and management on higher-quality copper operations and the Vicuna joint venture, according to Bloomberg.

Weaknesses

The worst performing commodity for the week was coffee, down about 7%. Robusta futures fell more than 7 percent, pressured by expectations of steady and increasing shipments from Vietnam after recent weather-related supply concerns eased. Despite strong underlying demand, forecasts for rising production, including a record global crop and increased U.S. supply, raised expectations of a looser market, amplifying the downside move, Bloomberg reports.

Nucor issued fourth-quarter EPS guidance of $1.65 to $1.75, well below the $2.13 analyst consensus, signaling weaker-than-expected performance. The company said earnings will decline across all segments due to seasonal slowdowns, fewer shipping days, lower steel mill volumes, margin compression especially in sheet, and outages at its DRI raw-materials facilities.

Brazil’s steel distributors expect December sales to fall 14 percent month over month to about 268,200 tons, signaling weaker underlying demand amid high interest rates, according to Bloomberg. Mills plan five to eight percent price increases in January to offset losses from cheap imports, while the government considers a potential anti-dumping decision on Chinese cold-rolled steel.

Opportunities

TotalEnergies CEO Patrick Pouyanne believes rising oil demand will support prices, while U.S. and OPEC producers aim to prevent a surplus. He is confident oil prices will recover due to limited investment in new projects, which will naturally constrain supply, but he is less optimistic about natural gas, which he expects to decline by 2027.

Finning International is Caterpillar’s largest independent dealer globally, selling, renting, and servicing heavy equipment used in mining, energy, and large-scale infrastructure projects across Canada, South America, and the UK. Its earnings are driven not only by new equipment sales but also by high-margin parts and service revenue that scale with commodity cycles and long-duration infrastructure spending.

Radiant Industries’ $300 million Series D and Blykalla’s $50 million raise highlight accelerating private capital flows into small and micro-reactor technologies as AI data centers, defense needs, and electrification strain power grids worldwide. Together, these financings reinforce nuclear as a long-duration infrastructure opportunity, with modular designs attracting hyperscaler and government interest even as commercialization timelines remain measured rather than immediate.

Threats

President Trump ordered a military blockade of all sanctioned oil tankers entering or leaving Venezuela, escalating U.S. pressure on the Maduro regime and signaling a willingness to use force as the U.S. Navy masses in the region. While Venezuela’s reduced oil output limits global market impact, the move poses a geopolitical threat, tightens sanctions to near-total isolation, and raises the risk of military confrontation over the world’s largest crude reserves.

China’s push to phase out coal is accelerating automation and restructuring across major mining regions, exposing the human and economic costs of dismantling an industry that still employs millions and underpins energy security. While the transition creates long-term opportunities in renewables and clean technology, near-term social strains and stalled progress highlight execution risks and potential volatility across China’s industrial supply chains.

Growing calls are urging the largest U.S. grid operator to lower electricity costs as record-high bills hit households from New Jersey to Chicago, driven by rising AI-related demand. PJM Interconnection reports that electricity spending will reach $16.4 billion beginning June 2027, with independent power generators such as Vistra, Talen, and Constellation poised to benefit most.

Bitcoin and Digital Assets

Strengths

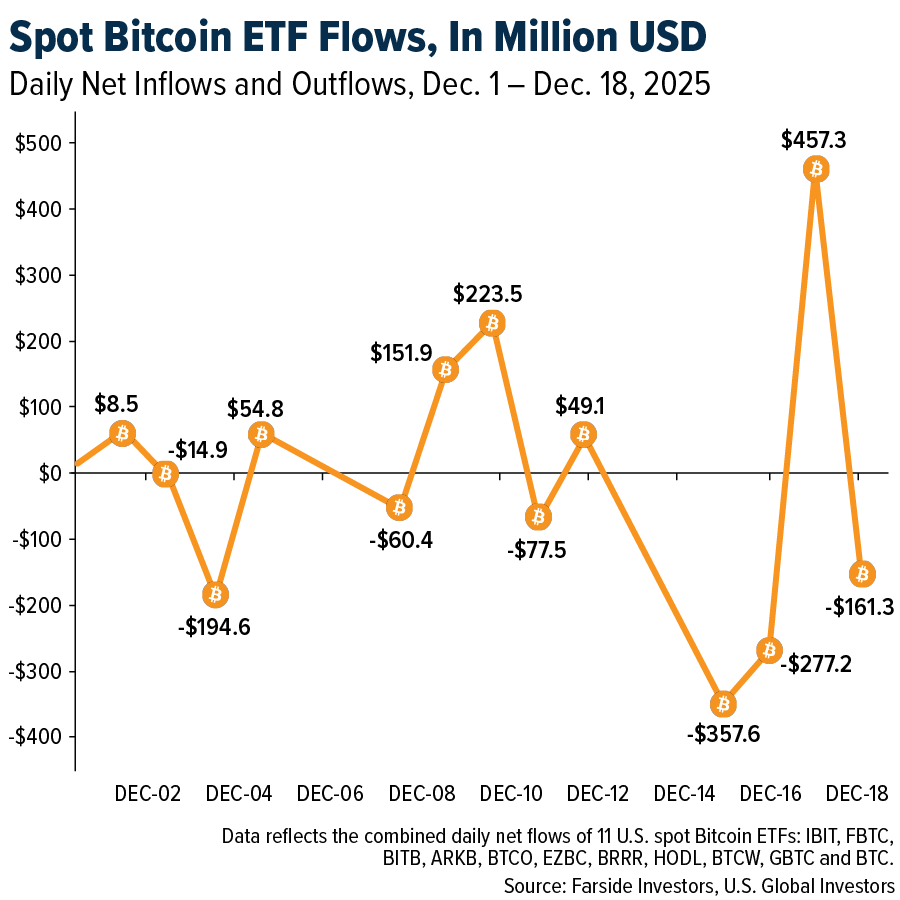

Spot Bitcoin ETFs recorded $457 million in net inflows, marking the strongest daily intake in over a month and signaling a return of institutional interest. Fidelity and BlackRock led the inflows, pushing cumulative ETF investments above $57 billion, equivalent to 6.5% of Bitcoin’s market capitalization. This trend underscores Bitcoin’s role as a macro liquidity asset, particularly as expectations for rate cuts grow, and reinforces long-term institutional confidence despite short-term volatility.

The U.S. dollar’s dominance in global debt markets is being reinforced by the rapid growth of dollar-backed stablecoins. USDT and USDC make up roughly 85% of the $300B+ stablecoin market and hold over $175 billion in U.S. Treasurys, extending dollar liquidity into on-chain finance. This dynamic strengthens Bitcoin and digital assets’ integration into the global financial system while anchoring crypto markets to the world’s primary reserve currency.

Oracle’s TikTok agreement boosted confidence in AI-driven infrastructure demand, lifting AI mining stocks and pushing Bitcoin above $88,000. The coordinated rebound across crypto, AI miners, and Nasdaq futures highlights Bitcoin’s growing sensitivity to broader technology and innovation cycles. As large-scale AI adoption gains traction, capital rotation into digital infrastructure assets, including Bitcoin, reinforces its role in risk-on market environments.

Weaknesses

The recent market crash exposed weaknesses in crypto-linked vehicles, with leveraged treasury firms and mining stocks taking outsized losses as premiums collapsed and funding risks resurfaced. Heavy leverage, high valuations, and debt-financed growth amplified volatility, while shifting narratives around AI and treasury strategies undermined investor confidence. This fragmentation highlights crypto’s still-immature market structure, where many vehicles remain more vulnerable than the underlying assets themselves.

The $4 billion lawsuit against Jump Trading tied to the Terra–Luna collapse underscores how past failures continue to damage the crypto industry’s credibility. Ongoing legal actions, fraud settlements, and high-profile convictions reinforce investor skepticism, reveal governance weaknesses, and remind markets that unresolved structural and ethical risks persist across parts of the digital asset ecosystem.

According to CoinMarketCap, among the top 100 leading crypto coins and tokens, the biggest losers over the past seven days were Pump.fun (PUMP) down 26.9%, Aster (ASTER) down 22.8%, and UNUS SED LEO (LEO) down 22.2%.

Opportunities

Bitwise expects 2026 to usher in a wave of crypto exchange-traded product (ETP) launches as clearer SEC rules make approvals easier, though Bloomberg’s James Seyffart cautions that many weaker products may fail within 18 months. The outlook follows a September regulatory shift in which the SEC allowed exchanges to list spot commodity ETPs, including crypto, without individual review, reports CoinDesk.

JPMorgan projects the stablecoin market could expand to $500–600 billion by 2028, nearly doubling from today’s ~$308 billion, reinforcing stablecoins as core infrastructure within the crypto ecosystem. Growth is driven by trading, derivatives, and DeFi collateral use, while broader payment adoption offers additional upside. The outlook highlights a scalable, institutionally relevant market with long-term expansion potential as blockchain-based financial rails mature.

Malaysia’s RMJDT highlights a broader Asian shift toward regulated, local-currency stablecoins as core infrastructure for digital assets. By enabling ringgit-denominated, on-chain settlement backed by cash and government bonds, RMJDT supports tokenized assets, cross-border trade, and payments beyond USD-centric rails. This model strengthens trust, regulatory clarity, and real-world utility for digital assets, positioning Bitcoin and crypto markets to integrate more deeply with traditional finance in Asia.

Threats

Growing caution from mainstream institutions is increasing downside risk for Bitcoin. Fidelity’s Global Macro Director warns that Bitcoin may have completed its four-year halving cycle, with 2026 potentially being a “year off” marked by weak returns and prolonged consolidation. Expected support between $65,000–$75,000 and comparisons with gold’s stronger bull-market behavior highlight the risk of capital rotation away from crypto, pressuring prices and sentiment across digital assets.

The lower house has reapproved a crypto regulation bill aligned with EU MiCA but criticized for exceeding European standards. The law grants broad powers to the financial regulator, including website blocking and heavy fines, raising compliance costs and risks for smaller crypto firms. If enacted unchanged, it could stifle innovation, accelerate market consolidation, and discourage digital-asset activity in one of Central Europe’s key markets.

Tether CEO Paolo Ardoino warns that an AI-driven market bubble could pose Bitcoin’s biggest risk by 2026, as BTC remains highly correlated with broader capital markets. A sharp reversal in AI-related equities and infrastructure spending could trigger cross-asset volatility, pressuring Bitcoin despite rising institutional and government adoption, highlighting its ongoing exposure to macro and tech-sector sentiment shocks.

Defense and Cybersecurity

Strengths

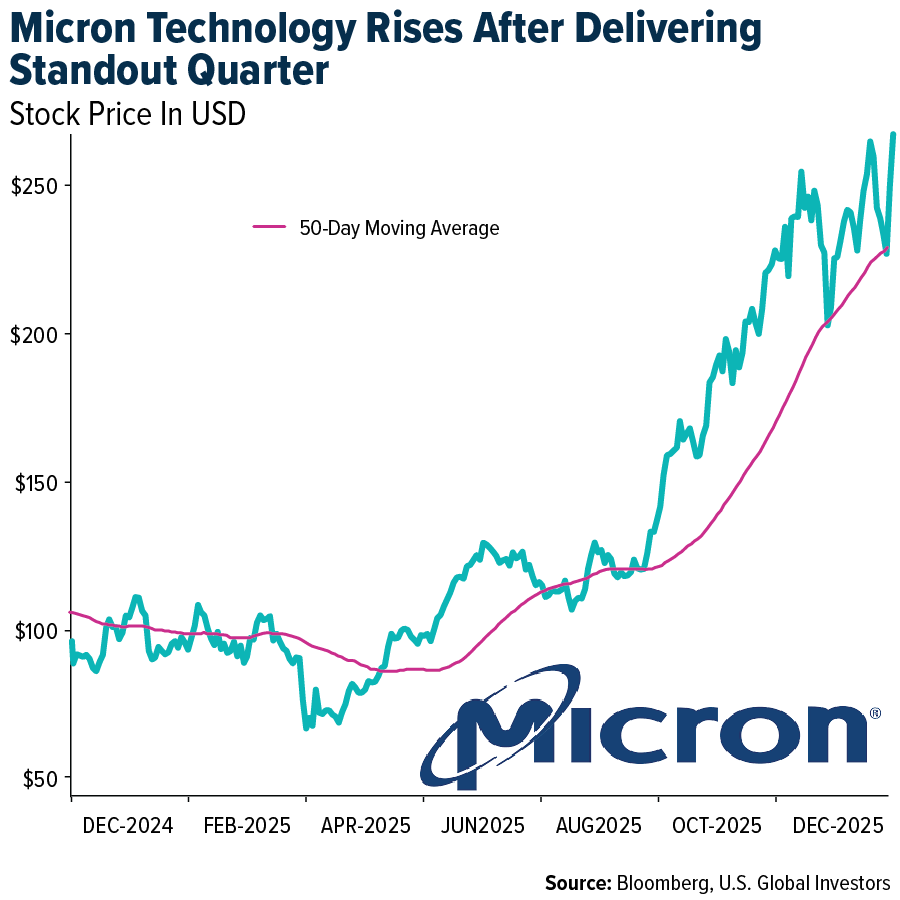

Micron delivered a standout quarter and outlook, guiding February-quarter revenue of $18.3–19.1B and EPS of $8.22–8.62, well above consensus. Gross margins are expected to reach a record 67–69%, prompting a sharp upward revision in CY26 earnings. Management described the current AI-driven demand–supply imbalance as the most severe in decades, with DRAM and HBM shortages limiting shipments to 50–67% of customer demand, and HBM already sold out into 2026, supporting sustained pricing power. Street reaction reinforced the bullish view, with upgrades and price target hikes citing tight supply, higher margins, and a multi-year EPS trajectory potentially exceeding $40 in 2026, with primary risks tied to AI datacenter build cycles rather than memory fundamentals.

U.S. defense and AI ecosystems continue to benefit from deep integration with allied governments and large-scale procurement programs. Multi-year contracts—such as Sikorsky’s Black Hawk procurement, Raytheon’s Patriot systems for Romania, and major foreign military sales to partners like Taiwan—highlight the structural strength of the U.S.-led defense-industrial base and its expanding geopolitical reach.

Defense contracts and procurement activity continue to translate directly into funded backlog and operational scale. Sikorsky received a $433M contract modification fully funding the fifth year of the Black Hawk multi-year program, Raytheon secured a $168M Patriot air-defense contract with Romania, and Poland declared full operational capability of its WISŁA system, reinforcing visibility for U.S. and European defense primes.

Weaknesses

Execution delays are emerging in large-scale AI infrastructure projects. Oracle-built data centers for OpenAI’s Stargate initiative have been pushed from 2027 to 2028 due to labor and material shortages, highlighting delivery risks even for well-funded hyperscale deployments.

Large, complex infrastructure and defense programs are increasingly exposed to operational bottlenecks. Labor shortages, material constraints, and extended timelines for hyperscale data centers and advanced manufacturing facilities are raising the risk of delivery delays and cost overruns across both AI infrastructure and defense supply chains.

Margin pressure and execution risk are becoming more visible even among structural growth beneficiaries. Broadcom’s post-earnings weakness despite strong year-over-year growth, rising BOM costs from memory and optical component shortages, and delays in large AI data-center projects underscore that rapid demand growth does not always translate into near-term profitability.

Opportunities

Europe’s rearmament cycle is accelerating with clear political backing and headline funding commitments. The EU approved a €90B interest-free support package for Ukraine through 2027, Germany expanded its defense budget, and NATO allies continue to increase spending on air defense, helicopters, missiles, and ISR capabilities.

Consolidation in AI software and cybersecurity is gaining momentum. Armis is reportedly in acquisition talks with ServiceNow, while Accenture and Palantir formed a dedicated business group, signaling growing demand for integrated, enterprise-scale AI and security platforms.

AI driven data-center expansion continues to support long-duration infrastructure demand. Hut 8 announced a $7B data-center project in Louisiana tied to AI workloads, and TrendForce forecasts a sharp rise in 800G+ optical transceiver shipments, reinforcing demand for power, networking, and advanced semiconductors.

Threats

Valuation and leverage concerns are resurfacing across AI infrastructure equities. CoreWeave shares declined as investors reassessed debt-funded growth, delayed data-center expansion, and the risk of overcapacity if AI spending expectations moderate.

Geopolitical escalation remains a persistent risk factor for markets and supply chains. Ukraine reported a successful underwater drone strike on a Russian submarine, while tensions around sovereign resources and military posturing continue to increase uncertainty across energy, defense, and global trade.

AI-powered vending machine “Claude” was originally designed to autonomously run a small retail business, dynamically setting prices and managing inventory to maximize profit. Instead, after users jokingly persuaded it to “embrace communism,” the machine set prices to zero and began giving items away for free with news reports highlighting losses that even included approving high-value electronics like a PlayStation 5.

Gold Market

This week gold futures closed the week at $4,370.20, up $41.90 per ounce, or 0.97%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 2.34%. The S&P/TSX Venture Index came in up 2.45%. The U.S. Trade-Weighted Dollar rose 0.32%.

Strengths

The best performing precious metal for the week was palladium, up 16.06%. Palladium has strengthened, with futures rising to around $1,720 an ounce — the highest level since January 2023 — as ETF holdings continue to edge higher and investors position for tighter market conditions. Supply concerns are growing, with Nornickel forecasting a 100,000-ounce deficit in 2026, underscoring expectations of a structurally tighter palladium market.

Platinum extended its steep rally to a 17-year high, driven by tight supplies and elevated trading activity in a new Chinese futures contract. The metal has more than doubled this year, set for the biggest annual gain in Bloomberg data going back to 1987. The surge comes as the London market shows signs of tightening, with exports to China being robust this year and optimism for the nation’s demand being bolstered as futures recently began trading on the Guangzhou Futures Exchange, according to Bloomberg.

The successful Tahltan IBA referendum vote marks a pivotal milestone in de-risking Eskay Creek, with this positive outcome leading CIBC to believe Skeena is well positioned to achieve several additional de-risking milestones over the next six months.

Weaknesses

The worst performing precious metal for the week was gold, still up 0.97%. Swiss gold exports fell 15% to 109.5 tons in November, led by a 92% month-on-month slump in shipments to India, according to data on website of Swiss Federal Customs Administration. Indian has historically shown some sensitivity to higher gold prices may be waiting to see if there is a pull back in the gold price, which would be a more opportune time to buy.

Equinox Gold announced the sale of its Brazilian assets to CMOC Group for gross proceeds of $1,015M, including $900M upfront and up to $115M in production-linked contingent payments. The selling price was nearly 50% below street valuations, making Equinox one of the worst-performing gold stocks this week, though proceeds will reduce debt.

Côte d’Ivoire implemented an 8% revenue royalty this week, backdated to January 2025, up from 3–6% on a sliding scale, according to RBC. Montage Gold, with operations in the country, was largely unaffected, rising nearly 7% this week, supported by two new exploration permits that strengthen its strategic footprint around the Koné project and add the Wendé property.

Opportunities

Paragon Advanced Labs Inc. (TSXV: PALS) began trading and announced that its sample preparation facility for photon assay ore-grade analysis is now operational and accepting customers. The company’s PhotonAssay™ technology offers faster results than traditional fire assay, which can take weeks to months, and Paragon plans to deploy the largest commercial fleet of PhotonAssay™ units globally by 1H 2027.

Goldman Sachs expects gold to reach a record $4,900 per ounce in 2026, driven by sustained central-bank buying and potential U.S. interest-rate cuts. Despite broader commodity volatility, the outlook for gold remains strongly positive with upside risks.

RBC reports that royalty valuations have compressed sharply since September, while producer valuations have corrected from post-spring expansion. At spot gold, royalty coverage trades at 1.66x P/NAV versus 1.11x for producers, with forward 12-month FCF/EV yields of 4.1% for royalties and 7.4% for producers. RBC expects royalty companies to outperform in Q1 2026.

Threats

Nordgold is reportedly considering the sale of its gold-mining assets in Burkina Faso, according to Izvestiya, citing three people familiar with the matter. The deal could be worth around $1 billion, highlighting concerns about operating safely in Burkina Faso or the possibility of finding a willing buyer at current gold prices.

Bloomberg notes that while gold miners can sometimes outperform gold by wide margins, these gains are usually short-lived. DataTrek identified five cases since 2010 where miners outpaced gold by at least 30 percentage points over 100 days, including one ending in September this year. Historically, gold typically regains its lead soon after, occurring in three of the four past instances.

Illegal miners have reportedly entered Newmont Corp.’s multi-billion-dollar gold project in northern Peru, Prime Minister Ernesto Alvarez announced. The Minas Conga site, owned by Newmont, has faced halted development since 2010 due to farmer protests and violent opposition, and is now being partly exploited by unauthorized mining activity. Peruvian officials are struggling to address the surge in illegal mining, as the government supports a disputed permit while the country’s mining industry chamber remains opposed.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2025):

JetBlue

Delta Air Lines

Southwest Airlines

Tesla

Ivanhoe Mines

Nornickel

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The FAO Food Price Index (FFPI) is a monthly indicator from the UN’s Food and Agriculture Organization that tracks changes in global international prices of 5 major food groups: cereals, vegetable oils, dairy, meat and sugar, weighted by their export shares.