Despite booming battery market, battery metals are in chronic oversupply

https://www.reuters.com/business/autos-transportation/ev-revolution-rolls-battery-metals-lose-their-charge-2025-12-19/

by Economy-Fee5830

Despite booming battery market, battery metals are in chronic oversupply

https://www.reuters.com/business/autos-transportation/ev-revolution-rolls-battery-metals-lose-their-charge-2025-12-19/

by Economy-Fee5830

5 comments

# Summary: Despite booming battery market, battery metals are in chronic oversupply

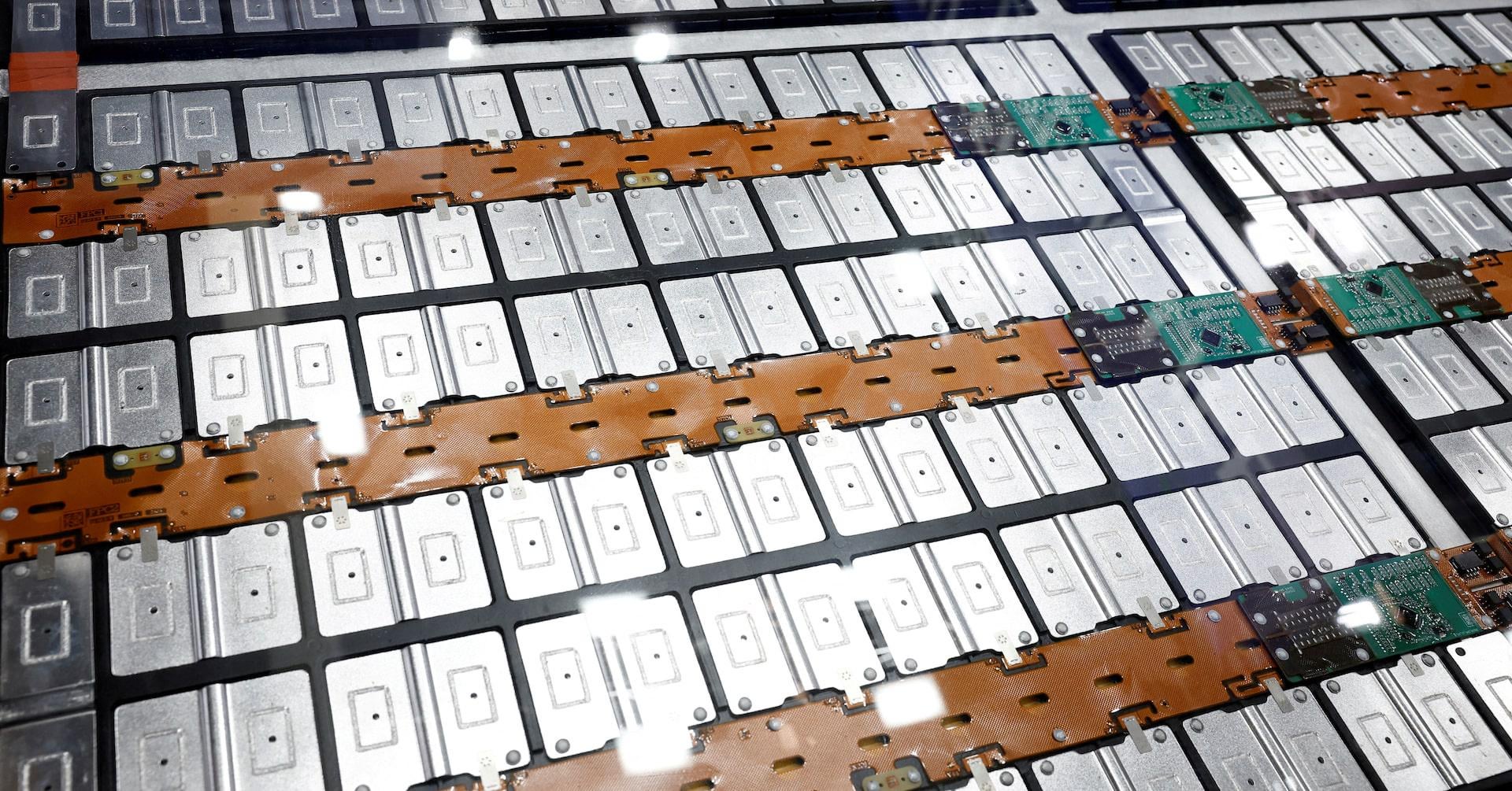

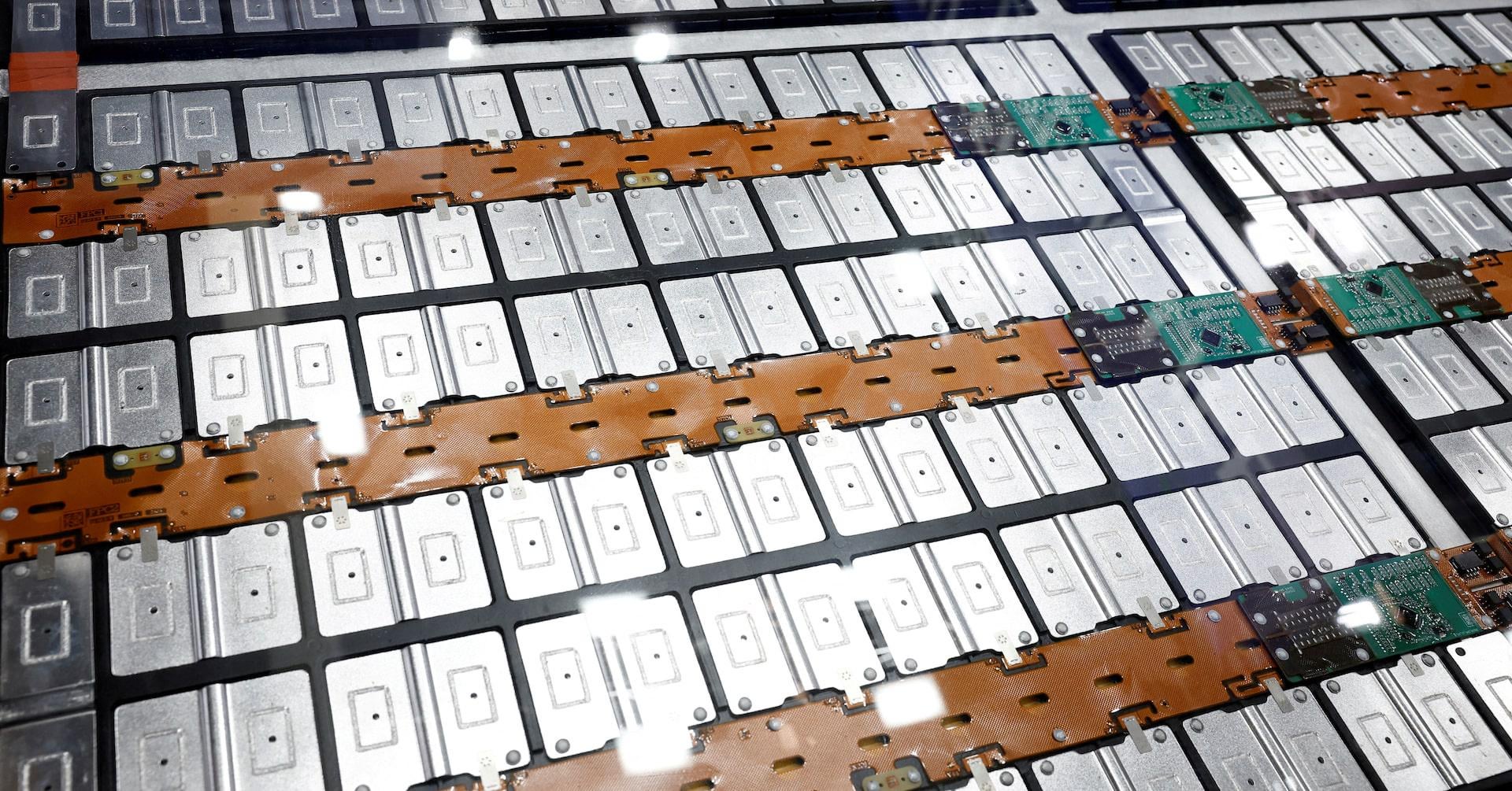

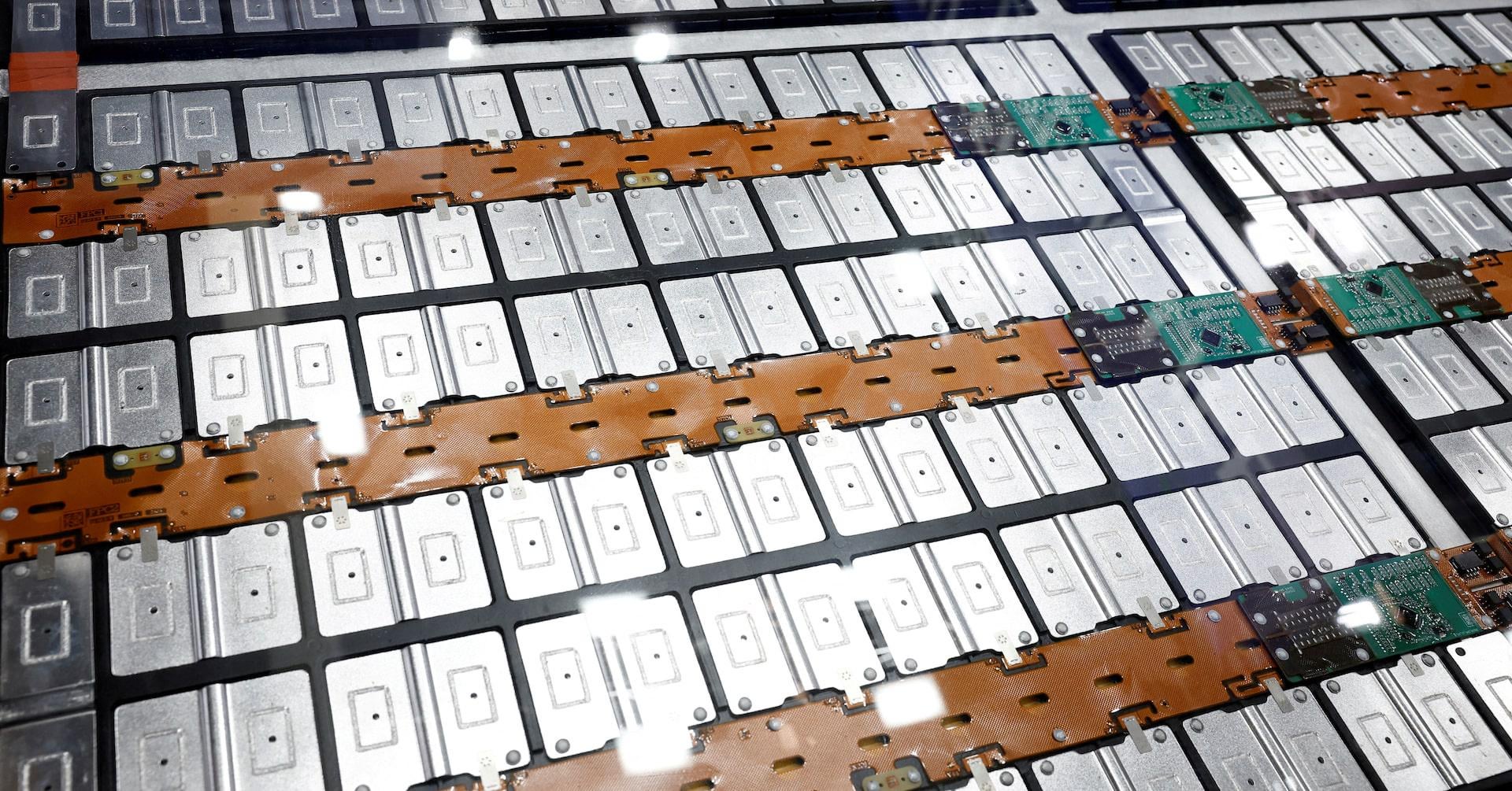

Global electric vehicle sales continue their rapid expansion, growing 21% year-on-year to reach 18.5 million vehicles in early 2025, with China accounting for 62% of the market. Yet battery metals like lithium, nickel, and cobalt face their third consecutive year of depressed prices due to massive oversupply.

The disconnect stems from rapid changes in battery chemistry driven by Chinese manufacturers. Lithium-iron-phosphate (LFP) batteries now dominate the Chinese market and are projected to capture 65% of global EV batteries by 2029, up from 48% currently. These safer, cheaper batteries use no nickel or cobalt, leaving producers of those metals facing structural demand challenges.

Indonesia’s unchecked nickel production has created a glut, with London Metal Exchange warehouse stocks ballooning to 338,900 tons and prices breaking below $15,000 per ton. Congo’s cobalt market faces similar oversupply, prompting the government to suspend exports and introduce quotas in October.

Lithium deployment grew 25% year-on-year, matching overall battery growth, though it faces emerging competition from CATL’s sodium-ion technology, which could eventually replace up to half the LFP market. Grid-scale energy storage offers lithium producers a growing alternative demand source, with installations up 38% in 2025.

The metals most likely to benefit long-term may be copper and aluminium, essential for wiring and vehicle frames respectively, rather than those dependent on rapidly evolving battery chemistry.

Lithium Ion batteries in today’s EV production are headed into extinction. Solid state batteries will be in production within the next two years. No fire hazards, ten minute charging and 500+ mile range. Silver supply will become the gating issue for mass production.

Why do we use words like ‘chronic’ to describe abundance. If we have a bunch of materials to make things that we need…that’s a good thing. The economic model based on scarcity and max profit is destroying us.

High end will be the introduction market as these batteries are carrying extremely high development and production costs.

I remember when the FUD of the day was that there wasn’t enough lithium to produce EVs for the whole world.

Comments are closed.