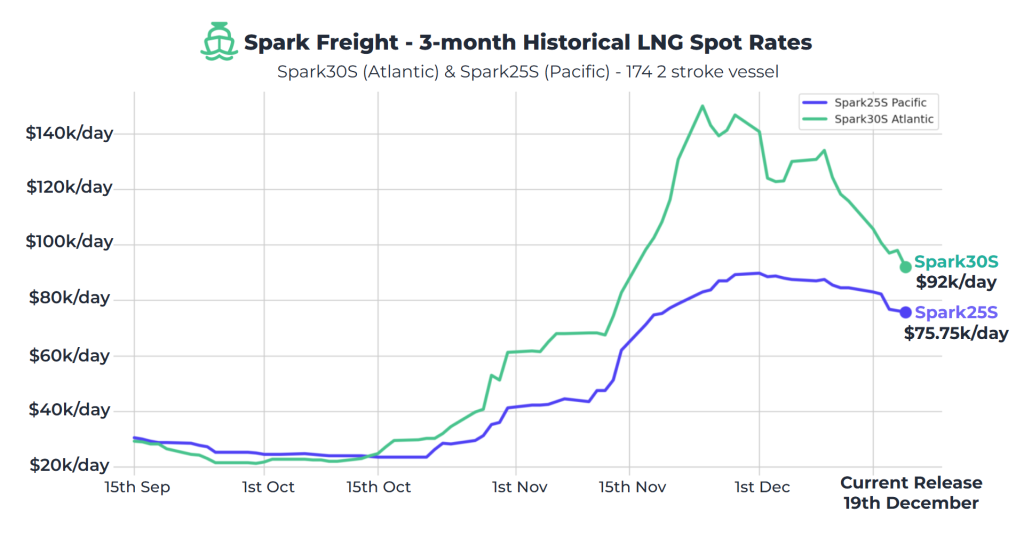

Spark’s data lead, Qasim Afghan, told LNG Prime on Friday that Spark30S (Atlantic) LNG freight rates dropped for a third consecutive week, decreasing by $23,750 to $92,000 per day – the first time Atlantic rates have dropped below $100,000 since mid-November, and the largest week-on-week drop since January 2024.

“Furthermore, Spark30 (Atlantic) forward freight rates for January 2025 also fell this week following FFA market activity, dropping $13,250 week-on-week to $50,500 per day,” he said.

Spark25S (Pacific) rates also fell this week, dropping $8,750 to $75,750 per day, Afghan said.

“The rush for seeking coverage for early January is slowing, bringing some softening in rates, though volatility remains a key feature of the near-term picture,” Fearnley LNG said in its weekly LNG report.

The Oslo-based advisory and brokering firm said that “early-January Atlantic laycans continue to trade firmly in six-figure territory, suggesting the winter spike may be moderating rather than ending abruptly.”

“Further out, fixing levels into the second half of January and February are lower. Whether this reflects genuine market easing or simply well-covered positions ahead of the holiday period remains an open question,” Fearnley LNG said.

“Market sentiment, however, points toward a gradual decline rather than a sharp fall, as supply and demand slowly rebalance,” it said.

“Longer-term chartering activity remains subdued, though expectations are that multi-month and multi-year rates will settle modestly above much of this year’s levels,” Fearnley LNG said.

European prices rise

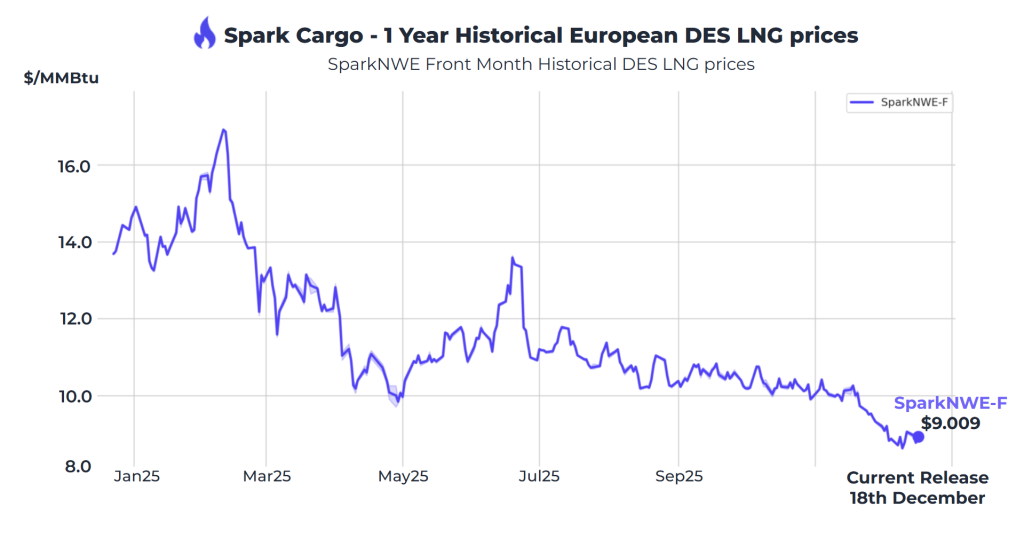

In Europe, the SparkNWE DES LNG increased compared to last week.

“The SparkNWE DES LNG front-month price for January increased by $0.228 to $9.009/MMBtu this week, whilst the basis to the TTF is assessed at -$0.495/MMBtu,” Afghan said.

“This past week has seen a significant narrowing of the JKM premium to the TTF, causing the US front-month arb (via COGH) to widen further this week to -$0.380/MMBtu and is now more strongly pointing towards Europe,” Afghan said.

“Similarly, the US front-month arb (via Panama) is now also closed out and pointing to Europe, assessed at -$0.177/MMBtu,” he said.

“The Nigerian front-month arb (via COGH) has closed out for the first time since April, assessed at -$0.035/MMBtu and now also marginally pointing to Europe,” Afghan said.

Image: Spark

Image: Spark

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU dipped from last week and were 68.24 percent full on December 17, 2025.

Gas storages were 71.29 percent full on December 10, 2025, and 77.10 percent full on December 17, 2024.

JKM

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia in February 2025 settled at $9.555/MMBtu on Thursday.

Last week, JKM for January settled at 10.700/MMBtu on Friday, December 12.

Front-month JKM dropped to 10.662/MMBtu on Monday and 9.455/MMBtu on Tuesday. It rose to 9.535/MMBtu on Wednesday.

State-run Japan Organization for Metals and Energy Security (Jogmec) said in a report earlier this week that JKM for last week “fell to mid-$9s/MMBtu on December 12 from low-$10s/MMBtu the previous weekend.”

“JKM fell as ample supply continued amid weak spot demand in Northeast Asia. On December 10, it fell below $10/MMBtu (the last time JKM was in the $9s/MMBtu range was in late April 2024). By the end of week, there were some buying activities by South Korean buyers, which led to a slight rebound, but the impact was limited,” Jogmec said.