Libya is poised to attract several hundred million dollars in new oil and gas investment as it prepares to award exploration and development licences to international energy companies next year.

This is the first time in more than 17 years that Libya, an Opec member, has opened its oilfields for new investments as it looks to boost production to two million barrels per day by 2030, from about 1.4 million bpd currently.

Several international oil companies including BP, Chevron, ExxonMobil, TotalEnergies, Eni, Shell and OMV have qualified for the new licensing round that covers 22 areas for oil exploration and development, with 11 blocks offshore and 11 onshore.

The government is expected to finalise licence awards by the end of February, with more than 30 companies competing for contracts.

The new licensing round comes as Libya’s economy, heavily reliant on hydrocarbons, is recovering strongly. Oil and gas account for nearly 95 per cent of exports and government revenue. The sector’s expansion has helped push real GDP growth to an estimated 13.3 per cent in 2025. By attracting foreign investment, the country aims not only to boost production but also to reinforce its broader economic recovery.

“It’s reasonable to expect several hundred millions to be committed in the round, higher if companies bid up offshore blocks,” Martijn Murphy, principal analyst for North Africa Upstream at Wood Mackenzie told The National.

“The real swing factor is the offshore Sirte, deepwater wells there can top $100 million each, so any competitive bidding will dramatically lift the total.”

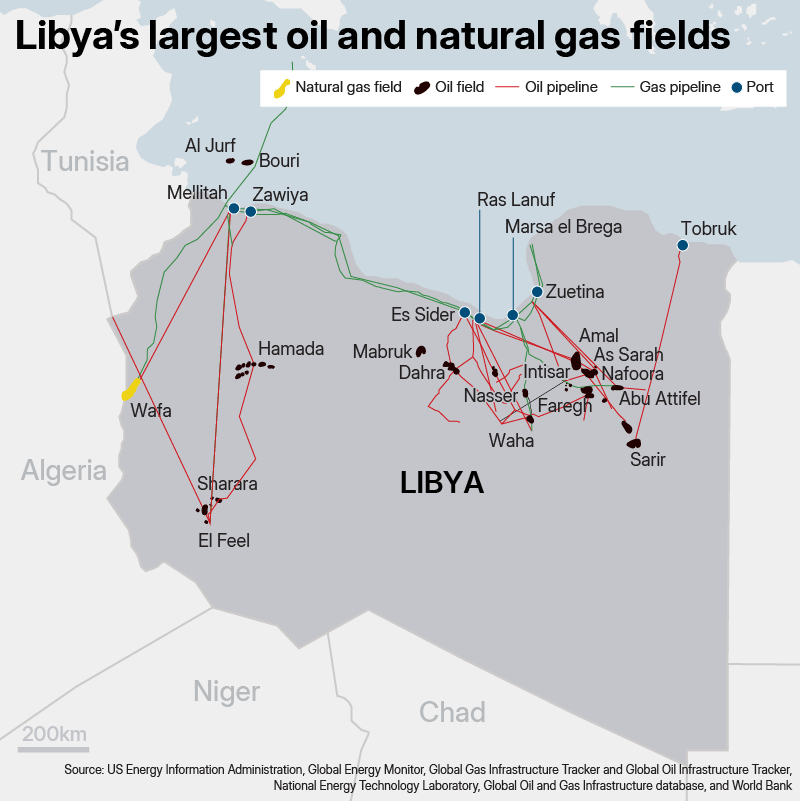

The Sirte Basin in north-central Libya is the country’s primary oil-producing region, holding most of its proven reserves − both offshore and onshore.

Libya produces some of North Africa’s cheapest, largely sweet oil, much of which has remained offline since the 2011 civil war that followed the overthrow of former leader Muammar Qaddafi.

Currently, the country is run by two governments − the UN-backed administration in Tripoli led by Prime Minister Abdul Hamid Dbeibah and the eastern government supported by military commander Field Marshal Khalifa Haftar.

“The new bidding round makes Libya an attractive prospect for investors seeking high-reward opportunities,” said Fiza Jan, senior analyst at Rystad Energy.

“Collectively, these blocks offer an estimated 10 billion barrels of oil equivalent resources along with additional 18 billion barrels of potential.”

Libya has revised its Production Sharing Agreement framework, which sets terms for how oil revenues are shared between the government and contractors. The updated framework boosts contractors’ potential internal rate of return to 35.8 per cent from just 2.5 per cent to attract more investments in Libya’s energy industry.

“With huge reserves, low lifting costs, and plenty of easy opportunities, Libya offers prospects not just for global oil majors and large independents, but also for small and medium-sized companies,” said Thomas Strouse, an American energy consultant advising on upstream oil and gas projects in Libya and the Mena region.

Security concerns

However, companies must navigate security risks, as Libya has previously shut down oilfields and terminals amid clashes between rival factions.

Last year, Libya’s National Oil Corporation declared force majeure at Al Sharara, its biggest oilfield, in the Murzuq Desert, in the west of the country, taking it offline temporarily amid unrest.

Force majeure refers to an unforeseen set of circumstances preventing a party from fulfilling a contract.

“Risk is always present in Libya and cannot be ignored. While production has been stable for some time, any sudden incident could disrupt output, potentially dropping it to 500,000 bpd within days,” Ms Jan said.

Libya’s output plummeted to 500,000 bpd in 2020 after repeated shutdowns of producing oilfields due to political instability.

Production has stabilised in recent months as major political standoffs and export blockades have eased.

“We also have seen co-operation between the eastern and western sides, especially after the replacement of central bank governor and the NOC head. The situation is slightly better, but there’s still a lot of trigger points in Libya,” Ms Jan said.

In January, NOC head Farhat Bengdara resigned for health reasons, with Masoud Sulaiman appointed as acting chief. Naji Mohamed Issa Balgasim was named governor of Libya’s central bank after both governments approved his appointment, helping ease tensions between the sides.

Gateway to Europe

Libyan crude is increasingly important to Europe as it looks to diversify its energy supplies away from Russia, following its invasion of Ukraine

Its proximity and a pipeline from western Libya to Italy make it an accessible source for Europe.

The country is also known for its low-sulphur content crude, which is highly valued by in European refiners.

“Libya, as a gateway or crossroads to Europe, is in an advantageous place to supply oil and gas. It has more resources than any other country in Africa,” Bob Fryklund, chief upstream strategist at S&P Global Commodity Insights, said.

At the beginning of 2024, Libya held Africa’s largest proven oil reserves, estimated at 48 billion barrels. It accounted for 41 per cent of Africa’s total reserves, according to the US Energy Information Administration data.

Libya’s exports to Europe have grown in recent years. In 2023, Europe’s imports accounted for about 78 per cent of Libya’s crude oil and condensate exports, according to the EIA. Most of Libya’s exports went to Italy, Germany, and Spain. Asia received an estimated 10 per cent of Libya’s oil exports.

Impact on Opec+ strategy

Libya has been exempted from Opec+ production adjustments because of its unstable output, but its recent increases undermines the group’s efforts to balance the markets, analysts say.

“If Libyan output rises towards 1.6 million bpd or higher, then Opec+ group will face mounting difficulty in balancing the market, which would mean deeper cuts if needed to offset Libya’s growth,” Ms Jan said.

Opec+ − which includes the UAE, Saudi Arabia and other Gulf producers, as well as Russia and other countries − has been boosting production since April this year to meet growing demand. However, the group has paused production increases scheduled for the first quarter of next year due to oversupply in the markets and weak seasonal demand.