Japan Furniture Market Outlook (2025–2033)

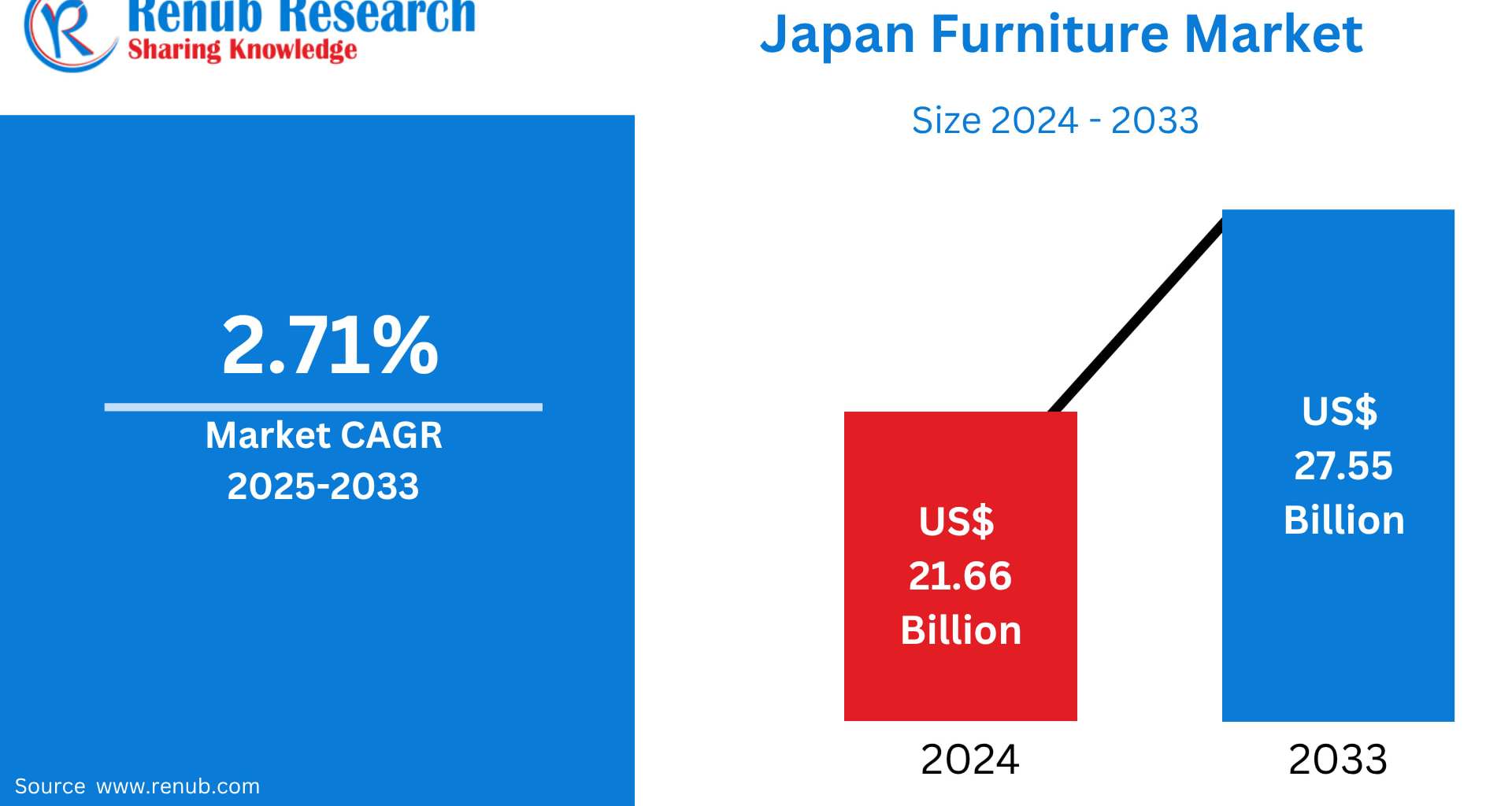

The Japan Furniture Market is projected to grow from US$ 21.66 billion in 2024 to US$ 27.55 billion by 2033, registering a CAGR of 2.71% during the forecast period 2025–2033, according to Renub Research. Market expansion is being driven by rising urbanization, continuous residential development, and growing consumer preference for space-saving, modern, and eco-friendly furniture.

Japan Furniture Market Overview

Furniture refers to movable objects designed to support human activities such as seating, dining, storage, and sleeping—ranging from chairs and tables to beds and cabinets. In Japan, furniture holds both functional and cultural significance, blending centuries-old craftsmanship with contemporary minimalism.

Japanese furniture design is globally recognized for its simplicity, compactness, and efficiency, qualities that are especially relevant in highly urbanized cities such as Tokyo and Osaka. With shrinking apartment sizes and a cultural inclination toward clutter-free living, Japanese consumers increasingly value multifunctional, high-quality furniture that maximizes utility without compromising aesthetics.

The Japanese furniture industry uniquely combines traditional woodworking skills with modern engineering and sustainable materials, positioning the country as a global trendsetter in minimalist and environmentally responsible furniture design.

Key Growth Drivers in the Japan Furniture Market

Urbanization and Space-Efficient Living

Japan’s urbanization rate reached approximately 92% in 2023, making compact living a defining feature of modern households. As apartments become smaller, demand for space-saving furniture—including foldable tables, storage beds, modular sofas, and wall-mounted shelves—has surged.

Manufacturers are focusing on smart design innovation, ensuring furniture performs multiple functions while maintaining visual harmony. This trend aligns strongly with Japan’s traditional philosophy of efficiency and minimalism, driving steady product innovation and sales growth across urban centers.

Rising Demand for Eco-Friendly and Sustainable Furniture

Environmental consciousness among Japanese consumers has increased significantly, boosting demand for furniture made from sustainably sourced wood, recycled materials, and low-emission finishes. Many domestic brands are adopting eco-friendly manufacturing practices and transparent supply chains to meet consumer expectations.

Government incentives promoting sustainability and Japan’s cultural respect for nature further reinforce this trend. Innovative materials such as biomass plastics and recycled composites are finding growing applications in furniture production, opening new opportunities for environmentally responsible manufacturers.

Emergence of E-Commerce and Digital Customization

Japan’s advanced digital ecosystem has accelerated the shift toward online furniture shopping. E-commerce platforms now offer augmented reality (AR) visualization, virtual showrooms, and digital customization, enabling consumers to preview furniture in their homes before purchasing.

Between 2020 and 2022, digital furniture sales in Japan rose sharply, driven by convenience, wider product selection, and strong mobile commerce adoption. Millennials and Gen Z consumers, in particular, prefer online channels, making digital retail a major growth engine for the market.

Challenges Facing the Japan Furniture Market

Aging Population and Declining Household Formation

Japan’s aging population and declining birth rate present long-term challenges. With fewer young households forming, demand for new furniture purchases has slowed in certain segments. Older consumers also tend to retain furniture longer, reducing replacement cycles.

To counter this, furniture manufacturers are increasingly targeting elder-friendly designs, such as ergonomic seating, adjustable beds, and lightweight furniture, while also exploring export markets for sustained growth.

Intense Competition and Price Sensitivity

The Japanese furniture market is highly competitive, featuring domestic brands, international players, and low-cost imports. This environment has increased price sensitivity, making it challenging for mid-range and premium brands to maintain margins.

Fast furniture retailers exert pressure on traditional manufacturers, forcing companies to balance cost efficiency, design differentiation, and product quality. Supply chain optimization and innovation remain critical for competitive advantage.

Segment Analysis of the Japan Furniture Market

Japan Beds Furniture Market

The bed segment is evolving rapidly due to lifestyle changes and Western influence. While futons and tatami mats remain culturally relevant, Western-style beds are gaining popularity for their comfort and health benefits.

Storage beds, compact frames, and adjustable beds for elderly users are driving innovation. With rising awareness of sleep quality and ergonomic support, this segment is expected to witness steady growth.

Japan Sofa & Couch Furniture Market

Sofas and couches have become essential in modern Japanese homes. Consumers favor minimalist, modular, and convertible designs that suit smaller living spaces. Washable fabrics, built-in storage, and durability are highly valued.

Scandinavian-inspired aesthetics blended with Japanese minimalism continue to influence consumer preferences, supporting sustained demand for high-quality upholstery.

Japan Wood Furniture Market

Wood furniture holds deep cultural significance in Japan. Consumers prefer oak, cedar, and hinoki cypress, emphasizing sustainability and natural aesthetics. Handmade and minimalist wooden furniture appeals to buyers seeking durability and timeless design.

With rising environmental awareness, demand for eco-certified and artisan-crafted wood furniture is increasing, benefiting small-scale manufacturers and premium brands alike.

Japan Glass Furniture Market

Glass furniture is popular among consumers seeking modern, airy interiors. Glass tables, shelves, and cabinets enhance the perception of space in compact apartments.

Advancements in tempered safety glass and hybrid materials are addressing concerns around durability and safety, supporting gradual growth in this segment.

Japan Residential Furniture Market

Residential furniture dominates Japan’s furniture industry, driven by urban living and apartment-based lifestyles. High demand exists for modular furniture, wall-mounted storage, and multifunctional designs.

Ongoing residential construction and renovation activities—particularly in metropolitan areas—continue to fuel furniture demand. Japanese and Scandinavian minimalist styles remain central to residential décor trends.

Japan Furniture Specialty Stores Market

Specialty stores play a vital role by offering personalized service, curated collections, and craftsmanship-focused products. These retailers appeal to consumers seeking unique designs and premium quality.

Showroom-style layouts, in-home consultation services, and private-label offerings help specialty stores differentiate themselves from mass retailers.

Japan Furniture Online Stores Market

Online furniture sales are expanding rapidly due to convenience and technological integration. Platforms such as Rakuten and Amazon, along with domestic retailers, offer competitive pricing, fast delivery, and immersive digital tools.

AR visualization, virtual room planners, and customer reviews are enhancing online purchase confidence, especially among urban professionals and younger consumers.

Japan Furniture Market Segmentation

By Product

Beds

Tables & Desks

Sofa & Couch

Chairs & Stools

Cabinets & Shelves

Others

By Material

Wood

Metal

Plastic

Glass

Others

By Application

Residential

Commercial

By Distribution Channel

Supermarkets & Hypermarkets

Specialty Stores

Online Stores

Others

Key Players Analysis (Covered with 5 Viewpoints)

Major companies shaping the Japan furniture market include:

Nitori

Muji

Karimoku Furniture Co., Ltd.

IKEA Kobe

Cassina Ixc

Huasheng Furniture Group

Ariake

CondeHouse

Hida Sangyo

Miyazaki Chair Factory

Each company is analyzed based on overview, key personnel, recent developments, SWOT analysis, and revenue performance.

Final Thoughts

The Japan Furniture Market is entering a phase of steady, design-led growth, supported by urbanization, sustainability initiatives, and digital transformation. While demographic challenges persist, innovation in space-efficient, eco-friendly, and smart furniture solutions continues to unlock new opportunities.

With a projected market size of US$ 27.55 billion by 2033, Japan remains a global benchmark for minimalist design, craftsmanship, and functional living. Companies that successfully integrate sustainability, technology, and consumer-centric design will be best positioned to thrive in Japan’s evolving furniture landscape.