Japan Insulin Pen Market Outlook

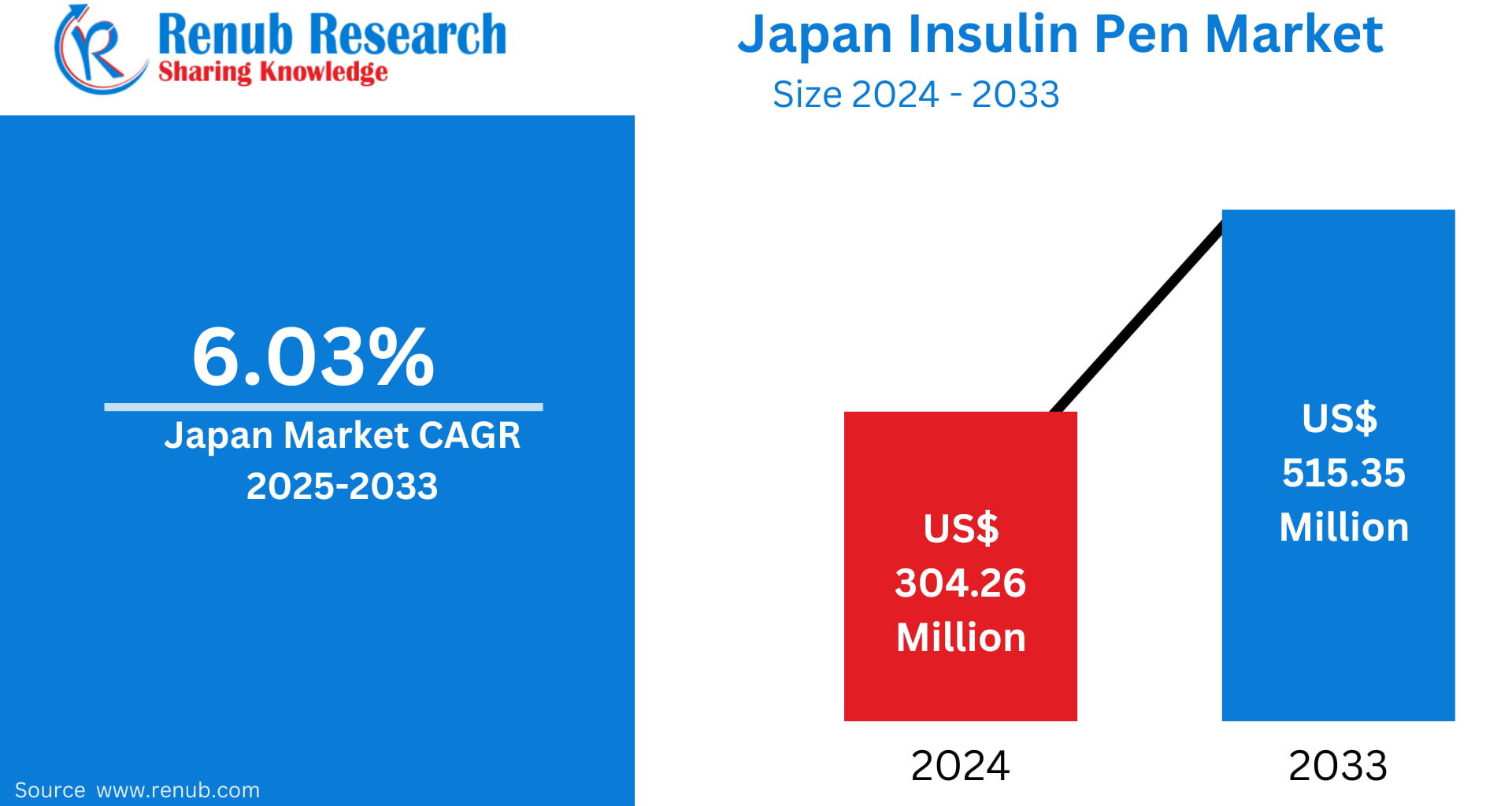

The Japan Insulin Pen Market is forecasted to grow from US$ 304.26 million in 2024 to US$ 515.35 million by 2033, registering a compound annual growth rate (CAGR) of 6.03% during the forecast period 2025–2033. This steady expansion is primarily driven by Japan’s rapidly aging population, rising prevalence of diabetes, and increasing preference for advanced, easy-to-use insulin delivery systems.

Japan Insulin Pen Market Overview

An insulin pen is a medical device designed to administer insulin safely and accurately for diabetes management. It combines a pre-filled or refillable insulin cartridge with a dial-based dosing mechanism, enabling patients to self-inject insulin with minimal effort. Modern insulin pens are available in disposable and reusable formats, and advanced models include dose memory, digital displays, and Bluetooth connectivity to support data-driven diabetes care.

In Japan, insulin pens have witnessed widespread acceptance due to a strong healthcare infrastructure, universal health insurance coverage, and high awareness of chronic disease self-management. Japanese patients prioritize precision, hygiene, comfort, and discretion, all of which insulin pens effectively deliver. Furthermore, healthcare professionals increasingly recommend insulin pens because they reduce dosing errors, simplify training, and improve long-term adherence to insulin therapy.

With the growing adoption of smart insulin pens integrated with mobile health applications, Japan’s insulin pen market is transitioning from basic drug delivery toward connected and personalized diabetes care ecosystems.

Key Growth Drivers in the Japan Insulin Pen Market

Rising Diabetes Prevalence and Aging Population

Japan has one of the oldest populations globally, with more than 29% of citizens aged 65 years or above. Aging is closely linked to a higher risk of Type 2 diabetes, which often requires insulin therapy as the disease progresses. The increasing number of elderly patients has created substantial demand for insulin delivery devices that are simple, accurate, and physically easy to handle.

Insulin pens are particularly beneficial for elderly patients because they:

Reduce manual dexterity requirements

Minimize injection pain

Lower the risk of incorrect dosing

As Japan’s senior population continues to expand, insulin pens are becoming an essential component of diabetes treatment protocols nationwide.

Shift Toward Convenient and Patient-Centric Drug Delivery

Traditional insulin administration using syringes and vials is gradually being replaced by insulin pens due to their ease of use and superior safety profile. Japanese patients value devices that support independence, privacy, and efficiency—especially for home-based and workplace insulin administration.

Technological innovations such as:

Dose memory tracking

Digital dose counters

Wireless data sharing

are accelerating insulin pen adoption across all age groups. These features enable better monitoring, reduce missed doses, and support improved glycemic control. As self-management becomes central to diabetes care in Japan, insulin pens are gaining traction as the most reliable and patient-friendly delivery method.

Government Reimbursement and Strong Healthcare Support

Japan’s universal healthcare system plays a critical role in supporting insulin pen adoption. Insulin pens are largely covered under national health insurance, making them financially accessible to most diabetes patients. Government-led initiatives also emphasize:

Early diagnosis

Treatment compliance

Prevention of long-term diabetes complications

Public awareness campaigns and structured patient education programs further encourage the use of modern insulin delivery technologies. This supportive regulatory and reimbursement environment significantly lowers barriers to adoption and sustains long-term market growth.

Challenges Facing the Japan Insulin Pen Market

High Cost of Advanced Smart Insulin Pens

Despite reimbursement coverage, advanced smart insulin pens equipped with Bluetooth and app connectivity often come with higher upfront costs. Not all digital features are fully reimbursed, increasing out-of-pocket expenses for patients. Additionally, ongoing costs related to disposable pen needles and replacement devices can pose affordability challenges, particularly for low-income or rural populations.

To overcome this barrier, manufacturers must balance innovation with affordability and collaborate with policymakers to expand insurance coverage for next-generation insulin pens.

Preference for Traditional Methods in Rural Areas

In rural parts of Japan, adoption of insulin pens can be slower due to:

Limited exposure to new medical technologies

Lower digital literacy among elderly patients

Continued reliance on traditional syringes

Healthcare access disparities and insufficient training further hinder adoption. Addressing this gap requires targeted education programs, improved distribution networks, and community-level engagement to ensure equitable access to modern insulin delivery solutions.

Segmental Analysis of the Japan Insulin Pen Market

Japan Disposable Insulin Pen Market

Disposable insulin pens are prefilled, single-use devices that offer maximum convenience and hygiene. These pens are especially suitable for:

Elderly patients

Visually impaired individuals

Newly diagnosed patients

In Japan, disposable insulin pens are widely used in hospitals and homecare settings due to their low maintenance and reduced risk of dosing errors. Their simplicity and reliability continue to drive strong demand across clinical and personal care environments.

Japan Type 2 Diabetes Insulin Pen Market

Type 2 diabetes accounts for the majority of diabetes cases in Japan. As the condition progresses, many patients require insulin therapy alongside oral medications. Insulin pens are the preferred choice for Type 2 diabetes patients because they offer:

Accurate dosing

Portability

Minimal training requirements

With rising diagnosis rates and improved patient education, insulin pen usage among Type 2 diabetes patients is expected to grow steadily throughout the forecast period.

Japan Insulin Pen Market by Hospitals

Hospitals play a pivotal role in initiating insulin therapy, particularly for newly diagnosed and hospitalized patients. Japanese hospitals increasingly favor insulin pens over syringes because they:

Improve dosing accuracy

Enhance patient comfort

Reduce preparation time for healthcare staff

Hospitals also serve as training centers where patients learn proper insulin pen usage before transitioning to homecare, reinforcing long-term adoption.

Regional Insights

Tokyo Insulin Pen Market

Tokyo represents the largest regional market for insulin pens in Japan. The city benefits from:

Advanced healthcare infrastructure

High diabetes awareness

Rapid adoption of smart medical devices

With widespread availability through hospitals, clinics, and pharmacies, Tokyo continues to lead in both innovation and consumption of insulin pen technologies.

Shizuoka Insulin Pen Market

Shizuoka offers moderate growth potential due to its mixed urban-rural population and aging demographics. While urban areas show strong adoption, rural regions require improved awareness and access. Targeted education initiatives could unlock significant growth opportunities in this region.

Aichi Insulin Pen Market

Aichi Prefecture, home to Nagoya, is a key industrial and healthcare hub. Rising lifestyle-related diseases and well-developed medical facilities are driving insulin pen adoption. Strong distributor presence and economic stability position Aichi as a major contributor to national market growth.

Japan Insulin Pen Market Segmentation

By Product

Disposable Insulin Pen

Reusable Insulin Pen

By Disease Type

Type 1 Diabetes

Type 2 Diabetes

By Distribution Channel

Hospitals

Homecare Settings

Others

Top 10 Cities

Tokyo, Kansai, Aichi, Kanagawa, Saitama, Hyogo, Chiba, Hokkaido, Fukuoka, Shizuoka

Competitive Landscape and Key Players

The Japan insulin pen market is moderately consolidated, with global and domestic players focusing on innovation, safety, and digital integration. All companies are analyzed across five viewpoints: Overview, Key Person, Recent Developments, SWOT Analysis, and Revenue Analysis.

Key Market Players

B. Braun Melsungen AG

Eli Lilly and Company

Becton, Dickinson and Company

Novo Nordisk A/S

Ypsomed AG

Terumo Corporation

Sanofi

Julphar

These players are investing heavily in smart insulin pen technologies, ergonomic designs, and strategic partnerships to strengthen their footprint in Japan’s evolving diabetes care market.

Final Thoughts

The Japan Insulin Pen Market is set for sustained growth through 2033, supported by demographic shifts, rising diabetes prevalence, and strong healthcare infrastructure. As patient-centric and digitally connected healthcare becomes the norm, insulin pens will remain at the forefront of diabetes management in Japan.

Manufacturers that successfully combine innovation, affordability, and accessibility—while addressing regional and demographic disparities—will be best positioned to capitalize on Japan’s expanding insulin pen market. With continued government support and technological advancements, insulin pens will play a critical role in improving diabetes outcomes and quality of life for millions of Japanese patients.