①Following the release of the impressive Q3 GDP data by the U.S. Department of Commerce this Tuesday, the extent to which AI has contributed to driving the U.S. economy quickly became a hot topic of discussion on Wall Street; ②Overnight, these discussions further reached a climax due to a latest tweet from the world’s richest man, Elon Musk…

Cailian Press, December 25 (Edited by Xiaoxiang) Following the release of the impressive Q3 GDP data by the U.S. Department of Commerce this Tuesday, the extent to which AI has contributed to driving the U.S. economy quickly became a hot topic of discussion on Wall Street. Overnight, these discussions further reached a climax due to a latest tweet from the world’s richest man, Elon Musk…

Musk predicted on Wednesday, in response to a post about U.S. economic growth on the X platform, that the U.S. economy would achieve double-digit growth within the next 12 to 18 months.

Musk further added that if applied intelligence could be used as an indicator of economic growth, triple-digit growth within approximately five years might also be possible.

Musk further added that if applied intelligence could be used as an indicator of economic growth, triple-digit growth within approximately five years might also be possible.

According to data from the Bureau of Economic Analysis under the U.S. Department of Commerce, the U.S. economy grew by 4.3% year-on-year in the third quarter, far exceeding the widely expected 3.2% forecast by analysts. This fairly robust economic growth further boosted U.S. stocks ahead of Christmas, with the S&P 500 Index reaching an intraday record high of 6937.32 points overnight, indicating that traders seemed quite optimistic about the U.S. economic outlook.

Such a strong economic performance has led many industry insiders to explore one question: how much of this growth is concentrated in the artificial intelligence sector?

And the answer seems rather astonishing…

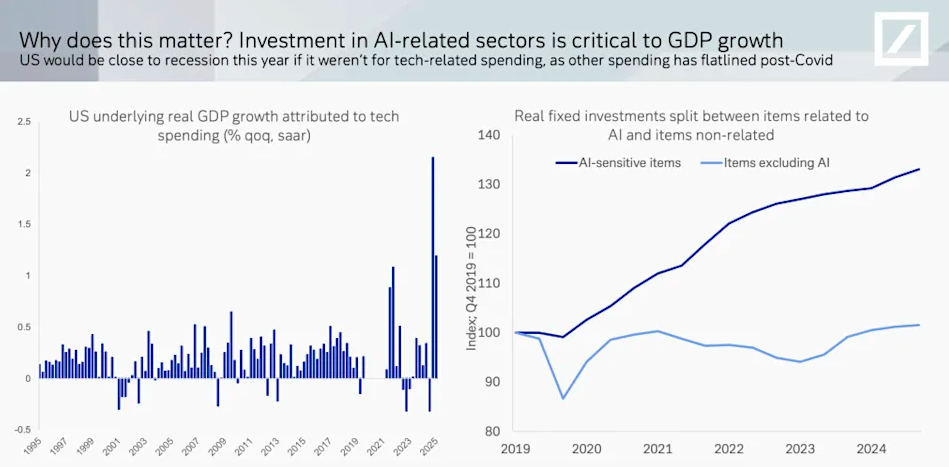

The widespread penetration and application of AI technology is expected to significantly enhance productivity and innovation capabilities. Therefore, there is no doubt that AI can play a substantial role in boosting economic growth, especially considering the current large-scale investments in the U.S. tech sector, often amounting to hundreds of billions of dollars.

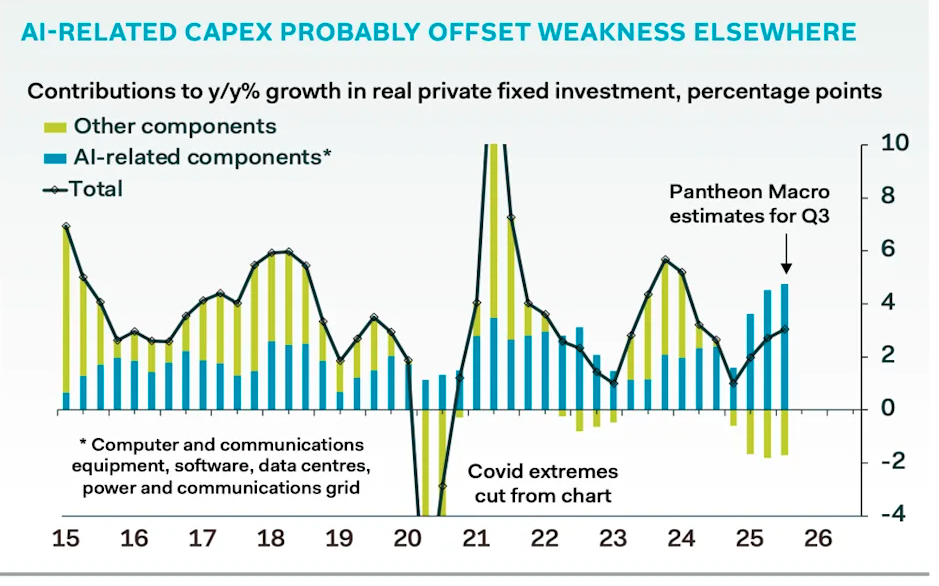

Pantheon Macroeconomics noted in a recent report that private fixed investment, a measure of corporate spending, has grown almost exclusively due to AI-related expenditures. A chart released by analyst Oliver Allen shows that private fixed investment outside of AI has actually been declining:

Note: The blue line represents AI investment, while the yellow line represents investment in other sectors.

“The persistent weakness in capital expenditure intentions indicates that investment outside AI-related sectors remains sluggish,” he told clients in the report.

Deutsche Bank expressed a similar view in a recent report discussing whether there is a bubble in artificial intelligence. Analysts Adrian Cox and Stefan Abrudan at Deutsche Bank wrote, “Investment in AI-related sectors is crucial for GDP growth. Without the support of non-tech-related spending and with other expenditures stagnating post-pandemic, the U.S. economy would be on the brink of recession this year.”

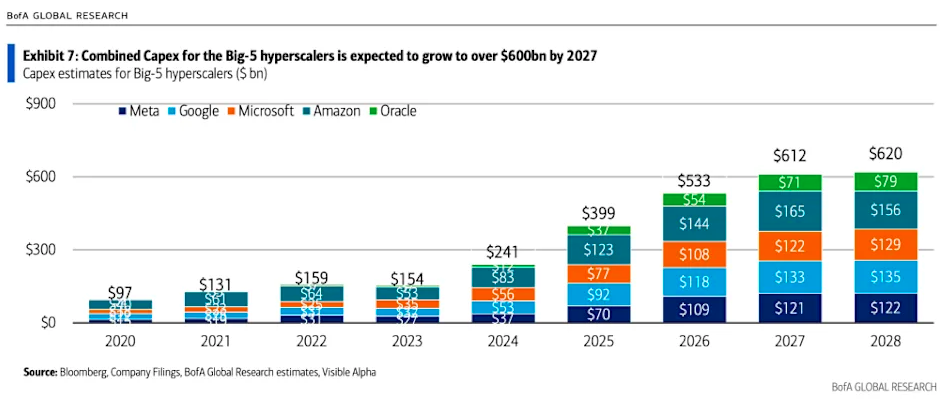

Currently, the scale of capital expenditure flowing into the artificial intelligence sector is enormous. According to estimates by Bank of America analysts Justin Post and Nitin Bansal, just five hyperscalers — Alphabet (Google’s parent company), Meta, Microsoft, Amazon, and Oracle — will spend $399 billion on AI-related capital expenditures this year, a figure expected to exceed $600 billion in the coming years.

Going forward, an increasing portion of capital expenditure in the AI sector is likely to be financed through debt. Bank of America noted that large technology companies have healthy cash flows and robust balance sheets, making it relatively easy for most of them to increase debt without compromising profitability.

“Frenzied speculation” will eventually face “performance validation.”

In fact, the scale of AI-related debt has already reached a record high. Goldman Sachs analyst Spencer Rogers recently pointed out to clients: “Net supply from AI-related issuers in the U.S. dollar credit market will surpass $200 billion in 2025, more than double last year’s total. Thirty percent of net dollar credit supply this year is AI-related.”

He expects this proportion to rise further next year.

Estimates from Bank of America show that these AI giants are striving to achieve $1 trillion in incremental revenue over the next five years: approximately $500 billion from cloud services, $400 billion from additional digital advertising spending, and $200 billion from AI subscription services targeting both consumer and enterprise markets.

“Historical data (2021-24) shows that for every $1 of capital expenditure invested, it generates an average of $0.90 in incremental revenue and $0.42 in incremental EBITDA (earnings before interest, taxes, depreciation, and amortization) the following year,” they wrote.

However, in reality, the U.S. capital markets and government can only hope that the optimistic forecasts by figures like ‘Musk’ prove accurate — as investors in AI shift from ‘frenzied speculation’ to ‘performance validation,’ the industry is now demanding that tech giants demonstrate their massive capital expenditures can translate into actual profit growth rather than mere accounting maneuvers. AI investment has gradually moved from being concept-driven to a more brutal phase of separating truth from fiction.”

If investments fail to yield the expected returns and the application of AI does not expand exponentially, the moment of market liquidation may arrive more rapidly.

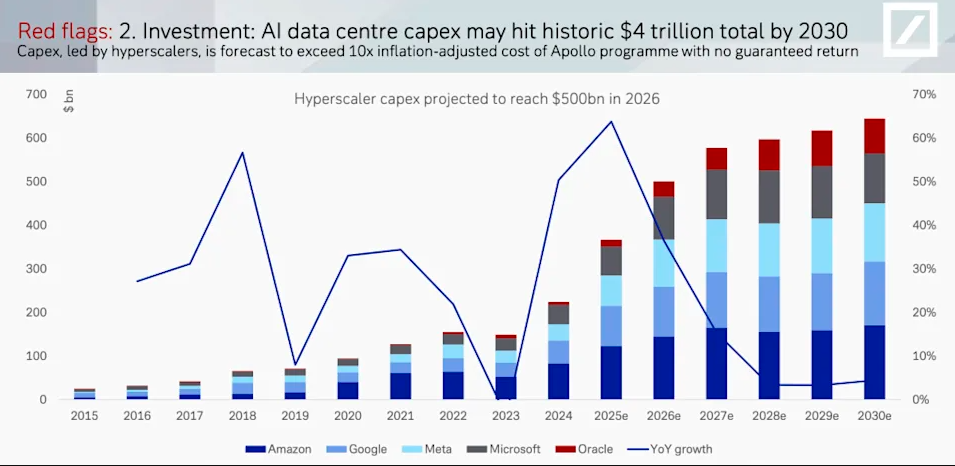

According to data from Deutsche Bank, by 2030, hyperscale AI enterprises will have cumulatively invested $4 trillion in artificial intelligence data centers—far exceeding the total cost of the U.S. moon landing program in the 1960s: “equivalent to ten times the inflation-adjusted cost of the Apollo program, with no guaranteed return on investment.”