Europe Sweetened Condensed Milk Market Size

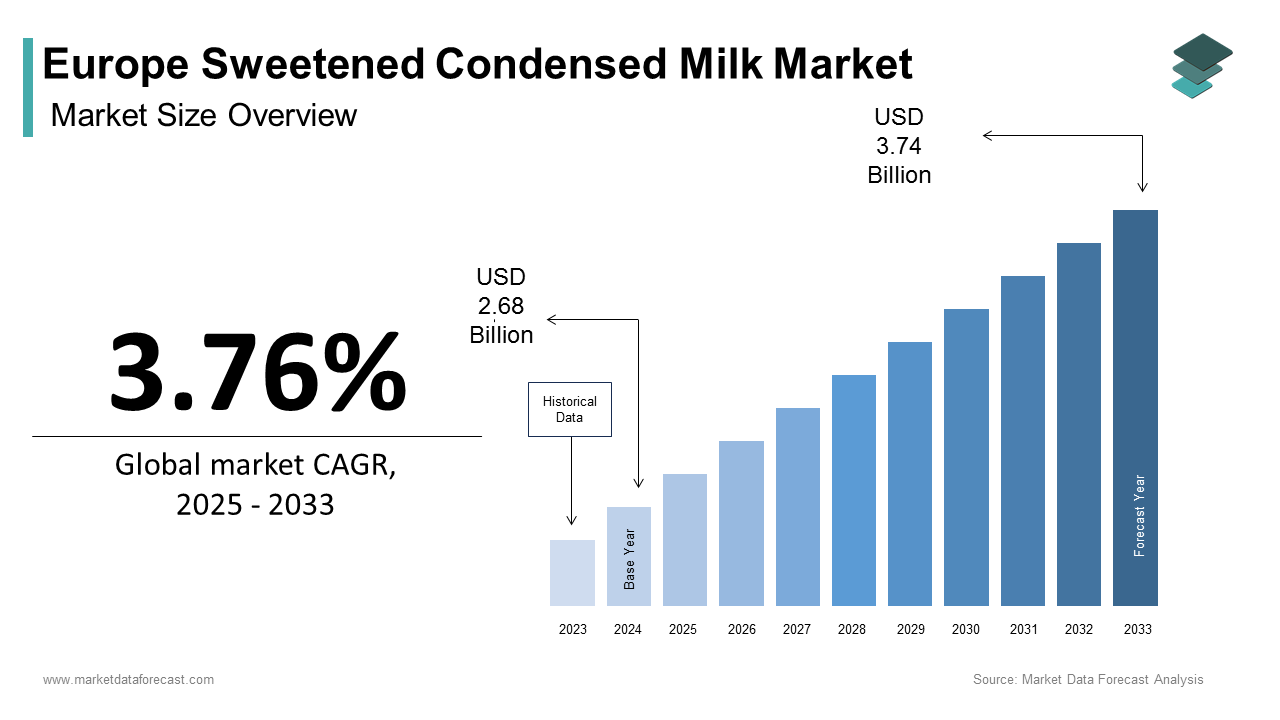

The Europe sweetened condensed milk market size was calculated to be USD 2.68 billion in 2024 and is anticipated to be worth USD 3.74 billion by 2033, growing from USD 2.78 billion in 2025 at a CAGR of 3.76% during the forecast period.

Sweetened condensed milk is a shelf-stable dairy product created by removing approximately 60% of water from cow’s milk and adding sucrose or other sugars to achieve a viscosity and preservation profile suitable for both direct consumption and industrial use. Unlike evaporated milk, sweetened condensed milk contains a high sugar content (typically 40–45%), which acts as a natural preservative and enables ambient storage without refrigeration until opened. While not a mainstream household staple across all European regions, it holds deep cultural significance in specific markets and culinary traditions. In Portugal, condensed milk is indispensable in desserts such as pudim flan and in coffee preparations like galão doce. In Eastern Europe, particularly Romania and Bulgaria, it features prominently in holiday baking and traditional confections. According to Eurostat, the European Union produces over 22 million metric tons of cow’s milk annually, providing ample raw material, though only a small fraction is diverted to condensed milk production. Regulatory oversight by the European Food Safety Authority (EFSA) ensures compliance with compositional standards under Regulation (EC) No 1308/2013, which defines sweetened condensed milk as containing not less than 8% milk fat and 28% milk solids non‑fat. This niche yet resilient product persists through cultural continuity, artisanal applications, and evolving foodservice demand and is anchored not in mass consumption but in ritual, flavor identity, and functional utility.

MARKET DRIVERS Cultural Entrenchment in Regional Dessert and Beverage Traditions

Sweetened condensed milk maintains steady demand in Europe due to its irreplaceable role in national and regional culinary rituals, particularly in Southern and Eastern European countries, which is primarily driving the European sweetened condensed milk market growth. According to national food consumption surveys in Portugal, a majority of households use sweetened condensed milk in home baking or coffee, reflecting strong cultural integration. The iconic pudim Abade de Priscos, a traditional caramel custard, relies exclusively on this ingredient for its dense sweetness and glossy texture,e as substitutes like evaporated milk or syrup fail to replicate the mouthfeel. Similarly, in Greece, ravani and karidopita (semolina and walnut cakes) require sweetened condensed milk for moisture retention and shelf stability, especially during religious festivals. As per the Romanian National Institute of Statistics, household surveys confirm that pork and dairy-based desserts, such as cozona,c remain widely prepared during Christmas and Easter, often incorporating condensed milk. These practices are intergenerational; consumer research in Portugal shows that younger generations report learning recipes from grandparents who used condensed milk as a pantry staple, underscoring continuity. This cultural embedding transforms the product from a commodity into a symbol of heritage, ensuring consistent household replenishment regardless of health trends or price fluctuations.

Expansion in Artisanal Coffee and Specialty Beverage Formulations

The rise of specialty coffee culture across Europe has unlocked new demand for sweetened condensed milk as a premium ingredient in signature drinks, particularly in urban centers, which is further boosting the regional market expansion. While traditionally associated with Vietnamese or Thai coffee, European baristas are increasingly adopting it for its creamy body, caramelized notes, and natural sweetness that eliminates the need for syrups. According to the European Coffee Federation, independent coffee shops in cities such as Lisbon, Porto, and Athens increasingly offer condensed milk-based coffee variants, reflecting growing popularity. For instance, the specialty coffee sector has recorded notable growth in condensed milk cold brew sales, which indicates consumer acceptance. Dairy processors have responded with barista-specific formats. In France, Lactalis launched a pourable, low viscosity condensed milk designed for seamless integration into espresso machines. Additionally, plant-based cafés in Berlin and Amsterdam now blend oat milk with coconut condensed milk to cater to vegan consumers seeking similar richness. This gourmet reinvention positions sweetened condensed milk not as a nostalgic relic but as a versatile, artisanal tool, which is bridging traditional dairy with modern beverage innovation and expanding its relevance beyond domestic kitchens.

MARKET RESTRAINTS Stringent EU Sugar Reduction and Nutritional Labeling Policies

The European Union’s aggressive public health agenda targeting added sugars poses a significant regulatory headwind for sweetened condensed milk, which is impeding the sweetened condensed milk market growth in Europe. According to the European Commission’s Farm to Fork Strategy, member states are encouraged to reduce population-level sugar intake by 10% by 2025, which is driving reformulation pressures. As per the Nutri‑Score system adopted in France, Germany, Belgium, and Spain, sweetened condensed milk typically receives an “E” rating, discouraging inclusion in school meal programs and public catering. In 202,4 the European Commission proposed amendments to Regulation (EU) No 1169/2011 requiring front-of-pack warning labels for foods exceeding 22.5 grams of sugar per 100 milliliters, which is a threshold that sweetened condensed milk exceeds at approximately 55 grams per 100 grams as verified by the European Food Safety Authority. Consequently, retailers like Carrefour and Edeka have reduced shelf space for standalone condensed milk in favor of lower sugar alternatives. School nutrition guidelines in Nordic countries explicitly prohibit its use in institutional recipes, which further limits exposure. These policies, though not banning the product outright, create a hostile retail and institutional environment that dampens trial among younger consumers and pressures manufacturers to reformulate, often at the cost of traditional taste and functionality.

Volatility in Dairy Feedstock and Energy Costs

Sweetened condensed milk production is highly sensitive to fluctuations in raw milk prices and energy expenses, both of which have intensified in Europe since 2022, which is further hampering the European market expansion. According to the European Dairy Association, the evaporation process required to concentrate milk is energy-intensive and consumes 16 to 18 kilowatt hours per 1,000 Liters of input milk, which indicates cost pressures. As per Eurostat, EU industrial electricity prices averaged €192 per megawatt hour in 2024, which is raising production costs. According to the European Commission’s Milk Market Observatory, raw milk prices in the EU reached €48.7 per 100 kilograms in early 2024, which is a 22% increase from 2022 levels and is driven by feed cost inflation and herd reductions. These dual pressures squeeze margins for processors, particularly small regional dairies that lack hedging capabilities. For instance, several condensed milk producers in Italy suspended operations in 2023 due to unsustainable input costs, which illustrates vulnerability. Without access to long term power purchase agreements or cooperative milk pooling, many traditional producers face existential risk, threatening the continuity of culturally significant products in local markets.

MARKET OPPORTUNITIES Development of Reduced Sugar and Functional Condensed Milk Variants

Innovation in product formulation is creating new market avenues through reduced sugar and nutritionally enhanced sweetened condensed milk to align with evolving consumer health expectations, which is a promising opportunity for the European sweetened condensed milk market. Leveraging enzymatic inversion and fiber‑based sweeteners like allulose or oligofructose, companies are developing versions with less sucrose while retaining viscosity and browning properties essential for baking. According to Arla Foods, in 202,4 a “Light Condensed Milk” was launched in Denmark and Sweden containing reduced sugar and added calcium, which is achieving a Nutri‑Score of “C” compared with the standard “E” and showing measurable improvement. Similarly, Portugal’s Lactogal introduced a condensed milk variant fortified with vitamin D and prebiotic fiber, which is targeting elderly consumers concerned with bone health and digestion. As per the European Functional Food Observatory, nearly one-fifth of new condensed milk SKUs in Western Europe in 2024 featured functional claims, which reflects reformulation momentum. Crucially, they maintain compatibility with traditional recipes. University of Lisbon taste tests confirmed reduced sugar versions of pudim scored highly among consumers, which preserves cultural utility while meeting regulatory and health imperatives.

Integration into Premium and Plant-Based Dessert Manufacturing

The premiumization of desserts in European foodservice and retail is driving B2B demand for sweetened condensed milk as a clean-label and functional ingredient in gourmet applications, which is another prominent opportunity in the European sweetened condensed milk market. Artisanal ice cream makers in Italy and France increasingly use it as a natural sweetener and texturizer to achieve smoothness without stabilizers. According to the Italian Artisanal Ice Cream Federation, more than a quarter of premium gelato shops in Rome and Milan listed condensed milk in ingredient declarations in 2024, which is showing professional adoption. Similarly, French patisseries utilize it in crème caramel, tarte Tatin, and bavarois for its moisture retention and Maillard reaction enhancement during baking. Beyond dairy, plant‑based dessert innovators are blending coconut or oat condensed milk into vegan cheesecakes and mousses. As per the European Plant‑Based Foods Association, EU retail sales of plant‑based desserts grew by over 30% in 2024, which is expanding hybrid demand. Companies like Rude Health and Alpro now source coconut condensed milk from Southeast Asia to meet this need. This B2B expansion transforms sweetened condensed milk from a household pantry item into a professional kitchen staple, which is insulating it from direct consumer health scrutiny while broadening its industrial relevance.

MARKET CHALLENGES Limited Appeal Among Health-Conscious and Younger Demographics

Sweetened condensed milk faces persistent resistance from health‑aware consumers and younger generations who associate it with excessive sugar and outdated dietary norms, which is primarily challenging the European sweetened condensed milk market. According to a 2024 Eurobarometer survey on food perceptions, two‑thirds of Europeans aged 18 to 30 view sweetened condensed milk as unhealthy or unsuitable for regular consumption, compared to far fewer older consumers. Social media and wellness influencers further amplify this perception, often labeling it as “liquid sugar” in viral content. As per the European Consumer Panel, household penetration among under‑35s in Northern and Western Europe remains below 15%, which reflects generational disconnect. Even in culturally strong markets like Portugal, the Portuguese Institute for Consumer Studies reported that fewer than one-third of adults under 30 prepare pudim at home, which is preferring store‑bought alternatives or sugar‑free desserts. Without successful repositioning as a functional or occasional indulgence ingredient, the product risks becoming confined to an aging demographic and limiting innovation investment and shelf presence in modern retail formats.

Fragmented Production Base and Lack of Economies of Scale

The Europe sweetened condensed milk market suffers from a highly fragmented manufacturing landscape dominated by small to medium dairies with limited investment capacity, constraining innovation and cost efficiency. Unlike fluid milk or yogurt, which benefit from centralized EU production networks, condensed milk is often produced in regional facilities serving local culinary needs. According to the European Dairy Association’s 2024 processing guidelines, plants typically operate below 5,000 metric tons annual capacity, far below the 20,000‑ton threshold needed for energy‑efficient evaporation, raising costs. Consequently, unit production costs remain significantly higher than in integrated multinational facilities, which limits competitiveness. Only three EU producers operate dedicated condensed milk lines with modern falling film evaporators. The rest rely on batch processing that increases thermal degradation and variability. This fragmentation discourages R&D in sugar reduction or functional fortification due to low ROI. As EU energy and compliance costs rise, many small producers face consolidation or exit, whichrisksg the loss of region‑specific product nuances and reduces consumer choice, ultimately weakening the market’s resilience and adaptability in a rapidly evolving nutritional landscape.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

3.76%

Segments Covered

By Product, Packaging, and Region

Various Analyses Covered

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic

Market Leaders Profiled

Nestlé S.A., FrieslandCampina, Lactalis Group, Danone S.A., Arla Foods, Müller Group, Royal A-ware, Hochwald Foods GmbH, Morinaga Milk Industry Europe, Meiji Holdings Europe, Fonterra Europe, Dana Dairy Group, Yili Europe, FrieslandCampina Professional, Ehrmann GmbH

SEGMENTAL ANALYSIS By Product Insights

The unflavored sweetened segment had the most dominating share of the European sweetened condensed milk market in 2024. The dominance of the unflavoured segment in this region is driven by the culinary tradition and functional versatility. According to Eurostat, dairy products remain among the most consumed food categories in the EU, with milk and milk‑based ingredients widely used in traditional desserts. Unflavored condensed milk is irreplaceable in authentic preparations across Southern and Eastern Europe, where its viscosity, sugar concentration, and Maillard reaction behaviour are essential. Portuguese households use it extensively in pudim flan, while Romanian cozonac cu nuca and Greek galaktoboureko rely on its binding and browning properties. The European Commission’s Traditional Speciality Guaranteed (TSG) registry confirms that several protected desserts implicitly require condensed milk for authenticity. Unflavored condensed milk is expected to remain dominant as cultural integration into national desserts ensures stable demand unaffected by flavor trends.

The flavored segment is the fastest-growing product category and is expected to exhibit a CAGR of 7.04% over the forecast period. The growth of the flavored segment in this regional market is attributed to Europe’s specialty coffee and dessert beverage trends. According to the European Coffee Federation, flavored dairy ingredients are increasingly adopted by cafés to simplify workflows and enhance sensory profiles. Brands have introduced caramel, vanilla, and mocha variants tailored for coffee drinks and seasonal desserts. Nordic markets have embraced cinnamon and spiced versions for winter beverages such as glögg and hot chocolate. Retail adoption is rising, with independent cafés in Lisbon and Athens increasingly stocking flavored condensed milk SKUs. Flavored condensed milk is expected to grow rapidly as beverage innovation and café culture drive demand for convenient and premium sweetening solutions.

By Packaging Insights

The cans segment was the dominant packaging format and occupied 75.5% of the European market share in 2024. This prevalence is sustained by historical legacy, functional performance, and supply‑chain efficiency. According to the European Food Safety Authority, canned condensed milk maintains microbiological safety and compositional integrity throughout its shelf life under standard storage conditions. The hermetic seal of tinplate cans provides unmatched protection against light, oxygen, and microbial ingress, enabling ambient storage for up to 12 months without refrigeration. Industrial users such as bakeries and cafés prefer cans for bulk consistency, with standardized 397‑gram units ensuring reproducibility. The European Bakery Association notes that professional bakers rely heavily on canned condensed milk due to dosing precision and reduced waste. Cans are expected to remain the dominant packaging format as shelf stability and consumer familiarity continue to outweigh alternatives.

The tubes segment is the fastest-growing packaging format and is estimated to witness a CAGR of 10.3% over the forecast period, owing to the growing consumer demand for convenience, portion control, and reduced food waste. According to Eurostat, single‑person households now represent more than one‑third of EU residences, creating demand for smaller, resealable formats. Tubes offer controlled dispensing that minimizes oxidation and spoilage after opening, addressing a key pain point with cans. University studies in Europe have confirmed that tube packaging reduces household food waste compared to traditional cans. This aligns with the EU’s Farm to Fork Strategy, which targets halving per‑capita food waste by 2030. Retailers report higher repeat‑purchase rates for tube formats due to perceived freshness and ease of use. Tubes are expected to grow rapidly as EU households and retailers embrace packaging that supports sustainability and convenience.

REGIONAL ANALYSIS Portugal Sweetened Condensed Milk Market Analysis

Portugal led the sweetened condensed milk market in Europe with a 27.7% share in 2024. The dominance of Portugal in the European market can be credited to the deep culinary integration and generational continuity. Condensed milk is central to national identity, featuring in desserts such as pudim flan and beverages like galão doce. Household penetration is among the highest in Europe, with most families keeping condensed milk as a pantry staple. Per capita consumption exceeds 1 kilogram annually, driven by daily coffee rituals and festive baking. Local brands dominate the market, offering formulations tailored to regional preferences. Portugal also exports condensed milk to diaspora communities across Europe, creating secondary demand streams. Government food‑heritage programs actively promote traditional recipes, ensuring intergenerational transmission. With its blend of domestic ubiquity, cultural symbolism, and diaspora outreach, Portugal is expected to remain Europe’s leading market.

Romania Sweetened Condensed Milk Market Analysis

Romania accounted for a promising share of the Europe sweetened condensed milk market in 2024. The growth of Romania in the European market is driven by the Orthodox traditions and rural household practices. Condensed milk is essential for festive baking, particularly in holiday breads such as cozonac. Rural consumption remains high due to limited refrigeration, with canned condensed milk serving as a practical staple. Local producers supply affordable formats through extensive village store networks, ensuring accessibility. Urban demand is growing through café adoption, with condensed‑milk coffee offerings expanding in major cities. Romania’s informal economy also supports small dairies producing condensed milk for local markets. This dual engine of ritual tradition and practical necessity ensures Romania’s sustained leadership in Eastern Europe.

Spain Sweetened Condensed Milk Market Analysis

Spain is estimated to register a prominent CAGR in the Europe sweetened condensed milk market over the forecast period due to the regional dessert culture and strong tourism demand. Condensed milk features prominently in traditional desserts such as leite creme and crema catalana, particularly in northern regions. Tourism amplifies consumption, with millions of international visitors driving demand in hotels, resorts, and cafés. Spanish brands have introduced smaller packaging formats to cater to tourist households and urban consumers. Dairy cooperatives ensura e steady raw‑milk supply, reinforcing production capacity. With its synergy of regional gastronomy, tourism exposure, and dairy infrastructure, Spain is expected to maintain a robust market presence.

France Sweetened Condensed Milk Market Analysis

France is predicted to account for a notable share of the Europe sweetened condensed milk market during the forecast period due to its repositioning from traditional use to premium culinary applications. Condensed milk is increasingly used in fusion desserts and specialty coffee, particularly in urban pâtisseries and cafés. Overseas departments contribute to mainland imports, where Creole cuisine relies heavily on condensed milk. French consumers increasingly view it as an artisanal ingredient, with surveys showing strong interest in creative cooking applications. Domestic brands have responded with premium packaging formats to reinforce gourmet positioning. This shift from commodity to specialty ingredient allows France to maintain relevance despite lower household penetration in metropolitan regions.

Greece Sweetened Condensed Milk Market Analysis

Greece is anticipated to grow at a healthy CAGR in the Europe sweetened condensed milk market during the forecast period due to the religious baking customs and premium dessert manufacturing. Condensed milk is indispensable in festive desserts such as galaktoboureko and kataifi, widely prepared during Easter and weddings. The artisanal ice‑cream sector further boosts demand, with thousands of gelaterias using condensed milk as a natural sweetener and texturizer. Greek producers supply both domestic and diaspora markets, with exports rising steadily to communities abroad. Economic recovery has revived household consumption, with sales growing annually since 2022. This fusion of religious ritual, tourism‑driven foodservice, and diaspora connectivity ensures Greece’s enduring role in the European market.

COMPETITION OVERVIEW

Competition in the Europe sweetened condensed milk market is shaped by a tension between cultural preservation and modernization. The landscape features large multinational dairy processors, regional cooperatives, and small local dairies, each serving distinct consumer segments. Multinationals like Nestlé compete on innovation, distribution reach, and global brand recognition, often introducing flavored or functional variants. In contrast, regional leaders such as Lactogal and FrieslandCampina emphasize authenticity, local sourcing, and recipe heritage to maintain loyalty in core markets. Small producers survive through niche availability in rural areas or specialty retail but face pressure from rising energy and compliance costs. Regulatory scrutiny on sugar content and evolving consumer health perceptions create headwinds, yet cultural entrenchment in countries like Portugal and Romania provides resilience. Success requires balancing traditional utility with contemporary expectations around health, convenience, and sustainability, which is making the market highly localized, emotionally driven, and resistant to generic strategies.

KEY MARKET PLAYERS

A few major players of the Europe sweetened condensed milk market include

Nestlé S.A FrieslandCampina Lactalis Group Danone S.A Arla Foods Müller Group Royal A-ware Hochwald Foods GmbH Morinaga Milk Industry Meiji Holdings Fonterra Dana Dairy Group Yili FrieslandCampina Professional Ehrmann GmbH Top Strategies Used by the Key Market Participants

Key players in the Europe sweetened condensed milk market focus on product reformulation to reduce sugar content while maintaining functional properties required for traditional recipes. They invest in alternative packaging such as resealable tubes to minimize food waste and enhance user convenience. Companies leverage cultural heritage by promoting authentic dessert recipes through educational and digital campaigns to sustain intergenerational demand. Strategic expansion into flavored variants aligned with coffee and dessert trends helps attract younger consumers. Additionally, they modernize production facilities to improve energy efficiency and integrate renewable energy sources in response to EU sustainability mandates and rising operational costs.

Leading Players in the Europe Sweetened Condensed Milk Market Nestlé maintains a strong presence in the Europe sweetened condensed milk market through its globally recognized brand and localized product adaptations. The company leverages its extensive dairy infrastructure to supply both retail and foodservice channels across Southern and Eastern Europe. Nestlé contributes significantly to the global market by exporting European-produced condensed milk to Middle Eastern and African regions, where demand remains robust. In 2024, Nestlé launched a coffee-inspired mocha-flavor condensed milk in Spain and Portugal, specifically designed for specialty cafés and at-home baristas. It also enhanced its canning line in Oeiras, Portugal, to improve energy efficiency and reduce carbon emissions per unit. These initiatives reinforce Nestlé’s strategy of aligning traditional dairy products with modern consumption trends while maintaining production sustainability. Lactogal is Portugal’s leading dairy cooperative and a cornerstone of the Europe sweetened condensed milk market, renowned for its Mimosa brand, which holds deep cultural resonance. The company supplies condensed milk not only domestically but also to Portuguese diaspora communities across Europe and beyond. Lactogal plays a pivotal role in preserving traditional recipes while innovating for new generations. In 2024, it introduced a strawberry swirl flavored variant in resealable tubes targeting younger consumers and expanded its reduced sugar condensed milk line fortified with vitamin D. The cooperative also invested in renewable energy at its Amarante facility, covering 40% of thermal demand through biomass. These actions demonstrate Lactogal’s commitment to cultural stewardship, health-conscious reformulation, and environmental responsibility. FrieslandCampina operates across multiple European markets with a diversified condensed milk portfolio serving both household and industrial customers. The company supplies ingredients to bakeries, ice cream makers, and cafés in Romania, Greece, and the Netherlands, where its consistent quality supports professional applications. Globally, FrieslandCampina exports European condensed milk to Southeast Asia under private label agreements, bridging regional demand gaps. In 2024, the company launched a functional condensed milk variant enriched with prebiotic fiber in the Dutch and Romanian markets and upgraded its evaporation technology to cut energy use by 18%. It also partnered with local schools in Transylvania to promote traditional dessert making using condensed milk. These efforts reflect a strategy grounded in B2B reliability, nutritional innovation, and community engagement. MARKET SEGMENTATION

This research report on the Europe sweetened condensed milk market has been segmented and sub-segmented based on product, packaging, and region.

By Product

By Packaging

By Region

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe