Hi everyone,

I’m hoping someone here might have experience with Swiss taxes and can give me some advice.

I recently received a letter asking me to pay CHF 4,500 in taxes for the year 2023, which really shocked me. The confusing part is that:

• I no longer live in Switzerland and have been officially deregistered since July 2025

• The letter arrived very late, long after the year 2023

• I was employed by a large, well-established company in Zurich

• Every month I received a payslip clearly showing gross salary, deductions, and net salary

• My understanding was that all taxes were properly deducted at source (Quellensteuer) by my employer

Because of this, I don’t understand how I could suddenly owe such a large amount.

A few days ago, I submitted a written objection directly to the tax office. When I spoke to an employee there, he told me:

• He doesn’t know when I’ll get an answer

• The payment deadline is one month

• I should pay first, and if my objection is accepted, the money would be refunded later

Honestly, I’m quite worried. CHF 4,500 is a lot of money, and I’m afraid that if I pay now, the process could drag on for months (or longer), and I might never see the money again — especially since I genuinely believe this amount is incorrect.

I only lived in Switzerland for a few years, so I’m not fully familiar with the tax system here.

Has anyone experienced something similar, especially after leaving Switzerland?

Is it really normal to pay first and sort it out later?

Any advice or insight would be greatly appreciated.

Thank you very much!

by moulaga77

33 comments

Hehe. You will also get the Tax Bill for 2024 since you left only this year in 2025.

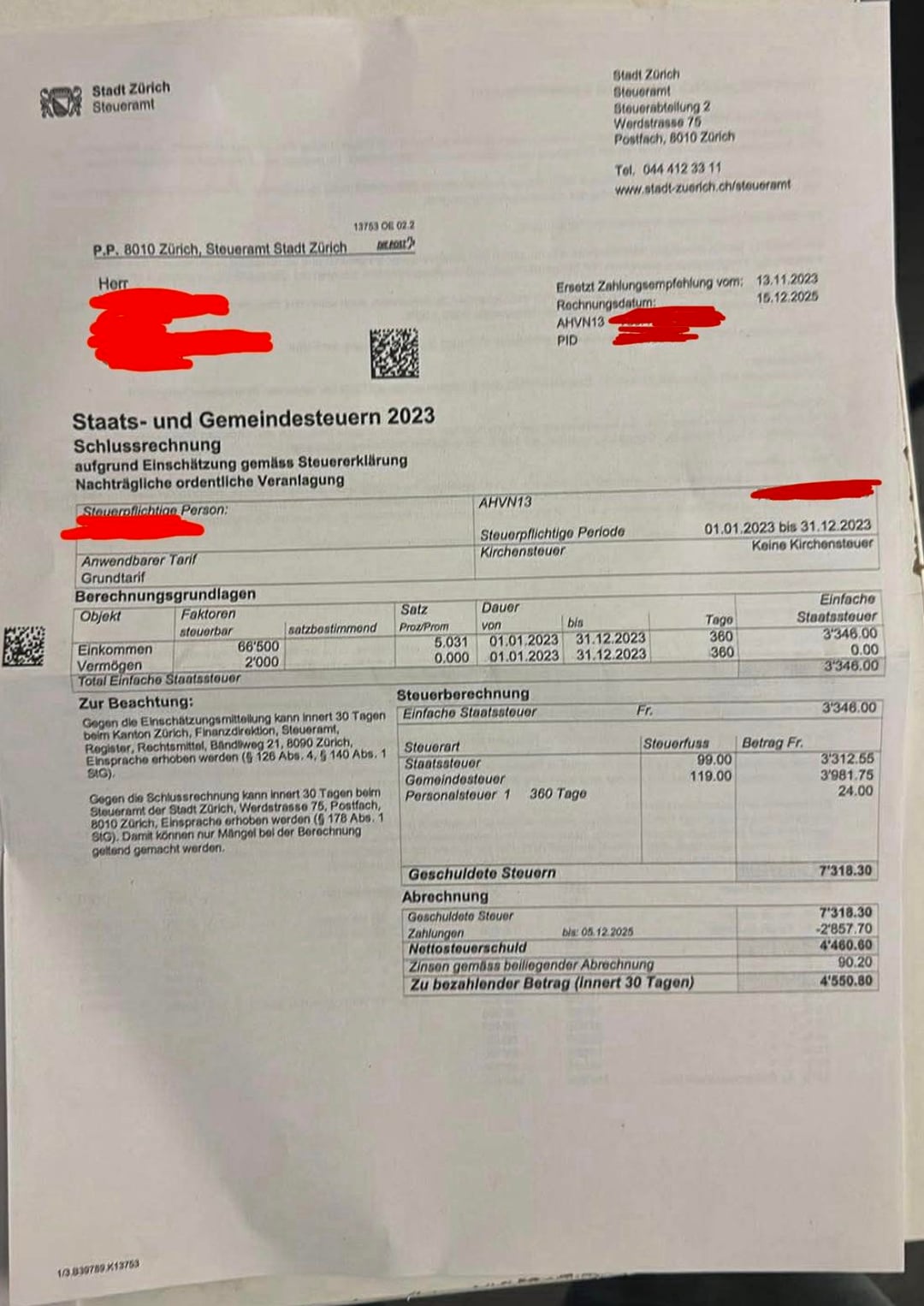

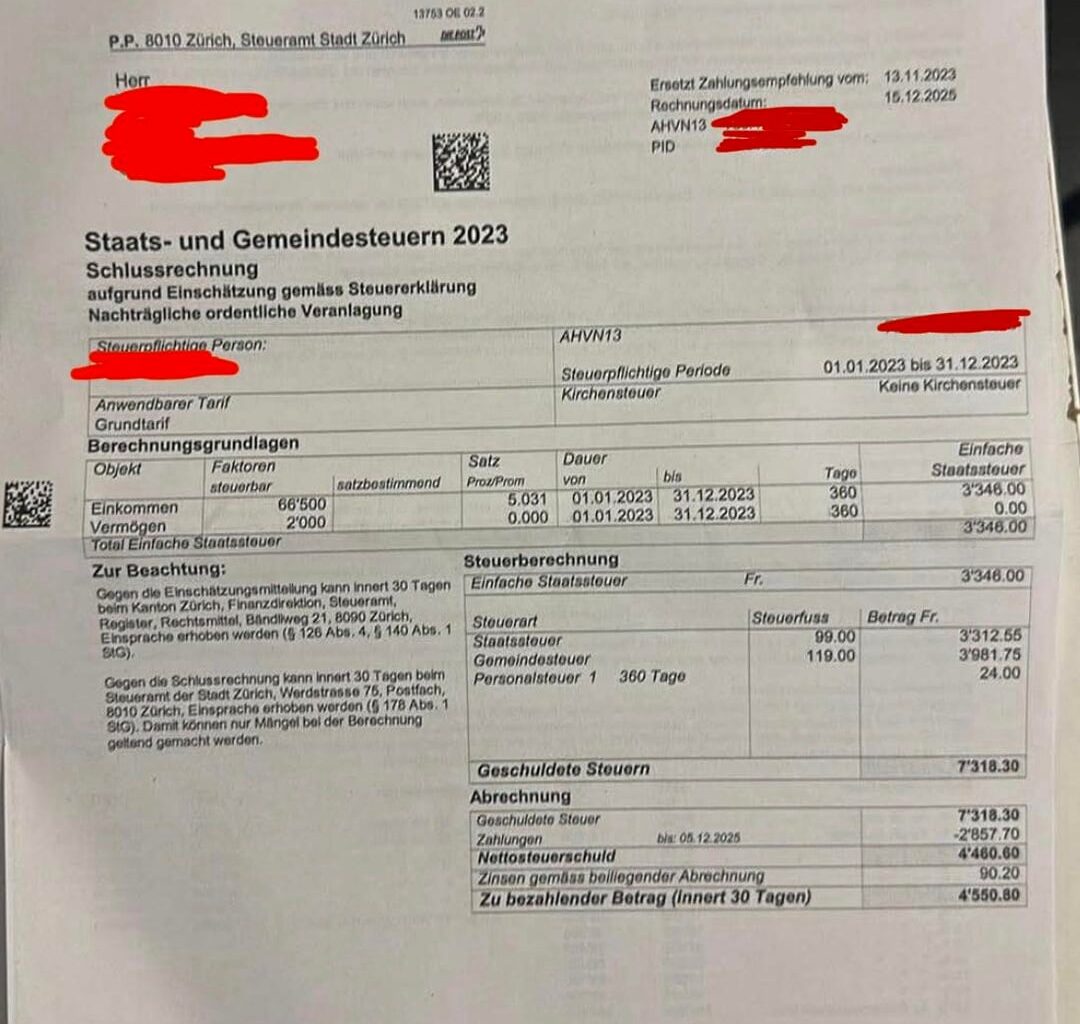

Pic 1 tells you everything you need to know. And yes, you have to pay taxes in Switzerland like everywhere else.

My assumption but not legal advice

If you worked in 2023 you have to pay income taxes for that year. The deductions were for AHV, BVG and accident insurance

you didnt submit your tax declaration for 2023, so they estimated your income instead. that always comes with a premium.

youll also receive a tax bill for 2024

Looks like you are on Quellensteuern. Did you request a “Nachträgliche ordentliche Veranlagung” in 2024 (or any earlier)? If you did not, this looks very strange

Honestly not sure about the pay first / pay later. If you can I would go directly to the office with your Salary certificate for the year 2023 and let them sort it out.

Did you ever file taxes while living in Switzerland? This is not mandatory under B permit (except if you do it once you have to always do it for subsequent years or if you earn or have Vermögen above a certain threshold (the above is below it)). The quellensteuer already paid was properly accounted for (2.5k paid in first line on second picture). I am wondering if you maybe submitted a tax file in 2022 or before and therefore were required to filed one for 2023, didnt and then now you get the final tax bill for 2023 without much deduction since you dodnt file them yourself.

Did you file a tax return? Because the bill states that it is based on the filed tax return.

Often source tax is not enough to cover all of the tax liability, especially since the city has a high tax rate. Therefore you have an outstanding amount.

Super stupid question but how did you receive the letter? Your say you are deregistered? I am honestly not sure they can make you pay the bill, so maybe don‘t – at least until you figures out if it is right.

Edit: quite normal to receive a bill this late. There is a bit of a backlog apparently..😅

Would be useful if you declared your situation like zipcode, marital status and age. IMO it’s very strange that the paid tax at source is so different from the actual tax calculated by authorities.

Did you have a Quellensteuer deduction?

If you earn more than (I think) 120’k/y you still have to file a Steuererklärung. It looks like you did not and they assumed an amount (Einschätzung).

I would call them and see whats up – tell them you didn’t know and ask polity if they might still let you file. The rate in this case is higher (Einschätzung) and you could save a lot – had a similar situation in the past and it was almost 50% lower.

Just in case: This is for 2023 – if you left in July’25 you might still need to file for 2024 and 2025. Ask them about that as well if you already call.

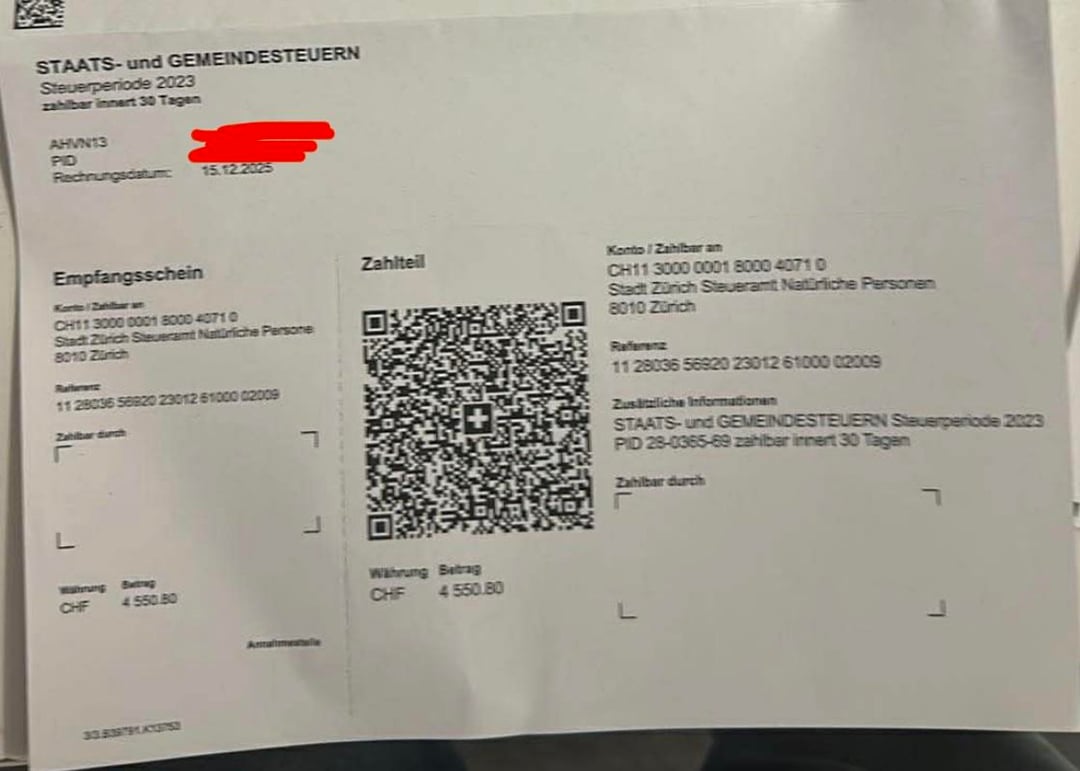

Nice of you to include the QR code, but I’m afraid I’m not gonna pay that tax bill for you.

“Is it really normal to pay first and sort it out later?”

This has been normal in all countries I have lived. First you have a tax estimate, and all the payments you do, including source tax, is actually just an estimate. Then later you file your taxes, the tax office calculates the final amount, and you get a refund or additional invoice. In Switzerland the tax office agas 5 years deadline to provide final calculation and invoice, which means you might get your invoice from 2025 as late as 2030.

From what I read you, had Quellensteuer.

So did you have work Permit B?

Did you earn under CHF 120k or over?

Contact also you’re companies HR, since they were in charge to ensure they submit everything correctly.

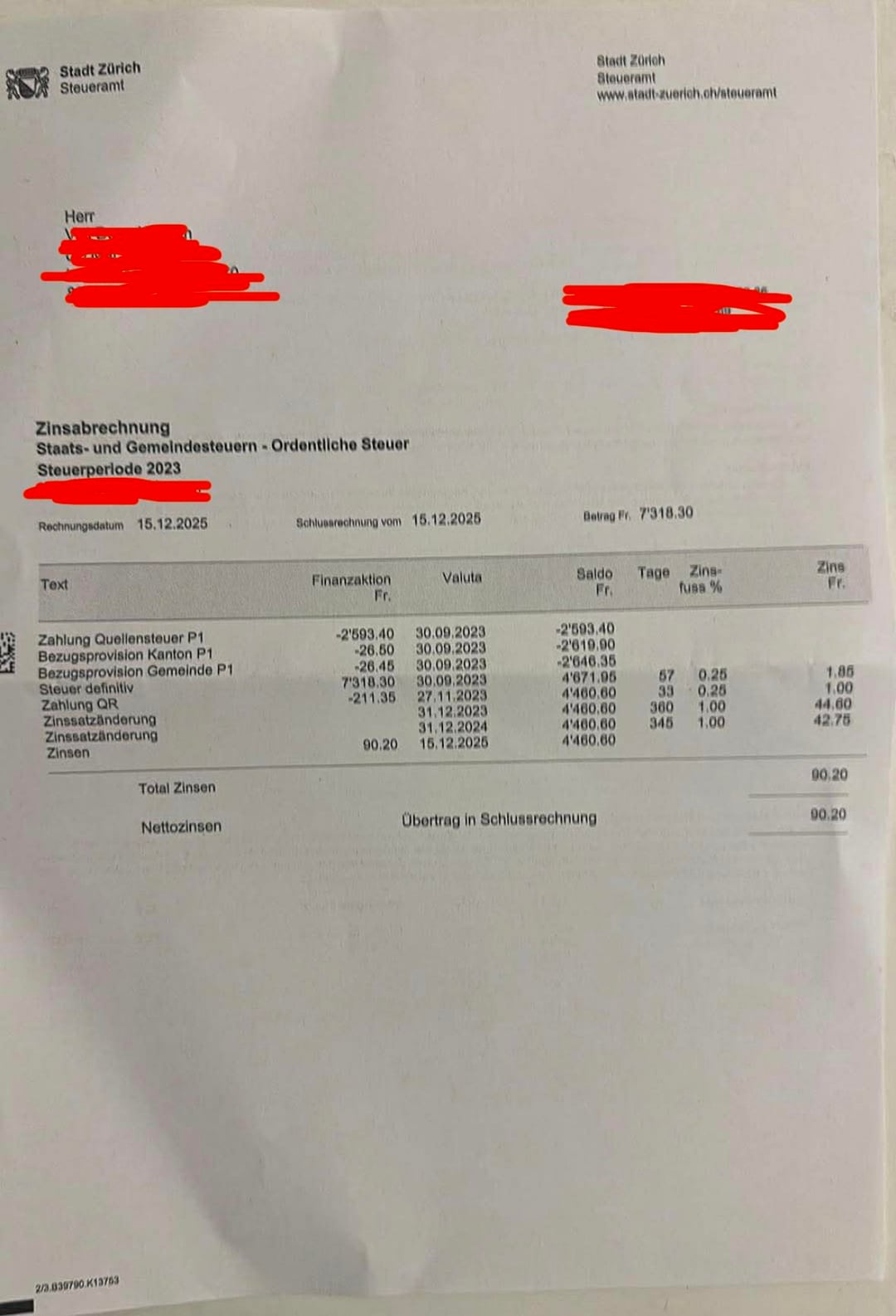

You paid Fr. 2593.40 direct over your employer (Quellensteuer). But it looks like this was way to less.

It looks like you have filled out a tax form. Hopefully for 24 too. Normaly when you officially leave you should also have done this for 25 until you left.

Zurich is behind a few years with the taxes. Talk to them again. You have to take action now. And you will also have to pay for 24 and 25.

Well, the tax at source that was deducted from your salary (2593.40 for a whole year) is way too little to be correct. Did you maybe switch to C permit some time in 2023?

[see chapter 3 Merkblatt zur Quellensteuer, enjoy](https://www.zh.ch/de/steuern-finanzen/steuern/treuhaender/steuerbuch/steuerbuch-definition/zstb-87-3.html)

You will receive Swiss tax bills after your own desmise. Get used to it

OP you will also have to file a departure tax return for 2025 (part-year resident) if I’m not mistaken.

Look into this and pay your taxes. Don’t tax evade like some are suggesting, this will bite you in the ass.

Hey

My friend works there. If you exceed a certain amount earned or have a certain amount of wealth, you need to pay taxes on top of souce tax. Just make an email (you can find it online) ask for 6 months more to pay or for 6 part payments per month (they will always grant you this) and the reason you are paying taxes (being NOV – nachträglich ordentlich veranlagt). If you submited your tax declaration, you need to pay the invoice. They will answer to your email within a few days.

Also if you submitted the tax declaration once for having a bigger amount to deduct from you income, you‘ll have to do it every subsequent year (you can‘t stop doing it once you started).

Pro tip: If you don‘t come back to Switzerland, you can just not pay it. There is nothing they can do to get the money from you abroad. However, if you want to come back later, you should pay it.

Well, the calculation is pretty transparent:

– It has been determined that you owe 7318 .- in taxes

– You have only paid 2593 .- through taxation at source

– Now they want to collect the difference

The 7318 .- they want from you is pretty much exactly the “correct” amount for your taxable income of 66500 according to Zurichs tax calculator (when using normal rates).

So there seems to be nothing wrong about the amount per se.

The more interesting question is, why you only paid such a low amount through taxation at source. Having paid only 2593 .- source tax would indicate a significantly lower taxable income than the 66k you apparently earned.

Did you have an additional income that was not taxed at source? Is there a chance that for some reason your employer didn’t deduct source tax for your whole salary?

Oh my – not the kind of holiday surprise one hopes for, is it.

I’m sorry you’re having to deal with this.

For what it’s worth, I’m sure this mess can be resolved in due course.

Two mechanisms are at play here:

1. [**Tax at source does not necessarily cover the** ***entire*** **tax owed, deductions are** ***preliminary*** **and based on an average, and the** ***definitive*** **bill can differ.**](https://www.zh.ch/de/steuern-finanzen/steuern/quellensteuer.html) Meaning you may still owe taxes after being taxed at source. If your income rises above a certain threshold, taxes can still be owed after the fact, and the tax authority will do a assessment in hindsight called a [**nachträgliche Veranlagung**](https://www.zh.ch/de/steuern-finanzen/steuern/treuhaender/steuerbuch/steuerbuch-definition/zstb-87-3.html#1509032720)**.** In this most recent bill they sent you, it states that source tax in the amount of CHF 2’593.40 were paid for you, and that the definitive bill for 2023 was CHF 7’318.30, meaning you still owe them for 2023 (and for 2024, and for half of 2025 – but those final reminders will come in later).

2. Tax authorities, **if they do not hear from the taxpayer** (because said taxpayer did not file a tax declaration, left out information, did not respond to the tax authorities’ letters, did not pay an amount due…) will either set an **estimate** and tax based on that (this estimate is usually quite a bit higher), and/or they will slap on interest and compound interest, and ultimately they will start debt enforcement proceedings.

From this bill pictured, it looks to me (mind you, I’m no tax expert) like you owe this tax for an assessment in hindsight.

If you disagree, you can evidence your disagreement using **proof of payment** and **prior letters from the tax authorities** and the **tax statements** you received from your employer.

>My understanding was that all taxes were properly deducted at source (Quellensteuer) by my employer

Is this understanding based on a **salary statement** from your employer that explicitly **states the** ***tax*** **deducted at source?**

Remember that deductions for AHV, IV, EO, UVG & PK are *not* taxes, so my question to you is whether you have documentation from your employer stating they paid your source tax.

Again: Even if there were taxes deducted at source, it may not have been enough to cover the entire bill, which can only be billed after the definitive numbers are in after the fiscal year ends.

So yes, all this can take a while.

>Is it really normal to pay first and sort it out later?

It’s normal to pay taxes ahead of the due date.

Or upon receiving de definitive bill.

Or at the very latest upon the first reminder for definitive bill.

The issue here is that this is the umpteenth reminder with the *final 30 day extension.*

If you thought you could skip town without sorting this out, the tax office is now showing you that you need to think again.

If the amount billed in the final reminder is not paid, the following will happen:

1. Further interest accrues, the amount rises. As it stands now, you already owe CHF 90.20 in interest, and that amount will compound rise every day.

2. The tax office, after having sent reminders and letters to no avail, can start[ debt enforcement proceedings](https://www.ch.ch/en/taxes-and-finances/debt–debt-enforcement-and-bankruptcy/debt-enforcement/), in which case the cost can skyrocket very fast, because you as the debtor have to pay for the debt enforcement process.

TL; DR: You did good in contacting the tax authorities, and if you can document in writing that you or your employer did pay *all* the source tax you owed, this will all resolve itself nicely.

Tax offices will be open again as of January 5th.

Happy Holidays

You did a tax declaration in 2023 so that’s the starting point, and you already paid Quellensteuer of approx Fr 2800 so that will be deducted from any final bill.

According to your tax bill above you had a taxable income of Fr 66500 giving you a tax bill of Fr 7300, less your QS of Fr 2800 leaving you with a bill for Friday 4500

Assuming the taxable income of Fr 66500 is correct, then you would in fact owe the balance of Fr 4500.

I work in taxes, the tax bill is not final nor enforceable if you submitted a claim against it within 30 days

this being said, late payment interests will continue to run until the date of payment

also if the numbers indicated are correct (ie taxable income) then there is very low chance you will not have to pay this 4500…

i would ask the HR of your company why the tax at source was so low… this seems very weird!

however in the end you are liable for taxes on this amount… if i were you i would prepare a full tax return and include all deductions to check whether the taxable income they’ve retained is correct. if not, you can always send them this new tax return (even if you’ve already sent the claim, its fine)

You‘ll have to pay it. You can see that the payments made by your employer already have been substracted. I don‘t see anything wrong with this letter except for it only coming this late.

You need to recon 1.5-2 months worth of salary for taxes in switzerland. So 7300 actually seems pretty low to me (obviously depemding on what you earned).

If you haven‘t yet paid the other taxes (2024/2025) prepare, because they will also still come… sorry to break the bad news.

earn a swiss salary but surprised to pay swiss taxes. welcome

Does this Quellensteuer also apply for people who worked and lived in Switzerland for just 1 or 2 years? Because normally, at least that’s told to me, the first 5 years working there the company where you work automatically takes the tax amount from your wage to immediately pay to the government, right? You get paid net and don’t have to deal with tax bills.

Pay up or our SpecOps will come get you

the sheer amount of people not understanding swiss tax code is astonishing

taxes are paid after the year has passed. In case you had to pay but did not declare, the tax office will come back to you and demand the tax be paid in retrospect. THere is nothing you can do else of: 1) paying, 2) ignoring and risking a fine/problems at the borders 3) appealing if you think the amount is not correct, which I would not do, it seems reasonable.

#good luck for paying taxes for 2024 and 1/2 of 2025 as well…

You still owe money – time to pay up!

SWISS authorities are very good at paying- repaying what they owe you so you don’t have to worry about not getting it back

Similar thing happened to my partner ages ago because her employer accidentally had put her in the wrong tax bracket and therefore her tax at source was too low – hence a big bill afterwards. We the had a similar issues 3 years later when both of us got the full child tax credit ( not married) and when we got the tax bill both of us got only half ( which is the right thing to do )- but the tax amount went up.

Uhhh just cuz you left doesn’t mean back taxes aren’t owed. 3 years after I left France I got one of these. You have to pay.

Whx didn’t you hide the QR code. Do you want us to pay for you?

There are infos in it

Comments are closed.