I’m looking at mortgages in Poland and I’m honestly shocked by the total cost.

I’ll attach a chart in the post, but the idea is simple:

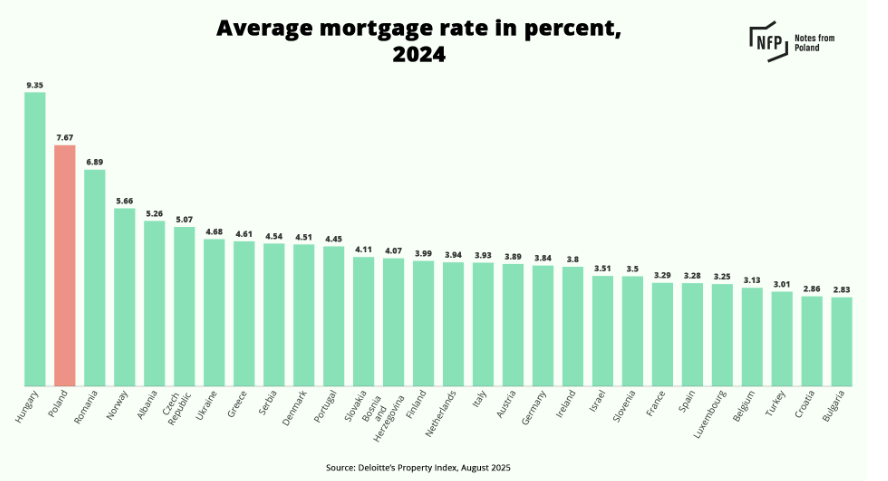

If I borrow €120,000 in Poland at around 8%, over the full term the total extra cost (interest) comes out roughly €140,000, so you end up paying about €260,000 in total.

In Spain, for the same €120,000, the total interest would be closer to €60,000 (so €180,000 total).

I get that rates differ by country and macro conditions, but this gap feels huge. For people who bought in Poland recently:

Is this actually how it plays out in real life, or am I missing something (fees, fixed vs variable, term assumptions, early repayments, renegotiations, etc.)?

If you’re in Poland: what rate did you get, fixed/variable, and what year did you sign? Any tips to avoid overpaying (e.g., refinancing strategies, shorter term, bigger down payment)?

(Posting mainly to understand what’s “normal” here and what’s just worst-case math from the calculator.)

by Professional-Tax3077

29 comments

This is unfortunately normal, but you’re forgetting to factor in the currency difference. In Poland, PLN has a higher inflation rate than the EUR. Factoring in the inflation difference you’ll come up with a similar (still worse in Poland, just similar) end value after paying it off. Ideally, overpaying monthly will significantly reduce the final interest cost.

Poland has higher inflation and a much much faster growing economy than Spain as you brought up. That usually means higher mortgage rates

>Is this normal?

Yes.

https://preview.redd.it/tb2by56gyj9g1.jpeg?width=921&format=pjpg&auto=webp&s=b0c29f491dcd0f13a60f22fb215d35c6d02bf7c0

I’m more confused by how Turkey has the 3rd lowest mortgage rate with a 38% interest rate

https://preview.redd.it/fpbte5za0k9g1.png?width=776&format=png&auto=webp&s=838dd595ef0a699efb58abb80a669306282f613e

That’s probably the last thing that stops apartment prices from going totally insane. Housing market in Poland is already totally sick, because it is absolutely detached from peoples income. To solve this we have to limit loans so the prices must be more rational or you would not sell it at all. Currently developers can give us literally any price, and still there will be someone to pay – 30 years loan instead of 20 years, what is the difference? You will always find someone more desperate.

Hopefully in december 2025 it’s 6% not 7.5%

In Poland most mortages are related to POLISH interest rate, which is higher than EUR or USD. PLN has higher rate. Inflation is sub 2,5% so below target, but interest rate is like 4%.

It is tense topic, since there is a space for lowering it more, but also polish monetary economist have stick in ass in general, since in 90s there was mass inflation period, so they are always safe player, extra safe to the level of deflation.

Which is probably bad, since with lower rates poland could get some extra jobs.

There is extra layer, as there are bank taxes on volume of borrings, which could work similar to extra interest rate. Polish Bank sector quite competitive (many banks) and some are national (state owned), so they are not particulary greedy (but a little yes).

This isn’t normal, or at least shouldn’t be…

I took a loan in Slovakian bank.

I hope that our currency won’t crash in the next 5-7 years, so I can repay my mortgage.

It’s so much cheaper in euro.

Join the eurozone -> lower interest rates -> lower costs -> lower mortgage costs. But the poor do never understand and the populists feed this dumbness.

Because we are rich and we want to pay more.

Thank you for your research,

Now check what’s central bank and who sets reference rates. Then cry

Yes we like to pay more

I got a 250k mortgage last year in Estonia. 1.35% bank margin + EURIBOR.

No ale jakie PKB mamy.

Unfortunately, the mortgages in Poland are expensive. The best way to save money is overpaying. Essentially, take a loan with a monthly payment of X for maximum length allowed if you know you can pay monthly at least 2X.

Poles like expensive electronics, palm oil, expensive mortgages…

7.67 is actually insane bro

Fixed mortgage rates are driven by the bond market:

Poland 10y bond rate ~ 5.2%

Spain 10y bond rate ~ 3.2%

60% higher in Poland.

AFAIK there are concerns about an economic bubble driven by all the mortgages similar to the US in Poland. When this bubble explodes, you’ll see many people getting instantly poor. It will be a disaster.

Oh and it gets worse, the % isn’t fixed – it changes, so you can pay 5% one month and in 6 months it might be 8% so yeah, it’s messed up. The % of loans with the variable interest rate is the highest in the EU with around 90% being that.

Oh and it gets worse, the % isn’t fixed – it changes, so you can pay 5% one month and in 6 months it might be 8% so yeah, it’s messed up. The % of loans with the variable interest rate is the highest in the EU with around 90% being that.

Yes. Try to take out a shorter loan. I borrowed for 15 years and hope to make overpayments once renovations are complete, to pay it back with less interest.

One set of variables can be so misleading. I used to live in Netherlands where the mortgages are relatively cheap but the housing market itself is hard to access. In Poland it’s expensive but I try to pay extra each month to limit the interest

Different countries have different interest rate. Euro zone is one of the lowest. In USA mortgage have the same interest rate as in Poland. In UK they are also more expensive than in euro zone. At the end you should not worries about nominal interest rate, but about real interest rate(interest rate- inflation) because if you have like 20% interest rate, and 22% inflation, it mean you have -2% real interest rate, and at the end you will get profit from the mortgage

Yes. That’s why on average, mortgages here are paid off in 11-13 years.

Also we consume less (ie. older, cheaper cars) because debt is expensive.

…and since we don’t have rent control, it’s usually cheaper to buy than rent anyways.

Euro vs Non Euro

The highest one are all outside the Eurozone, for the exception of Greece and Portugal. And still don’t want to be in the eurozone. Their loss….

Wszystko przez Glapińskiego

Comments are closed.