Europe Beef Market Snapshot

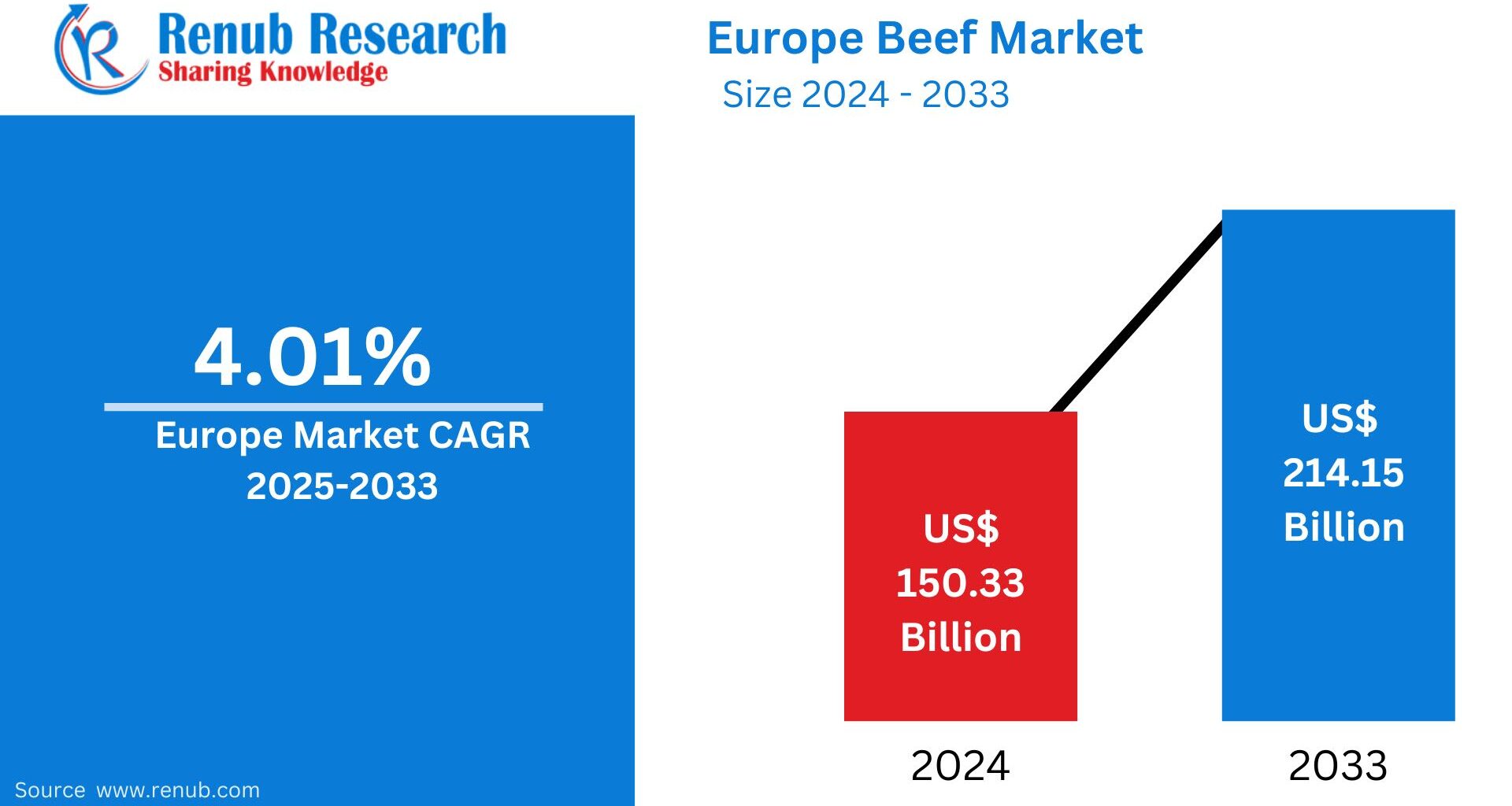

The Europe Beef Market is projected to grow from US$ 150.33 billion in 2024 to US$ 214.15 billion by 2033, registering a CAGR of 4.01% from 2025 to 2033, according to Renub Research. This steady expansion is being fueled by rising demand for premium protein, technological upgrades in meat processing, expanding export opportunities, and supportive government initiatives promoting sustainability, traceability, and animal welfare across the European Union.

Europe Beef Market Overview

Europe has a centuries-old legacy of cattle rearing and beef consumption, making the sector a cornerstone of the region’s agricultural economy. Major producing and exporting nations such as France, Germany, Ireland, Spain, and the United Kingdom contribute significantly to both domestic supply and international trade.

European beef enjoys a strong reputation for high quality, traceability, and safety, underpinned by strict EU regulations governing animal health, slaughter practices, labeling, and cold-chain logistics. Advanced infrastructure and integrated supply networks ensure efficiency from farm to fork.

Sustainability has emerged as a defining theme. Consumers increasingly demand eco-friendly production, transparent labeling, and high animal-welfare standards, prompting producers to adopt regenerative grazing, precision livestock farming, and carbon-reduction practices. At the same time, digital traceability systems are enhancing trust and accountability across the value chain.

However, the industry is also navigating structural challenges. Climate policies under the European Green Deal, concerns over methane emissions and land use, and a gradual shift toward plant-based diets are reshaping demand patterns. In response, the beef sector is innovating—balancing productivity with environmental responsibility to remain competitive.

Key Factors Driving Europe Beef Market Growth

1. Advancements in Production and Processing Technology

Technological progress is a major catalyst for growth in Europe’s beef industry. On farms, precision feeding, genetic optimization, and data-driven herd management are improving animal health, productivity, and feed efficiency. These innovations help reduce costs while aligning with sustainability goals.

At the processing level, advanced slaughtering, chilling, and cutting technologies ensure consistent quality, hygiene, and traceability. Packaging innovations—such as vacuum sealing and modified atmosphere packaging (MAP)—extend shelf life, minimize food waste, and enhance export readiness.

Together, these advancements allow European producers to meet rising quality expectations while complying with some of the world’s strictest food safety standards, supporting long-term market growth.

2. Expansion of Export Markets

Europe’s reputation for premium, responsibly produced beef is opening doors in Asia, the Middle East, and North America. Growing middle-class populations and demand for high-quality protein are driving imports of European beef, particularly products certified for halal and kosher markets.

Trade agreements, branding initiatives, and compliance with international standards are helping European exporters penetrate new markets. Export growth also provides a buffer against fluctuating domestic consumption, stabilizing revenues and enhancing profitability for producers and processors alike.

3. Innovation and Product Diversification

Changing lifestyles and dietary habits are accelerating product innovation across the European beef market. Beyond traditional cuts, producers are expanding into value-added products such as marinated meats, pre-seasoned portions, ready-to-cook meals, and convenience-focused packaging.

Premium categories—including organic, grass-fed, locally sourced, and ethically produced beef—are gaining traction among affluent and environmentally conscious consumers. This diversification helps brands differentiate themselves, strengthen customer loyalty, and capture new growth opportunities despite competitive pressures.

Challenges Facing the Europe Beef Market

Environmental and Sustainability Pressures

Beef production is under increasing scrutiny for its environmental footprint, particularly regarding greenhouse gas emissions, land use, and water consumption. EU initiatives such as the Farm to Fork Strategy and broader climate targets are pushing producers toward lower-carbon practices.

While sustainable farming methods—like regenerative grazing and improved manure management—offer long-term benefits, they require significant upfront investment. Compliance costs and operational complexity remain key challenges, especially for small and mid-sized farms.

Shifting Consumer Preferences

Health, environmental, and ethical concerns are influencing European consumers to reduce red meat consumption, particularly among younger demographics. The rise of plant-based and flexitarian diets is reshaping demand, putting pressure on traditional beef volumes.

To stay relevant, producers are responding with leaner cuts, organic and grass-fed options, and hybrid meat-plant products. Adapting to these evolving preferences is essential for maintaining market share in an increasingly health- and sustainability-focused food landscape.

Europe Beef Market Overview by Country

Germany Beef Market

Germany remains one of Europe’s most important beef markets, supported by a strong retail sector and high consumer standards. Demand is increasingly shifting toward organic and sustainably sourced beef, driven by transparency and animal-welfare concerns. Despite declining per-capita consumption and rising production costs, Germany continues to adapt through enhanced traceability systems, local sourcing, and digital retail platforms.

France Beef Market

France is a leading producer, renowned for premium breeds such as Charolais, Limousin, and Blonde d’Aquitaine. The market emphasizes traceability, origin labeling, and sustainability, with growing adoption of low-emission grazing practices. While challenges include declining production and farmer profitability, France remains resilient through innovation, cooperative farming models, and premium product positioning.

Italy Beef Market

Italy’s beef market is deeply tied to its culinary heritage, with native breeds like Chianina and Piedmontese prized for quality. Although per-capita beef consumption has declined significantly over the past decade, demand for premium, traceable beef remains strong. Imports—particularly live cattle from France—play a key role in supply, while sustainability initiatives continue to shape the sector’s future.

United Kingdom Beef Market

The UK beef market is characterized by strong demand for ethically sourced and high-quality beef, alongside growing scrutiny over sustainability. Rising production costs, labor shortages, and dietary shifts present challenges, but innovation in farming practices and value-added products is helping the sector remain competitive.

Recent Developments in the Europe Beef Market

2024: IMI Global entered a strategic partnership to support U.S. CattleTrace, enhancing rapid contact-tracing databases and advancing cattle verification capabilities. This reflects a broader industry trend toward digital traceability and biosecurity.

2023–2024: Major global players showcased premium and halal beef portfolios at international trade events, reinforcing Europe’s integration within global beef supply chains.

Europe Beef Market Segmentation

By Cut

Brisket

Shank

Loin

Others

By Slaughter Method

Halal

Kosher

Others

By Distribution Channel

Supermarkets & Hypermarkets

Retail Stores

Wholesalers

E-Commerce

Others

By Country

France, Germany, Italy, Spain, United Kingdom, Belgium, Netherlands, Russia, Poland, Greece, Norway, Romania, Portugal, Rest of Europe.

Competitive Landscape

The Europe beef market is moderately consolidated, with global and regional players focusing on scale, traceability, sustainability, and branded premium offerings. Key companies profiled in the market include:

JBS S.A

Tyson Foods

Pilgrim’s Pride Corporation

Danish Crown Group

Vion Food Group

WH Group

Hormel Foods Corporation

Muyuan Foods

Each company is evaluated based on company overview, leadership, recent developments, SWOT analysis, and revenue performance, highlighting competitive strategies and growth positioning.

Final Thoughts

The Europe Beef Market is entering a phase of balanced transformation—where growth is driven not by volume alone, but by quality, sustainability, and innovation. With market value expected to exceed US$ 214 billion by 2033, Europe’s beef industry remains resilient despite environmental pressures and shifting consumer preferences.

Producers that successfully integrate technology, traceability, premiumization, and sustainable practices will be best positioned to thrive. As Europe continues to align agricultural productivity with climate and health objectives, the beef sector’s ability to adapt will define its long-term competitiveness in both domestic and global markets.