California Proposition 13 defenders say it allows seniors to live in their home without being priced out.

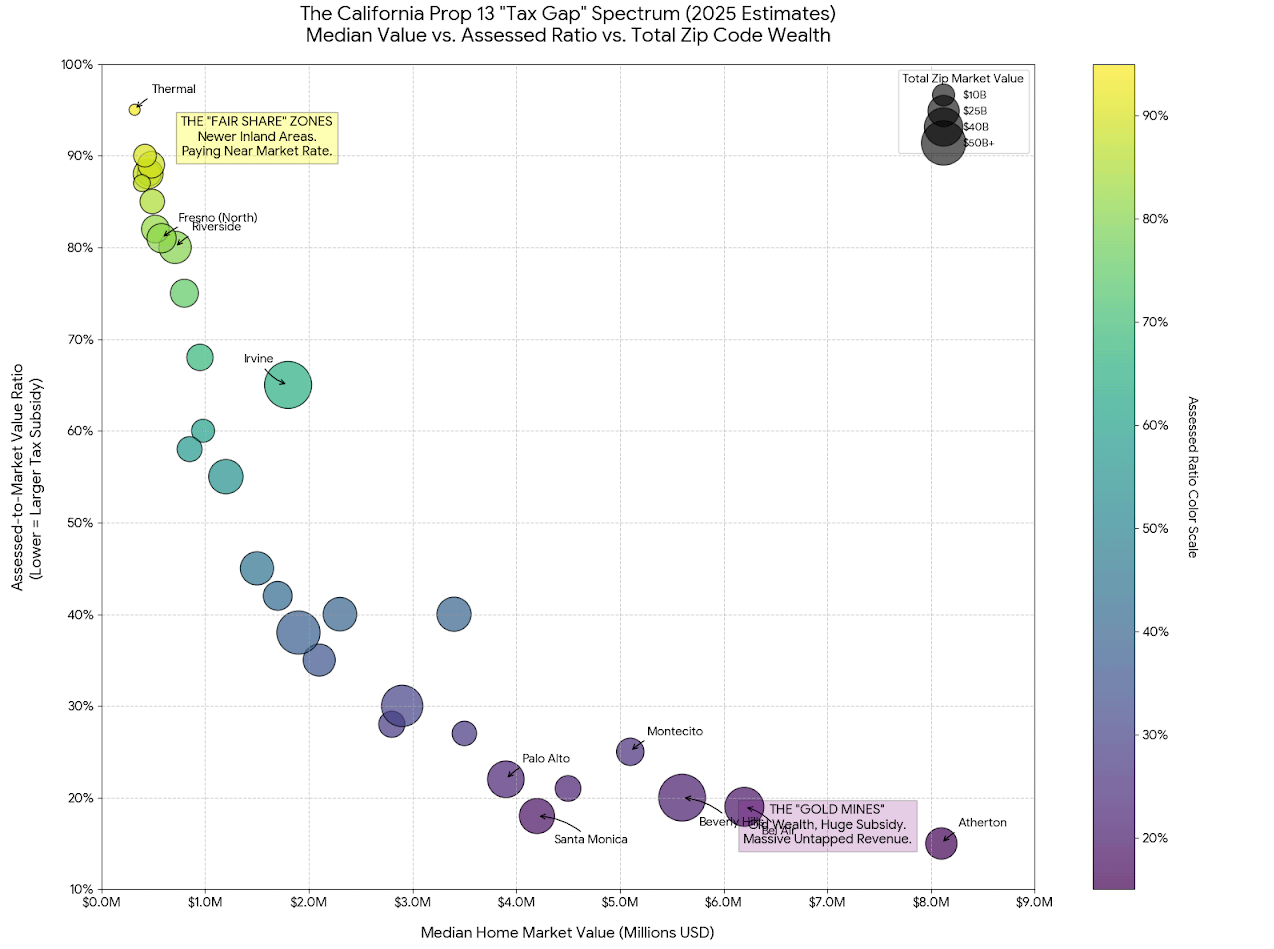

The reality is that it subsidizes the wealthiest people, in Atherton, Beverly Hills and Palo Alto, who probably have multiple homes anyway like billionaire VCs and tech execs

We could stop subsidizing those billionaires and cut property and income tax rates for everyone, if we trim prop 13 to just a means tested benefit for the primary residence

On top of that, it will make the housing market more liquid and fair, especially for first time home buyers.

Posted by orijing

28 comments

Is there a source for this?

If prop 13 was actually about seniors, it wouldn’t apply to commercial properties. The “helping seniors” is just a thin veneer to give a major tax cut to already wealthy people and entrenching their wealth while hampering the social mobility of any newer residents.

To be fair, to evaluate the “helping seniors” statement we would need some demographic data, like % of residents who are senior in each city.

In any case, a home being assessed at 20% of it’s market value is outrageous.

As somebody with a hosue in Atherton, I think my taxes should be higher. But to my mind, it makes more sense for it to come in the form of higher/more progressive income tax or even a wealth tax. Property taxes aren’t correllated enough with wealth dichotomies.

I know that this is spiteful, but I’d vote for a law if its only effect was hurting people who live in Atherton.

California Reagan Republicans wrote the proposition so this is what we expected.

This only shows a smattering of zip codes or cities. I’d love to see one that fully represents the data so I’d know if there were any odd outliers or if the selected data is representative of the whole.

> The reality is that it subsidizes the wealthiest people,

And the oldest people! In most of California’s Bay Area, you can zoom in, and see homes bought in the 1980s and 1990s paying around $2,000-$5,000 per year property taxes on $1M-$5M homes.

But anyone who has purchased their home since 2010? That person is likely paying as much as $25,000 per year in property taxes, and for no reason other than the purchase date, even next door to the other house in my example, paying one tenth as much property tax.

See for yourselves. Every Bay Area property shown with property taxes paid: https://www.officialdata.org/ca-property-tax

I cannot believe people are arguing against prop 13. One of the few pieces of legislation that CA got right.

Why should a homeowner, who purchased a home for

$500k in 2019, pay property taxes on the 2026 value of $1.5m? They are not responsible for the inflationary surge in value. They do not benefit, monetarily, from the surge in value. If the property taxes reflected the paper value of the home, they could very well be priced out of living there and lose their home. To the younger millennials and gen z who are frustrated because they can’t afford a home and think, “good!” – who do you think buys the home after the family who paid $500k loses it? A wealthy person who can afford the $1.5m. Not you. You dont benefit from appealing prop 13. No one does but those who are wealthy and can come in and swoop up properties in foreclosure from those who arent wealthy

Yeah, very beautiful. Especially this part.

https://preview.redd.it/p6umdw0kvu9g1.png?width=336&format=png&auto=webp&s=28828827a5f91cf9bdd6801e92e96c7330cec90c

I live in Illinois and get to watch as working families and seniors are getting taxed out of their homes as every petty govt entity can write themselves a blank check and raise taxes to whatever they want deep in the bowels of various local comittees. Since noone really knows who they are except the insiders who beneift they are never held accountable. Illinois badly need a proposition 13 because we have a people that serve the government instead of a government that serves the people.

Prop 13 is the worst policy CA has in my opinion. It robs the schools and is just a tax break for people who have already made it.

The biggest harm though as the OP tangentially notes is the liquidity issue. Imagine you scrap together enough to buy a house somewhere in greater LA. You get in. Now you change jobs and your new job is on the other side of LA from where you purchased your house. Now you commute a vast distance every day to get there worsening pollution, wasting your time, and more and why? Because there is no house you can buy that will give you as good a deal. You are now a prisoner of this house you randomly picked in time.

I’m very very very happy I don’t live in CA anymore. I live where schools are good because local taxes fund them and taxes on houses reflect the value of the houses, it is an actual tax on the wealthy who have 20 million dollar houses just miles from where I live in a modest house.

Repealing prop 13 should be a movement from the bottom, but its very hard to dislodge the upper middle class who also rule through NIMBY and zoning to screw general society. I myself am upper middle class but I vote every time for more housing and transit and development not to protect my little yard frozen in time.

If they cared about keeping seniors in their homes, they would have written it with age and/or income limits. Many other cities have rules like this.

Prop 13 has never been about that. It is about protecting assets for the wealthy.

Ah yes this is the reason why I pay $14k a year on my 900sqft home bought in 2022 when all of my neighbors pay 8k on 2000+ sqft homes

So let’s tweak it? No commercial. Means test residential.

Redditors all think it’s welfare for the rich but folks like me can only afford our homes that we bought at the bottom of the crash because we assume a stable tax rate.

Age discrimination should be unconstitutional.

Yes, there are people living in $7 million-$20 million homes in Beverly Hills that they bought decades ago and are paying a pittance in property taxes. I recently saw one house that sold for $7 million, and the assessed value was $400,000, meaning their property taxes were only about $5-6k a year. The new owner will be paying about $80,000 a year in property taxes for the same house. Also, tens of thousands of rich people in California own vacation homes and many of them are paying a pittance in property taxes on those too. At minimum, prop 13 should be reformed to only apply to a primary residence.

It subsidizes people who don’t die, i.e., corporations. The eventual outcome of Prop 13 will be that everyone will be renters except those so wealthy that property taxes don’t matter.

Yeah let’s just stop taxing rich people and let’s also pretend rich people aren’t really rich they’re paupers

This is another example of why property taxes makes no sense not so ever! I have a solution for that “get rid of it!!!!” and replace it with a sale tax on houses, all of a sudden all the problems you are talking about are resolved.

We could solve the Prop 13 problem by making it only apply to owner-occupied primary residences.

>We could stop subsidizing those billionaires

These words don’t mean what you think they mean. It’s insane to call restrictctions on a government’s ability to take someone’s money a “subsidy” for the person being taken from.

Taking less of someone’s money is not a subsidy. It does not cost you, or anyone else, anything to take less of someone else’s money. The size of your neighbor’s house does not take away from your own well-being except for the poison of jealousy.

Also your premise doesn’t even solve the problem you think it does. California doesn’t have a statewide property tax. That money goes to local government, so the property tax paid in Beverly Hills stays in Beverly Hills. Those rich communities are not struggling to fund their public services at the current tax rates.

This is what subsidies do most of the time.

If you consider the “User Cost of Housing” the financial burden to homeowners shifted from property tax to borrowing costs. So the real beneficiaries are mortgage lenders. The money that is no longer going to the State is now going toward interest payments

It’s popular to shit on Prop 13, but if you grew up in a state where property taxes got jacked up every time the teachers’ union went on strike, you’d probably understand it more. The whole point of home ownership is to have some stability, but state governments will soak property owners whenever they have a revenue shortfall, and that completely undermines the whole point.

CA property owners pay for it one way or another. Their taxes can’t increase past a certain amount, but that drives up property values, and so new entrants get locked into a much higher valuation for their homes than comparable ones in other states. The upshot is that they can bank on a predictable property tax rate for the entirety of the loan.

So in CA, the barrier to entry is higher, and the benefit is stability. In other states, the barrier to entry is lower, but you’re subject to the whims of your state government.

First-time buyers are on the menu.

Only the rich can even get seated anymore.

Personally, this has made middle class accessibility possible in (already tough to survive) California for me and several people I know. I’ll defend prop 13, because being price out of your house in old age is now only stressful, but burdensome and humiliating. It can be devastating. As regressive as it is, at time it can really help some people maintain a grasp on the cliff of this exploitative system.

Your post makes no sense

you’re saying they live in Beverly Hills therefore they are billionaires with lots of properties. You’re forgetting the big earners from prop 13 have their houses for 40-50 years now. You’re saying if someone had $50k or $100k in 1980 they most definitely have a multiple house portfolio plus millions in other investments. That’s way off

Yes you can set it to only owner occupied, you’ll still be stuck with lots of aging owners that own a house for 30+ years. It’s not going to move the needle much

Once they changed it so the kids need to move in after the parent passes – people thought here we go big fix, nothing really changed

I have a family member who worked a low hourly wage their whole lives, had enough for a down payment on a $300k house in the 80s no 401k. About 80% of the neighbors are still original working class but the new neighbors are paying $2m on not new builds

The only true solution is to tell these people they’re not allowed to live next to rich people anymore, there’s no other way out. These neighborhoods everyone is talking about barely have a SFH rental market, from the comments here it’s like they each have hundreds of houses for rent

Comments are closed.