President Donald Trump’s return to the White House in January 2025 has ignited a firestorm across the Atlantic. With aggressive new tariffs targeting European imports, everyday Americans and Europeans alike are feeling the pinch – from skyrocketing car prices in Detroit to empty shelves in Berlin supermarkets. This isn’t just policy; it’s a full-blown economic showdown that’s dominating headlines, fueling protests, and reshaping global alliances.��

The Spark: Trump’s “Liberation Day” Tariffs Hit HardTrump wasted no time after his inauguration, slapping 25% tariffs on EU steel, autos, and luxury goods under his “Liberation Day” economic plan. Aimed at protecting U.S. jobs, these measures have backfired spectacularly for Europe. German car giants like Volkswagen and BMW report billions in losses, with factories idling as exports to America – their biggest market – grind to a halt.Imagine a Munich assembly line worker staring at a half-built Audi, knowing it won’t reach U.S. shores without a massive price hike.

That’s the reality today. EU leaders, from France’s Macron to Germany’s Scholz, convened emergency summits in Brussels last week, warning of retaliation. Yet Trump’s team doubles down: “Europe’s been freeloading on NATO and trade for decades – time to pay up.” The result? EU GDP forecasts slashed by 1.5% for 2026, per IMF estimates.��

Europe’s Breaking Point: Protests Erupt from Paris to WarsawStreet-level fury is boiling over. In Paris, yellow-vest style protests have reignited, now rebranded “Tariff Vests,” with demonstrators blocking highways and chanting “Trump Out!” Similar scenes unfold in Warsaw, where Polish truckers blockade borders, fearing job losses from disrupted supply chains. A viral video from last Tuesday shows 50,000 marching in Frankfurt, smashing tariff symbols made of imported steel.Why so explosive?

Europe’s economy was already fragile post-Ukraine war energy shocks. Now, with U.S. tariffs adding €100 billion in annual costs, inflation spikes to 5% across the Eurozone. Small businesses crumble first: Italian olive oil exporters pivot to Asia, but at huge losses.

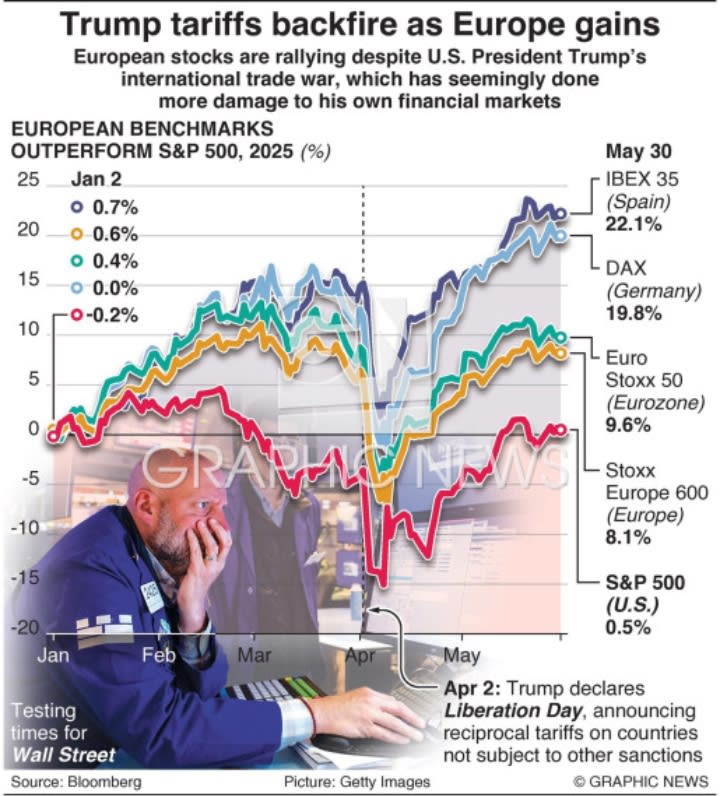

British firms, post-Brexit, face double whammy as Trump lumps UK into the EU tariff net despite special pleas from PM Starmer.�One French farmer told Reuters: “We grew olives for American tables; now they’re rotting. Trump’s winning his war – we’re the casualties.” Personal stories like these dominate social feeds, amplifying the outrage.America’s Side: Jobs Saved or Illusion?Back home, Trump hails victory. U.S. steel mills in Pennsylvania hum again, adding 20,000 jobs per Commerce Department figures. Consumers? Not so lucky. A Ford F-150 now costs $5,000 more due to European parts tariffs. Grocery aisles see 15% jumps in cheese and wine prices – staples for middle-class dinners.Economists warn of blowback.

Retaliatory EU tariffs on U.S. soybeans and whiskey could wipe out 100,000 farm jobs in the Midwest. Wall Street wobbles: Dow dipped 800 points last Friday on trade war fears. Yet Trump’s base cheers – polls show 62% approval for “tough on Europe” stance, per Gallup.Critics like Sen.

Warren call it “economic nationalism gone mad,” predicting stagflation by mid-2026. Supply chains fracture: iPhones assembled in China now cost more with EU component tariffs looping back.NATO Cracks: From Allies to Adversaries?Trade bleeds into security. Trump threatens to pull U.S. troops from Germany unless NATO spending hits 3% GDP. Europe scrambles: France pushes “strategic autonomy,” eyeing nuclear-sharing deals sans America. Leaked Pentagon memos reveal drills excluding Europe for the first time since Cold War.Russia watches gleefully.

Putin’s Kremlin ramps up Baltic incursions, betting on transatlantic rifts. A Brussels think-tank warns: “Tariffs today, vulnerability tomorrow – Europe’s defense exposed.”Public sentiment shifts fast. Pew polls show 55% of Americans now view EU as “economic rival,” up from 32% pre-Trump 2.0. Europeans reciprocate: 68% see U.S. as “unreliable partner.”Global Ripple: Asia and Beyond BraceChina smirks, courting Europe with tariff-free deals.

India inks EV battery pacts with Berlin, filling U.S. voids. Developing nations suffer collateral: African cobalt miners lose EU auto demand.Crypto surges as hedge – Bitcoin hits $120K amid fiat fears. Gold bugs rejoice too.Voices from the Frontlines: Real Stories Fueling the FireMeet Anna, a Barcelona exporter: “My family’s clothing business shipped 40% to U.S. Now bankrupt.

Kids ask why no Christmas gifts.” Or Mike, Ohio steelworker: “Job saved, but wife’s European cheese costs double. Trump’s win feels Pyrrhic.”These anecdotes go viral on TikTok, racking millions of views. Emotional hooks drive shares – anger, fear, hope.What’s Next: Recession or Reset?2026 forecasts grim: EU recession odds at 60%, U.S. slowdown at 40%. G20 in Delhi next month could broker truce, but Trump demands concessions first.

Optimists see reset: Europe innovates green tech, America reshores factories. Pessimists predict “Trade Iron Curtain.”Your move? Diversify investments – euros tanking, dollar strong. Stock Euro Stoxx futures short. And watch: This saga’s just beginning.