China announces provisional tariffs of 21,9 to 42,7 percent on milk and cheese from the European Union starting December 23, 2025, targeting Roquefort and Gorgonzola cheeses. This responds to European tariffs against Chinese electric cars and provokes a strong reaction from the European Commission, which calls the measures unjustified and unfounded.

On Monday, December 22, 2025, the Chinese Ministry of Commerce announced provisional tariffs of 21,9 to 42,7 percent on milk and cheese imported from the European Union, effective Tuesday, December 23. According to the Chinese government, The decision is the result of an investigation that concluded that European dairy products receive subsidies and cause “substantial damage” to China’s dairy industry..

The new round of surcharges directly affects traditional dairy brands in the European bloc, especially cheeses with protected designation of origin, such as French Roquefort and Italian Gorgonzola. The tariffs on milk and cheese are in addition to other measures. already adopted by Beijing in response to the European Union’s actions in the trade dispute over Chinese electric cars.

Rates between 21,9 and 42,7 percent

According to an announcement from the Chinese Ministry of Commerce, the new tariffs on European dairy products will be temporary at this initial stage.

See also other features

China is resorting to hunters, cash rewards, and controlled culls to contain the advance of cunning and aggressive wild boars weighing up to 200 kg, following a population explosion, fatal attacks, millions in agricultural losses, and a growing presence of the animals in cities and densely populated urban areas.

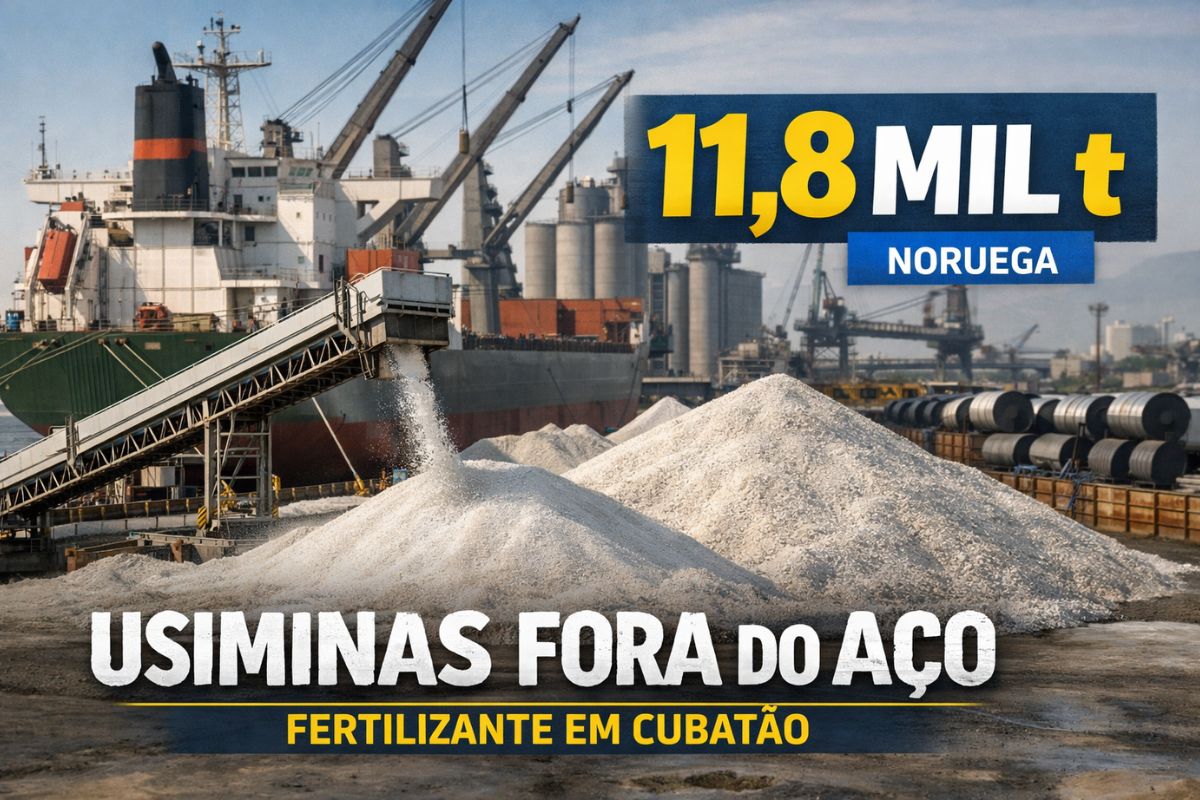

Usiminas makes its first fertilizer shipment in history, receiving 11,8 tons from Europe, testing a new logistical avenue outside of steel and responding to import pressures that are crippling the entire Brazilian steel industry.

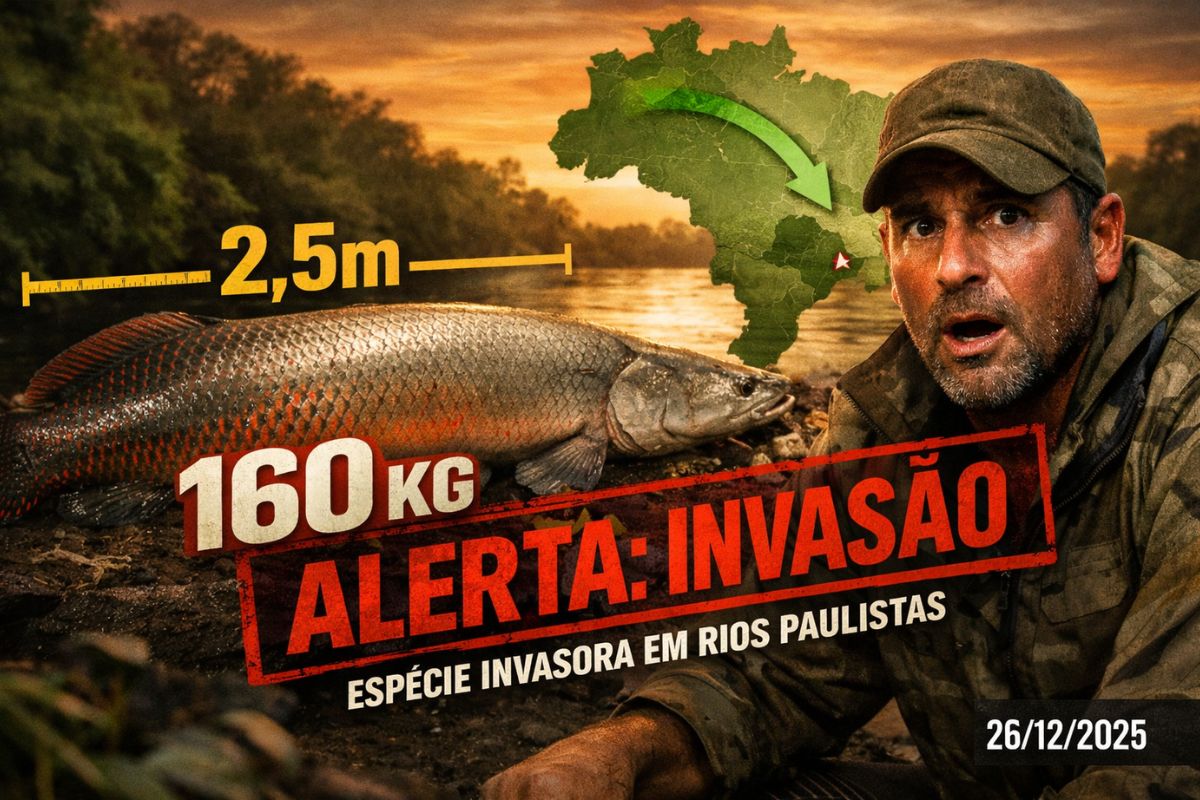

A giant 160-kilogram Amazonian fish caught in a São Paulo river has sparked an invasion alert, threatened local fish, had no predators, and become a target for police to fish without limits.

The region that feeds more than 1 billion people a year: this plain combines ancient irrigation, modern engineering, and colossal rice and wheat harvests that underpin global food security.

The rates will vary from 21,9 to 42,7 percent, with most companies paying something close to 30 percent on the imported value..

These surcharges apply to different types of milk and cheese produced in the European Union and sold in the Chinese market.

Beijing claims the goal is to offset the effect of subsidies granted to European producers, which, according to Chinese research, artificially reduce production costs and harm the competitiveness of the local dairy industry.

These measures may be revised in the future, once the final decision of the anti-subsidy investigation conducted by China is released.

Until then, the European dairy sector will operate in an environment of uncertainty in one of the world’s largest consumer markets.

Roquefort and Gorgonzola cheeses are now in Beijing’s crosshairs.

Among the affected products, China highlighted cheeses with protected designation of origin, such as Roquefort from France and Gorgonzola from Italy, icons of European cuisine and with high added value..

These items typically occupy the premium segment on supermarket shelves and menus, which increases the sensitivity of producers and exporters to the new tariffs.

For European manufacturers, the loss of competitiveness in China could squeeze margins, reduce sales, and even force them to seek new buyer markets.

For Chinese consumers, the rising cost of imported cheeses tends to strengthen the position of domestic producers, who gain market share while imports from the European Union become more expensive.

By targeting well-known and symbolic products, China is also sending a political signal.

The message is that Beijing’s response to the European Union will not be limited to industrial sectors, but will extend to issues sensitive to the image and economy of European countries..

The battle over electric cars is at the heart of the crisis.

The announcement of tariffs on milk and cheese did not come out of nowhere.

In 2023, the European Union opened an anti-subsidy investigation into electric vehicles manufactured in China, alleging that automakers in the Asian country receive state support that distorts competition in the European electric car market.

The European investigation resulted in the imposition of tariffs on the Chinese automotive sector, which escalated the dispute.

Since then, China has begun to react with a series of measures against European products, including imports of cognac, pork, and now dairy products..

Each new announcement increases the perception of an escalating trade war between the two largest trading powers on the planet.

For China, the European Union’s offensive against electric cars threatens a strategic industry that the country has been using to expand its technological and industrial influence in the world.

For Brussels, Chinese subsidies threaten the survival of European manufacturers in a sector key to the energy transition. The result is a conflict that has spilled over from the automotive sector to the consumer’s table.

European Union criticizes Chinese investigation.

The political reaction from the European Union was swift. The European Commission described China’s investigation as weak and poorly substantiated.

According to spokesperson Olof Gill, quoted by the international press, the assessment in Brussels is that the process is based on questionable allegations and insufficient evidence, making the measures “unjustified and unfounded.”.

The criticism reinforces the perception that Chinese tariffs on milk and cheese from Europe have a strong political component.

In the view of European authorities, Beijing is using the anti-subsidy investigation framework as a tool for leverage in the broader dispute over electric cars and access for Chinese products to the European market.

At the same time, China maintains that it is merely defending its domestic industry.

For the Chinese government, Subsidized products from the European Union reach the market with artificially low prices, distorting competition and threatening jobs in the dairy sector.This clash of narratives deepens the distrust between the two sides.

In practice, subsidies mean that governments cover part of the production costs of companies, whether through cheap credit, tax incentives, or direct support.

When a subsidized product enters another market, it tends to be sold at a lower price than competitors that do not receive the same type of state aid..

This is the argument used by China against the European Union in the case of dairy products, and also the reasoning that the EU applies to the Chinese electric car industry.

Both sides claim to defend fair competition, but they disagree on who is actually distorting the rules.

And you, do you think China is just retaliating against the European Union or is it taking this trade war too far?