Relatively subdued prices of crude oil in the international market led to India’s oil import bill contracting by 12 per cent year-on-year in April-November despite higher oil import volumes and the country’s growing dependency on imported crude oil, as per the latest data from the petroleum ministry.

The country’s net oil and gas imports — crude oil, petroleum products, and natural gas — for the eight-month period were also down over 12 per cent year-on-year in value terms. Lower prices led to a reduction in the value of petroleum product imports despite stable volumes, while in the case of natural gas, lower import volumes amid price volatility was the primary reason for the lower import bill.

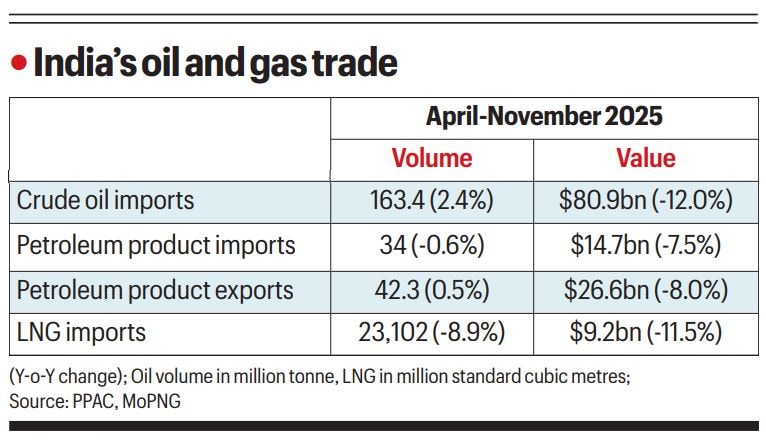

India’s oil imports in value terms in the first eight months of the current financial year 2025-26 (FY26) were $80.9 billion, down from $91.9 billion, even as oil import volumes increased to 163.4 million tonnes from 159.5 million tonnes a year ago, an increase of 2.4 per cent, according to provisional data from the Petroleum Planning and Analysis Cell (PPAC) of the Ministry of Petroleum and Natural Gas (MoPNG).

India is the world’s third-largest consumer of crude oil and depends on imports to meet the bulk of its requirement. The country’s oil import dependency in domestic petroleum product consumption in April-November increased to 88.6 per cent from 88.1 per cent in the corresponding period last year amid declining domestic oil production and rising consumption of petroleum products, which are derived from crude oil.

Oil imports top India’s merchandise imports, and the heavy reliance on imported crude oil makes its economy vulnerable to global oil price fluctuations. This also impacts the country’s trade deficit, foreign exchange reserves, the rupee’s exchange rate, and inflation rate, among others. Against that backdrop, the fall in international crude oil prices has been a positive for the Indian economy.

The price of the Indian basket of crude for April-November averaged at $67.6 per barrel, down from $80 in the first eight months of the last financial year. This fall in crude oil prices has been largely due to a global supply glut, precipitated by increasing oil production from various major producers and an unwinding of production cuts by the Organization of the Petroleum Exporting Countries (OPEC) and their allies — a grouping called OPEC+ — amid slower-than-anticipated growth in global oil demand.

India’s domestic crude oil production in April-November declined to 18.8 million tonnes from 19.1 million tonnes in the year-ago period. Consumption of petroleum products, however, rose to 160.2 million tonnes from 158 million tonnes a year ago. Total production of petroleum products from domestically-produced crude oil in the eight months was 18.3 million tonnes, reflecting a self-sufficiency level of 11.4 per cent, or import dependency of 88.6 per cent.

Story continues below this ad

The Indian government aims to reduce the country’s reliance on imported crude oil, but faces challenges due to sluggish domestic oil output amid rising demand. In 2015, the government had set a target to cut the dependence on imported oil from 77 per cent to 67 per cent by 2022. However, import dependency has only increased over the years.

The country’s net oil and gas imports for the April-November period were down 12.4 per cent year-on-year at $78.2 billon, as per the PPAC data. Although India is a net exporter of petroleum products, it does import some of these products as well. The value of petroleum product imports in April-November declined to $14.7 billion from $15.9 billion, even as import volumes were largely stable at around 34 million tonnes. Lower prices also led to a reduction in the value of the country’s petroleum product exports during the eight-month period to $26.6 billion from $28.9 billion a year ago, while export volumes were stable at a little over 42 million tonnes.

As for natural gas, which is imported into India as liquefied natural gas (LNG), import value for the first eight months of the current financial year was $9.2 billion, down 11.5 per cent from a year ago, while import volumes fell almost 9 per cent year-on-year to 23,102 million standard cubic metres (mscm). The lower import volumes were largely due to lower demand from sectors like power, fertilisers, and refineries. While plentiful monsoon rains eased electricity demand and led to lower feedstock requirement by gas-based power plants, volatility in the international LNG market and elevated spot prices made the other major gas consuming sectors partly shift to alternative fuels like naphtha.

Expand

© The Indian Express Pvt Ltd