Europe Data Integration Market Size

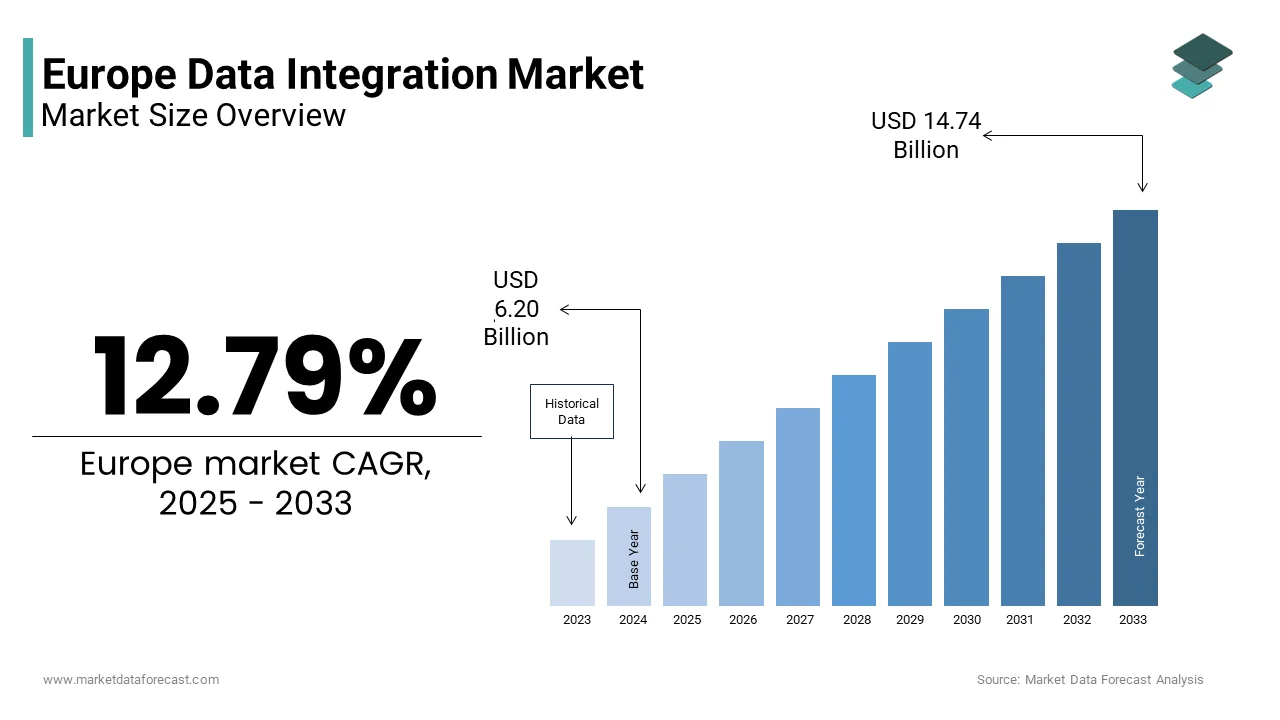

The Europe data integration market size was valued at USD 5.50 billion in 2024 and is anticipated to reach USD 6.20 billion in 2025 and USD 14.74 billion by 2033, growing at a CAGR of 12.79% during the forecast period from 2025 to 2033.

Data integration is the process of combining data from scattered sources (like apps, databases, IoT) into a single, unified view to break down silos, ensuring consistency, accuracy, and accessibility for better analysis, AI, and smart business decisions, often using methods like ETL/ELT, APIs, or streaming. In a region characterized by advanced digitalization ambitions yet burdened by legacy infrastructures and fragmented data governance, integration serves as the connective tissue enabling interoperability at scale. Large enterprises across Europe have broadly integrated cloud computing services into their operational frameworks, which emphasizes a significant transition toward distributed data environments. Data generation within the region has experienced substantial growth, driven by the increasing prevalence of interconnected smart devices. The advancement of digital public services has contributed to the expanding volume of data managed within the European digital landscape. Industrial automation processes have played a key role in accelerating the accumulation and flow of regional data. Crucially, policy frameworks such as the European Data Strategy and the Data Governance Act prioritize data portability and cross-sectoral reuse, making integration not merely a technical function but a strategic enabler of Europe’s data sovereignty vision.

MARKET DRIVERS Rising Adoption of Cloud Native Architectures Fuels Integration Demand

Enterprises across the region are rapidly shifting from monolithic systems to cloud native environments built on microservices, containers, and serverless functions, and this acts as a major factor accelerating the growth of the Europe data integration market. This architectural evolution disperses data across multiple cloud platforms, creating complex integration requirements that legacy middleware cannot address. Organizations in Europe are increasingly adopting strategies that involve the use of multiple cloud environments. The rate at which these multicloud approaches are being implemented has shown a significant upward trend over recent years. Public sector digital projects are now frequently designed to require functional compatibility across different cloud service providers. These dynamics necessitate integration platforms that support event-driven data flows, real-time API orchestration, and dynamic schema management. Industries such as banking and logistics, where latency and data consistency directly impact customer experience, are leading this adoption, driving demand for modern integration fabrics capable of operating across hybrid and distributed infrastructures.

Regulatory Imperatives for Data Harmonization Drive Integration Investments

The region’s expanding regulatory ecosystem compels organizations to consolidate and standardize data from disparate operational silos, which further contributes to the expansion of the Europe data integration market. Beyond the General Data Protection Regulation, newer mandates like the Corporate Sustainability Reporting Directive require firms to aggregate environmental, social, and governance metrics from suppliers, HR systems, and financial ledgers into auditable formats. According to multiple sources, a significant increase is anticipated in the number of companies needing to provide sustainability disclosures. Similarly, the Digital Operational Resilience Act obliges financial institutions to maintain end-to-end visibility across all third-party ICT data flows. As per sources, the majority of large institutions have commenced updating their data management systems to meet these reporting obligations. Consequently, data integration has evolved from a backend utility into a board-level compliance necessity, reshaping procurement priorities across regulated sectors.

MARKET RESTRAINTS Persistent Data Silos Across Legacy Public Sector Systems Impede Integration Efficiency

Many public institutions remain anchored to decades-old IT systems and lack standardized data protocols, despite the region’s digital government ambitions, which hampers the growth of the Europe data integration market. Many public administrations across Europe have yet to achieve full interoperability within their digital infrastructures. A notable portion of government entities continues to depend on manual data transfers or fragile custom integrations, and a majority of municipal services in certain regions rely on legacy software systems developed in previous decades. These legacy environments store data in incompatible formats, often without metadata or audit trails, making large-scale integration labor-intensive and error-prone. Even EU-funded initiatives like the Digital Europe Programme struggle with cross-national inconsistencies, particularly in health and justice sectors where national data models diverge significantly. This infrastructural fragmentation suppresses public sector demand for scalable integration solutions, limiting a key growth avenue for vendors.

Shortage of Specialized Data Integration Talent Constrains Solution Deployment

The successful deployment of modern data integration platforms demands professionals skilled in distributed systems, semantic modeling, and real-time data engineering, talent that is in critically short supply across the region. This restrains the expansion of the Europe data integration market. Within a few years, projections indicate a significant personnel gap in the information and communications technology sector, with data integration roles notably affected. A recent survey shows that most businesses consider internal knowledge gaps a primary barrier to cloud integration adoption. Currently, a small minority of universities provide specialized programs in data interoperability or integration architecture. This deficit forces organizations to rely on costly external consultants or delay projects altogether, particularly in sectors like utilities and rail transport, where operational technology and IT systems must be harmonized—a task requiring rare hybrid competencies.

MARKET OPPORTUNITIES Expansion of Industrial IoT in Manufacturing Unlocks New Integration Frontiers

The deep integration of Industrial Internet of Things devices into European manufacturing is generating high velocity operational data that must be fused with enterprise systems to enable predictive analytics and digital twins, and thereby is expected to drive the growth of the Europe data integration market. Large manufacturing organizations across the European Union have increasingly adopted Internet of Things technologies to oversee their production processes. Industrial sensors have achieved widespread implementation within European manufacturing facilities. A growing number of manufacturers are expected to implement digital twin technology to create virtual representations of their physical assets. The deployment of digital twins necessitates the establishment of continuous data exchanges between physical equipment and simulated environments. This trend creates demand for edge-aware integration platforms that support time series data ingestion, protocol translation (e.g., OPC UA to MQTT), and low-latency streaming, capabilities that vendors can tailor to Europe’s advanced, automation-intensive industrial base.

Public Sector Data Spaces Create Structured Integration Ecosystems

The European Commission’s initiative to launch common European data spaces across health, energy, mobility, and finance is establishing governed, standardized environments that inherently require robust integration backbones. This provides potential opportunities for the expansion of the Europe data integration market. Multiple data spaces are currently undergoing active development. Efforts are underway to interconnect health records across a vast population of citizens. The energy sector is working to unify grid information from various national transmission operators. Distributed energy resources are being integrated into a centralized data framework. Technical initiatives aim to reconcile information from numerous distinct sources. Common semantic models are being utilized to ensure data interoperability. Unlike ad hoc enterprise projects, these policy-driven ecosystems offer long-term, compliance-anchored integration contracts with predictable technical specifications. Vendors that align with EU reference architectures, such as those based on International Organization for Standardization and European Committee for Standardization frameworks, can embed their solutions into foundational public digital infrastructure, which secures recurring revenue streams.

MARKET CHALLENGES Cross-Border Data Fragmentation Hinders Seamless Integration

National divergence in data standards, taxonomies, and technical implementations continues to obstruct pan-European integration, despite the EU’s single market vision, which is among the major challenges for the Europe data integration market. The European Commission acknowledges that even in harmonized areas like e-invoicing, businesses must maintain separate integration pipelines for each member state due to the inconsistent application of the EN 16931 standard. Small and medium enterprises identify the lack of consistency in data across national borders as a primary obstacle to expanding their digital operations. Electronic health records utilize a diverse array of clinical coding systems that vary significantly between different national frameworks. The absence of a unified metadata registry or semantic layer necessitates extensive customization of integration solutions per jurisdiction, which leads to inflated costs and reduced deployment velocity. This fragmentation undermines the scalability of integration investments and delays the realization of EU wide data utility.

Evolving Cybersecurity Threats Complicate Trusted Data Exchange

Data pipelines have become prime targets for cyber threats as integration expands across hybrid and third-party ecosystems, which slows down the expansion of the Europe data integration market. An increase in security incidents involving data pipelines has been observed. Improperly configured application programming interfaces and insufficient data lineage controls are noted as common vulnerabilities. New regulatory requirements compel essential organizations to ensure data integrity across their integrated systems’ full lifecycle. Existing technology platforms often lack the native capabilities to meet these obligations. Supervisory authorities have initiated investigations into the security safeguards for cross-system data flows. Financial institutions face compounded pressure from both the Digital Operational Resilience Act and General Data Protection Regulation to implement tamper-evident logs and real-time anomaly detection. Yet, few commercial integration tools offer embedded zero trust or confidential computing features, forcing organizations to build costly security overlays or defer integration initiatives altogether.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

12.79%

Segments Covered

By Offering, Business Application, Enterprise Size, Deployment Mode, Vertical, And By Country

Various Analyses Covered

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, & Rest of Europe

Market Leaders Profiled

Microsoft, Amazon Web Services, Inc., Alphabet Inc, SAS Institute Inc., IBM Corporation, Oracle, SAP SE, Informatica Inc., Cisco Systems, Inc., Hitachi Vantara Corporation (Subsidiary of Hitachi, Ltd.), Salesforce, Inc., Precisely, TALEND, Denodo Technologies, TIBCO Software Inc., Actian Corporation, KPMG LLP, Software AG, Adeptia, SnapLog, among others

SEGMENTAL ANALYSIS By Offering Insights

The tools segment dominated the Europe data integration market in 2024. The dominance of the tools segment is primarily driven by the widespread deployment of enterprise-grade integration platforms that support automation, scalability, and real-time data processing. Organizations across sectors are prioritizing self-service and embedded integration capabilities within analytics and cloud environments, reducing dependency on manual coding and external consultants. Enterprises have shown a clear preference for data integration solutions that are intuitive and easy to use. This is evident in the adoption of platforms featuring visual interfaces and readily available connectors. The pattern indicates a general move away from custom-built, specialized services towards more flexible, pre-configured tools. This shift suggests a desire for greater autonomy in managing data integration tasks, reducing reliance on external or bespoke development efforts. Besides, as per research, the adoption of data fabric and data mesh architectures, both inherently tool-centric, grew year on year across Western Europe, further consolidating the dominance of the tools segment. These architectures enable decentralized data ownership while maintaining governance, a model particularly attractive to large multinational corporations operating under the European Union’s strict data localization norms. The convergence of artificial intelligence and integration tools, such as AI-powered schema mapping and anomaly detection, has also accelerated tool adoption, as enterprises seek to reduce integration cycle times and improve data quality without proportional increases in technical staffing.

The services segment is likely to experience the fastest CAGR of 12.4% from 2025 to 2033 due to the growing complexity of hybrid data landscapes that demand strategic consulting, custom implementation, and ongoing managed support. Mid-sized enterprises often lack the internal expertise required to manage and configure modern integration platforms, leading them to rely on specialized vendors for deployment and optimization. Furthermore, regulatory compliance initiatives such as the Corporate Sustainability Reporting Directive require tailored data lineage and audit trail configurations that cannot be achieved through out-of-the-box tools alone. Financial institutions are increasingly partnering with third-party integration specialists to ensure their data pipelines comply with updated digital resilience standards. This reliance on expert services, particularly for legacy modernization, cloud migration, and cross-border interoperability, fuels sustained demand, especially in the public sector and highly regulated industries where precision and auditability outweigh cost considerations.

By Business Application Insights

The operations segment led the Europe data integration market in 2024. The supremacy of the operations segment is attributed to the need to synchronize data across supply chains, production systems, and logistics networks in real time. European manufacturers and logistics providers operate in highly interconnected ecosystems where delays or inaccuracies in data exchange directly impact delivery performance and inventory costs. Large enterprises frequently integrate warehouse management systems with external logistics partners to facilitate operational data exchange. The European Commission’s Digital Product Passport initiative—mandating end-to-end traceability for products under the Eco Design for Sustainable Products Regulation—further intensifies integration demands across procurement, quality control, and maintenance workflows. Additionally, the integration of enterprise resource planning and transportation management systems allows for more efficient order fulfillment processes. Real-time data synchronization between internal systems and transport providers is a common practice used to streamline logistics workflows. This operational efficiency imperative, coupled with rising adoption of digital twins and predictive maintenance, anchors operations as the primary application driver for data integration investments across industrial and service sectors.

The human resources segment is on the rise and is expected to be the fastest-growing segment in the market by witnessing a CAGR of 13.1% from 2025 to 203,3 owing to the convergence of workforce analytics, regulatory compliance, and employee experience platforms that require unified data from payroll, performance management, learning systems, and external labor market databases. The impending implementation of pay transparency regulations necessitates that larger organizations perform regular gender-based salary assessments. Conducting these mandatory evaluations requires the unification of human resources and financial data sets. Legislative requirements are driving a trend toward the consolidation of internal data systems across various countries. A significant portion of multinational employers is opting to invest in integrated data platforms. These technological investments are designed to facilitate the movement of personnel and the identification of employee skills across international borders. Moreover, the rise of hybrid work has amplified demand for real-time sentiment and productivity data, necessitating integration between collaboration tools like Microsoft Teams and HR information systems. These dynamics transform HR from an administrative function into a data-driven strategic pillar, propelling integration adoption at an unprecedented rate.

By Vertical Insights

The BFSI sector captured the leading share of the Europe data integration market in 2024. The prominence of the BFSI segment is credited to stringent regulatory mandates, real-time transaction monitoring needs, and omnichannel customer engagement strategies. Financial institutions must integrate data across core banking, risk management, anti-money laundering, and customer relationship platforms while ensuring full auditability and data lineage. Several institutions have implemented enterprise-wide data integration layers to align with evolving regulations concerning operational resilience and digital assets. A notable majority has adopted these measures across their systems. Furthermore, numerous asset managers now utilize integrated data pipelines. This approach is primarily used to gather metrics required for sustainable finance disclosures and environmental, social, and governance reporting. The push toward open banking, driven by the revised Payment Services Directive, has further accelerated API based integration. This regulatory and innovation-driven data convergence solidifies BFSI as the leading vertical for integration spend across Europe.

The healthcare and life sciences segment is expected to exhibit a noteworthy CAGR of 14.1% from 2025 to 2033. The swift growth of the healthcare and life sciences segment is propelled by the rollout of the European Health Data Space, which mandates interoperability among national electronic health record systems, clinical trial databases, and public health registries. Several member states have launched national initiatives aimed at integrating health data. These programs are structured to align with a wider regional framework for health data. Furthermore, personalized medicine initiatives require the fusion of genomic data, wearable device outputs, and hospital records, datasets historically stored in isolated silos. The use of integrated data platforms has shown potential to quicken the process of recruiting participants for clinical trials. More details can be found by consulting relevant organizations. Concurrently, the European Medicines Agency now requires real-world evidence derived from harmonized patient data for accelerated drug approvals, compelling pharmaceutical companies to invest in cross-organizational integration infrastructures. These converging scientific, regulatory, and policy drivers position healthcare and life sciences as the most dynamic growth frontier in the European data integration landscape.

COUNTRY ANALYSIS Germany Data Integration Market Analysis

Germany outperformed other countries in the Europe data integration market and accounted for a 21.3% share in 2024. The dominance of the German market is attributed to its advanced industrial base and strong digital policy framework. As Europe’s manufacturing powerhouse, the country has spearheaded the adoption of Industrie 4.0, which inherently demands seamless data flow between machines, enterprise systems, and supply chain partners. The national GAIA X initiative, part of the broader European effort to build sovereign cloud infrastructure, has further stimulated demand for interoperable data solutions across automotive, machinery, and chemical sectors. Additionally, Germany’s stringent implementation of the General Data Protection Regulation has pushed enterprises to adopt integration tools with embedded data governance and consent management features. The country’s robust public-private research ecosystem, including collaborations between Fraunhofer Institutes and SAP, continues to incubate next-generation integration technologies, reinforcing Germany’s position as the regional integration leader.

United Kingdom Data Integration Market Analysis

The United Kingdom followed closely in the Europe data integration market and held a 17.4% share in 2024. The expansion of the UK market is fuelled by its dense concentration of financial institutions, fintech firms, and professional services organizations. Despite Brexit, the UK remains deeply integrated into European data flows, particularly in banking and insurance, where cross-border data exchange is essential. According to sources, a notable portion of major banks have upgraded their data integration architectures since two thousand twenty two to meet the operational resilience requirements of the Senior Managers and Certification Regime. The National Health Service’s digital transformation program, which includes the deployment of integrated care records across England, has also contributed significantly to public sector integration demand. Public spending on health data infrastructure is increasing. London’s status as a global fintech hub fuels continuous innovation in API-led integration and real-time analytics. This dual engine of finance and public health ensures the UK’s sustained prominence in the regional market.

France Data Integration Market Analysis

France is also a significant player in the Europe data integration market because of strong government-led digital initiatives and defense sector modernization. The French Digital Republic Act and the Health Data Hub project have created structured environments for cross-agency data integration, particularly in social services and healthcare. A platform for health data integration connects a significant number of patient records across various healthcare entities. A government defense ministry initiated a program to consolidate classified and operational data, requiring secure integration layers for intelligence and logistics systems. Enterprise adoption of data integration platforms has increased within certain industrial sectors, including aerospace and energy. This blend of sovereign cloud ambition, public health innovation, and strategic industrial policy cements France’s role as a key integration market in continental Europe.

Netherlands Data Integration Market Analysis

The Netherlands experienced a consistent growth of the Europe data integration market due to its role as Europe’s logistics gateway and a global leader in agricultural technology. The Port of Rotterdam, Europe’s largest seaport, operates a fully integrated digital twin that synchronizes data from shipping lines, customs, warehousing, and rail networks in real time. Logistics companies are adopting event-driven integration platforms to streamline container movement and minimize delays. In agritech, companies collaborate on precision farming platforms that integrate satellite imagery, soil sensors, and market pricing data, requiring high-fidelity data orchestration across cloud and edge environments. Public funding supports the development of digital infrastructure to enhance connectivity. Data cooperative initiatives are being established to facilitate secure information sharing among smaller businesses. This unique convergence of trade, sustainability, and innovation positions the Netherlands as a specialized yet influential node in Europe’s integration ecosystem.

Sweden Data Integration Market Analysis

Sweden is likely to expand notably in the Europe data integration market from 2025 to 2033, owing to its leadership in clean technology and advanced health informatics. Swedish district heating networks widely use integrated data platforms to help manage renewable energy supply and demand. This approach supports the country’s ongoing effort to achieve net-zero emissions. In healthcare, the national My Healthcare Journal initiative enables citizens to access and share their medical records across providers, a system built on standardized FHIR-based integration protocols. More than half of the residents in Sweden are active users of the national eHealth platform. This usage demonstrates significant engagement with digital health services. Swedish enterprises also lead in adopting data mesh architectures, with companies like Ericsson and Spotify pioneering decentralized data ownership models that require lightweight, domain-specific integration tools. This culture of digital public good, combined with private sector innovation,n creates a fertile ground for integration technologies, making Sweden high-growthth per capita market despite its modest population size.

COMPETITIVE LANDSCAPE

The Europe data integration market features intense competition among global technology leaders and specialized regional vendors, each vying to address the continent’s unique blend of regulatory rigor, digital sovereignty ambitions, ns and industrial diversity. Incumbents leverage their established cloud ecosystems and enterprise relationships to embed integration capabilities directly into broader digital transformation suites. Meanwhile, niche providers differentiate through deep vertical expertise,e particularly in healthcare finance and manufacturing, ng where data semantics and compliance requirements are highly specific. The competition is further intensified by rapid technological evolution, including the rise of data mesh architectAI-poweredowered metadata management, and real-time streaming platforms. European buyers increasingly demand solutions that balance automation with auditability, forcing vendors to innovate in both functionality and governance. This dynamic environment rewards agile, ty strategic alignment with EU policies, and the ability to deliver secure interoperable data flows across fragmented legacy and modern infrastructures.

KEY MARKET PLAYERS

Dominating players in the Europe data integration market are

Microsoft Oracle Corporation Amazon Web Services, Inc Alphabet Inc SAS Institute Inc. IBM Corporation Oracle SAP SE Informatica Inc. Cisco Systems, Inc. Hitachi Vantara Corporation (Subsidiary of Hitachi, Ltd.) Salesforce, Inc. Precisely TALEND Denodo Technologies TIBCO Software Inc. Actian Corporation KPMG LLP Software AG Adeptia Snap Logic Top Players In The Market SAP SE is a pivotal contributor to the Europe data integration market through its comprehensive suite of data management and integration tools embedded within the SAP Business Technology Platform. The company enables enterprises to unify transactional and analytical data across cloud and on-premises landscapes. This innovation strengthens its position by reducing integration complexity for European firms navigating stringent regulatory environments while accelerating hybrid cloud adoption across industries such as manufacturing and finance. Oracle Corporation plays a significant role in the Europe data integration landscape by offering Oracle Fusion Cloud Data Integration as part of its broader cloud infrastructure. The company providpre-builtilt adapters and real-time replication tools that support complex data harmonization across global enterprises. It made enhancements that enable European customers in sectors like telecommunications and public services to achieve seamless interoperability while maintaining governance, reinforcing Oracle’s strategic relevance in the region. IBM Corporation contributes extensively to the Europe data integration market through its IBM Cloud Pak for Data and Watsonx data fabric solutions. These platforms emphasize governed data integration across hybrid multicloud environments with built-in security and AI-driven metadata management. This aligns with the European Union’s vision for trustworthy AI and data sovereignty. Additionally, IBM’s integration offerings now support the European Health Data Space standards, which positions the company as a key enabler ocross-borderer health data interoperability. Top Strategies Used by the Key Market Participants

Key players in the Europe data integration market prioritize strategic product innovation by embedding artificial intelligence and machine learning to automate data pipeline development and governance. They actively align their platforms with European regulatory frameworks such as the General Data Protection Regulation and the Data Governance Act to ensure compliance and build trust. Expansion through partnerships with local cloud providers and system integrators enables deeper market penetration, especially in the public sector and highly regulated industries. Continuous enhancement of interoperability features, such as support for FHIR in healthcare and EN sixteen nines eighty in e invoicing,g addresses domain-specific integration challenges. Additionally, vendors invest in developer ecosystems by offering open APIs and low-code environments to accelerate adoption among European enterprises seeking agile and scalable data solutions.

RECENT MARKET NEWS In March 2024, SAP SE introduced generative AI features in its Integration Suite to automate data mapping and pipeline vvalidationon strengthening its Europe data integration market presence. ence In November 2023, Oracle Corporation launched autonomous data integration capabilities with machine learning optimization to support European data residency and compliance, and n eedsto enhanceg itsmarket positiono.n In February 202,4 IBM Corporation expanded partnerships with European research institutions to advance federated learning models aligned with EU data sovereignty principles, es reinforcing its integration leadershi.p In May 2024, Microsoft Corporation integrated Microsoft Fabric with European Health Data Space standards, enabling compliant health data interoperability across member states,s boosting its footprint.t In January 202,4 Informatica Inc unveiled a new data governance module tailored to the Corporate Sustainability Reporting Directive, ve helping European enterprises meet ESG disclosure mandates and solidifying its market .role MARKET SEGMENTATION

This research report on the Europe data integration market is segmented and sub-segmented into the following categories.

By Offering

By Business Application

Sales Marketing Operations Finance Human Resources

By Enterprise Size

Large Enterprises Medium Enterprises Small Enterprises

By Deployment Mode

By Vertical

IT& Telecom Healthcare & Life Sciences Retail & Consumer Goods, Media & Entertainment BFSI, Energy & Utilities Government & Defense Others

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe