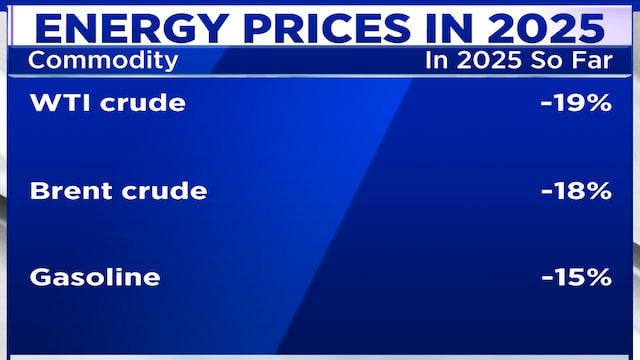

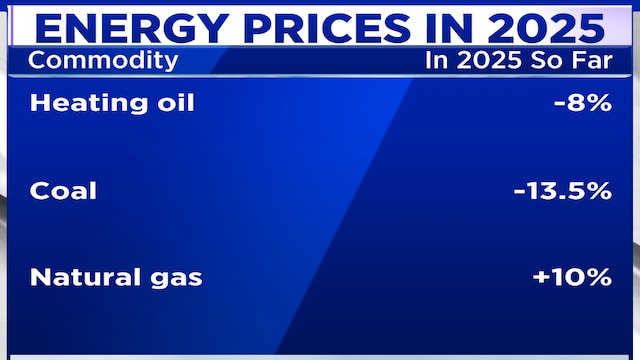

Taneja said that despite many commodities hitting record highs, energy prices have lagged due to surplus supplies and lingering questions around global demand. “It appears that, at least in the first quarter of 2026, we are going to be witnessing more or less the same kind of landscape and scenario,” he said, adding that the key risk to this outlook would be a geopolitical trigger.

Among potential flashpoints, Taneja flagged Venezuela as a major variable. “Venezuela, when it comes to oil, is a superpower. They have the largest oil reserves in the world,” he said, noting that US involvement in the region could alter supply dynamics and disrupt the current balance.

On the demand side, he said growth is being driven largely by India and parts of the Middle East, but not at a scale sufficient to push prices materially higher. He also pointed to the role of US policy in anchoring prices around a comfort zone. “$60 they need in order to keep the shale industry in good shape because if it’s less than $60, then the shale can get into trouble,” he explained, adding that the US, India and even Russia are broadly comfortable with oil near the $60-a-barrel level.

Based purely on supply-demand fundamentals, however, Taneja believes crude prices should be slightly lower. He pegged the fair price closer to $58 per barrel and argued that the Organisation of the Petroleum Exporting Countries’ (OPEC) ability to prop up prices is constrained. “OPEC at this stage doesn’t really have much to do. OPEC without Russian support cannot really go too far,” he said, stressing that meaningful action would require Saudi Arabia and Russia to act in tandem—something that appears unlikely given their preference for geopolitical stability.

Also Read: Silver is the metal of the future amid investment boom; crude oil oversupply limits upside: Analysts

A potential breakthrough in the Ukraine conflict could push prices lower still. “If there is some kind of breakthrough over Ukraine… then I think we are going to see oil maybe about $55 to $58 per barrel,” Taneja said.

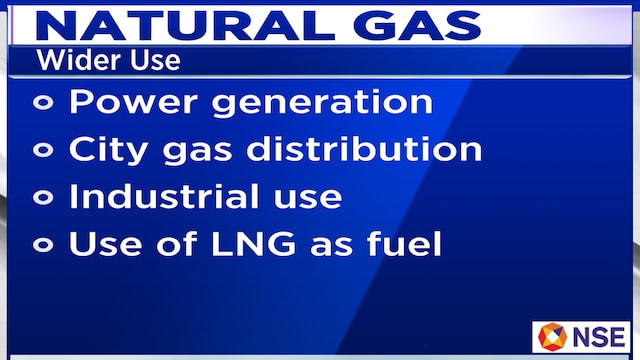

In contrast to oil’s subdued outlook, Taneja expects natural gas demand to rise steadily and structurally in the years ahead. He said two forces are driving this trend: the global shift toward cleaner energy and the rapid transformation of the gas market itself.

“Natural gas is considered green energy. Strictly speaking, it’s not, but that’s a different debate, but it’s considered a green energy,” he said, explaining that this perception is accelerating adoption across countries seeking lower-carbon alternatives.

Equally important is the rise of liquefied natural gas (LNG), which is turning gas into a more globally traded commodity. “Thanks to LNG, where you can ship gas from one part of the world to another… it is also now partially become a kind of global commodity,” Taneja said, noting that LNG has broken down the traditional regional silos of gas markets.

He pointed to Asia as the main engine of demand growth. “There are countries like India, Korea, Japan, China, and they’re actually showing more appetite for natural gas,” he said, adding that this is driving the creation of new supply routes, including Arctic pathways, and encouraging more exporters to serve energy-deficient regions.

While demand is rising, Taneja cautioned that gas prices will remain volatile due to ample global supply. “Since there is plenty of gas available, the prices are going to see up and down just like we see in oil,” he said.

Also Read: Crude oil prices to stay under pressure in the first half of 2026 on supply overhang: Christof Ruehl

Even so, he argued that gas is evolving differently from oil, shaped more by long-term pipeline agreements—such as those linking Russia and China or the Middle East and Europe—than by spot markets alone. Over time, he expects gas to acquire a distinct status. He described it as becoming a “sovereign” commodity, developing its own ecosystem of pricing, regulation and geopolitics, separate from the oil market.

For the entire interview, watch the accompanying video