2025 was another pivotal year for the U.S. oil and natural gas industry. U.S natural gas production and demand both reach record highs in 2025, with a 16 percent increase in recoverable supply helping meet rising domestic and global demand. At the same time, global oil demand continued to grow, with the International Energy Agency projecting the world will require an additional 25 million barrels per day in new oil and gas projects over the next decade.

Source: AGA 2025-2026 Winter Heating Outlook

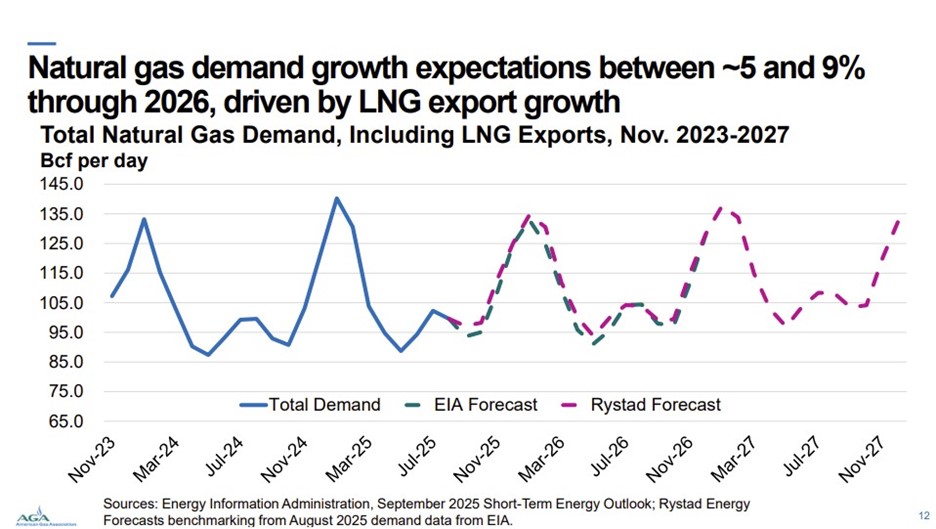

After years of policies that constrained investment and delayed infrastructure, the industry delivered measurable results in 2025. LNG export approvals resumed, long-overdue permitting reform advanced, and production records continued to fall, strengthening national security, supporting the economy, and keeping energy affordable for American households. Federal forecasts show U.S. LNG exports climbing to an average of 14.7 billion cubic feet per day in 2025, up from a record 11.9 billion cubic feet per day in 2024.

These outcomes marked a clear shift from the prior policy approach, which prioritized restrictions over reliability and slowed critical energy infrastructure development. In 2025, the Trump administration’s renewed focus on energy dominance and infrastructure realigned federal priorities with market demand, restoring momentum across the energy sector and unlocking new opportunities for growth.

Here’s a look at the highlights from 2025:

Permitting Reform Gains Momentum

Permitting reform gained strong support in 2025 as lawmakers, industry leaders, and business groups pushed to modernize outdated approval processes that delay critical infrastructure. Following Congress’s return from the August recess, a diverse coalition urged Congress to streamline reviews, reduce delays, lower costs, and boost energy investment.

The letter, signed by a broad cross-section of business and energy groups, including the Independent Petroleum Association of America, the U.S. Chamber of Commerce, and the National Association of Manufacturers, stated:

“The time has come to modernize our nation’s permitting systems so that our communities can build the infrastructure necessary to grow our economy, create good-paying jobs, and meet the challenges of today and tomorrow.”

By modernizing permitting processes and reducing approval delays, critical energy infrastructure can be built faster to meet rising demand and address grid constraints. Streamlined approvals also help lower project costs and support economic growth, enabling more reliable and affordable energy for American households.

The National Petroleum Council (NPC) reinforced this urgency in a new report that underscored that permitting challenges create structural vulnerabilities in the nation’s energy system, contributing to price volatility, supply insecurity, higher costs, and job losses.

Energy Secretary Wright, who commissioned the NPC report, called its findings an important step forward:

“The National Petroleum Council’s findings confirm what President Trump has said from day one: America needs more energy infrastructure, less red tape, and serious permitting reform. These recommendations will help make energy more affordable for every American household.”

Momentum continued to build toward the end of the year. In December, the House advanced the bipartisan SPEED Act, which would overhaul the National Environmental Policy Act, and passed the PERMIT Act, targeting Clean Water Act reforms designed to reduce permitting backlogs. Together, these measures signal meaningful progress toward faster, more predictable permitting outcomes.

LNG Exports Resume and Break Records

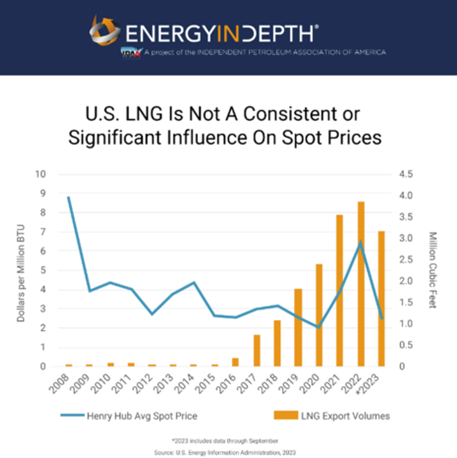

Following the LNG moratorium under the previous administration, the U.S. Department of Energy officially reopened LNG export authorizations in early 2025. The move restored regular order to the LNG approval process, as required under the Natural Gas Act. Record-setting exports followed throughout the year, demonstrating that domestic prices remain stable even as American LNG reaches global markets.

In 2025, the United States set LNG export records for four consecutive months, further demonstrating the resilience of the U.S. energy system. The United States now supplies 55 percent of Europe’s LNG, helping EU countries reduce reliance on Russian gas.

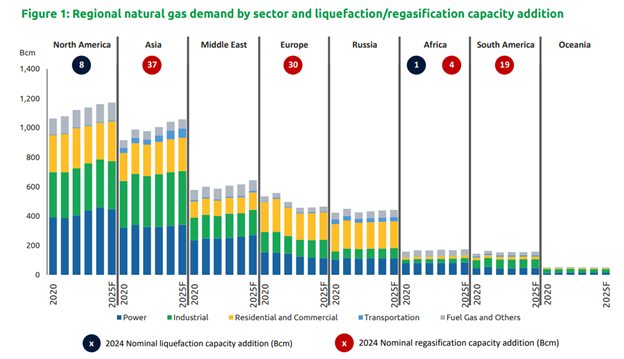

According to the International Gas Union’s Global Gas Report 2025, Asia and other emerging economies drove the bulk of global gas demand growth in 2024, while global LNG demand is projected to rise by another 71 Bcm in 2025. This highlights that U.S. LNG exports are critical not just for Europe but also for meeting fast-growing energy needs in Asia.

With LNG exports poised to double, North American export capacity is projected to grow from 15.4 billion cubic feet per day (Bcf/d) to nearly 30 Bcf/d by 2029, an increase of 13.9 Bcf/d according to EIA estimates. This expansion positions the U.S. to meet European energy security needs while supporting rising demand in Asia, American jobs, and long-term economic growth.

During an interview with Axios, Jarrod Agen, executive director of the White House National Energy Dominance Council, captured the global demand for American energy:

“It’s Europe, it’s Asia. They are looking for U.S. energy. They want to get off of Russian energy sources, and we have such a supply.”

U.S. LNG exports have already provided over 273,000 American jobs and are projected to generate $166 billion in tax revenue through 2040, with additional projects under construction expected to amplify these benefits.

Energy Secretary Chris Wright summarized the global importance of U.S. LNG exports in May 2025:

“The facts are clear: expanding America’s LNG exports is good for Americans and good for the world.”

Offshore Production Expands

In 2025, Congress and the administration prioritized expanding offshore energy consistent with the President’s energy dominance agenda. Early in the year, one of the first House Committee on Natural Resources’ oversight hearings highlighted the importance of restoring offshore oil and natural gas development.

Momentum continued in the fall when a federal court reaffirmed presidential authority over offshore leasing, clearing the way for new development. In November, the Interior Department followed with a major offshore leasing expansion, covering waters off California, Florida, and Alaska. These actions align with the Department of the Interior and BOEM’s Five-Year Offshore Leasing Plan (2026–2031), which proposes up to 34 lease sales across the Gulf of America, Alaska, and the Pacific coast. By providing long-term clarity and predictability, the plan encourages investment, supports thousands of jobs, and strengthens U.S. energy security.

Interior Secretary Doug Burgum emphasized the importance of these developments:

“Through a transparent and inclusive public engagement process, we are reinforcing our commitment to responsible offshore energy development—driving job creation, bolstering economic growth, and strengthening American energy independence. Under President Donald J. Trump’s leadership, we are unlocking the full potential of our offshore resources to benefit the American people for generations to come.”

Offshore energy continues to deliver substantial economic benefits. activity in the Outer Continental Shelf supported 250,000 jobs and $59.5 billion in economic output. In 2025, BOEM held Lease Sale Big Beautiful Gulf 1, generating over $300 million in high bids for 181 blocks. This sale reflects strong industry confidence in U.S. offshore energy and continued growth across the sector.

Future offshore leasing is projected to produce 2.3 million barrels of oil equivalent per day through 2040 , while maintaining stringent environmental standards. Gulf operations continue to emit significantly less per barrel than most other producing regions worldwide.

Alaska Energy Resurgence

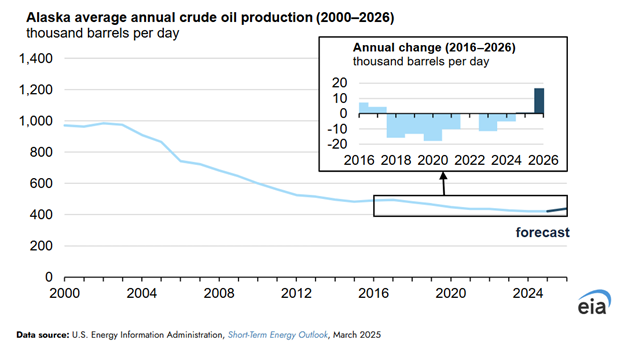

Alaska’s energy sector regained momentum in 2025 as coordinated federal and state actions focused on unlocking the state’s vast resource potential. On his first day in office, President Trump signed the executive order Unleashing Alaska’s Extraordinary Resource Potential, supporting the Alaska LNG project, reopening access to leases in ANWR and NPR-A, and encouraging responsible resource development.

State leaders praised the move as a critical step toward strengthening energy security and affordability. Senator Lisa Murkowski wrote in a statement:

“The policies laid out in this Executive Order will improve our economy, our budget, and our quality of life while simultaneously making energy more affordable and enhancing national security. Alaska is the blue chip in the United States’ energy portfolio, and I thank President Trump for helping us capitalize on our resources.”

EIA forecasts show Alaska crude oil production is expected to grow in 2026 for the first time since 2017, driven by projects such as Nuna and Pikka—marking the largest annual increase since 2002 and signaling renewed long-term production strength.

Source: Energy Information Administration (EIA), 2025

According to the Alaska Oil & Gas Association, the industry supported more than 69,000 jobs and $5.9 billion in wages in 2022, underscoring its importance to Alaska’s economy and national energy supply.

Record Production While Reducing Emissions

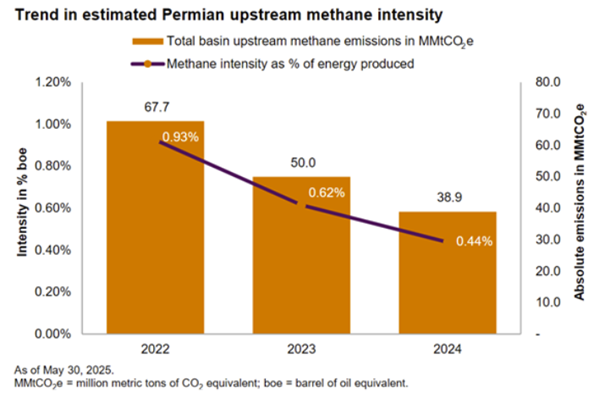

Even through increased demand and renewed energy dominance, U.S. producers continued to demonstrate that record production and emissions reductions can advance together. Methane emissions intensity in the Permian Basin dropped by more than 50 percent from 2022 to 2024, even as the basin contributed nearly half of U.S. oil production and over 20 percent of natural gas output.

Source: S&P Global Commodity Insights, 2025

This year’s Environmental Partnership report highlighted how nationwide methane emissions declined 40 percent since 2015, even as production increased by more than 50 percent.

Return to Realistic Energy Expectations

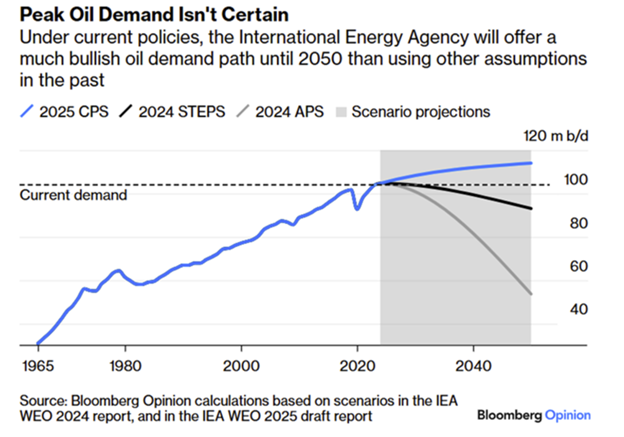

Also notable in 2025 is that the International Energy Agency (IEA) returned to its core mission of providing objective, market-based energy analysis. After years of speculative scenarios that assumed peak fossil fuel demand by 2029, the IEA reinstated its Current Policies Scenario, projecting continued growth in oil and natural gas demand through 2050.

As Bloomberg reported:

“The annual report being prepared by the International Energy Agency shows decades more of robust fossil-fuel use, with oil and gas demand growing over the next 25 years — not just possible, but probable.”

The shift is more than academic. Banks, investors, and governments rely on IEA modeling to guide infrastructure and energy security decisions. The return to tried-and-tested demand projections has already produced tangible benefits: renewed investment in oil and gas projects, stabilization of energy markets, and clearer signals to policymakers on infrastructure priorities.

After years of underinvestment that risked future shortages, banks reversed course and renewed commitments to oil and natural gas development. Similarly, from Massachusetts and New York to California and Pennsylvania, policymakers quietly reopened the door to natural gas infrastructure, delayed unrealistic emissions targets, and backed away from climate litigation. Together, these developments signal a return to pragmatic energy expectations and policies grounded in reality.

Looking Ahead to 2026

The momentum built in 2025 sets the stage for continued U.S. energy leadership in 2026. Permitting reform, expanded offshore development, and renewed investment in Alaska will remain central to meeting growing global demand. Europe is actively reducing reliance on Russian energy, while Asian markets are increasing imports of U.S. LNG.

At home, think tanks and policy experts are stressing energy strategies that bolster economic competitiveness and grid reliability while accounting for growing electricity needs from AI, data centers, and electrification. AI and data centers are driving significant electricity demand in North America and Asia, highlighting the need for flexible, reliable natural gas to stabilize grids and integrate renewables efficiently.

U.S. energy remains a critical tool for allies and a foundation of domestic prosperity. 2026 will be a year where energy leadership, pragmatic policy, and technological innovation converge to provide reliable, affordable, and globally impactful energy.

Bottom Line

2025 reinforced that the United States can lead the world in energy production while strengthening the economy, meeting global demand, and reducing emissions. With policy reform, infrastructure investment, and continued innovation, the U.S. oil and natural gas industry enters 2026 positioned to deliver affordable, reliable energy at home and abroad.