Europe Catalyst Market Size

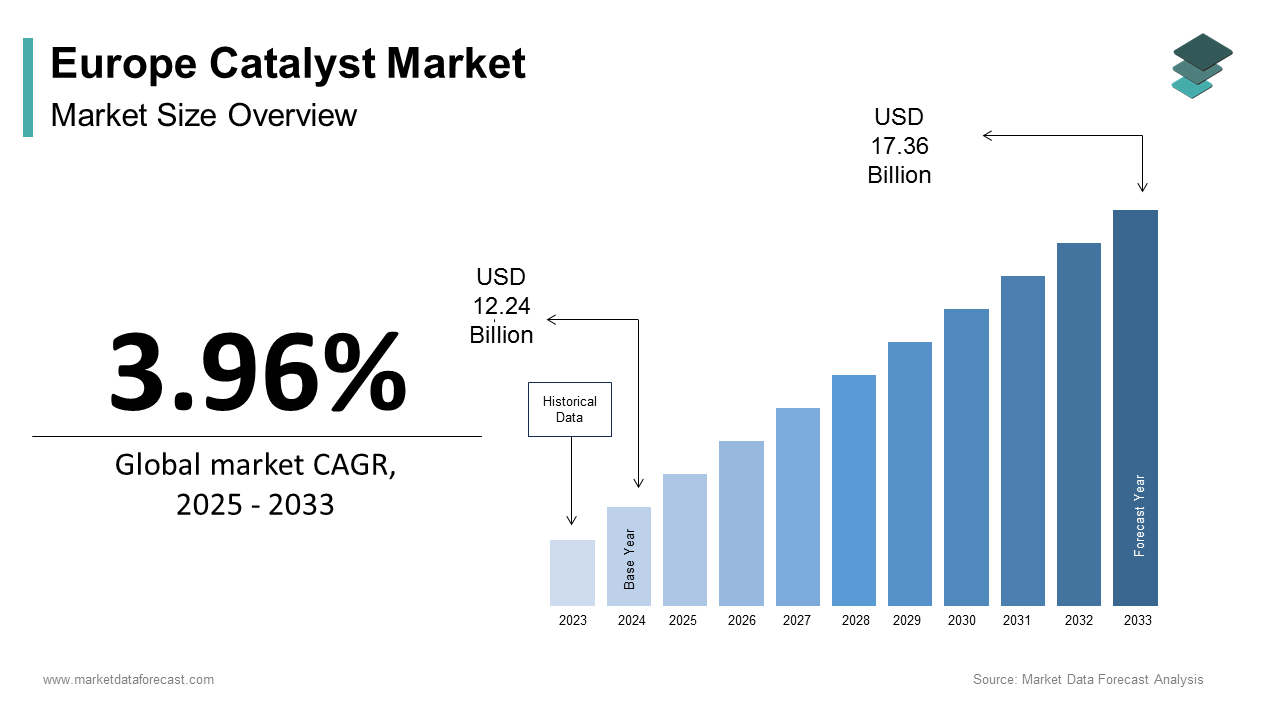

The Europe catalyst market size was calculated to be USD 12.24 billion in 2024 and is anticipated to be worth USD 17.36 billion by 2033, growing from USD 12.73 billion in 2025 at a CAGR of 3.96% during the forecast period.

Catalyst includes a technologically advanced sector focused on materials that accelerate chemical reactions without being consumed, playing an indispensable role in refining, chemical synthesis, emission control, and renewable energy conversion. Catalysts in Europe are central to industrial decarbonization strategies, with applications spanning automotive exhaust systems, petrochemical processing, hydrogen production, and biobased manufacturing. As of 2025, regulatory frameworks such as the EU Green Deal and the Industrial Emissions Directive exert profound influence on catalyst formulation and deployment, mandating higher efficiency and lower environmental footprints. According to the European Environment Agency, industrial processes accounted for 19% of the EU’s total greenhouse gas emissions in 2023, which is creating urgent demand for catalytic solutions that enable cleaner production. Simultaneously, as per the European Commission, the EU remains heavily dependent on imports for platinum group metals, with over 85% sourced externally in 2024, which indicates strategic vulnerabilities in supply chains. These intersecting pressures of regulation, resource dependency, and industrial transformation position catalyst innovation as a linchpin of Europe’s transition toward a circular and low-carbon economy.

MARKET DRIVERS Stringent Emission Regulations Drive Adoption of Advanced Catalytic Converters

The tightening of vehicle and industrial emission norms across Europe is primarily driving the European catalyst market growth. According to the Council of the EU, Euro 7 standards were adopted in April 2024 to further lower pollutant emissions from cars, vans, and trucks, including stricter lifetime requirements for NOx, CO, and particulate matter. In parallel, the EU’s Medium Combustion Plant Directive covers approximately 143,000 plants between 1–50 MW, requiring stricter NOx, SO₂, and dust limits to improve air quality. To meet these benchmarks, manufacturers are deploying advanced vanadium and zeolite‑based catalysts capable of operating efficiently at lower exhaust temperatures. Research on zeolite catalysts shows promising NOx conversion efficiencies at reduced temperatures. These regulatory imperatives not only sustain existing catalyst markets but also accelerate R&D into more durable and resource-efficient formulations.

Industrial Decarbonization Policies Fuel Demand for Green Hydrogen Catalysts

Europe’s push toward green hydrogen is catalyzing demand for electrocatalysts used in water electrolysis, which is further contributing to the catalyst market expansion in Europe. According to the European Commission’s Hydrogen Strategy and REPowerEU plan, the EU aims to produce 10 million tonnes of renewable hydrogen annually by 2030, alongside 10 million tonnes of imports. This requires a massive scale‑up of electrolyzer capacity from <1 GW in 2023 to ~40 GW by 2030. Proton exchange membrane electrolyzers, which rely on iridium and platinum catalysts, are favored for their dynamic response. According to the USGS, global iridium production is extremely limited, only a few tonnes annually, making scarcity a key challenge. Research under Horizon Europe has focused on lowering iridium loading while maintaining performance. Additionally, the Net Zero Industry Act designates electrolyzer manufacturing as a strategic priority, which is aiming for 40% of EU deployment needs to be met domestically by 2030. These developments position catalysis as a critical enabler of Europe’s clean hydrogen economy.

MARKET RESTRAINTS Volatility in Critical Raw Material Supply Constrains Production Scalability

The European catalyst market faces constraints due to reliance on platinum group metals (PGMs). According to the European Commission’s 2023 Critical Raw Materials Report, platinum, palladium, rhodium, and iridium are classified as critical, with EU import dependency exceeding 90%. South Africa and Russia together supply the majority of global PGMs, with Russia accounting for ~28% of palladium and platinum supply in 2023. Sanctions and trade disruptions have caused volatility. According to Johnson Matthey’s 2024 PGM Market Report, significant rhodium price spikes are due to supply shortfalls. Recycling helps mitigate supply risk, but recovery rates remain limited. As per the ICCT, end‑of‑life catalyst recycling contributes meaningfully but cannot fully offset demand.

High Capital and Technical Barriers Limit the Entry of New Innovators

Developing advanced catalysts requires high capital intensity and specialized facilities, which further restricts the expansion of the European catalyst market. Cefic (European Chemical Industry Council) highlights severe competitiveness challenges, with high investment needs for compliant production lines under ISO and REACH standards. Establishing pilot and coating facilities often exceeds tens of millions of euros. The European Institute of Innovation and Technology (EIT) acknowledges that clean‑tech startups face scaling barriers, with many unable to move beyond the pilot stage due to a lack of validation partnerships. Certification and durability testing add further delays. According to TÜV Rheinland, emissions and durability testing for industrial catalysts involves lengthy certification processes. These barriers entrench incumbents with large R&D budgets and limit disruptive innovation.

MARKET OPPORTUNITIES Circular Economy Initiatives Unlock Catalyst Recycling and Reuse Potential

Europe’s robust regulatory framework for waste valorisation is a transformative opportunity in catalyst lifecycle management. According to the EU Waste Framework Directive, member states must achieve at least 70% recovery of non‑hazardous construction and demolition waste by 2025. Spent catalysts from refineries and chemical plants are increasingly reprocessed through hydrometallurgical and pyrometallurgical routes to reclaim platinum, nickel, and molybdenum. Umicore confirms that its advanced facilities can recover platinum group metals from spent automotive and industrial catalysts with recovery efficiencies above 90%. BASF’s Environmental Catalyst and Metal Solutions division also provides closed‑loop recycling services. Furthermore, the EU Battery Regulation (2023/1542) requires sustainable design and recycling provisions for batteries, which indirectly incentivize modular architectures for catalysts as part of broader circular economy goals. The European Commission’s Joint Research Centre has validated that recycling processes can reduce the carbon footprint of new material production by up to 60%. These policies not only mitigate raw material risks but also create secondary material streams that reshape catalyst economics from linear consumption to resource stewardship.

Emergence of Biocatalysis Opens Sustainable Pathways in Fine Chemicals

The integration of biocatalysts into Europe’s fine chemical and pharmaceutical manufacturing offers a high‑growth frontier for the European catalyst market due to the sustainability and precision synthesis demands. Unlike traditional metal catalysts, biocatalysts operate under mild conditions, generate minimal waste, and enable stereoselective reactions critical for active pharmaceutical ingredients. The European Federation of Biotechnology highlights biocatalysis as a growing pillar in pharmaceutical synthesis, with increasing adoption in chiral drug production. Regulatory tailwinds further accelerate adoption; the European Medicines Agency provides scientific guidelines encouraging green chemistry approaches, including enzymatic routes to reduce solvent use and heavy metal residues. Companies like Novozymes and Codexis have partnered with European pharma firms to develop immobilized enzyme systems with high turnover numbers. Horizon Europe has funded enzyme engineering projects targeting lignin depolymerization and CO₂ fixation, with initiatives such as SPLENDOR and CBE JU programs receiving multimillion‑euro allocations. These advances position biocatalysis not as a niche alternative but as a scalable pillar of Europe’s sustainable chemical industry.

MARKET CHALLENGES Regulatory Fragmentation Across Member States Delays Technology Deployment

Despite EU‑level harmonization efforts, divergent national interpretations of chemical safety and emissions standards create significant delays in catalyst market entry across Europe, which is one of the major challenges to the European market growth. While REACH provides a common framework for chemical registration, individual member states retain authority to impose additional restrictions under national emission control laws. According to Cefic, regulatory fragmentation increases compliance costs for chemical producers, with industry audits estimating cost increases of 20–25%. In the automotive sector, ACEA’s regulatory guide mentions delays in type‑approval processes due to differing national protocols, which can extend vehicle launches by several months. Such inconsistencies undermine the single market principle and disincentivize investment in next‑generation catalysts.

Thermal and Chemical Degradation Under Real‑World Conditions Limits Catalyst Longevity

The operational durability of catalysts in industrial and mobile environments is further challenging the catalyst market expansion in Europe. Real‑world exhaust streams contain sulfur, phosphorus, and particulate matter that poison active sites and block pores. According to Empa (Swiss Federal Laboratories for Materials Science and Technology) research, catalysts degrade significantly under long‑term automotive use. In stationary applications, VTT Technical Research Centre of Finland has studied catalyst deactivation in biomass combustion environments, confirming alkali metals like potassium accelerate SCR catalyst degradation. While advanced washcoat architectures and protective overcoats show promise, their commercial scalability remains limited by manufacturing complexity.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

3.96%

Segments Covered

By Raw Material, Application, And Region

Various Analyses Covered

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic

Market Leaders Profiled

BASF SE, Johnson Matthey, Clariant AG, Evonik Industries AG, Umicore, W. R. Grace & Co., Arkema S.A., Solvay S.A., Albemarle Corporation, Haldor Topsoe

SEGMENTAL ANALYSIS By Raw Material Insights

The metals segment captured the largest share of the Europe catalyst market in 2024. The dominance of metals in this European market is attributed to their irreplaceable role in emission control and petrochemical refining. As per the European Environment Agency, all new passenger vehicles sold in the EU since 2021 are equipped with three‑way catalytic converters containing an average of 2.8 grams of platinum group metals per unit. According to Eurostat, Europe’s 128 operational refineries processed over 12 million barrels of crude daily as of 2024, with hydroprocessing catalysts containing nickel molybdenum or cobalt molybdenum remaining standard for sulfur removal from diesel. The Euro 7 emission standard requires enhanced NOx and particulate conversion efficiency, compelling manufacturers to increase precious metal loadings despite cost pressures. As per the International Council on Clean Transportation, nearly 30% of end‑of‑life automotive catalyst metals are recovered in the EU, ensuring partial supply security. These operational and regulatory drivers reinforce the dominance of metals in catalytic applications. The segment is expected to maintain its leadership over the forecast period.

The zeolites segment is anticipated to grow at a CAGR of 8.9% over the forecast period in the European market. The exceptional selectivity, thermal resilience, and ion exchange capacity of zeolites are supporting the growth of this segment in Europe. According to the European Refiners Association, zeolite Y‑based catalysts in fluid catalytic cracking units achieve conversion yields exceeding 75%, outperforming amorphous silica alumina alternatives. As per a 2024 validation study by the German Aerospace Center, Cu‑SSZ‑13 maintains over 90% NOx conversion efficiency at exhaust temperatures as low as 150°C, enabling compliance with stringent EU industrial emission limits. Furthermore, the EU’s Horizon Europe program has funded over 15 projects since 2022 focused on synthesizing hierarchical and nanosized zeolites to enhance mass transfer and reduce precious metal dependency. These technological and regulatory synergies position zeolites as the cornerstone of next‑generation emission control and green chemical synthesis. The segment is expected to expand significantly over the forecast period.

By Application Insights

The heterogeneous catalyst segment held the leading position in the Europe catalyst market in 2024. The dominance of heterogeneous catalysts in this European market is driven by their ease of separation, reusability, and operational stability in continuous processes. According to the European Chemical Industry Council, over 90% of Europe’s base chemical production relies on heterogeneous catalysis. As per the European Automobile Manufacturers Association, all 12.4 million new light‑duty vehicles registered in the EU in 2024 incorporated heterogeneous three‑way or diesel oxidation catalysts. The EU Industrial Emissions Directive mandates continuous abatement of volatile organic compounds from over 50,000 facilities, most of which employ fixed‑bed heterogeneous catalysts. Advances in nano-structuring and support engineering, such as alumina‑coated cordierite monoliths, have extended catalyst lifespans by up to 40%, reducing downtime and waste generation. These functional and regulatory advantages ensure heterogeneous systems remain the backbone of Europe’s catalytic infrastructure. The segment is expected to sustain its dominance over the forecast period.

The homogeneous catalyst segment is a promising segment and expected to register a CAGR of 7.4% over the forecast period in the European market. The rising demand for high‑precision synthesis in pharmaceuticals, agrochemicals, and specialty polymers is propelling growth in this segment. According to the European Federation of Pharmaceutical Industries and Associations, over 60% of new active pharmaceutical ingredients approved in Europe since 2022 involve at least one homogeneous catalytic step, often using palladium or ruthenium complexes. According to the European Medicines Agency’s 2023 sustainability guidelines, solvent reduction and metal residue minimization, driving innovation in ligand design and catalyst recovery. As per a 2024 pilot at a Sanofi facility in France, immobilized rhodium complexes in ionic liquids achieved 99.5% product purity with 90% catalyst reuse over ten cycles, as validated by the French National Centre for Scientific Research. These advances are transforming homogeneous catalysis into a scalable, sustainable industrial process. The segment is expected to expand steadily over the forecast period.

REGIONAL ANALYSIS Germany Catalyst Market Analysis

Germany dominated the European catalyst market in 2024 by holding 24.1% of the regional share. The leading position of Germany in the European market can be credited to its strong chemical industry, automotive manufacturing base, and stringent environmental enforcement. According to Destatis, Germany accounts for nearly 28% of the EU’s chemical output, while the European Automobile Manufacturers Association confirms that the country produces 32% of passenger cars in Europe. As per the Federal Ministry for Economic Affairs and Climate Action, German refineries processed around 2.1 million barrels of crude daily in 2024, requiring extensive hydro processing catalysts. Germany also hosts Europe’s most advanced catalyst R&D ecosystem, with institutions like the Max Planck Institute and Forschungszentrum Jülich pioneering low‑precious‑metal and single‑atom catalysts. These structural, regulatory, and innovation advantages solidify Germany’s preeminent role in shaping the continent’s catalytic landscape. Germany is expected to maintain its leadership in catalyst innovation and consumption in the coming years.

France Catalyst Market Analysis

France occupied the second leading share of the European catalyst market in 2024. The prominent position of France in the European market is driven by a large refining sector, nuclear‑powered hydrogen strategy, and strict environmental regulations. According to the French Ministry of Energy, France operates 10 major refineries with a combined crude processing capacity of 1.4 million barrels per day, making it one of Europe’s largest refiners. The French Environment and Energy Management Agency reported that the country targets 6.5 GW of electrolyzer capacity by 2030, spurring demand for electrocatalysts. Over 3,500 combustion plants are mandated to install selective catalytic reduction systems under the French Environmental Code. Furthermore, CNRS and IFP Energies Nouvelles have co‑developed more than 20 advanced catalyst formulations since 2020, supported by €300 million in state funding. This blend of industrial scale, energy transition policy, and scientific excellence positions France as a pivotal catalyst market. France is likely to strengthen its role in the European catalyst ecosystem in the next decade.

Italy Catalyst Market Analysis

Italy is likely to hold a substantial share of the European catalyst market over the forecast period owing to the petrochemical clusters, air quality mandates, and green chemistry investments. According to ISTAT, Italy’s petrochemical complexes in Porto Marghera and Brindisi produce over 40 million tons of chemicals annually. The Italian National Agency for Environmental Protection reported that more than 12,000 combustion units were retrofitted with oxidation catalysts between 2022 and 2024. Italy’s National Recovery and Resilience Plan allocated €1.2 billion to green chemistry innovation, including catalyst recycling and biocatalysis development. These environmental pressures and strategic investments sustain Italy’s strong catalyst consumption across both traditional and emerging applications. Italy is expected to remain a strong catalyst consumer with growing emphasis on green chemistry.

Netherlands Catalyst Market Analysis

The Netherlands is expected to register a prominent CAGR in the European catalyst market during the forecast period due to its refining hub and leadership in circular catalyst solutions. According to the Dutch Central Bureau of Statistics, the Port of Rotterdam processes over 120 million tons of crude oil annually, hosting Europe’s largest refinery cluster including Shell’s Pernis complex. The Dutch Ministry of Infrastructure and Water Management confirmed that in 2024, BASF and Umicore processed over 1,000 tons of spent catalysts to recover platinum group metals. National policies under the Dutch Climate Agreement mandate a 49% reduction in industrial emissions by 2030, boosting demand for advanced catalysts. With strong research institutions like TNO and Delft University of Technology, the Netherlands is expected to remain a critical hub for catalyst innovation and recycling. The Netherlands is likely to expand its role as Europe’s center for catalyst circularity.

United Kingdom Catalyst Market Analysis

The United Kingdom is anticipated to account for a notable share of the regional market during the forecast period owing to its pharmaceutical sector, regulatory autonomy, and decarbonisation strategy. According to the Association of the British Pharmaceutical Industry, the UK produces 25% of Europe’s branded pharmaceuticals, driving demand for homogeneous catalysts. The Department for Energy Security and Net Zero outlined that the UK’s Industrial Decarbonisation Strategy targets 20 million tons of CO₂ abatement annually by 2030, spurring investment in hydrogen projects. Over 5,000 industrial installations are required to employ catalytic oxidizers under the Clean Air Strategy. Despite Brexit, the UK continues to align with EU technical norms through mutual recognition agreements, ensuring seamless catalyst supply chains. These sectoral strengths and policy continuities sustain the UK’s significant role in Europe’s evolving catalyst ecosystem. The UK is expected to remain a significant player in catalyst innovation and industrial decarbonisation.

COMPETITION OVERVIEW

The Europe catalyst market features a competitive landscape defined by technological sophistication strategic resource management and alignment with stringent environmental mandates. Incumbents such as BASF Johnson Matthey and Clariant leverage decades of process expertise and global scale to maintain dominance while facing rising pressure from specialty innovators focused on biocatalysis and single atom systems. Competition extends beyond product performance to include lifecycle services catalyst recovery models and digital integration capabilities. Regulatory harmonization under EU directives creates a level playing field yet national implementation differences allow for localized advantages. New entrants from Asia are gaining ground through cost competitive offerings but struggle with certification timelines and trust in high reliability applications. Meanwhile collaborations between chemical companies research institutes and end users foster co innovation that blurs traditional supplier customer boundaries. This dynamic environment rewards agility sustainability credentials and deep application understanding over mere scale.

KEY MARKET PLAYERS

A few major players of the Europe Catalyst market include

BASF SE Johnson Matthey Clariant AG Evonik Industries AG Umicore W. R. Grace & Co Arkema S.A Solvay S.A Albemarle Corporation Haldor Topsoe Top Strategies Used by the Key Market Participants

Key players in the Europe catalyst market pursue integrated strategies centered on sustainable formulation development, strategic recycling infrastructure,e and deep collaboration with industrial and regulatory stakeholders. Companies are actively reducing reliance on critical raw materials through nanostructuring ligand engineering and alternative active phases. They invest in closed-loop recovery systems to reclaim platinum group and base metals from spent units, ensuring supply resilience. Partnerships with automotive OEMs chemical producers and hydrogen project developers enable co creation of application specific catalysts that meet evolving compliance standards. Digitalization of performance monitoring and predictive maintenance enhances customer value beyond hardware supply. Additionally, our firms align R&D agendas with EU initiatives such as Horizon Europe and the Net Zero Industry Act to secure funding and accelerate commercialization. These multifaceted approaches collectively reinforce technological leadership and market relevance in a rapidly transforming regulatory and industrial landscape.

Leading Players in the Market BASF SE is a global leader in catalysis with deep integration across chemical, automotive, and environmental sectors in Europe. The company develops a comprehensive portfolio of heterogeneous and homogeneous catalysts for refining, emission control, and polymer production. In recent years BASF has intensified its focus on sustainable catalysis by launching low precious metal formulations and advancing circular economy models. In 2024 the company expanded its catalyst recycling facility in Schwarzheide Germany to recover platinum group metals from end of life automotive converters at industrial scale. BASF also collaborates with European automakers to co design next generation three way catalysts compliant with Euro 7 standards. These initiatives reinforce its global influence while addressing Europe’s decarbonization and resource security imperatives through innovation and closed loop systems. Johnson Matthey PLC plays a pivotal role in the Europe catalyst market through its expertise in emission control and green hydrogen technologies. The company supplies advanced catalytic converters to major European automotive manufacturers and is a leading provider of fuel cell and electrolyzer catalysts. In 2024 Johnson Matthey inaugurated a new electrocatalyst pilot plant in Royston United Kingdom dedicated to low iridium proton exchange membrane solutions for green hydrogen production. The firm also partnered with several EU industrial clusters to deploy compact selective catalytic reduction systems fosmall-scalele biomass boilers. These actions demonstrate Johnson Matthey’s strategic pivot toward clean energy applications while maintaining its stronghold in traditional automotive catalysis across global markets. Clariant International Ltd is a key contributor to the Europe catalyst market with a strong emphasis on specialty and process catalysis for fine chemicals and renewable feedstocks. The company’s portfolio includes tailored solutions for biobased polymer production, syngas conversion, and VOC abatement. In 2024, Clariant launched its EnviCat VOCevo catalyst series optimized for low temperature oxidation in the food and coating industries across Southern Europe. The firm also enhanced its digital catalyst monitoring platform to provide real-time deactivation alerts and regeneration guidance. Through its “Catalysts for Sustainability” program Clariant supports European chemical producers in transitioning to circular and low carbon processes. These efforts underscore its global commitment to high-value sustainable catalysis aligned with EU regulatory and industrial transformation goals. MARKET SEGMENTATION

This research report on the Europe catalyst market has been segmented and sub-segmented based on raw material, application, and region.

By Raw Material

Chemical compounds Metals Zeolites

By Application

Heterogeneous Catalyst Homogeneous Catalyst

By Region

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe